Skip to comments.

Why There's No Real Inflation - Yet

TMO - Money Morning ^

| 1-30-2013

| Martin Hutchinson

Posted on 01/30/2013 11:35:47 AM PST by blam

Why There's No Real Inflation - Yet

Economics / InflationJan 30, 2013 - 01:16 PM GMT

By: Money Morning

Martin Hutchinson writes: According to Milton Friedman, "inflation is always and everywhere a monetary phenomenon."

If that is true, then you have to wonder where the heck all of the inflation is.

Every central bank in the Western world is holding interest rates down, and almost all of them are printing money like it's going out of style.

Five years ago, nearly every economist in the world would have told you this would cause inflation to skyrocket, and the big deficits governments were running would make matters even worse.

Taken together, monetary and fiscal policies are far more extreme than they have ever been.

Yet, inflation has remained rather tame at 2%. In Friedman's world that just wouldn't be possible.

What does it all mean?....

It means even Nobel Prize-winning economists can get it wrong-at least in the short run.

Here's why Friedman has been wrong on inflation so far. It starts with his basic theory.

Friedman's Theory on Inflation

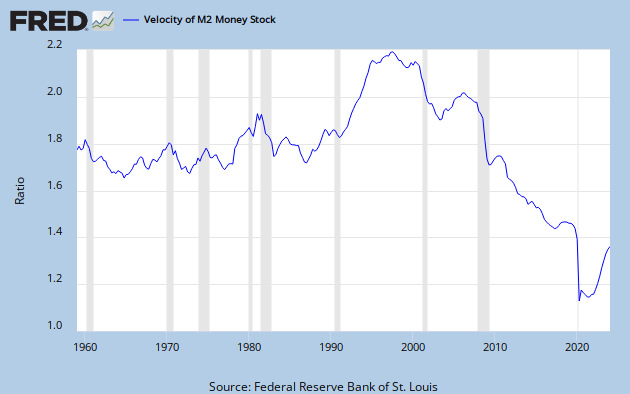

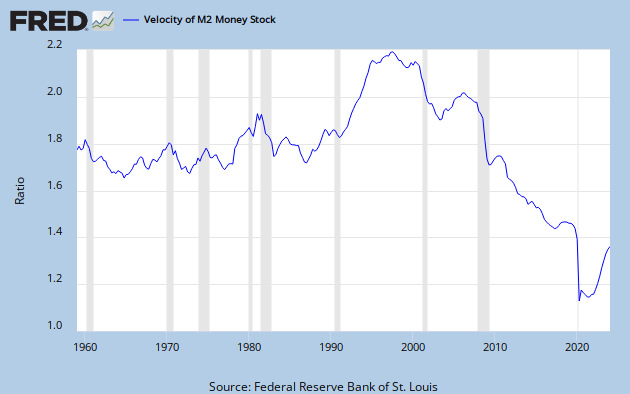

The central equation of Friedman's monetary theory is M*V=P*Y, where M is the money supply, Y is Gross Domestic Product, P is the price level and V is the "velocity" of money, thought of intuitively as the speed at which money moves around the economy.

In this case, the M2 money supply has been increased by 11.5% in the last two months and 8.2% in the past year, while the St. Louis Fed's Money of Zero Maturity (the nearest we can get to the old M3) has increased by 13.1% in the last two months and 8.4% in the last year.

Since GDP is increasing at barely 2%, that ought to mean prices should increase by 6%, just based on the last year's data alone.

Needless to say, that's not happening, since consumer price inflation is under 2%.

Of course, monetarists will tell you that money supply produces inflation only with a lag.

Fine, but it's also true that the M2 money supply has been increasing by 7.4% over the last five years. Admittedly, there was a year in mid-2009-2010 when it stayed flat, but otherwise the monetary base has been increasing at about 8-10% per year.

Again, growth in those five years has been below 2%, and five years is longer than anyone thinks the lag should be. So why isn't inflation at least 5% not 2%?

