Posted on 06/29/2021 6:58:22 AM PDT by blam

US Home Prices Just Accelerated At Their Fastest Pace On Record

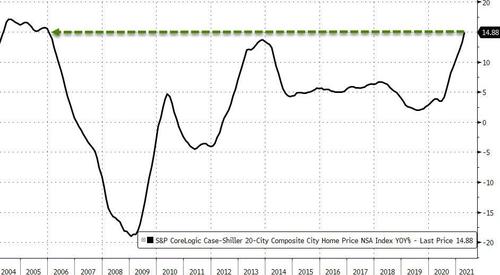

According to the Case-Shiller indices, home prices in America’s 20 largest cities have exploded at 14.88% YoY in April – the highest since Nov 2005…

Phoenix, San Diego, Seattle reported highest year-over-year gains among 20 cities surveyed…

All cities are seeing home prices appreciate at double digits (a little higher than The Fed’s 2% “goal”).

But, on a national scale, it gets even worse. Case-Shiller’s National Home Price Index rose 14.59% YoY in April – that is the fastest pace of home price inflation on record (back to 1988)

That is faster than the prior peak acceleration in September 2005!

“We have previously suggested that the strength in the U.S. housing market is being driven in part by reaction to the COVID pandemic, as potential buyers move from urban apartments to suburban homes,” Craig Lazzara, global head of index investment strategy at S&P Dow Jones Indices, said in statement.

“April’s data continue to be consistent with this hypothesis. This demand surge may simply represent an acceleration of purchases that would have occurred anyway over the next several years. Alternatively, there may have been a secular change in locational preferences, leading to a permanent shift in the demand curve for housing.”

The question for Jay Powell is – explain how this is “transitory” if you’re never gonna taper or hike rates?

Increasing violence, Antifa and BLM in the cities wouldn't have anything to do with it, eh?

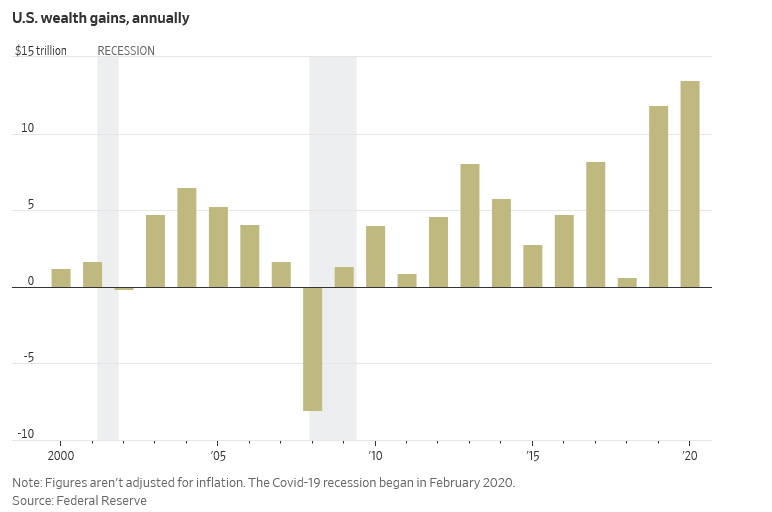

When you look at connections between home prices and median family income in various places, it makes one wonder, how the heck does anyone afford a house, if they are dependent on their paychecks to pay a mortgage?

And if it turns out that there are just so many all cash buyers out there, who the heck has all this money to buy these houses? Are they cashing out of investments on Wall Street to buy houses instead as an investment? Are Chinese people buying American houses?

It does seem that the housing market is not functioning the way it used to.

The middle class is being priced out of the housing market in many cities in this country.

Yup! Absurd. IF I could afford to buy something else I’d downsize but the smaller stuff is more than we paid for what we got now. Then again, we’ll be able to take in a couple illegal alien families currently. All part of the kill the suburbs plans with the ‘accelerating affordable whatever housing act’.

“Increasing violence, Antifa and BLM in the cities wouldn’t have anything to do with it, eh? “

Fast...I too believe it may have everything to do with price increases.

