Posted on 09/17/2021 2:40:24 PM PDT by blam

One month ago, when looking at the internals of the UMich report, we noted that there was “A Sudden Negative Change In The Economy” as consumer spending intentions collapsed. One month later, it has only gotten worse.

While overall consumer sentiment staged a modest rebound from last month’s dismal plunge…

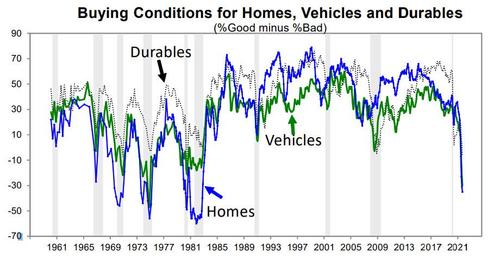

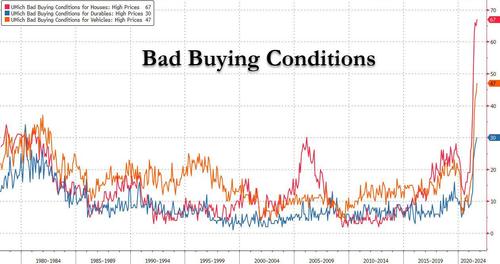

… the internals went from bad to worse, and as survey director Richard Curtin explained, “buying attitudes for household durables fell again in early September to a low reached only once before” – during the galloping inflation of 1980 when Volcker hikes rates to 20% while – “long term economic prospects fell to a decade so low.” It wasn’t just durables: as shown in the chart below, sentiment for buying conditions of vehicles and homes was similarly the worst in over 40 years. As a result, “the decline in assessments of buying conditions for homes, vehicles, and household durables left all three near all-time record lows” with the declines due to spontaneous references to, what else, high prices.

This, according to Curtin, is consistent with an ongoing spending shift from goods to services, although the gains in service spending have been recently slowed sharply by the Delta variant, and according to Goldman, souring expectations for future service spending is why the bank recently slashed its GDP forecasts.

While some anticipated that the August plunge in confidence, one of the worst on record, would quickly disappear since “it was driven by emotions”, the subsequent reality has shown that there is something greater at play here, namely the US consumer being tapped dry with no stimmy cash left and with prices still soaring.

It gets worse: with consumers freaking out over soaring inflation we are about to enter a buyer’s strike because with the Fed repeating over and over that hyperinflation is transitory, consumers would rather hold on to their cash which means the all important spending which drives 70% of the US economy is about to grind to a halt:

There was a complete rout of net favorable views of buying conditions: household durables fell to the lowest level since 1980, vehicles fell to the lowest level since 1974, and homes to the lowest level since 1982. These record drops were all due to complaints about high prices: homes had the highest negative ratings of home prices ever recorded, vehicles had the most negative price references since 1974 (in response to the first oil embargo), and durables had the worst price rating since 1980.

And speaking of galloping inflation, UMich found that “although declining living standards were still more frequently cited by older, poorer, and less educated households, over the past few months, complaints about rising prices have increased among younger, richer, and more educated households. Recent income gains rose slightly, and net household wealth rose, especially among those with incomes in the top third.” In other words, the “transitory” hyperinflation is now crushing everyone, rich and poor, dems and republicans, young and old, cis and transgender, he, she and its.

Curtin then drifted into a philosophical discussion of the three potential reactions to inflation:

Consumers have initially reacted by viewing the rise in inflation as transitory, believing that prices will stabilize or even fall in the future. As a result, postponing purchases is seen as a viable strategy. This implies a slowdown of spending in the months ahead and a more robust rebound later in 2022.

Here, however, the UMich sentiment chief admits that “the main alternative is that inflation will not be transient but will rise further due to an unprecedented expansion in fiscal and monetary policies. The resulting rise in inflationary psychology will lessen resistance to rising prices and stiffen demands for increased wage gains.”

