Posted on 03/11/2023 5:22:31 PM PST by HogsBreath

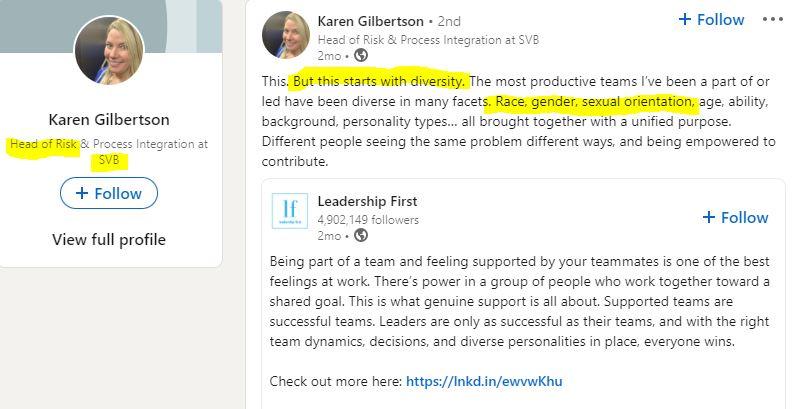

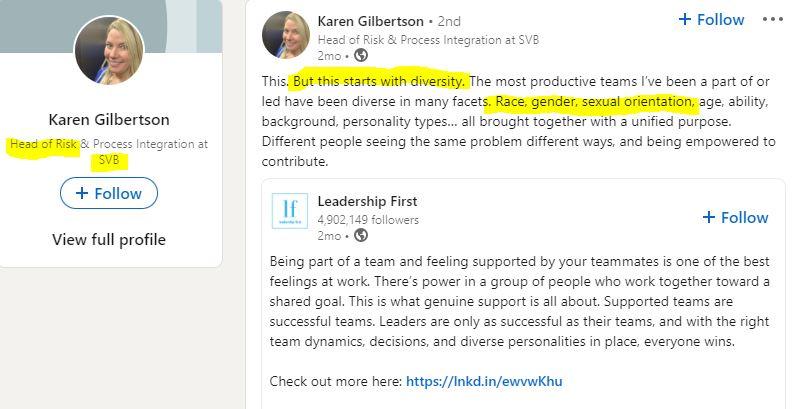

A head of risk assessment at the beleaguered Silicon Valley Bank has been accused of prioritizing pro-diversity initiatives over her actual role after the firm imploded on Friday.

Jay Ersapah - who describes herself as a 'queer person of color from a working-class background' - organized a host of LGBTQ initiatives including a month-long Pride campaign and implemented 'safe space' catch-ups for staff.

(Excerpt) Read more at dailymail.co.uk ...

Fabulous!

It shows.

Having a person like that in charge of risk assessment would be one of the first things on a list of risks that a reasonable person would put together for any corporation.

The Bank of Woke

Went broke

The sad thing is that the federal government will probably bail them out.

Sadly, probably not. There'll probably be a bailout.

Fiduciary responsibility?? Who cares about that stuff? What matters is that we can brag about our awesome wokeness.

We haven’t seen anything yet.

I believe it’s United Airlines that will soon have em sitting in the pilot’s seat of their commercial airliners. It will be kinda like this bank, what could possibly ever go wrong??!!!

SANTA CLARA, CALIF. – January 10, 2022—Silicon Valley Bank, the bank of the world’s most innovative companies and their investors, today announced it has committed to provide at least $5 billion by 2027 in loans, investments and other financing to support sustainability efforts and the company has set a goal to achieve carbon neutral operations by 2025.

“Our ability to make a meaningful difference for people and the planet, and to address the systemic risk that climate change presents, is magnified by the outsized impact our innovative clients make,” said Greg Becker, CEO, Silicon Valley Bank. “Over the last 12 years, our Climate Tech and Sustainability and Project Finance teams, for example, have supported hundreds of companies that are working to accelerate the transition to a more sustainable, low carbon world.”

SVB’s sustainable finance commitment aims to support companies that are working to decarbonize the energy and infrastructure industries and hasten the transition to a sustainable, net zero emissions economy in several related sectors:

Circular economy

Climate resilience

Energy efficiency and demand management

Green buildings

Renewable energy, energy storage and grid infrastructure

Sustainable agriculture and alternative foods

Sustainable transportation

Technology solutions that mitigate greenhouse gas emissions

Waste management and pollution control

Water technology

This is the perfect example of ESG investing......

That’s so “gay”. LOL!

Anyone...

https://www.sec.gov/Archives/edgar/data/719739/000119312512085818/d256682d10k.htm

Does the above mean that SVB’s parent company is incorporated in...Delaware...?

1500 of the 37,000 small business funded by SVB were launched and owned by climate radicals. It’s good that they are out of busimess.

ESG is dangerous not just for business, but society.

The ‘inmates’ are running the American Asylum in every economic and political sector!

Help us, President in Exile Trump! You’re our only hope!

many, many banks are incorporated in Delaware ...

“The sad thing is that the federal government will probably bail them out.”

WE will bail them out. They’re calling it a ‘bail in’. Cute.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.