Posted on 11/17/2022 8:41:27 AM PST by EBH

The Federal Reserve may have to raise its benchmark interest rate much higher than it has previously projected to get inflation under control, James Bullard, who leads the Federal Reserve Bank of St. Louis, said Thursday.

Bullard's comments raised the prospect that the Fed's rate hikes will make borrowing by consumers and businesses even costlier and further heighten the risk of recession. Wall Street traders registered their concern by sending stock market futures further into the red early Thursday. The Dow Jones Industrial Average was down about 330 points shortly before trading began.

Bullard's remarks followed speeches by other Fed officials in recent days that suggested they see only limited progress, at most, in their use of steadily higher rates to fight inflation.

The Fed's key short-term interest rate “has not yet reached a level that could be justified as sufficiently restrictive,” Bullard said. “To attain a sufficiently restrictive level, the policy rate will need to be increased further.”

The Fed is seeking to raise borrowing rates to a level that restrains economic growth and hiring in order to cool inflation.

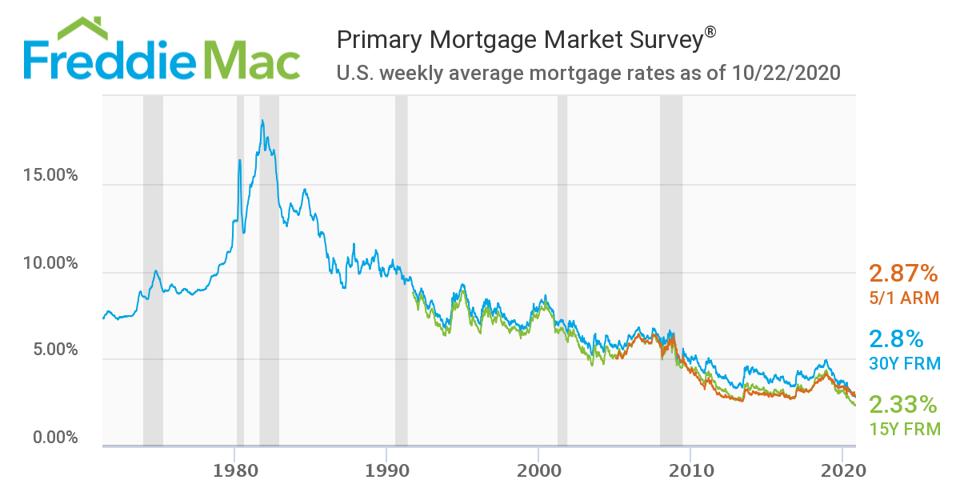

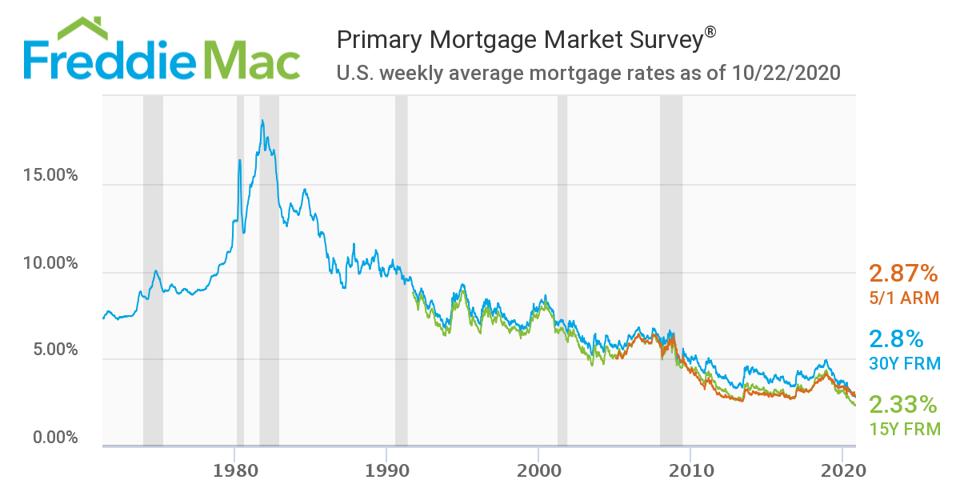

The central bank has rapidly raised its benchmark rate by an aggressive three-quarters of a point at each of its last four meetings — the fastest series of hikes since the early 1980s. The cumulative effect has been to make many consumer and business loans costlier and to raise the risk of a recession.

Those increases have boosted the Fed's short-term rate to a range of 3.75% to 4%, up from nearly zero as recently as last March, to the highest level in nearly 15 years.

Bullard suggested that the rate may have to rise to a level between 5% and 7%...

(Excerpt) Read more at msn.com ...

Bastards are determined to send unemployment up over 10%. That is their goal.

In 1980 and 81, the Fed pushed most interest rates above 18% to stop Jimmy Carter’s inflation. It is going to get worse before it gets better.

Let’s go Brandon!

Not enough pain is being inflicted currently.

You don't have to cause a recession/depression to stop inflation. My God. Don't do this sh!t again.

“Doesn’t sound like a pivot is coming anytime soon.”

The pivot won’t happen for awhile, much to the chagrin of the cheap money whores.

The squealing will be monumental.

“Oink, Oink.”

Sounds like he’s fronting for a lotta short positions

Lower taxes, increase tariffs and drill baby,drill. Hold interests low!!!!

The only other way is to stop spending, printing money, broadly raise taxes and increase production and we all know that ain’t gonna happen

I bought a new car that year (with excellent credit) and got the super good prime rate of 22%.

Good times, good times...

Agree the recession is snowballing fast fasten seat belt for the next two years.

In this situation, with this government fighting “climate change” above all, you will need a very deep recession/depression to bring inflation down.

In the Reagan years the interest rates were jacked up very high first, but within a year of that supply side measures were introduced. It did take a pretty hard but relatively short recession with significant unemployment to bring inflation under control, but by late 83/early 84 things were taking off and the supply side measures gave Reagan the landslide re-election.

This government we have today categorically rejects supply side measures (such as oil and gas) because it wants to fight “climate change” and fundamentally “recreate” (destroy) the world economy. So what you will get is a long, hard downturn with A LOT of unemployment. And without changing this government, there is no path out.

1Mortgage Rate History: Check Out These Charts from the Early 1900s

2Here's how much home prices have risen since 1950

quit inching it up and just go there already.

That was the first time I ever borrowed money. I bought all of my cars used (very used) for cash because I didn't want to pay the ridiculously high interest rates.

“You don’t have to cause a recession/depression to stop inflation.”

That is a true statement—if the government stops deficit spending like a drunken sailor.

In 2022 this is not going to happen.

Imho the Fed rate will have to get above 10% to get a handle on inflation.

I know you don’t want to hear it—but don’t get mad at me—get mad at the politicians.

The Fed created this mess by lowering interest rates in the first place instead of letting their buddies go belly up. It would have been better for all of us if we had taken a little pain back in 2007. The Fed first plays the God of salvation and then the God of death in order to pay the piper. They need to be abolished.

Did that get it under control? Or did getting rid of his policies get it under control.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.