Posted on 08/24/2019 7:14:48 AM PDT by SeekAndFind

There are three negative supply shocks that could trigger a global recession by 2020. All of them reflect political factors affecting international relations, two involve China, and the United States is at the center of each.

Moreover, none of them is amenable to the traditional tools of countercyclical macroeconomic policy.

The first potential shock stems from the Sino-American trade and currency war, which escalated earlier this month when President Donald Trump’s administration threatened additional tariffs on Chinese exports, and formally labeled China a currency manipulator.

The second concerns the slow-brewing cold war between the U.S. and China over technology. In a rivalry that has all the hallmarks of a “Thucydides Trap,” China and America are vying for dominance over the industries of the future: artificial intelligence (AI), robotics, 5G, and so forth.

The U.S. has placed the Chinese telecom giant Huawei on an “entity list” reserved for foreign companies deemed to pose a national-security threat. And although Huawei has received temporary exemptions allowing it to continue using U.S. components, the Trump administration this week announced that it was adding an additional 46 Huawei affiliates to the list.

The third major risk concerns oil supplies. Although oil prices CL.1, -0.37% have fallen in recent weeks, and a recession triggered by a trade, currency, and tech war would depress energy demand and drive prices lower, America’s confrontation with Iran could have the opposite effect.

Should that conflict escalate into a military conflict, global oil prices could spike and bring on a recession, as happened during previous Middle East conflagrations in 1973, 1979, and 1990.

All three of these potential shocks would have a stagflationary effect, increasing the price of imported consumer goods, intermediate inputs, technological components, and energy, while reducing output by disrupting global supply chains.

(Excerpt) Read more at marketwatch.com ...

RE: “After all” is not a convincing argument for Nouriel Roubini

I’m interested in reading your take as to why Roubini’s opinion is wrong regarding both the trade and technology war ( i.e. it will be more or less permanent ) and why Brexit is NOT a permanent negative supply shock to the UK.

Trap 2: There are more examples of where the Thucydides Trap was applicable, but no war took place, than where war resulted. Neither World War was the result of a Thucydides Trap. I seriously doubt that China wants a war with its largest trading power.

Trap 3. Comparing oil prices back two to four decades ignores the supply effects that have taken place since then.

This incredibly naive article is simply a scare piece to try and dampen the fact that the economy is roaring despite the Chicken Little calls from the MSM.

...what China is banking on.

_____________________________________

Do they then reverse course and become compliant when POTUS is re-elected?

Or do they have other options ready to be gamed?

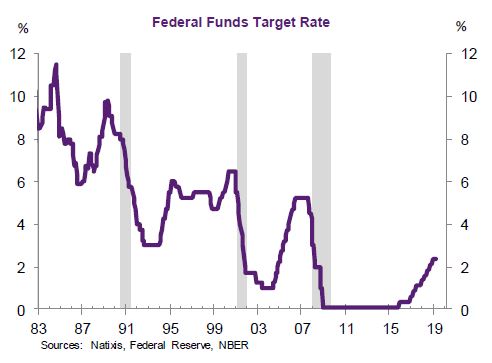

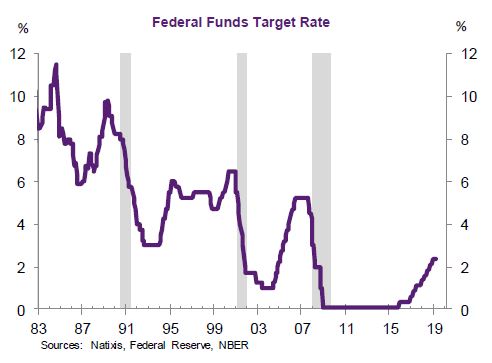

The FED demonstrated in the past election cycle they were going to do whatever it took to elect democraps. How many rate increases did they make to cause a market downturn going into November 2018?

The US government and the Federal Reserve have been at war with savers since the George W. Bush administration.

*************

Because of persistently low interest rates many people have been “forced” into buying risky equities. Unfortunately, they often do so without an awareness of the variability of returns in the stock market. They also, for the most part, have done little to no research or the companies they buy. Nor do they understand the underlying valuation metrics of the companies.

In other words, its like going into gold mining without understanding the risks, difficulties and dangers associated with doing it.

Due diligence is an essential part of investing yet few people actually spend the time and effort required to manage risks. This is especially true when they feel pressured to increase their income to meet ever rising expenses. Wall Street preys on people like this.