Monetarists would explain that by telling you that monetary velocity has declined over the last five years.

That's obvious from the equation, but what is monetary velocity and why has it declined?

The velocity of money is simply the average frequency with which a unit of money is spent in a specific period of time. And in our day-to-day activities, it's obvious that monetary velocity has in fact increased.

More people are using debit cards, which cause transactions to move instantaneously from the bank account to the merchant, and many people are using Internet banking, which similarly increases the speed of transactions, reducing both the amount of physical cash carried and the time that old-fashioned checks spend sitting in storage at the U.S. Postal Service.

So what is the problem?

Monetarists will tell you that the decline in monetary velocity is due to the massive balances, over $1 trillion, which the banks have on deposit with the Fed, which just sit there and do nothing.

That's probably correct since while the deposits exist, the ordinary mechanisms of monetary movement simply don't work, since that money has no velocity.

As a result, Bernanke and his overseas cohorts have succeeded in saving themselves from being hindered by a surge in inflation.

The Japanese experience over the last 20 years suggests that this position, with a huge money supply and no inflation, may continue for 20 years or more.

In short, thanks to the banks, Freidman's monetary theory has simply stopped working.

Why Inflation is Headed Our Way Eventually

It's not clear to me whether at some point the banks will start lending the trillion-dollar balances at the Fed, in which case inflation will revive rapidly.

However, there is one other economic theory that is relevant here.

Austrian economists like Ludwig von Mises will tell you that ultra-low interest rates will create an orgy of speculation, in which markets create a huge volume of "malinvestment" - investment that should not economically have been made, and which has less value than its cost.

Eventually-like it did in 1929, the volume of malinvestment becomes so great that a crash occurs, in which all the bad investments have to be written off, huge losses are taken and a wave of bankruptcies sweeps across the economy.

This didn't happen in Japan. The banks went on lending to bad companies, creating a collection of zombies which sapped the vitality from the Japanese economy and has produced more than 20 years of economic stagnation.

In Japan, the politicians have even decided to print more money and do still more deficit spending. Since Japan has debt of 230% of GDP this will almost certainly produce a crisis of confidence, in which buyers stop buying Japan Government Bonds. That will cause the government to default and will more or less shut down the Japanese economy - the worst possible outcome.

Since politicians hate periods of liquidation, they could encourage the same behavior here, in which case growth will continue at current sluggish rates until the Federal deficit becomes so great that nobody will buy U.S. Treasuries.

Again, without a Treasury market, there will be an economic collapse.

At that point, you're likely to get all the inflation you want - it's basically what happened in the German Weimar Republic in 1923.

The point is, Bernanke has created something of a new monetary ground, increasing the money supply rapidly without getting inflation. But it won't last.

At some point we'll get hyperinflation and probably a Treasury default.

For investors the action to take is obvious: Buy gold. At some point fairly soon, you'll need it.

TOPICS: News/Current Events

KEYWORDS: economy; gold; hyperinflation; inflation; investing; recession; shtf

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-47 next last

To: marron

You are right that the inflation is masked. First, there has been significant inflation in health care, higher education, and housing (until recently). Not coincidentally, these are three areas where you have significant moral hazard, coupled with governmental policies designed to encourage debt financing.

Equities and debt have also inflated. Once again, this is partially due to moral hazard (especially with respect to sovereign debt). Commodities, as well have inflated.

The reason we don’t see consumer level inflation at the level it could be given monetary policy is because there has been no stimulative effect to all of these policies. Basically, wages haven’t increased, so consumers are generally tapped out. This means no consumer inflation, because companies have no pricing power.

Finally, we export much of our inflation. Since everything out there is priced in dollars, we are printing for a global economy, not a national one. This means that the inflation is spread out over a much larger economy.

The answer is that we have had significant inflation — just not in the areas that they are looking for it.

