Posted on 09/28/2014 10:13:30 AM PDT by expat_panama

Investment & Finance End of 2014 Q3 into Q4 Thread Edition

| Comodities | Stock Indexes | ||||||

| now | 3 Mo. Chg. | Annualized return | now | 3 Mo. Chg. | Annualized return | ||

| gold | $1,220.26 | -7.2% | -25.9% | S&P500 | 1,982.85 | 1.2% | 4.7% |

| silver | $17.71 | -16.2% | -50.7% | DJIA | 17,113.15 | 1.7% | 7.0% |

| oil | $512.66 | -6.2% | -22.6% | NASDAQ | 4,512.19 | 2.4% | 9.8% |

| U.S. $ | $85.62 | 6.7% | 29.8% | Rus2k | 1,119.33 | -6.2% | -22.5% |

Looks like the dollar soared (so much for Fed printer devaluations), metals tanked (so much for safe havens), and while big cap. stocks have done best this past quarter the current status is "market under pressure" (read: under a cloud)

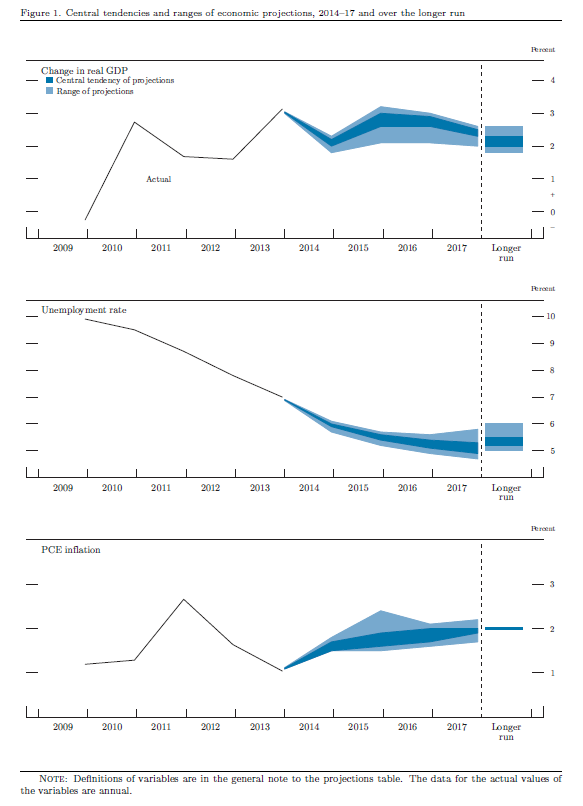

OK so while the future is anyone's guess we do know that these plotted guesstimates are what the Fed (FOMC) is planning on

---[click/enlarge]>>

The new-quarter homework reading assignment. Note: this material will be on the Final Exam:

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |

Energy CPI:

hi & happy Friday! My 2 main ISP’s both went off line yesterday and I’m logged on thru my cell fone but fortunately nothing’s happening —except stock futures are up today & metals are down. Oh, and big report day today (unemployment ha ha ha...). cheers!

Happy Jobs Day!

NFP +248K

UE 5.9%

Private +236K

Participation Rate 62.7% (vs 62.8% previous)

What about sanitation clothing and masks? One of those I know of is APT. It's way up the past few months, but I believe lost some steam yesterday.

LAKE makes hazmat suits.

5.9%???? LOL, they have as much credibility as the CDC director.

Bkmk

More reasons to sell the BOND ETF.

The new managers of Bond have drastically sold their Canadian Bonds and are buying Mexican and ? bonds.

http://finance.yahoo.com/news/life-gross-bond-adjusts-portfolio-190031199.html

I agree. There's all kinds of derivative plays. But I personally believe this will all blow over (until next time). Wait for a pullback in price on your targeted stock start accumulating if that's your strategy. Cheers!

My first thought was Purell, then I found out it was a private company. :(

Metals are not safe haven ... they represent speculation.

NED DAVIS: Gold Will Plunge To $660

Business Insider

By Myles Udland

John LaForge, commodities strategist at Ned Davis Research says gold is going to $660 an ounce.

In an appearance on CNBC on Thursday, LaForge said that the end of the current “supercycle” for gold could push the precious metal down to $660 an ounce, or about 40% lower than where it is currently trading.

LaForge said that in the 1980s, the price of gold fell about 65% from peak-to-trough as the precious metal enduring a 20-year bear market.

And after hitting $1900 an ounce in 2011, gold should see a similar peak-to-trough decline in current cycle.

“We know that commodities run in supercycles, and they eventually die. And gold looks like it’s dying,” LaForge said.

“So $660 is certainly in the cards.”

http://finance.yahoo.com/news/ned-davis-gold-plunge-660-211412410.html

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.