Posted on 08/20/2019 12:38:57 PM PDT by SeekAndFind

Every quarter, the Federal Reserve Bank of New York releases data on how much household debt Americans are accumulating. Here’s everything you need to know about American debt in Q2 2019.

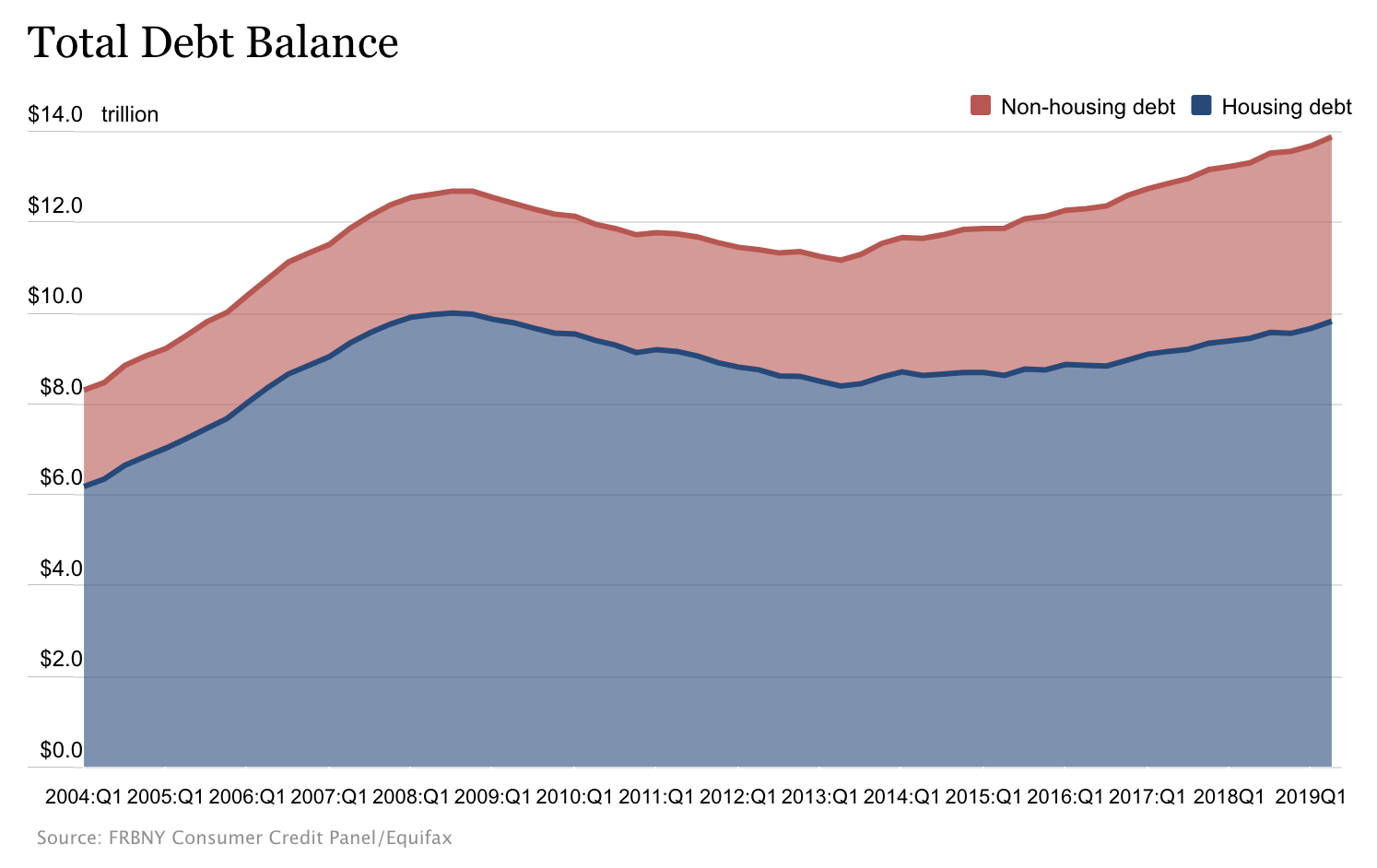

– Total household debt level at $13.86 trillion, up 1.4% ($192 billion) from Q1

– 20th consecutive quarter with increase in debt

– Mortgage household debt rose by $162 billion in the second quarter to $9.4 trillion

– Total mortgage debt the highest it’s been since Q3 2008

– Mortgages and refis increased by $130 billion to $474 billion, the highest since Q3 2017

– $17 billion increase in auto loan balances

– $20 billion increase in credit card balances

– $8 billion decline in student loan balances

– 0.2% increase in 90-days-late credit card balances to 5.2%

– 0.1% fewer mortgages are delinquent—0.9% down from 1.0% in Q1

– Only 10.5% of mortgages in early delinquency (30-60 days late) transitioned to 90+ days delinquent, the lowest rate since 2005

– 232,000 bankruptcies in Q2 compared to 225,000 in Q1

– More student loans are severely derogatory (in danger of repossession or charge-off) than mortgages right now:

– HOUSEHOLD DEBT AND CREDIT REPORT (Q2 2019) (Federal Reserve)

I learned (or inherited) the same basic attitude and,as a result,I haven't had a mortgage since I was in my late 30s and haven't had a balance on a credit card since my 20s.

Thankful that our household debt has been zero for the last 3 years.

Lots of numbers here. No real information.

So how much is the average debt per family?

This doesn’t seem to take into account what is also owed to the National Debt.

There you go...

Average debt per family is a more useful metric.

I love comparing my situation to the "average", whether it be debt, retirement savings, or income.

Always well up in the 90th percentile of each group. That's how I know I'm doing pretty well.

I'm really concerned with what will happen when all the Baby Boomers retire. Most of them have under $200K in retirement savings and Social Security alone is not going to cut it for most of these folks.

I see a big tax grab for those who did manage their finances properly. The Fable of the Ant and the Grasshopper comes to mind.

haven’t had a balance on a credit card since my 20s.

They won’t be retiring, they will work until the day they die.

No mortgage for us! Paid off a 30 Year Mortgage in 16 Years!

Thank you and God bless President Trump!....................

We owe no one anything. Except annual property taxes and any monthly utility I may use. We have every thing we need for life. We have no need for credit.

So do we, we pay the balance in FULL every month!..............They hate me..............

Deadbeats.

128 million households in the US. I agree the information was pretty much useless.

So what do they call someone who doesn’t?.....................

The plan is ‘die broke’...so far, so good.

Study.

Same here, and I like the security of it. I would gladly have a lower standard of living and know I don’t owe anyone anything. It amazes me people are in debt at my age and have huge house payments. Hit the big 60 and work with people older than I am with huge mortgages. Ack, will they ever be able to retire?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.