In terms of inflation being masked, technology was important. But bigger was the end of the cold war. Suddenly, in the span of a few short years, China, Russia, the former Soviet Republics, East Europe, and to a large degree India, became part of the global economy. This created an almost post WWII like environment, where countries which actually produced had a massive, untapped market. Whereas in post WWII it was mostly the US, this period gave the US, Germany, England, and Japan a huge opportunity for wealth creation. Most of this opportunity was squandered, but it did allow Japan especially to remain in their stagnation and not collapse under the weight of their debt.

Unfortunately, everyone decided that the best use of this opportunity was to center an economy around real estate bubbles, so we are now in a situation where we simply cannot allow these price bubbles to deflate. We are stuck with an expansionary monetary policy until everything collapses.

Looking down the road, I think that many of these price bubbles (education, equities, etc.) have hit a kind of ceiling. I think the next round will consist of aggressive currency debasement. I would not be surprised to see commodities as the only asset class to rise in this period, as a currency war naturally leads to a general trade war (increasing commodity prices would, in this scenario, be a supply phenomenon, not demand side). Any other inflationary effect of the race to the bottom in currencies could be offset by further damage to the underlying economy. But we are in a bad place, globally. The entire world is fully dependent on price bubbles, and fully dependent on currency debasement.

To: blam

Agree with all those commenting on food prices. Anyone saying there is little/no inflation has not paid for groceries in the last 2-3 years.

Food prices are through the roof! I'm sure if a Repub was in the WH, the "media" would harping on how "the people" are having a hard time putting food on the table due to the rising costs.

22

posted on

01/30/2013 1:07:07 PM PST

by

jeffc

(The U.S. media are our enemy)

To: NY.SS-Bar9

I agree with you and with the viscosity agreement. To say there is no inflation is to ignore the commodity markets. Now, it looks like inflation could return to the stock market as small investor get back in.

Price of corn is clearly inflated due to drought and RFS; however, the decline in the dollar clearly has increased corn prices. Same with oil, by all accounts plenty of production, but price remains high.

23

posted on

01/30/2013 1:11:45 PM PST

by

11th Commandment

(http://www.thirty-thousand.org/)

To: JerseyHighlander

7 years ago we would have been... 7 years ago gold had just broken through $500 never to look back.

24

posted on

01/30/2013 1:15:00 PM PST

by

palmer

(Obama = Carter + affirmative action)

To: marron

Offshoring our manufacturing has kept prices low. That's just part of the story. China is willingly printing up their currency to keep their prices low here. That exports our inflation there and is a big reason why it hasn't shown up here.

25

posted on

01/30/2013 1:18:24 PM PST

by

palmer

(Obama = Carter + affirmative action)

To: Old North State

If they issued the mandatory gold buyout order, would you comply? Didn’t think so. Nor will your neighbors or anyone else with a brain.

26

posted on

01/30/2013 1:32:35 PM PST

by

Trod Upon

(Civilian disarmament is the precursor to democide.)

To: Trod Upon

Re post 26: That’s what I think, too. I find it hard to believe that anyone with gold at home would simply turn it in.

27

posted on

01/30/2013 1:39:14 PM PST

by

Former Proud Canadian

(Obamanomics-We don't need your stinking tar sands oil, we'll just grow algae.)

To: blam

And in our day-to-day activities, it's obvious that monetary velocity has in fact increased. Nope

Velocity of M1 Money Stock in the US data by YCharts

An increase in prices is just a symptom of inflation. But there are always several pressures working simultaneously to decrease the rise in prices caused by increases in the money supply such as:

1) during a recession, it is normal for prices to decrease and

2) money sent to China to buy Chinese goods lowers the American money supply which tends to decrease demand which tends to decrease prices.

The drop in velocity, the recession, and trade with China are price lowering pressures that are working against the price increasing pressures that are caused by the increase in the money supply.

28

posted on

01/30/2013 1:39:31 PM PST

by

mjp

((pro-{God, reality, reason, egoism, individualism, natural rights, limited government, capitalism}))

To: NY.SS-Bar9

That's what I've been screaming for the past 4 years. The statistics are only as honest the people creating them and every one of them calls Barack Obama "Boss". I think we are in a period of "biflation" which is defined as "a state of the economy where the processes of inflation and deflation occur simultaneously".

