Posted on 12/25/2020 4:25:26 PM PST by Blood of Tyrants

In the past during normal times, to raise money for the federal government, the Treasury would sell government bonds. However, in recent years, they have abandoned any pretense of selling bonds and have instead just printed more money. Which raises the following question)s); 1. If the fedres is just printing money, is the US actually borrowing it? And can we just print more money to pay it back?

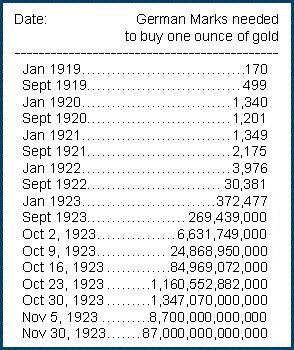

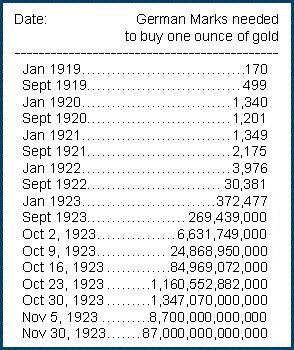

And the scary thing is that once the government discovers that when it needs more money it can just print it, it eventually does. The problem is runaway inflation which will destroy your life;s savings unless you have it invested in hard assets like gold, real estate, brass casings and copper jacketed lead, etc.

Chynah

It is not going away anytime soon.

Watch the velocity which Trump vastly increased.

The Fed is a private corporation, and it runs itself to make a profit for the owners.

If you want to borrow $100, the Fed can create the $100 for you. But they insist on receiving $105 in return. Where does that $5 interest payment come from? From the Fed. They will be happy to create that additional $5 for you so that you can pay them back the $105 you owe them. But, of course, this means you must borrow more from the Fed.

That’s the problem of privately owned Central Banks which depend on debt-driven economies and endless interest payments. Back during the Civil War, the Lincoln administration printed Greenbacks. That was government printed money created to ensure liquidity in the marketplace. There was no interest. You get $100 and you pay back $100 and no one is getting rich off that currency transaction. But the economy is fueled and functions well.

I do not believe that any national economy needs to be fueled by debt. But, of course, The Powers That Be don’t share my view.

For the government just prints it out of thin air and calls it “quantitative easing”

No printing press needed. Books and balance the books infer a credit to balance the debit. Pffttt. No need.

Book entry There is no debit to the credit. It simply appears.

It’s all held together by a fragile belief system. Fiat currency has value because we believe it does. It’s best not to think about it too much and continue to consume. Like when Bush told us to go shopping after 9/11.

[We’re going cashless]

Which is why I expect “Mark of the Beast” “money” to be all-electronic (as most payments / direct deposits, etc. already are). A “credit” to each “authorized” account. Essentially a UBI.

[Zimbabwe here we come!]

Yes. One reason (IMHO) the book of Revelation (basically) says: “A loaf of bread for a day’s wage”. Now, only the paraphrases (which I generally avoid) say it that way. It will be Zimbabwe on a global level.

The AMP version of Revelation 6:6:

AMP And I heard something like a voice in the midst of the four living creatures saying, “A quart of wheat for a denarius (a day’s wages), and three quarts of barley for a denarius; and do not damage the oil and the wine.”

A couple of others:

ESV And I heard what seemed to be a voice in the midst of the four living creatures, saying, “A quart of wheat for a denarius, and three quarts of barley for a denarius, and do not harm the oil and wine!”

KJV And I heard a voice in the midst of the four beasts say, A measure of wheat for a penny, and three measures of barley for a penny; and see thou hurt not the oil and the wine.

Here’s how I understand it. The Fed, in particular the NY Fed, through the primary dealers replace bonds with Federal Reserve Notes (currency). The bonds end up on the Fed balance sheet as a debt, about $7 trillion now, but they can keep rolling and expanding this. Seems like most of this new money stays tied up with the rich, so you get asset inflation (stocks, real estate, etc) and not much consumer inflation, so far. I think the main risks of this scheme going forward are the value of the currency and cultural instability.

It is the tax system.

For every 1 buck they get 1.68 back. It is the velocity of that 1 buck that enriches the Treasury.

The Treasury must stay ahead of inflation.

I have a 100 Trillion dollar bill in my wallet

I just looked for a picture and it seems that Apmex is selling them for $100 I am pretty sure I paid $2 or 3

I should have bought a pallet

one explanation...endorsed by that renowned economist, AOC...and Biden/Harris’s Wall St!

Wikipedia: Modern Monetary Theory (MMT)

In 2019, MMT became a major topic of debate after U.S. Representative Alexandria Ocasio-Cortez said in January that the theory should be a larger part of the conversation...

MMT became increasingly used by chief economists and Wall Street executives for economic forecasts and investment strategies...

https://en.wikipedia.org/wiki/Modern_Monetary_Theory

watch following from 3mins in. Creighton, of The Australian newspaper, is virtually the only finance journalist asking the right questions. no-one knows how much covid debt has been bought by China. says Australian Govt doesn’t know who who owns about half of Australia’s covid debt (via bonds) because it’s hidden behind entities like HSBC and JP Morgan:

VIDEO: 7m: 13 Oct: Sky News Australia: Alan Jones Show: Advanced governments act as though there’s ‘no cost to debt’ and it ‘won’t end well’

The advanced governments of the world are conducting an extraordinary economic experiment and think there’s no cost to debt, but “it’s not going to end well”, according to the Australian’s Adam Creighton.

“The advanced governments of the world – Australia included – they’re really conducting an extraordinary economic experiment,” Mr Creighton told Sky News host Alan Jones.

“They’re operating as if there’s no cost to debt, but logic would suggest – and also history – that there is a cost and at some point it’s going to catch up with us...

https://www.skynews.com.au/details/_6200123952001

China only holds a little over 1 trillion in treasury securities at this time.

Remember treasury notes are paid out when they become mature. If China unloads securities on a secondary market prematurely, they would have to sell below value. The new holder would then collect when the note reaches maturity.

When either Japan or China cut back on future treasury purchases, the New York money market notices.

The American establishment wants you to believe that foreigners are screwing you over. When its actually our own people screwing us over. Those people live in area codes around Washington D.C.

Nice. And it’s coming out of thin air!

I don’t think he needs the suit, though.

He could probably do the work in a t-shirt and jeans.

I am glad you asked that, it’s been bothering me this week.

Where does the Federal Reserve get the money to loan the federal government?>>>>>>>>>>>>>>>>>>>>>>>>

The short answer: CHYNA

The Treasury hasn't printed money for years.(When they did, these were called US Notes. They had a red seal, where the Federal Reserve Notes have a green seal.) The Treasury "prints" Debt Paper (bonds and notes) which they "sell" (usually indirectly through "Open Market Operations") to the Federal Reserve to obtain the money that the government spends. The whole thing is one, big, f'n shamocracy.

ML/NJ

I remember many decades ago, $5 bills were “United States Notes” and not “Federal Reserve Notes”.

And $1 bills were “Silver Certificates”.

Isn’t a major issue, that our currency is not backed by tangible assets, such as gold or silver or any other actual physical asset?

It took 22 post for the truth to get out

Now, who will read it

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.