Posted on 04/12/2022 5:36:20 AM PDT by blam

The only thing surprising about the freight market slowdown is the speed at which it’s unfolding.

The supply chain “bullwhip effect” is both predictable and expected. The surge of inventories and declining freight costs/capacity imbalances will be deflationary.

The trucking market has slowed. Demand for trucks usually surges during the Spring, but this year, demand for truckload freight has broken out of this typical seasonal pattern.

Outbound Tender Volume Index (OTVI) is an index which measures the volume of truckload order requests in the contract truckload market. The OTVI chart shows year over year activity from 2018 to this year.

The bullwhip effect is something every supply chain 101 student learns about – the idea that upstream providers overproduce in reaction to a one-time demand shock.

What is the bullwhip effect?

According to the Chartered Institute of Procurement and Supply, the bullwhip effect “is defined as the demand distortion that travels upstream in the supply chain from the retailer through to the wholesaler and manufacturer due to the variance of orders which may be larger than that of sales.”

The best way to think of this in terms of COVID is that in the early part of the cycle, the Federal Reserve was pouring trillions of dollars into the economy to ensure that the market didn’t collapse. Consumers went out and spent all of that money on physical goods. At the same time, production in China and the U.S. was shut down or limited. The combination – stimulating consumption but limiting production – caused the American consumer to burn through almost all inventory.

Retailers ordered more goods based on the inflated demand at that time. Upstream to them, wholesalers and manufacturers did the same. Along that chain some even ordered bumper stock.

When the orders didn’t arrive as planned, they ordered more. And upstream to them, vendors also ordered more for the same reason. As orders flowed upstream, everyone started to produce at unprecedented levels.

Consumers, flush with excess cash and bullish due to high employment and a roaring economy, continued to order physical goods. Then the products started flowing, and in spite of delays, they poured in.

Earlier this year, consumers pulled back… at first just slightly. But all of those products kept pouring in, along with buffer stock. Warehouse inventories piled up. And now consumers have shifted away from consuming physical products and have started to consume services and experiences once again. Meanwhile, all of that inventory keeps coming.

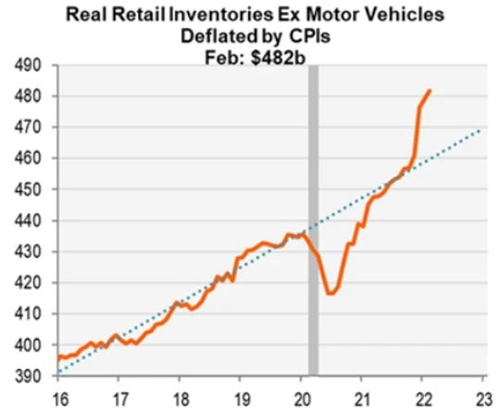

And now we can see those goods in market data. Here is a chart of real retail inventories, excluding new or used autos. Because inventories are counted on the basis of their dollar value, rapid inflation can make inventories appear artificially higher, so remember that these numbers have been deflated by the Consumer Price Index, or CPI. In other words, inflation has been stripped out to reflect ‘true’ growth in inventory volume, not just price.

And as goods flow into our economy, there is nowhere to transport them. Warehouses are full and spending on goods has stalled as Americans suddenly have more options. So freight demand has slowed.

Inventory at very high levels

FreightWaves’ editorial and research staff, as well as its Market Experts, are constantly conducting channel checks. Lately, we are hearing that national big box retailers have plenty of inventory, particularly in large discretionary categories, such as furniture and household goods.

On Twitter, where the freight markets are suddenly becoming a trendy topic of discussion in conjunction with economic activity, there is a suggestion that other large consumer categories are seeing a sudden slowdown as well.

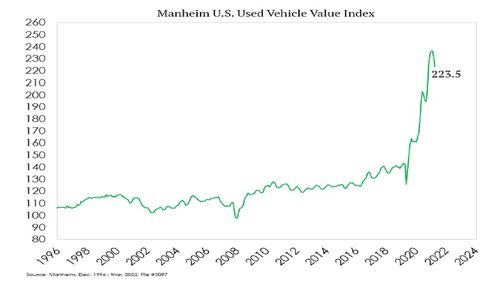

Used cars have been nearly impossible to come by and have experienced unmatched price inflation for the past two years. This could be changing.

Meanwhile, used vehicles experienced the biggest drop in prices in two years.