With biflation on the one hand, the economy is fueled by an over-abundance of money injected into the economy by central banks. Since most essential commodity-based assets (food, energy, clothing) remain in high demand, the price for them rises due to the increased volume of money chasing them. The increasing costs to purchase these essential assets is the price-inflationary arm of Biflation. With biflation on the other hand, the economy is tempered by increasing unemployment and decreasing purchasing power. As a result, a greater amount of money is directed toward buying essential items and directed away from buying non-essential items. Debt-based assets (mega-houses, high-end automobiles and other typically debt based assets) become less essential and increasingly fall into lower demand. As a result, the prices for them fall due to the decreased volume of money chasing them. The decreasing costs to purchase these non-essential assets is the price-deflationary arm of biflation

29

posted on

01/30/2013 1:54:11 PM PST

by

RC one

(.From My Cold Dead Hands.)

To: MrB

I checked out the Rabbi and read the radio show transcript from "Harbingers part 2"

If this is a 7-year cycle we need to look at 7 years before and going backwards to develop a pattern.

I want to be carful about reading too much into what the Rabbi says here.

7-year Jubilees according to the Rabbi can either be a matter of blessings or none. So if September is the operative month and we are in 7-year cycles lets reach back into our historical memories and see if we see any patterns. I can't fill in anything significant where I have placed a "?":

Sept. 1994 (R) take Congress back 1st time in 40 years (Nov)

Sept. 1987 Stock market crash

Sept. 1980 The Reagan landslide (Nov)

Sept. 1973 Yom Kippur War

Sept. 1966 ?

Sept. 1959 Castro takes over Cuba (July)

Sept. 1952 Eisenhower, (R) win both houses of Congress

Sept. 1945 End of WWII (Sept 2)

Sept. 1938 ?

Sept. 1931 Deflationary spiral begins which leads to Great Depression

Sept. 1924 Election of Coolidge (R) both houses of Congress

Sept. 1917 US enters WW I (April)

Sept. 1910 ?

Sept. 1903 ?

Sept. 1896 McKinley elected, free silver movement frees us from Europe's gold-based control.

Sept. 1889 ?

Sept. 1882 ?

Sept. 1875 ?

Sept. 1868 Andrew Johnson impeachment trial (Feb)

Sept. 1861 US Civil War begins (April)

Sept. 1847 ?

Sept. 1840 ?

Sept. 1833 ?

Sept. 1826 ?

Sept. 1819 ?

Sept. 1812 War of 1812 (June)

Sept. 1805 ?

Sept. 1798 ?

Sept. 1791 ?

Sept. 1784 ?

Sept. 1777 ?

Sept. 1770 ?

Do we see any discernible patterns here?

FReegards!

30

posted on

01/30/2013 1:58:30 PM PST

by

Agamemnon

(Darwinism is the glue that holds liberalism together)

To: MrB

All bad news, all policy consequences of liberalism, will be hidden until they can’t be hidden anymore

Based on prior experience with the USSR, the over/under on that is around 70 years.

To: Agamemnon

Hadn’t thought of anything before the judgement of 9/11, as Cahn was just referring to the parallels of 2001 and 2008 to biblical judgement.

32

posted on

01/30/2013 2:07:45 PM PST

by

MrB

(The difference between a Humanist and a Satanist - the latter admits whom he's working for)

To: MrB

All on the “jubilee” 7 yr cycle. Jubilees occur at 50 cycles

or seven , seven years plus one year. We have voted in leaders to bring about our own destruction.

Our elected leaders have pandered to

the most perverse and perverted agenda.

We as a Nation have cursed YHvH after His warnings.

We have called down on ourselves the curse of Isaiah 9:11-21

After years of pagan idolatry, YHvH allowed the hedge

of protection to be lowered and the nation of Israel

was attacked by the Assyrians.