… (T)he he first step in the revolution by the working class is to raise the proletariat to the position of ruling class to win the battle of democracy.So there really is no difference between the Democrats and the 20th century (and 21st century) left-wing totalitarians; they are one and the same, as Woodrow Wilson openly admitted.

— Communist Manifesto, Chapter 2

What will be the course of this revolution? Above all, it will establish a democratic constitution, and through this, the direct or indirect dominance of the proletariat. […]

Democracy would be wholly valueless to the proletariat if it were not immediately used as a means for putting through measures directed against private property and ensuring the livelihood of the proletariat. […]

In America, where a democratic constitution has already been established, the communists must make the common cause with the party which will turn this constitution against the bourgeoisie and use it in the interests of the proletariat — that is, with the agrarian National Reformers. …

— The Principles of Communism

… (I)t is very clear that in fundamental theory, socialism and democracy are almost—if not quite—one and the same. They both rest at bottom upon the absolute right of the community to determine its own destiny and that of its members. Men as communities are supreme over men as individuals. …

— Woodrow Wilson, “Socialism and Democracy”

The not-so-cleverly hidden message: Elect a democrat.

The Fed is political. Everything in Washington is.

It’s nothing but filler for a newsletter. Same guys saying the same things that never happen.

“...potential shock...has all the hallmarks of...could have the opposite effect...”

Boy oh boy, I’d better prepare for an asteroid hit, Yellowstone erupting and a plague. They’re all possible, too.

I guess for this coming economic horror, I’d better move all my stocks to cash, right? Is that what the proggies want me to do?

The EU central bank is already at minus zero percent. Forget savings accounts as a way to invest. Going forward thats not likely to be a viable option anymore.

Once you understand that the Federal Reserve system has one function which is the redistribution of wealth from the American people to banks and corporations you can start to understand how we acquired $25 trillion in debt. The creation of our currency.

The Federal Reserve bank creates dollars out of thin air and then loans them to us at interest. The only way to pay the interest is to borrow more dollars. So over time the snowball just keeps getting bigger. our debt can never be paid off as the Fed creates our currency.

Trump IMO has plans to get us away from the Fed in his second term. All these tweets is Trump’s way of bringing the public along on the issue so they won’t be shocked when he makes his move.

The petro dollar is dying. The US dollar will not be the reserve currency of the world much longer. Trump knows this. Its imperative that we get rid of the Federal Reserve. Obviously Congress will never act. The mechanism to circumvent the Fed is already in place. The US Treasury department can issue its own debt instrument and create dollars at zero interest. Those dollars which have no debt attached can be used to pay off our debt. That is what I believe Trump will do.

RE: I guess for this coming economic horror, I’d better move all my stocks to cash, right?

And where do you put your cash?

First step is to make the distinction what is otherwise a blur in people’s minds between the free market and national political sovereignty.

China is politically a threat to be taken seriously and dealt with seriously. But economically, China is an easy straw-man. Part of the reason is the confusion between the free market and national political sovereignty and the Lying Leftist Media helps keep that confusion going.

Socialist-style government intervention in the voluntary cooperation between buyers and sellers in the marketplace is what creates shortages and economic woes.

Fake news

I’ve been buying small cap gold stocks.

The ones I bought have tripled on some cases but I won’t make any money cause i’m a greedy slob and have already watched some go back to original price

That’s my investment advice for the day :)

Trump is probably the best economist around.

“The left loves to talk up democracy.”

Sure. But, when popular votes went against them (abortion, gun laws, faggot marriage), they got judges to overturn those results.

Nowadays, with so many Millenials and women indoctrinated into liking leftism and socialism, they more trust the votes to go their way.

Americans would hate a true democracy, constantly bombarded with issue campaigns on every issue under the sun, using TV, mailings, emails, texts, billboards...

Good questions. If Trump is re-elected my view is that they will eventually sign a trade agreement, but not really honor it (so what’s new?). In other words, agree to a fake deal to buy more time. They are notorious for playing the long game so what’s four more years of waiting?

But if more businesses move their operations outside of China and the Chinese economy noticeably deteriorates then who knows what high level, game changing political “adjustments” could occur?

The possibilities are manifold but I think we are holding a strong set of cards and if we demonstrate resolve, China may bend, but only in a face saving way.

My question was “Is that what the proggies want me to do?” Context, please.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.