Posted on 09/18/2021 5:47:10 AM PDT by blam

Yesterday, I outlined a terrible secret.

That secret?

That the Fed knows the official inflation measure, the Consumer Price Index (CPI) is practically useless for forecasting future inflation.

In a little-known paper published in 2001 the Fed found that food inflation, NOT CPI or PCE, is the best predictor of future inflation. Fed researchers wrote the following:

We see that past inflation in food prices has been a better forecaster of future inflation than has the popular core measure [CPI and PCE]…Comparing the past year’s inflation in food prices to the prices of other components that comprise the PCEPI (as in Table 1), we find that the food component still ranks the best among them all…

Source: St Louis Fed (emphasis added).

I want you to focus on these two admissions:

1.The Fed has admitted that its official inflation measures do not accurately predict future inflation.

◾The Fed admitted that FOOD prices are a much better predictor of future inflation. In fact, food prices were a better predictor of inflation than the Fed’s PCE, non-durables goods, transportation services, housing, clothing, energy and more.

I mention all of this because today food inflation is erupting higher.

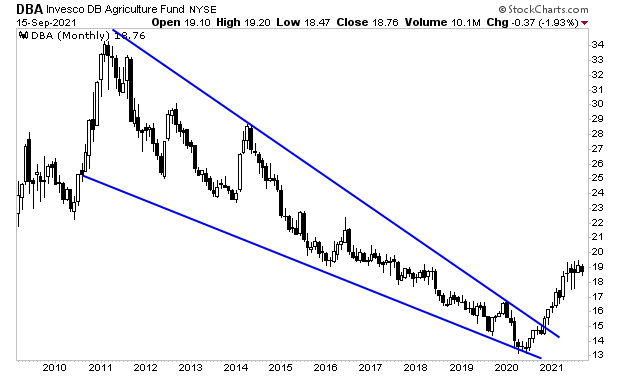

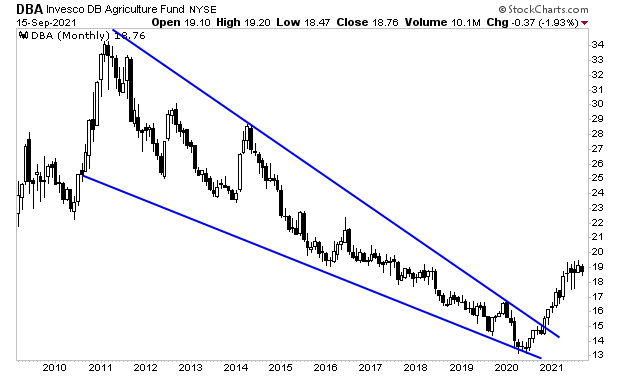

We already noted that agricultural commodities are ripping higher.

But the situation is even worse than I imagined. The below quote is truly horrifying…

Adjusted for inflation and annualized, [food] costs are already higher now than for almost anytime in the past six decades, according FAO data. Indeed, it’s now harder to afford food than it was during the 2011 protests in the Middle East that led to the overthrow of leaders in Tunisia, Libya and Egypt, said Alastair Smith, senior teaching fellow in global sustainable development at Warwick University in the U.K.

Source: Yahoo! Finance

Put simply, food inflation today than at almost any time in the last 60 years. That would include the 1970s, when inflation went into the double digits and the stock market crashed over 50% in a matter of months.

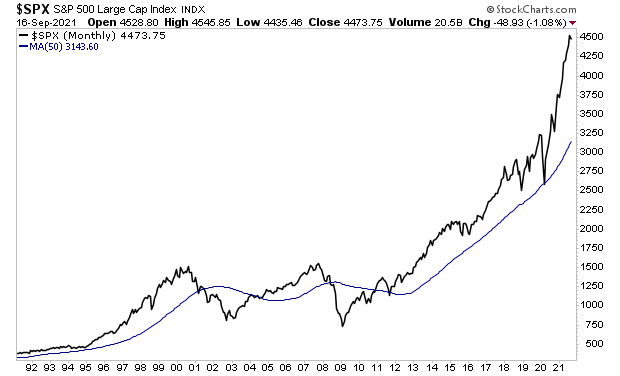

If you think we’re immune to something like this now, take a look at the below chart. This is a massive bubble, looking for a pin. And by the look of things, inflation is it!

Revelation 6:6 Ping. We’re headed there but it doesn’t happen overnight. This is one of the steps to that time.

Comments on rev 6:6 meaning; https://www.bibleref.com/Revelation/6/Revelation-6-6.html

$5,000,000,000,000 / 332,655,522 people = $15,030.56 for every man, woman and child... Wow.... It's like Obama bucks....how could we go wrong.?????

“Magic” thinking is all around us. I explained to a 20-something last week that 5% inflation was in effect a 5% pay cut. He couldn’t grasp that concept at first, but then did and comforted himself in the notion that “....wages will increase to stablize things again...”.

You’re always so cheery.

Get the government out of the way of the farmer! They can outproduce everyone else on food!

In the 1930s, American Farmers, even in the depression and dust bowl years, produced so much it was Steak for breakfast, lunch, supper as it was the cheapest thing on the market.