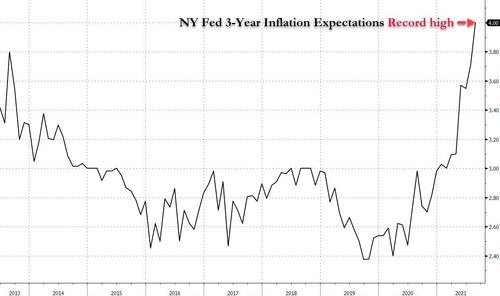

Of course, this would also be the moment the Fed officially loses control of inflation expectations, although as Curtin notes, “this reaction takes a long time to fully develop, and is contingent on significant increases in long-term inflation expectations, which have yet to be observed.” Here we completely disagree with the UMich assessment because as even the NY Fed’s own survey showed this week, 3 year inflation expectations are now the highest on record.

Which means that with every month that “transitory” inflation keeps rising, and the realization that transitory is in fact permanent , we near the “final alternative” for how consumers view inflation, which is the following:

The final alternative is that consumers may believe that the most effective strategy to maintaining their purchasing power is to emphasize increases in their incomes, net of taxes and transfers. The effectiveness of pandemic transfers were shown to be successful in offsetting hardships among those most vulnerable to economic disparities. Transfers to offset the inflationary erosion of living standards would be justified in a similar manner.

In theory this is wonderful; in practice with the US economy sliding into stagflation, what will actually happen is a collapse in real wages which prompts consumers to shift from cautious to euphoric, and buy anything they can to preserve what purchasing power they still have.

This is also the first step in the progression to hyperinflation.

Food Inflation Hits Record High, Prices Up Sharply On Beef, Chicken, Pork, Turkey, Eggs, And Fish

Prices of some staples have been driven sky-high. Some of the truly startling annual numbers from Friday’s Producer Price Index:

•Beef and Veal: +59.2 percent

•Pork: +34.1 percent

•Chickens: +32 percent

•Fish: +18 percent

•Turkey: +41.4 percent

•Fresh eggs: +31.7 percent

Shortening and cooking oils are up a jaw dropping 43.5 percent.

Good. People rarely complain loud enough until it hits their pocketbook (or they’ve maxed out all of their credit cards) just to feed their family, drive their vehicles, or heat/cool their homes.

Gee..what else happened in 1980 as inflation and malaise rose ??

Something about an election maybe ??

How will the propaganda media blame this on Trump? They will find a way.

Just wait till Slo Joe’s new taxes kick in, the howling will really start.

This will make Little Jimmy Carter look like a mere practice run...

“...with consumers freaking out over soaring inflation we are about to enter a buyer’s strike because with the Fed repeating over and over that hyperinflation is transitory, consumers would rather hold on to their cash...”

They are holding onto cash which, if the expectation of inflation is correct, will be worth less and less. I would think a rational reaction would be to buy all the durable, fungible goods that you can. Anything that holds value as the dollar loses value.

Maybe if people were to stop buying things, inflation would slow, but I would expect a lot of pain along the way.

Yeah, so let’s pass Nancy’s $3.5T ultrapork and watch a pound of ground beef go to $200.

Come on Man, we aren’t going to run out of money, they are printing it like crazy!

Odd,

Durable goods are as cheap as they’ll ever be from this point forward.

If you need a new washer or refrigerator, now is the time to buy it.

But if you don’t buy food there is no inflation.

Nothing another 10 trillion in spending can’t fix.

It’s a mostly peaceful inflationary rise…

It’s going to get worse.

Trump is not totally without fault. He signed the huge spending bills last year and was never really was focused on stopping deficit spending.

And of course in standard 1970s era Decomcrate fashion, the Biden Democrat’s are blaming “bad actors” for the consequences of their stupid montary and public policy decisions.

Inflation is too many dollars chasing too few goods. The Biden Democrats solution to this is to spend $3.5 trillion more!

It is going to get much much worse people. This is only after 8 months in office!

They will but it won't work. The MSM has lost all credibility with the majority of the country.

To Dems, socialists & communists, Don’t complain, you voted (or stole enough votes) for this to happen.

“They are holding onto cash which, if the expectation of inflation is correct, will be worth less and less. I would think a rational reaction would be to buy all the durable, fungible goods that you can. Anything that holds value as the dollar loses value.”

indeed ... UNLESS the sheeple are buying into the propaganda that the inflation is “transitory” ... (boy are THEY gonna be in for an unpleasant surprise ...)

Congress not Trump writes the Budget

Who controlled Congress? the Dems.

Instead of manufacture fraudulent excuse to never hold the Democrat accountable for anything, how about you focus on the real culprits just this one time?

How true, when it hits home personally is when we wake up

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.