On September 11, 2001, YHvH allowed a breach in our hedge of protection.

The following day, Democrat Tom Daschle called down a curse on America.

On September 11, 2004, Democrat John Edwards repeated the curse on America.

On February 24, 2009 Democrat Barack Hussein Obama repeated the curse for the third time.

(Matthew 18:16; 2 Cr 13:1; Deu 19:15 & Amos 3:12)

The stock market fell 7% on Sept 17, 2001

( 29 day of the month of Elul)

Seven years later on the 29th of Elul,

it fell again 7 %

At the end of each Sabbatical year,

all debts are made worthless.

Seven years after the attack on September 11, 2001,

We elected a man to lead this country whose

whole persona is built on lies.

In 721 BCE, the walls of Israel were breached.

The nation's leaders with pride and in arrogance

of heart cursed YHvH.

See Isaiah 9:10.

Isaiah 9:9 .....Asserting in pride and in arrogance of heart: Isaiah 9:10 "The bricks have fallen down,

But we will rebuild with smooth stones;

The sycamores have been cut down,

But we will replace them with cedars."

This nation was dedicated in St Paul's chapel

located at the corner of Ground Zero.

The Sycamore tree at St Paul's chapel

was destroyed by a steel beam from

the World Trade Center.

The New York Stock Exchange was

chartered under a Sycamore tree.

Ten years after the initial breach

the nation of Israel was attacked

and overrun by the Assyrians.

Half the nation was captured

and taken off to imprisonment.

I love metaphors;

they teach those who have ears to hear.

For more information buy the book Harbinger

by Jonathan Cahn

if my people,

who are called by my name,

shall humble themselves,

and pray, and seek my face,

and turn from their wicked ways;

then will I hear from heaven,

and will forgive their sin,

and will heal their land.

Seek YHvH in His WORD ! Ask and you will receive His Salvation !

shalom b'SHEM Yah'shua HaMashiach

33

posted on

01/30/2013 2:11:39 PM PST

by

Uri’el-2012

(Psalm 119:174 I long for Your salvation, YHvH, Your teaching is my delight.)

To: Mr. K

Yup, shopping for food is more painful and expensive than ever. Inflation is already here. It’s just being hiddden from investors.

34

posted on

01/30/2013 2:50:07 PM PST

by

Crucial

(Tolerance at the expense of equal treatment is the path to tyranny.)

To: blam

M2 Velocity is at Historic Lows

Cash is piling up in Banks and Corporations

No One in their right minds will invest cash in this environment, with a negative ROI for injected capital

The GDP Velocity is dangerously close to 1

To: blam

The real inflation rate is over 5%. The gubmint is cooking the on inflation estimates.

To: blam

I think part of the reason might be that the Chinese haven’t re-flooded our market with their increasingly worth less dollars we’re paying them with.

If they do that, like France did with Germany in the 20s, we will get hit. Hard.

To: blam; jiggyboy; PA Engineer; TigerLikesRooster; Cheap_Hessian; CJinVA; Jet Jaguar; ...

To: Jet Jaguar

39

posted on

01/30/2013 7:00:33 PM PST

by

GOPJ

( Revelation can be more perilous than Revolution. Vladimir Nabokov)

To: blam

US Inflation does not take into consideration the critical items in a budget for most Americans, e.g., food and energy. So we have officially had no inflation under Obama... so to speak, yet gas has doubled and milk is $4 bucks a gallon, meat is higher and all basic food is coming in smaller packaging and prices are at the same time rising. I would like to see the Governments figures on the higher prices for food and energy, even though they don't count.

Pumping/printing money and distributing through the banks means that with fewer people borrowing money, most of this Ca$h ends up in investments. Hence according to the Administration, everything is good (for now), yet once the this money has doubled stocks as it already has done, the real inflation will start to kill the American workers. The only folks who this does not matter for are those who get total subsidized living from government payments....

40

posted on

01/30/2013 7:04:03 PM PST

by

Jumper

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-47 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson