Skip to comments.

The inverted yield curve explained and what it means for the economy and your money

CNBC ^

| 08/16/2019

| Al Lewis

Posted on 08/16/2019 8:46:38 AM PDT by SeekAndFind

If you’ve been gleaning financial headlines, you may be asking, what is this “inversion of the yield curve” thing and why is it so scary?

An inverted yield curve marks a point on a chart where short-term investments in U.S. Treasury bonds pay more than long-term ones. When they flip, or invert, it’s widely regarded as a bad sign for the economy.

Getting more interest for a short-term than a long-term investment appears to make zero economic sense.

Go to any bank and you will likely get a lower interest rate on a 6-month CD than you would on a 5-year CD. The bank pays you less because you’re only giving up your money for six months instead of five years. But imagine if this were inverted and bank paid more for the 6-month than the 5-year CD.

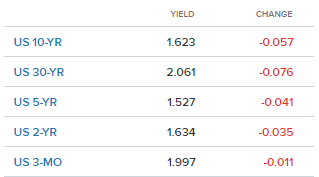

Now think of the U.S. Treasury as a bank. On Wednesday, the Bank of Uncle Sam offered a two-year CD that pays more than its 10-year CD. That is to say, 2-year Treasury bonds were yielding 1.603% while 10-year Treasurys were yielding 1.6%.

As a consumer, you can see a similar trend at retail banks. The difference between what 6-month vs. 5-year CDs yield, while not inverted, has gotten a lot smaller. The trend is positive for consumers in some ways, with mortgage rates likely to come down further.

One reason inversions happen is because investors are selling stocks and shifting their money to bonds. They’ve lost confidence in the economy and believe the meager returns that bonds promise might be better than potential losses they could incur by holding stocks into a recession. So demand for bonds goes up and the yields they pay go down.

(Excerpt) Read more at cnbc.com ...

TOPICS: Business/Economy; History; Society

KEYWORDS: debt; money; negativerates; recession; stockmarket; yieldcurve

Navigation: use the links below to view more comments.

first 1-20, 21-23 next last

This widespread loss of confidence explains why inverted yield curves have proceeded every recession since 1956. The last inversion began in December 2005 and heralded the Great Recession, which officially began in December 2007. Then came the 2008 financial crisis. There was also an inversion before the tech bubble burst in 2001.

That’s why an inversion is so scary. But does this mean we’re having a recession and a big downturn in the stock market? Not necessarily.

To: SeekAndFind

PLEASE NOTE:

It may depend on how long the inversion lasts. A brief inversion could be just an anomaly. In fact, some inversions have not preceded recessions.

The curve may also have inverted because of the Federal Reserve. The market may be saying the Fed has kept the benchmark short-term rate it controls too high and that the central bank should cut rates further because the economy is slowing.

This time around the yield curve has been distorted by more than $15 trillion worth of foreign bonds that pay negative interest rates — negative interest rates being another trend that seems to make zero economic sense.

Since the 2008 financial crisis, central banks around the globe have never been able to return interest rates to historically normal levels. They lowered interest rates to zero, and even below in some cases, to fight the Great Recession. Interest rates and bond yields have been low all through the recovery and expansion that followed, and they’re low still. So no reason to panic, some market observers say, because this is the new normal.

2

posted on

08/16/2019 8:49:57 AM PDT

by

SeekAndFind

(look at Michigan, it will)

To: All

Stock prices could use a correction. But I don’t see that stopping the economic growth train we are on now - just a slight slow down.

No recession - unless we let the media talk us into one with their fear mongering and Trump hate.

3

posted on

08/16/2019 8:52:42 AM PDT

by

TheTimeOfMan

(The Eloi unexpectedly protected the Morlocks from rogue Eloi as they themselves prepared to be eaten)

To: SeekAndFind

I think it is important to note that the economy has been tuned for almost 30 years to be heavily dependent on external trade.

Working for a Fortune 100 company, I can assure you that the China issues are real and are already resulting in job losses and reduced spending.

I am not saying that things will not become more focused domestically eventually, but it's a large train to change directions quickly, and that change is already having impacts on growth.

Note that I also am not saying it's a bad policy, just that it will have impacts.

To: TheTimeOfMan

Can you throw some numbers out instead of words like “train” and “mongering”? :)

it would help put things in a better perspective.

Are earnings beating the street this quarter around?

Does the REAL slow down in China and Germany affect us?

Are there any new tax laws going into effect this year?

The media doesn’t cause recessions, no matter how much of a boogeyman we make it out to be.

5

posted on

08/16/2019 8:56:33 AM PDT

by

dp0622

(Bad, bad company Till the day I die.)

To: SeekAndFind

When interest rates are this low I think it means exactly squat.

6

posted on

08/16/2019 8:58:20 AM PDT

by

Brilliant

To: SeekAndFind

This widespread loss of confidence explains why inverted yield curves have proceeded every recession since 1956.

...

Wrong.

An Inverted yield curve means the Federal Reserve is manipulating short term interest rates to be much higher than what the market would charge.

