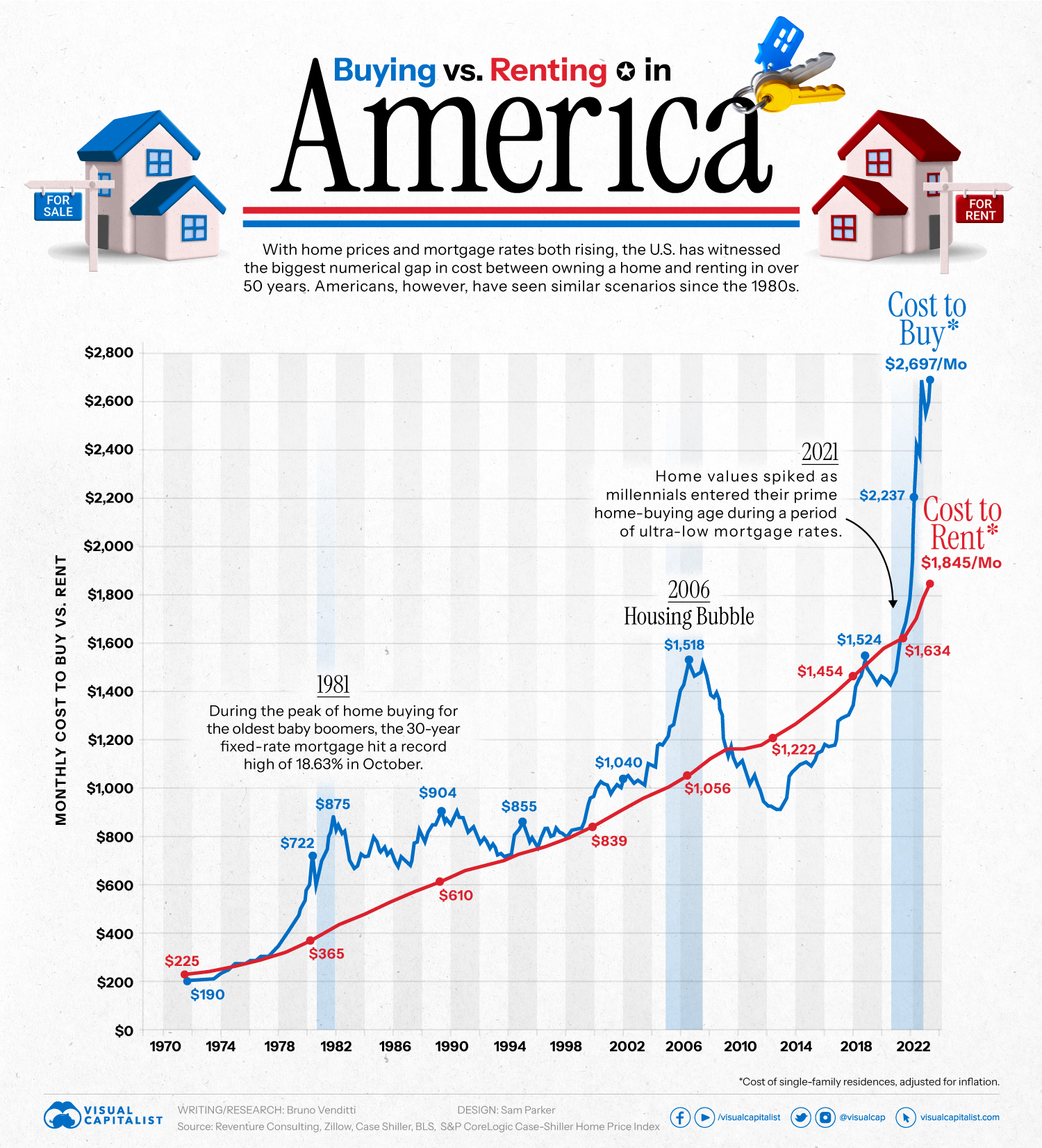

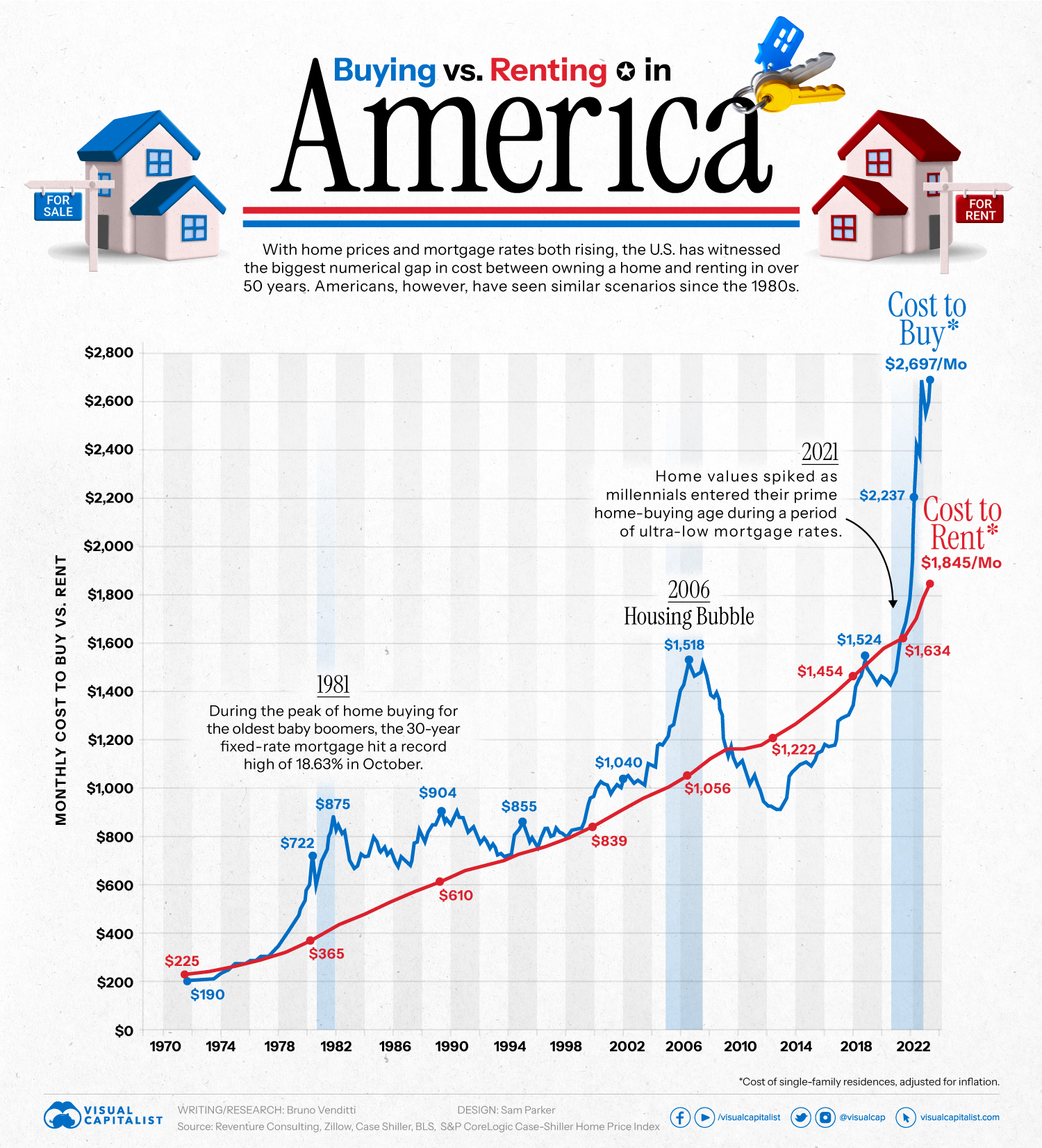

If it costs less to rent than to buy, you should rent.

Posted on 03/07/2024 9:26:22 AM PST by where's_the_Outrage?

Radio personality Dave Ramsey has been called out online for delivering out-of-touch real estate advice to homebuyers.

“Is it even possible to follow Dave Ramsey’s advice on a mortgage?” one person asked on Reddit — and their skepticism makes sense when you do the math.

The ideal way to buy a home, according to Ramsey Solutions, the finance guru’s website, is to buy it outright in cash.

But if you’re not sitting on a mountain of money, Ramsey Solutions says the only home loan you should consider is a conventional, fixed-rate mortgage with a 15-year (or less) term. Your monthly mortgage payment also shouldn’t exceed 25% of your take home pay.

“I just don't see that happening,” the Redditor wrote, “unless your take home [pay] is more than 20% of the home's value, or maybe if you buy a one-bedroom in the bad parts of the country.”

Are they right that Ramsey’s mortgage advice is unrealistic for most Americans — or are these risk-averse recommendations reasonable? Here’s the math.

U.S. homes sold in Dec. 2023 went for a median price of $402,045, according to Redfin. For simplicity’s sake, let’s say you buy a $400,000 home with a 20% down payment of $80,000, leaving you with a mortgage principal amount of $320,000.

With a 15-year fixed rate mortgage at 6.66% — the rate as of Feb. 14 — you would have to make a monthly mortgage payment of around $2,815.

