Posted on 09/28/2014 10:13:30 AM PDT by expat_panama

Investment & Finance End of 2014 Q3 into Q4 Thread Edition

| Comodities | Stock Indexes | ||||||

| now | 3 Mo. Chg. | Annualized return | now | 3 Mo. Chg. | Annualized return | ||

| gold | $1,220.26 | -7.2% | -25.9% | S&P500 | 1,982.85 | 1.2% | 4.7% |

| silver | $17.71 | -16.2% | -50.7% | DJIA | 17,113.15 | 1.7% | 7.0% |

| oil | $512.66 | -6.2% | -22.6% | NASDAQ | 4,512.19 | 2.4% | 9.8% |

| U.S. $ | $85.62 | 6.7% | 29.8% | Rus2k | 1,119.33 | -6.2% | -22.5% |

Looks like the dollar soared (so much for Fed printer devaluations), metals tanked (so much for safe havens), and while big cap. stocks have done best this past quarter the current status is "market under pressure" (read: under a cloud)

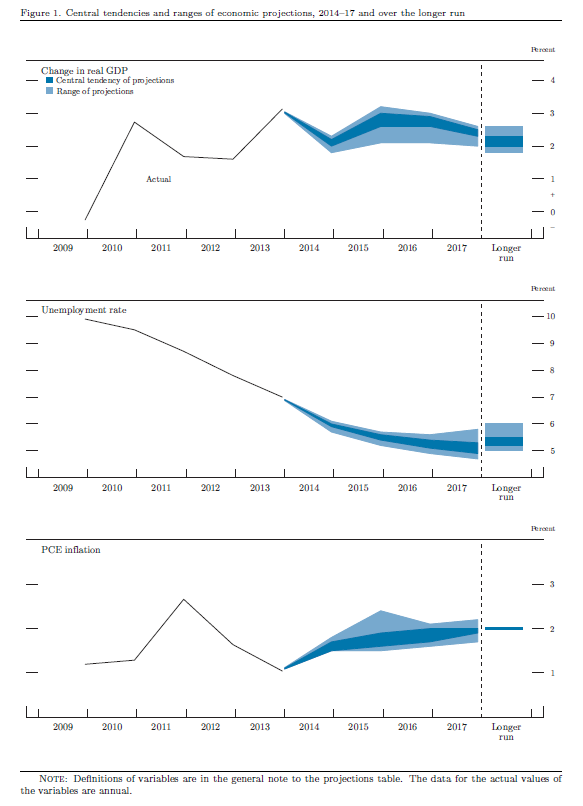

OK so while the future is anyone's guess we do know that these plotted guesstimates are what the Fed (FOMC) is planning on

---[click/enlarge]>>

The new-quarter homework reading assignment. Note: this material will be on the Final Exam:

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |

--and on top of all that we got mid-term elections to shake things up...

Metals are not safe haven ... they represent speculation.

Bump for later. Thanks!

lol! You know it and I know it but we may need to keep this just between a select few of us..

Youtube link was given to me by my niece.

https://www.youtube.com/watch?v=w4q8fs8gTIs

| Monday, September 29, 2014 |

Good morning and Yikes!

Metals are flat but stock futures are down a half percent this morning, Yahoo blames China surprises (US stocks: Futures fall amid Hong Kong unrest, data jitters) but this was predicted a while ago: Mark Twain thinks stocks are in for a rough ride. Busy day beginning an hour before opening w/ reports on Personal Income, Personal Spending and PCE Prices.

Wondering how things will look when the week picks up speed...

http://blogs.wsj.com/moneybeat/2014/09/28/expect-more-volatility-with-stocks-priced-near-perfection/

September 28, 2014, 2:57 PM ET

Expect More Volatility With Stocks Priced Near Perfection

By E.S. Browning

One reason stocks were so troubled last week is that they are getting closer to what Wall Street, in its inimitable slang, calls being “priced for perfection.”

Priced for perfection, unfortunately, doesn’t mean attractive. It means that stock prices are so high that gains depend on a very favorable investing environment, with strong corporate profits, low interest rates, low inflation and continued global growth.

If the environment starts looking less favorable, stocks can weaken, as they did last week.

Stocks probably aren’t completely priced for perfection yet, money managers say, but they are moving that way. The S&P 500 stock index closed Friday at 19.4 times its companies’ net profits for the past 12 months, well above its long-term average of 15.5, according to Birinyi Associates.

Many consider the long-term economic outlook good enough that stocks can keep rising in the medium term. What worries people is the next few weeks and months.

When cracks widen in the investing backdrop and stocks are pricey, traders are quicker to sell. And cracks are widening. Among them: Next year’s expected Federal Reserve interest-rate increases, which are appearing now on investors’ radar screens, growing tensions with Russia and renewed concerns about China’s uncertain economic growth.

“The market is primed for more volatility,” said Scott Clemons, chief investment strategist at Brown Brothers Harriman Private Banking, which oversees $26.8 billion in New York. “We are in for a lot more days like Thursday,” when the Dow Jones Industrial Average fell 264 points, its worst decline since July.

snip

I have known many many people who lived 1930-1940 that might disagree a tad.

So what happens to BABA (among others) when it theoretically reaches $1T capitalization valuation, and the Chicoms decide not to play nice?

Data this week:

Monday -

8:30 am Personal Income (consensus +0.3%)

8:30 am PCE (Consensus +0.4%)

Tuesday -

9:00 am Case-Shiller

10:00 am Consumer Confidence (Consensus 92.3)

Wednesday -

Domestic Auto Sales (Consensus 5.8 million)

8:15 am ADP (Consensus +207k)

9:45 am PMI

10:00 am Construction Spending (Consensus +0.3%)

Thursday -

8:30 am Initial Claims (Consensus 298K)

Friday - JOBS DAY

8:30 am NFP (Consensus +215K)

8:30 am UE (Consensus 6.1%)

I;m out of pocket Tuesday and Wednesday at the Deutsche Bank Leveraged Finance Conference. Shaq is speaking at lunch tomorrow and Leon Panetta at dinner. I’d rather hear Shaq unless Panetta is going to talk about CIA :-)

known many many people who lived 1930-1940 that might disagree

Me too, the saying was keep gold for the mortgage and silver for groceries. They were wrong though, because while a $100 spent on gold in '33 would be worth $3,850 today, that same $100 in stocks would now be worth $870,000.

Whoa NEAT!!! PLEEZE fill us in on what happens...

This will be entertaining.

I mean, the Chicoms really want to buy American food and American T-bills that U.S. farmers and U.S. bureaucrats really love to sell to 'em --but only in dollars. Only way Chicoms can get dollars is by peddling cheap Wallmart knockoffs and this war the Chinese gov't has with their business sector simply does not make any sense.

Of course, the war the U.S. gov't is having w/ it's business sector doesn't make any sense either though...

“Of course, the war the U.S. gov’t is having w/ it’s business sector doesn’t make any sense either though...”

Ain’t that the truth.

We shall see.

Yeah, that's my take. Way back when G.W. was first elected the Chicoms rammed a U.S. plane in international waters and took the crew prisoner demanding an 'apology' from the U.S. Fine. GW's 'apology' said that America regretted that the Chicoms were such idiots and the prisoners were released.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.