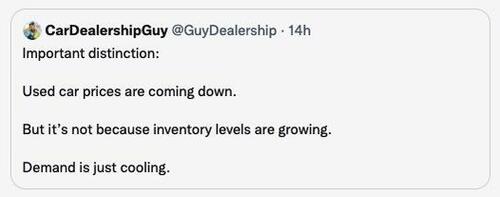

The CEO of a chain of used car dealerships has a blog that discusses the used car trends for the general public. On Twitter, he talks about market conditions frequently. On April 9th, he posted:

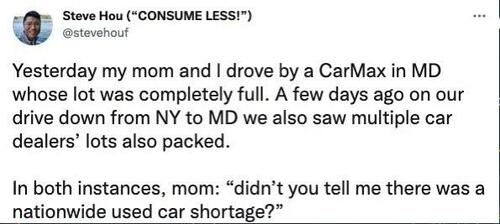

This was followed by Quant researcher Steve Hou, who posted:

,/A>

,/A>

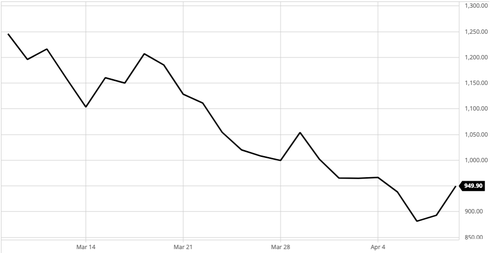

Lumber prices are also coming down, after two years of inflated prices and extremely tight supply. In the past month, lumber commodity prices have dropped from $1,252 to $949 per-thousand-board-feet, a 30% decline.

A shift by consumers to services

Higher energy and food prices likely shocked the consumer into a spending pullback on physical goods – while retailers were desperately rebuilding inventories – at the same time that consumers finally began to shift spending away from physical goods to services. And without demand, you don’t need to move anything quickly.

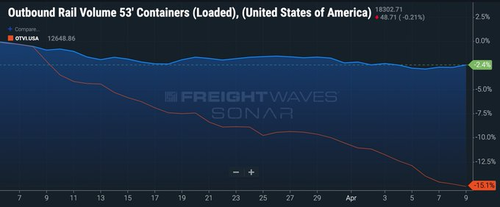

Shippers feel much less urgency and therefore they are slowing the freight velocity of their supply chains. We can see that in volume shifts between the modes of transportation they’re using. Railroads move products slower, including intermodal (containerized freight on the rails). It’s currently 21% cheaper to move a container of freight on intermodal than it is via a truck (door-to-door) – an all-time savings high.

Chart: Cost delta percentage intermodal vs. truck

The chart below displays volume trends in intermodal and truckload. Intermodal is holding its own, while truck volumes are slowing.

Chart: 53-ft. containers on rail vs. truckload volumes

This is all good for consumers – prices for freight will come down. Supply chain bottlenecks will ease. What were recently inventory shortages are now gluts, and will likely result in price discounts, not increases. This is a late-stage supply chain correction.

The trucking industry, particularly small trucking firms, will end up feeling the pain. But this was inevitable. A freight recession happens far more often than a GDP recession. The last time this happened was 2019, when the freight market experienced a downturn, but the broader economy did not.

I think a freight recession is inevitable and I think that inflation has to cool. It was either going to be the Federal Reserve’s job to do so or the market’s to do so. We can thank the supply chain bullwhip for doing the Federal Reserve’s job.

China’s latest round of system-wide shutdowns may be the final straw that pushes many supply chain executives in America to reevaluate their sourcing strategy (if they haven’t already). China is becoming far too unpredictable and unstable as a supplier. Importers should take this breather to catch up.

There is still lots to be bullish about. The “bullwhip correction” will be a different kind of headache than we’ve had to deal with for the past two years, but the good news is the market is correcting and things are “normalizing” – as least as far as supply chains are concerned.

Want to track the same data and get an edge on competitors in the market? SONAR’s high-frequency platform tracks global supply chain activity in real-time, with the freshest perspective on the global upstream economy.

You have been brain washed your whole life and so have I to believe what you just posted. I didn’t wake up until 2008 and I was in the banking /lending industry for 30 years.

We are similar to the old Roman Empire.

The Empire still had a Senate, but it’s not clear what the Senate was there for. The Emperor (and the Army) seemed to call all the shots. The Senators were just there to feel important and to get rich.

Our own Senate won’t manage monetary policy, or declare war or pass a real budget. They are just there to feel important and to get rich.

Of course, our situation is worse — because in Rome, the Emperor usually exercised authority, for better or worse. Under our system, our government “runs itself” in mysterious ways and the President is not involved. I think the government ignored both Trump and Biden — for two different reasons, but in each case the Deep State shrugged them off and said, “forget about that guy, he doesn’t matter”.

We need a high tariff on imported car parts to INCENTIVISE a repatriation of that vital industry back to the USA.

We’re looking to replace two hopper bottom trailers. Price just went up $7000 each yet can’t deliver until Feb 2023.

Nice article!

Sound analysis.

Thank you.

Yep, we needed a new roof for an outbuilding and were told by the contractor not until October....................

The Creature From Jekyll Island

Like private corporations that turn over all their earnings to the US Treasury.

That’s how “We The People” get cut out of the deal.

Except “We The People” get all the earnings.

How do they do it?

Page 27, “When a borrower cannot repay and there are no assets which can be taken to compensate, the bank must write off that loan as a loss. However, since most of the money originally was created out of nothing and cost the bank nothing except bookkeeping overhead, there is little of tangible value that is actually lost. It is primarily a bookkeeping entry”

By buying up your collateral at a discount when you default on a deal or go bankrupt.

Good information. Thank you for posting.

The Fed buys my collateral?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.