Posted on 01/03/2023 8:41:25 AM PST by millenial4freedom

US stocks will surge back toward record highs in 2023 once the Federal Reserve signals that it'll ease up on its monetary-tightening campaign, according to Fundstrat Global Advisors co-founder Tom Lee.

Lee said in a recent interview that he expects the S&P 500 to steadily climb 24% from its current level to hit 4,800 points this year – which would mean the benchmark index retesting the all-time high it reached in January 2022.

(Excerpt) Read more at msn.com ...

Jim Cramer would be proud of him.

I think the US Dollar as the Petrodollar is going to fall soon and I can't imagine what that will do to the market and the economy.

What brilliant folks these folks are! They can't find their nose on their face.

Sounds good to me.

I don’t know what the Fed is going to do. The recent spending bill puts pressure on the FED to raise rates.

The Bond Market today is shouting the FED to stop raising rates. The FED always follows the Bond Market, usually after some delay. If the Bond Market moves substantially the FED has no choice but to follow it, the Bond Market is much larger than the FED.

Sooner or later he will be right.

Then he will point to that one time and say:

“See I predicted what was going to happen”

Global deflation is the name of the game in 2023 - and beyond into 2024.

W.H. Press Secretary Karine Jean-Pierre sent him this information by e-mail for him to disseminate!

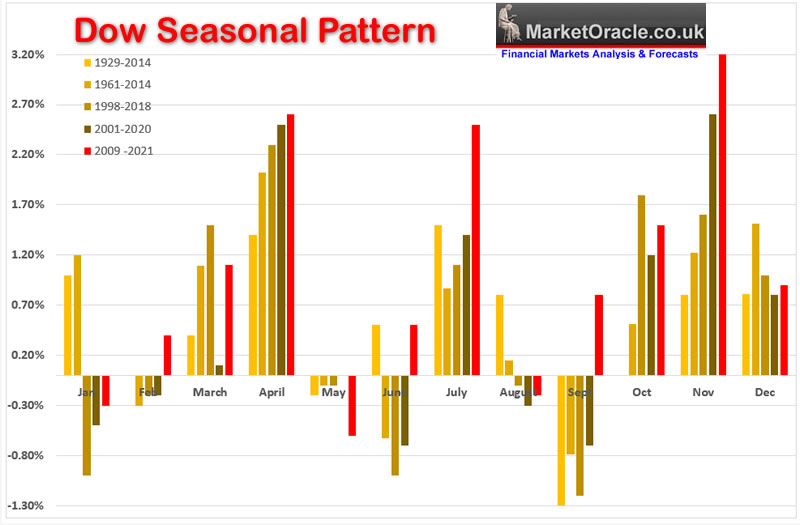

SEASONAL ANALYSIS

The seasonal pattern suggests after a pause in Feb, higher into late April, then correct from early May into late June followed by a volatile summer terminating in a swing low during September that should set the scene for a bull run into the Christmas Holidays with of course intra month volatility during October that resolve to the upside just as the perma-bears are crowing at their loudest that the end is neigh.

As for 2023, a December peak sets the scene for a correction into February, rally into late April / Early May. Summer is going to be volatile with a downwards bias, probably all the way into early October, so maybe a mini bear market from Early May to early October, weak not on the scale of 2022, and then a powerful bull run into the end of the year for a strong up year.

https://www.marketoracle.co.uk/Article70729.html

Check your IRAs highest amount and tell me when you hit that dollar amount again ....and don't even think of how inflation impacts your purchasing power.. you've been robbed but that's how the game is played with fiat money...

b. s.

a 24% rebound may not keep up with inflation over the last 48 months........

Even if it happens.

Even if that happened, I’d be lucky to be back where I was one year ago at this time.

We need a compilation of all Lee’s words. I love video compilations.

**This will only be the 94th time Tom Lee will be proven wrong since the Fed started tightening.**

Zelenskyyyy-puppet will probably be asking for more money the 94th time by this summer.

Which of those statements is likely to be true... first?.. second?.. both?

And who the hell is Tom Lee?

Of course, if the s&p drops 20%, it takes more than a 20% return to get back to even. Something like 25%

I talk to maybe 3-4 other people that trade.

Old joke was do the complete opposite of what Cramer is doing.

And it's held true over the years....I never watch the moron....but I hear about him.

FWIW=

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.