Posted on 08/20/2019 12:38:57 PM PDT by SeekAndFind

Every quarter, the Federal Reserve Bank of New York releases data on how much household debt Americans are accumulating. Here’s everything you need to know about American debt in Q2 2019.

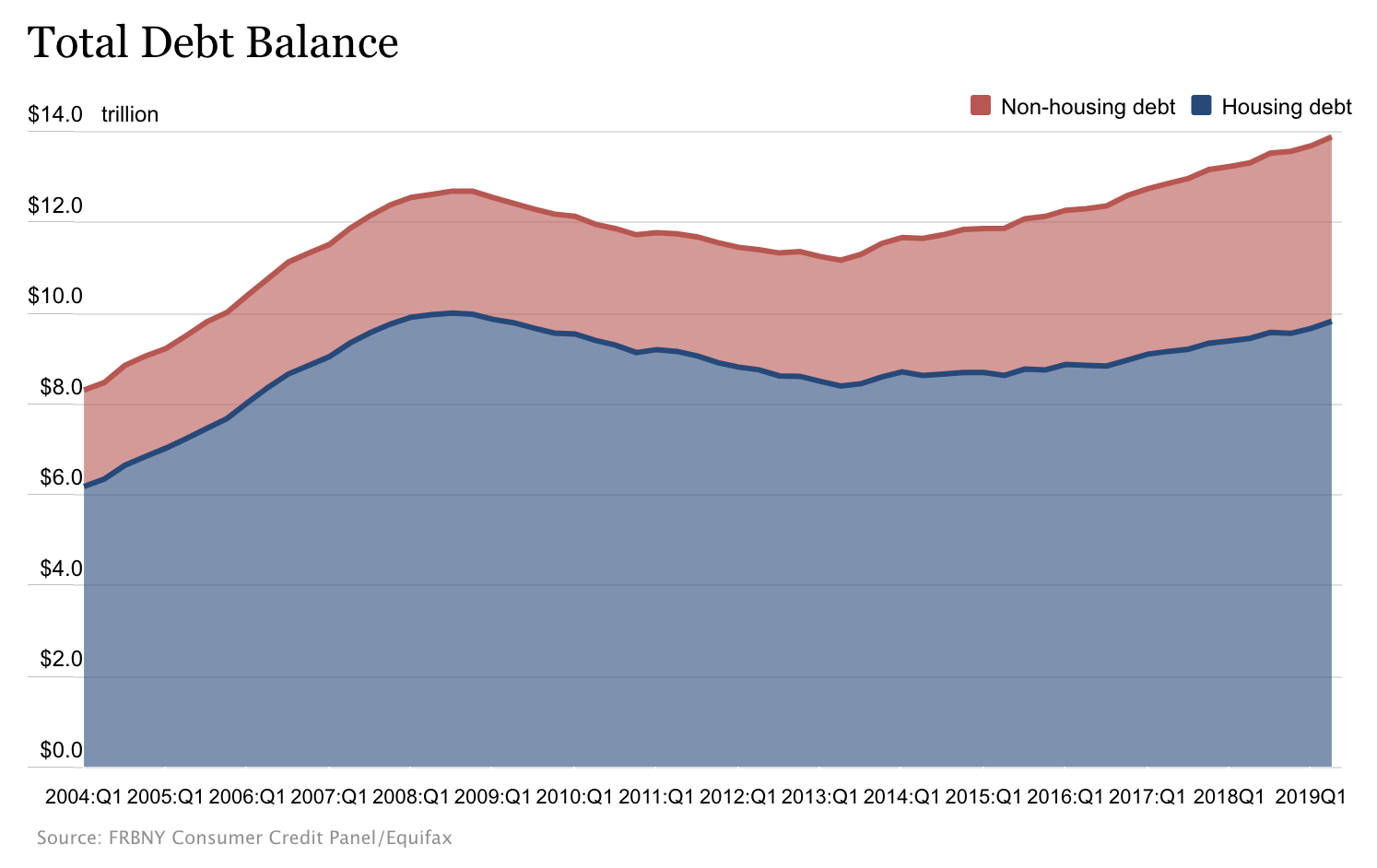

– Total household debt level at $13.86 trillion, up 1.4% ($192 billion) from Q1

– 20th consecutive quarter with increase in debt

– Mortgage household debt rose by $162 billion in the second quarter to $9.4 trillion