The Fed does this to put the brakes on economic growth, because they incorrectly believe that economic growth causes inflation

Economic weakness is what triggers inflation. Ask yourself how Venezuela has such high inflation and Zimbabwe before them.

7

posted on

08/16/2019 9:03:26 AM PDT

by

Moonman62

(Charity comes from wealth.)

To: SeekAndFind

To: TexasGunLover

Chemotherapy has impacts too. But sometimes the disease is so bad you have to take the strongest medicine to get over it. Extracting ourselves from economic servitude to China is one such situation. It’s worse for them.

9

posted on

08/16/2019 9:09:17 AM PDT

by

pepsi_junkie

(Often wrong, but never in doubt!)

To: SeekAndFind

The world is lined up around the block to buy long term US treasuries.

In some parts of the world there is a negative interest rate on national treasuries. Of course they want ours. Naturally the yield will go down if you don’t need to produce an incentive to buy-—duh

The truth does not meet the narrative of the global cabal objective to make Trump look bad.

cnbc is FAKE NEWS

To: SeekAndFind

The article is a lot of useless talk.

This is about the difference between 1.603% and 1.6% The difference is negligeable! ($3 yearly on a principal of $100,000.)

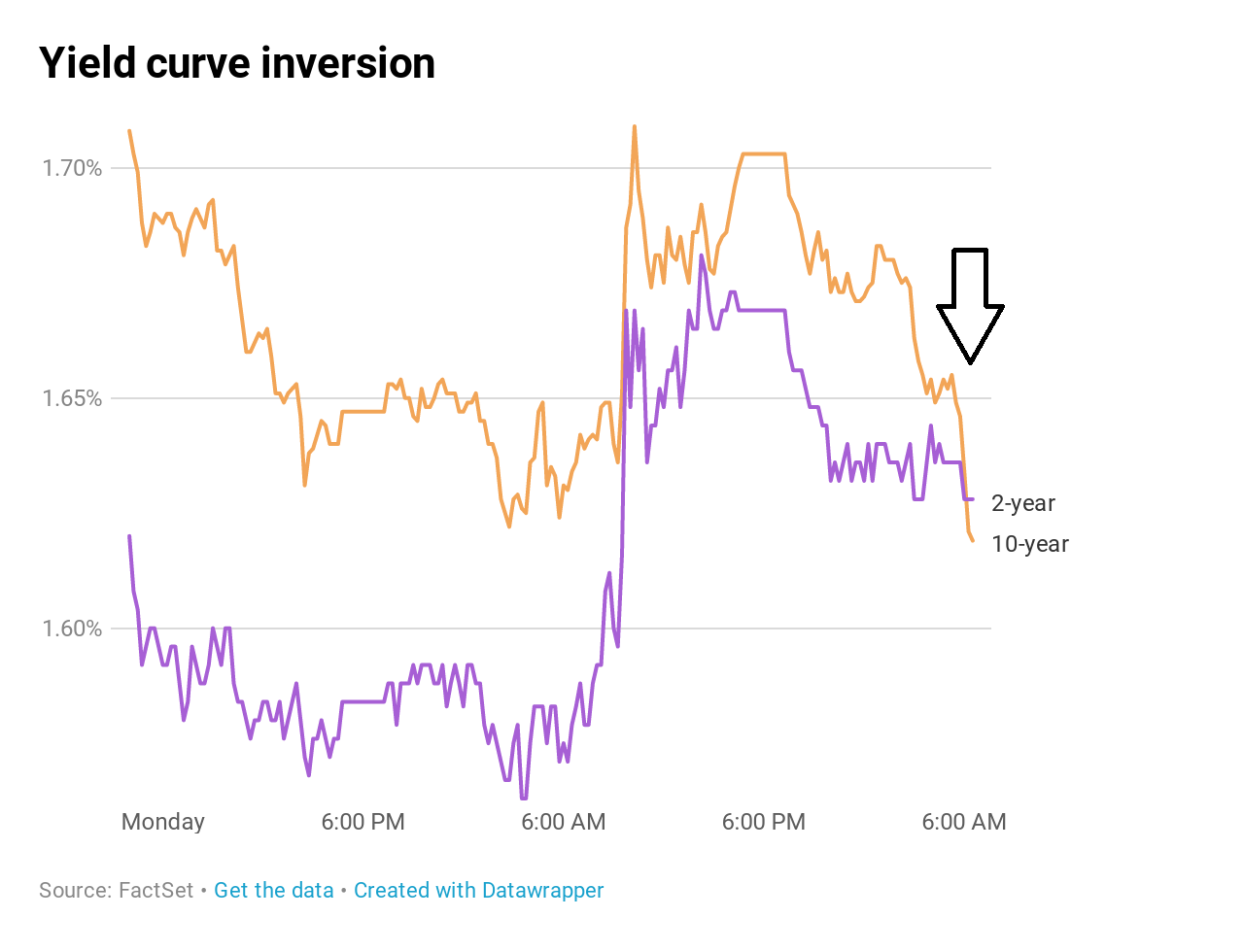

The graph starts at 1.60% at the bottom, and goes to 1.70% at the top. Not much difference, but it is exaggerated by the exaggerated scale of the chart. The numbers are not far from each other. Then there’s the ominous arrow pointing DOWN! Ohhh! scary!