So FDR had the government buy up tens of thousands of cattle, hogs, bulldozed trenches, shot and buried the livestock. They also dumped milk into the sewers.

All to get the price up in the Depression.

Yes, but is that surprising? The CPI and PCE measure what prices are today. The quoted inflation rate is the percentage change between today's prices and last month's or last year's. Other than guessing that next month's will be the same as last month's they aren't predictive. It's like guessing what your car's speed will be in the future from reading your odometer. The Fed's report was that food is the leading indicator - first food goes up or down and then the other parts of the CPI do later. I wish he had linked the full report which might give more details like time lag and a correlation figure.

Next the author quotes a statement about food prices:

Adjusted for inflation and annualized, [food] costs are already higher now than for almost anytime in the past six decades, according FAO data. Indeed, it’s now harder to afford food than it was during the 2011 protests in the Middle East that led to the overthrow of leaders in Tunisia, Libya and Egypt, said Alastair Smith, senior teaching fellow in global sustainable development at Warwick University in the U.K.First, that is an international figure so it is not directly impacted by US inflation. Next, it says "adjusted for inflation" so it is measuring food relative to everything else which has nothing to do with overall inflation. Third, it is undated. Was this said recently or a couple years ago before the economic thrashing around from COVID?. Was this a worldwide price or a regional price? Since he brings up middle eastern countries, I wonder if the "problem" relates to the drop in oil prices during the Trump administration and the troubles that caused in the mid-east. And does a "teaching fellow in global sustainable development" have an ax to grind other than monetary inflation?

Finally, the author used a long term graph of the S&P 500 on a linear scale rather than a logarithmic scale. Any long term growth looks like it has a big jump at the end threatening a bubble on a linear scale. But if it went up at a constant 10% per year (long term stock average) it would have the same jump in the end. If you put it on a logarithmic scale, constant growth looks like a straight line showing where the bubbles of above average growth are. On a linear scale from 1900 to today you would have a hard time seeing the 340 point drop in the Dow Jones Industrial Average that marked the Great Depression because it would be less than half the size of the minor 860 point drop over the past two weeks. Make the graph with a logarithmic scale and the depression shows as a major 90% crash while today is a 2% dip

I didn't give my email address to download his newsletter/sales pitch, but I bet he is selling gold.

The stimulus for the S&P was the Trump corporate tax cuts of 30% that went to profits. The pin that will also burst the bubble is a return to pre-Trump taxes.

Treasury receipts are actually higher now than they were before the Trump Tax Cuts but it is never enough for the dims. This data is hard to come by in a search via any search engine and this is the best I could find on short notice:

Inflation is the other pin that will burst the bubble. Consumers feel less secure so they naturally stop spending for all but essentials. Sure, some will hoard durable goods as a hedge against inflation but not all can and that only lasts so long. It has proven folly for most items but land, gold and silver.

That was my guess too.

Prepper ping.

Growing your own is good insurance against food shortages.

Always a whine.

Years ago when I posted mostly archaeology/anthropology articles people would complain that 'that' sort of stuff doesn't belong on FR.

FReepers just like to complain, I guess.

Ignore the Eeyore whiners. I enjoy seeing your threads/posts.

If you have a ping list, please add me. TIA.

"I bet he is selling gold. "

Blam : " That was my guess too."

Diana in Wisconsin : "Get the government out of the way of the farmer!

They can outproduce everyone else on food!"

"That the Fed knows the official inflation measure, the Consumer Price Index (CPI) is practically useless for forecasting future inflation.

In a little-known paper published in 2001 the Fed found that food inflation, NOT CPI or PCE, is the best predictor of future inflation "

"The Fed has admitted that its official inflation measures do not accurately predict future inflation.

◾The Fed admitted that FOOD prices are a much better predictor of future inflation.

In fact, food prices were a better predictor of inflation than the Fed’s PCE, non-durables goods,

transportation services, housing, clothing, energy and more."

"Adjusted for inflation and annualized, [food] costs are already higher now than for almost anytime in the past six decades, according FAO data.

Indeed, it’s now harder to afford food than it was during the 2011 protests in the Middle East that led to the overthrow of [foreign]leaders ..."

-------------------------

INDIRECTLY RELATED - SUPPLY CHAIN CHAOS

Jane Long :” Any holiday shopping should be “wrapped up”, by now. “

A tangled supply chain means shipping delays. Do your holiday shopping now.

Many items destined for retailer shelves this holiday season are hopelessly snarled in the global supply chain.

At : https://freerepublic.com/focus/f-news/3996053/posts

Have computer accessories on the shelf. Extra mouse, extra keyboard and so forth.

Also have the ability to work hard wired not wireless if needed.

I always thought they called economics “the dismal science” because it was dismal that the vast majority of people lack the intelligence to understand it at all...

:-(

Christmas is too commercial anyway.

My keyboard just gave up the ghost on me and I got a new one so I’m set.

Interestingly, it took less than a week to arrive from over seas. NOT China, but I don’t remember where.

Thanks. No ping list

However many column inches the article was, distilled to half a sentence.

You're welcome.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.