My lovely wife asks each time she goes to Sam’s or WMT where the hell is all that money coming from to buy cart loads of stuff and load it into a caddy escalade...In one of the poorest areas in the US. I’m missing something...

bubble, bubble, toil and trouble...

We just closed our house sale last week...whew...and our Realtor said there are Many cash sales...some from California. Movers said lots of Pot money...who knows.

The are two big factors:

1) Mortgage rates hit the lowest levels in history last year. Average of 3.11% interest. The housing boom before 2008 rates were never below 6%. Folk can pay a much higher sticker price with the same mortgage payment.

2) Wall Street has decided residential real estate is a great investment. Billions are pouring in from hedge funds to buy rental stock across the country.

Did you hit the jackpot? And what are your housing plans now, if I may ask.

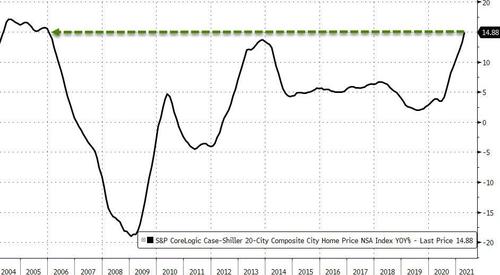

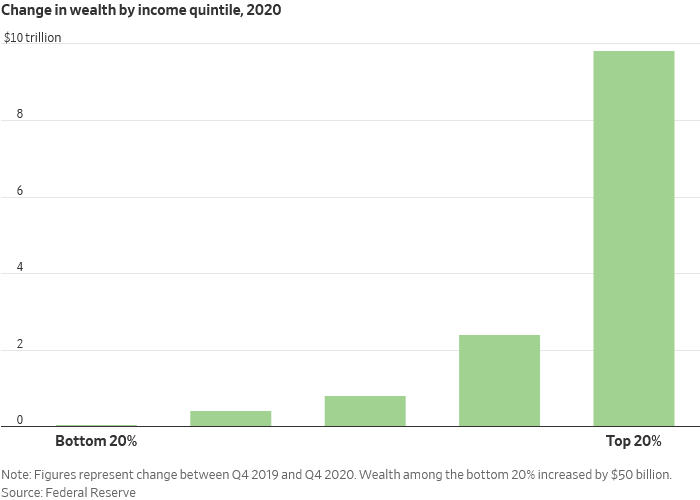

Via the wsj:

Bubble.

When home prices (and rents) become disconnected from wages, the prices MUST eventually come down.

Welfare, SNAP, Section 8, Medicaid, Covid Checks, and on and on and on....

No matter what you do, the checks keep coming!

I wish I had a magic 8-ball to tell me when it’s going to pop. :)

How in heck did that happen?

Wondering how much of this cash was laundered from the multi-trillion stimuli?

You have the correct answer

And more money is flowing now to sellers, so they in turn have bigger chunks of cash to shop with themselves

The losers are investors buying mortgages with ridiculously low returns

40-45% of the population is doing exceptionally well. Record earnings. The other 55-60% are going paycheck to paycheck

Real-estate is where all the inflation is going to.

Wall Street companies like Blackrock are buying up all the homes for an average of 20 to 50% over the asking price and turning entire neighborhoods into rental properties.

This is why home values are soaring.

people wanting to get out of apartments/ condos and wanting to live where an oversite committee wasnt telling them what to do and they could move away from neighbor's they didnt like.

As for the money end??. Lots of it down south is baby boomers who were a large section of the work force. They are selling their old homes to the aforementioned people and cashing out some of their 401's and moving south.

the bottom line for a large chunk of these baby boomers leavi g is they were forced out of the work place. The younger generation wants things done anyway it can be done and dont care as much about quality as quantity. Old people are too hung up on the particulars of doing the job right once. Now days management just wants someone to sign the paperwork. They dont care how a job got done as long as they have someone to throw under the bus if the finished product goes south. My 2 cents.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.