Posted on 08/27/2009 3:25:44 PM PDT by RobinMasters

The US banking system will lose some 1,000 institutions over the next two years, said John Kanas, whose private equity firm bought BankUnited of Florida in May.

“We’ve already lost 81 this year,” he told CNBC. “The numbers are climbing every day. Many of these institutions nobody’s ever heard of. They're smaller companies.”

Failed banks tend to be smaller and private, which exacerbates the problem for small business borrowers, said Kanas, who became CEO of BankUnited when his firm bought the bank and is the former chairman and CEO of North Fork bank.

“Government money has propped up the very large institutions as a result of the stimulus package,” he said. “There’s really very little lifeline available for the small institutions that are suffering.”

This comes at a time when the FDIC has established new rules on bank sales. Private equity, for instance, would have to hold double the capital of their competitors in order to buy such an institution, said Kanas.

(Excerpt) Read more at cnbc.com ...

thats ok our dictator can take them over.

DEPORT BARRY SATORO!

And yet they want us to believe job losses will stop, people will begin buying cars and houses, and the economy will grow again?

“...many of these institutions nobody’s ever heard of?”

Except, maybe, possibly, THEIR INVESTORS!!! Or the American’s who bank with them???

Nobody’s ever heard of??? Can I just open, then, the FirstUnitedNationalBankofPAMom? I’ll protect your investment real gooood.

FUBO your not my Prez! and another 100 million agree. It’s time to kick some a__!

I think we need to throw another 10 trillion at it.

That will fix the problem FOR SURE!

*facepalm*

We obviously need to borrow more money and the government needs to print more money (/sarc)

Did you see the job postings advertised by the FDIC?

They’re in a huge hurry to fill hundreds financial-type jobs in the next two months.

Stimulus 2! That should take care of everything.

great..I own private stock in and helped start-up two small banks 4-5 years ago, but only one took TARP loan.

both were hit by the Silverton collapse

http://www.nytimes.com/2009/06/06/business/06silverton.html

|

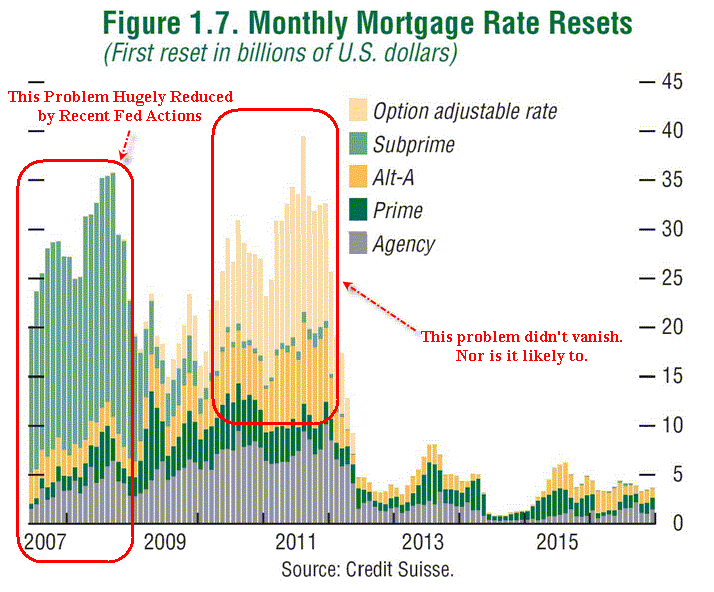

Did you see the job postings advertised by the FDIC? They’re in a huge hurry to fill hundreds financial-type jobs in the next two months. I saw this elsewhere, but it sums up what is going on out there in the housing market that is still driving this economy:When a statutory foreclosure takes place on a property in most states, it will wipe clear nearly ALL other liens on that property.Traditionally, banks absolutely LOVE this, as they can gain a house dirt cheap, especially if the house has a home equity loan on it, if the home owner has paid down some of the principle, or a 2nd or 3rd mortgage exists that contributed to the purchase price when bought. However, for the last several months, many banks will inform a delinquent homeowner that the bank is foreclosing on the house and they MUST move out. The bank might threaten to have the sheriff remove the delinquent home owner and his belongings. But in many cases, banks are NOT “pulling the trigger” and statutorily foreclosing on properties. The banks are instead just leaving the houses vacant -- on approximately one-third of homes of which could have been legally foreclosed on by the banks. So WHY IN THE HELL aren't banks legally foreclosing on the courthouse steps when they legally can? The Financial Accounting Standards Board eased the rules on mark-to-market bookkeeping in April, giving banks more time to convert assets. However, unchanged in the new rules is that the minute a bank legally forecloses on a house -- WHAM, they have to record that new foreclosure price down in their books, often taking a HUGE loss. For example, if a bank forecloses on a house and resells it to an investor for $150K, when the mortgage had $250K left, the bank then must record a NEGATIVE $100K in the books. No big deal in a normal market – the bank would normally just absorb the loss. But in THIS market, with few qualified buyers and LOTS of inventory, if a bank does that on hundreds or thousands of homes too rapidly – that bank would set off automatic valuation triggers, no longer be financially-solvent, and the FDIC would swoop down and take possession of that bank. Quite frankly, the FDIC is hiring like mad to have enough employees to manage these bank assets when they take possession. They aren’t in a hurry, per se, to take over ALL of the banks they really SHOULD take over. That is, not until they have enough asset managers, auditors, etc in place to manage taking over those banks. That massive FDIC hiring frenzy is still going on at this time. So when you hear news anchors say that the banks are fine, the housing market is rebounding, and that the economy is in an upturn, remember this chart: |

Obama is in way over his head. Its apparent. The stock market is very much set for a major correction. I see no reason why it has risen as much as it has. There are close to 2 million people within the next 6 months who will run out of unemploy benefits.

I dont think it will go another full year before people realize how bad it is. I volunteer at a soup kitchen a couple days a month. The volume usually is about 100 a day. Its been more than, I would estimate, 300 a day the times Im there.

bttt

We are in a stock market rally, all is well.

LOL!!! That would make a fabulous tagline!

May I borrow it for a few days?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.