The real purpose of the article is to use the word “recession.” It is used so that it will be picked up and quoted endlessly. They really want Trump defeated!

The article is a fraud.

11

posted on

08/16/2019 9:36:47 AM PDT

by

I want the USA back

(The further a society drifts from the truth, the more it will hate those who speak it. Orwell.)

To: SeekAndFind

Is it another Soros manufactured crisis like before?

12

posted on

08/16/2019 9:38:57 AM PDT

by

SMARTY

("Nobility is defined by the demands it makes on us - by obligations, not by rights".)

To: SeekAndFind

What I don’t hear mentioned much is the concept that MAYBE the reason the long term are valued lower than short term is because many investors are hinging the economy’s future more on politics than they used to, and in 10 years we are much much more likely not to have Trump-like economic policies than we are to have in 2 years.

All this inversion is saying is an affirmation that Trump and his policies are good for the economy and for investment.

The fear of losing Trumpinomics is what is driving down long term yields

13

posted on

08/16/2019 9:52:01 AM PDT

by

z3n

To: z3n

RE: The fear of losing Trumpinomics is what is driving down long term yields

I think you meant the fear of losing Trumponomics is what is driving down long term VALUES ( not yields ).

If yields are down, that means the VALUE of the bonds are up.

A Lower yield means the markets are PURCHASING the bond. A higher yield means the markets are dumping the bond.

14

posted on

08/16/2019 10:00:15 AM PDT

by

SeekAndFind

(look at Michigan, it will)

To: SeekAndFind

Yes, Thanks. I almost backed up when I typed that to correct it but didn’t.

Isn’t much of investing like prospecting?

Isn’t that why the markets took off before Trump even took office?

Just the promise of pro-growth policy was enough.

Now, the opposite is true.

Even if Trump gets a second term, he will definitely be gone in 10 years and who ever succeeds him, even if Republican, is likely not to be as pro-growth as he is

15

posted on

08/16/2019 10:03:58 AM PDT

by

z3n

To: TexasGunLover

“I think it is important to note that the economy has been tuned for almost 30 years to be heavily dependent on external trade.”

Are you referring to exports, or imports?

You can’t be referring to exports, as they constitute only about 12% of U.S. GDP.

You could be referring to imports, but even then they are not the lion’s share of U.S. GDP. Imports reached their highest share of U.S. GDP in 2008, at about 17.43% of GDP, and in 2017 stood at 15.03%.

70% or more of the U.S. GDP is within the domestic economy alone.

Now then, your statement MIGHT be better as in a reference to the stock market performance of the biggest U.S. major companies. Their earnings have increasingly reflected their global clout - like Apple’s equipment sold everywhere, GM one of the biggest car makers in China, U.S. agro-industrial-complex feeding the world, Starbucks, McDonalds, Amazon, Walmart - yes. BUT how much of what they sell is produced in America, and how much is produced outside the U.S., and how much of their global sales come back to feed the U.S. domestic economy as investment here. All of that weighs on how much their good result is seen inside the U.S. GDP and U.S. jobs.

The behavior of the big-company-weighted stock market indexes is not necessarily a gauge of how well the U.S. GDP is doing, and vice versa.

16

posted on

08/16/2019 10:20:16 AM PDT

by

Wuli

To: Wuli

You can’t be referring to exports, as they constitute only about 12% of U.S. GDP.

12% is a massive amount.

To: SeekAndFind

This CNBC guy ignores the broader view which is capital flows back and forth between equity and bond markets.

With the stock market climbing steadily until recently, the bond markets have less bidders which can only drive bond prices down and effective interest rates up.

Short term interest versus long term interest are not as statistically notable as volumes of treasuries nearing maturity.

Equations that summarize the yield curves are based on statistical models that are prone to sensitivity. A sensitivity analysis can pinpoint change points that cause model instability. As new data enters, the sensitivity points change.

Reporting inverted yield curves and then sensationalizing it is what CNBC and the moribund financial press do. They pull headlines out of thin air to sell themselves as seers when in fact they are no better than clowns on parade.

The broader view is that the Trump Administration is working around the clock to transform American industry back to production from predominately servicing businesses. The country will relearn what it means to make things.

The pundits of the financial press have had their day. Don’t listen to their astrological prognosticating rants.

18

posted on

08/16/2019 10:41:48 AM PDT

by

Hostage

(Article V)

To: TexasGunLover

19

posted on

08/16/2019 10:49:59 AM PDT

by

Wuli

To: All

Interesting, informative, educational discussion. Thanks to all posters.

20

posted on

08/16/2019 10:56:51 AM PDT

by

PGalt

Navigation: use the links below to view more comments.

first 1-20, 21-23 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson