It's easy to verify all of this on AI nowadays.

Posted on 12/26/2025 7:21:34 PM PST by chud

The price of silver is about $78.65 as of Friday—a new high—according to the New York Commodity Exchange.

Silver’s price surge has outpaced gold, though the more expensive metal’s price rose just over 1.2% to hit a high of $4,562.70 on Friday.

(Excerpt) Read more at forbes.com ...

For perspective, a pre-1965 Quarter is now worth $14 and change.

If only I had bought silver when it was cheap.

I got lucky and bought a set of 8 sterling (92.5%) silver flatware for $30 in about late September for $30. The net meltable silver was 75 ounces.

In September, it was worth $2,500 in melt value.

Today, it is worth $5,925.

Wow!

Cannot continue at this pace

It will fall back to below 50 soon. I could be wrong.

It is “cheap”, right now.

Consider, with inflation, $50 silver in 1980 is $200/ounce today.

Ergo, silver today, just shy of $80/oz, is severely undervalued, priced in fiat.

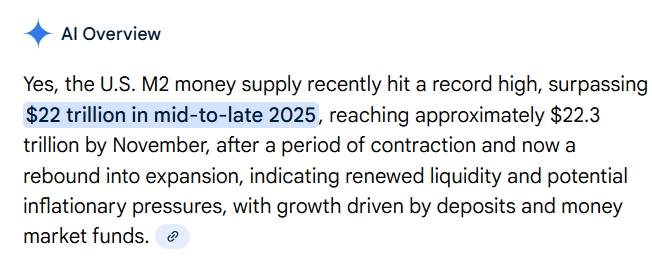

Also, remember, it’s not that silver is increasing in value. Silver’s value is rock steady. It’s the fiat dollar that is wasting away.

That thinking is what is holding back so many from trading worthless fiat green-inked TP for real money, while they still can.

Its supposed to be $250 by July. Color me and Mr. GG2 happy. We’re giddy at $79.

It's easy to verify all of this on AI nowadays.

So, mortgage the trailer and put it all in silver?

> Silver’s value is rock steady.

Industrial demand strongly affects the silver price.

I am on record saying that $250 is not going to happen, at least not in the next 10 years.

much more likely is that it will peak just shy of 100 and then fall off a cliff and $35 here we come.

Consider, with inflation, $50 silver in 1980 is $200/ounce today.

Ergo, silver today, just shy of $80/oz, is severely undervalued, priced in fiat.

Agreed.

The price action this week alone has been crazy, it's like a rocket ship.

When you consider that we are at nominal highs, and NOT inflation-adjusted highs, there is still a lot of room here for the price to go up.

Well I have never been a big silver girl. I’m all about gold. But things are changing and the dynamics appear to be in place for silver to soar. Fortunately Mr. GG2 has always had faith in silver as well as gold. I always said it would never go over $45.

I bought 500 oz at $17 ten years ago - my brother thinks I’m crazy if I don’t sell at these prices.

In fact, he’s picking me up for breakfast and dragging me to a dealer tomorrow AM - it’s like a family intervention!

Call me crazy but I think I’m going to hold onto it a bit longer.

I fear for their lives if you sell now :)

😎don’t worry - my family is safe and so is my silver hoard

Silver hit $50 during the Hunt brothers era. That was worth lot more than $79.

I have a friend in a similar situation. His wife was against him buying silver, but now she admits it was a smart move and is relentlessly pestering him to sell.

Whatever you do, don't sell it all.

You could sell a little, then sell a little more with every five dollars that it goes up.

Me...I'm not selling.

I said value is rock steady. Price is an artificial fiat value set by banksters as they short paper silver.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.