For those payments to be no more than 25% of your monthly take home pay, you’d need to earn at least $11,260 per month before taxes — and that doesn’t factor in additional housing costs such as property tax, home insurance and utilities.

(Excerpt) Read more at moneywise.com ...

Right on. I leased one car when I was younger. Dumb move. Since then it’s late model high mileage cars. It’s never done me wrong.

I’m now in a position to have a company car which saves a ton. I just bought my my old company car to have a little used personal one.

We also live in less house than we can afford. It’s amazing how that works out.

“Baby Boomers have accumulated large amounts of wealth that many will never spend in their lives.”

Or very little. Or none.

It’s amazing, and it is only loosely related to their relative income.

Credit Card math, Home buying math, and Car buying math

ARE NOT TAUGHT TO ALL HIGH SCHOOL STUDENTS...

I WONDER WHO’S AGAINST THAT ? ? ? ? ?

The feedback mechanism needs to be short enough that people can figure out the causation for their lack of wealth - but a surprising portion of the people can’t figure it out why at the end of a pay period they have no money from the beginning of it, nor how to reduce risk from minor volatility.

“get a 30 year mortgage and pay it off early by doubling payments.”

We basically did that. On the first house, made two payments a month. One on the loan, and one applied to the principal. After that we were able to pay cash.

For years we lived WAY below our means. It wasn’t fun, but in the big picture it has paid off.

That happened to me and my wife in the mid-1970s. We were trying to save enough to buy our first home, but inflation was raging during the Jimmy Carter regime. We couldn't afford homes we liked and needed to save more for a down payment. By the time we saved enough, the starter home we got was more expensive than the nicer homes we passed on just 6 months earlier. We did a lot of extensive work on that starter home to fix it up. Sold it ten years later and moved up to a nicer better home. We were smarter on the 2nd home, and got a loan from a friend in order to pay 20 percent down and avoid the insurance cost if we had only paid 10 percent down. You pay insurance against a bank loan if the down payment is less than 20 percent. Friend was happy, we paid that 2nd loan off within two years at 10 percent a year, we were still better off not having to pay that insurance cost against the primary loan. We paid extra into our monthly payments to bring down the principal, enabling us to pay off the loan within 15 years.

Except in rare cases, you are always better paying down a 30-year mortgage and putting the difference between the 15-year payment and the 30-year payment aside in a pool of diversified investments.

The key to retiring early and comfortably is the ability to reduce spending and save money.

What one invests in is important but not nearly as important as the ability to save the money in the first place.

It’s ideal to get a 15 year mortgage, but a 30 year mortgage gets you a bigger better house and it’s better than renting.

____________________________________________________

And just why is it better than renting?

If you have a low income and the furnace goes out what do you do, you put your repair on the credit card. If you buy you also have insurance of two months of house payment or rent payment on average.

Ramsey is correct. Live as cheap as you can until you have enough money to pay cash for a house, fix it up and trade up until you get what you want. It works.

I can listen to Ramsey for about 5 seconds before that voice drives me crazy. Don’t know what that accent is called, but it’s nerve wracking.

excellent!

Dave doesn’t follow his own advice, and what he does say is really stupid.

The fact is, for a down payment, and for many times no down payment, a person can leverage large sums of money to buy an investment property they get to also live in.

Where else can a person borrow $100,000 $500,000, even a $1 million at low interest rates?

When I purchased my most recent company vehicle a few years ago, the sales manager at the dealership told me I was one of about 20% of his customers who bought vehicles instead of leasing them. I thought it was because everyone wants to drive the newest and best vehicles on the road, but he said there was a more practical side to it:

“Nobody wants to be driving a vehicle that isn’t under warranty anymore.”

Exactly. That’s what we told the very young couple who cleaned our house.

Live below your means.

Save as much money as possible.

Always pay cash unless credit is absolutely necessary.

A mortgage on your primary residence is also one of the only financial instruments that is rigged in favor of the CUSTOMER. You can always refinance a mortgage with no penalty if mortgage rates fall, but the bank has no such option if mortgage rates rise.

Where I live, houses in the worst part of town are $325,000. The city overall is predominantly lower middle-class families.

$400k is about right, though average homes here are about $400k. Think also about the $80k down payment. That takes a long time to get together, especially with everything else being so expensive.

A good option is to get the 30 year then pay more on the principle with the goal of getting it paid down in 15 years, but allowing “wiggle room” in case some months - or years - are tighter financially than others and you could just pay at the 30 year rate those months that you need to.

Plus, a person locks in the pricing.

If it costs less to rent than to buy, you should rent.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.