– Total mortgage debt the highest it’s been since Q3 2008

– Mortgages and refis increased by $130 billion to $474 billion, the highest since Q3 2017

– $17 billion increase in auto loan balances

– $20 billion increase in credit card balances

– $8 billion decline in student loan balances

– 0.2% increase in 90-days-late credit card balances to 5.2%

– 0.1% fewer mortgages are delinquent—0.9% down from 1.0% in Q1

– Only 10.5% of mortgages in early delinquency (30-60 days late) transitioned to 90+ days delinquent, the lowest rate since 2005

– 232,000 bankruptcies in Q2 compared to 225,000 in Q1

– More student loans are severely derogatory (in danger of repossession or charge-off) than mortgages right now:

– HOUSEHOLD DEBT AND CREDIT REPORT (Q2 2019) (Federal Reserve)

As long as voting is allowed, nothing is more certain than that the bankers are going to get it in the neck.

bookmark

THAT is the game ender.

* As of August 1, 2019, the official debt of the United States government is $22.0 trillion ($22,022,779,932,478).[1] This amounts to:

More. Much more depressing info here....

See the link in post 24.

However much an average family owes in personal debit is nothing. NOTHING compared to what they owe in US debt.

I did my part. I paid off my undergrad and law school student loans within four years after graduation and pay off my credit card debt in full every month, and I have done so since the late 1990s.

The only debt I didn’t pay off immediately was my car loan - I took it out in 2002 at 0.9% and just made monthly payments. The useful life of the car was eight years.

If I can’t pay in cash (or pay fully in a few months), I don’t buy it. Simple.

What are you driving, a Yugo?

100% Debt free for 7 years now

Nah, I drove a Saab. 5 year loan, but I left town after 8 years and I didn’t need the car anymore. So I sold it for a good price. It was running great and I expect it would have served me well at least another 8 years. I miss that car.

So we added $12 trillion in national debt in the last 10 years, and only reduced household debt $2 trillion from 2008 to 2014.

Where did the other $10 trillion go. $10 trillion to prop up the stock market? Or maybe like $6 million to pump up the stock market and $4 trillion for endless wars.

It must be nice to be rich and have the government make you richer still.

Thanks for the stats... It’s like a black cloud that no one ever talks about and ignores. When this should be the very first thing factored in when discussing debt.

Those are some good indicators for the Fake Indian.

Her whole campaign is about forgiving debts and holding televised public floggings of bankers.

Deadbeat here!! Have not had a balance in over 20 years. No loans of any kind now and don’t plan on having any. Made promise to self when retired to NEVER borrow money and have kept it. Driving 10YO car now and each month I put away what the payment used to be. Have enough to buy another for cash anytime I want but I am happy with my car so plan on driving till the wheels fall off.

So we have...

04.0 Trillion non-housing debt +

10.0 Trillion housing debt +

22.5 Trillion Imposed national debt +

= 36.5 Trillion total debt as a whole, not 14.0.

“Most of them have under $200K in retirement savings and Social Security alone is not going to cut it for most of these folks.”

A 1/3 of baby boomers have zero saved and most BB have on average $110,000 in debt.

Lot of folks will never retire or their money is going to run out quick.

How far from or near a bubble are the numbers:

Mortgage debt 45% of GDP in 2018

Mortgage debt 57% of GDP in 2008

Non-Mortgage Household debt 24% of GDP in 2018

Non-Mortgage Household debt 21% of GDP in 2008

The elephant in the room?

College student loan debt:

Student Loan debt 2018 1.46 trillion (7.3% of GDP in 2018)

Student Loan debt 2008 640 billion (4.5% of GDP in 2008)

Can I pay my share debt now and then be given super citizen status? I’m not joking. Think about it. It will happen.

Wait. You forgot to add in 51 Trillion for reparations.

That is going to be great isn’t it? They will never do this, they are just manipulating the ignorant with BS. They would have to eliminate all other free stuff to pay for it. There is no way that can ever have both, let alone just one of the promises.

Hopefully not that long, but as an engineering manager it’s not like my job will kill me and I make to much to want to give it up to live on less...

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.