Posted on 01/02/2022 6:15:39 AM PST by Texas Fossil

The head of OneAmerica insurance said the death rate is up a stunning 40% from pre-pandemic levels among working-age people.

“We are seeing, right now, the highest death rates we have seen in the history of this business – not just at OneAmerica,” the company’s CEO Scott Davison said during an online news conference this week. “The data is consistent across every player in that business.”

OneAmerica is a $100 billion insurance company that has had its headquarters in Indianapolis since 1877. The company has approximately 2,400 employees and sells life insurance, including group life insurance to employers in the state.

Davison said the increase in deaths represents “huge, huge numbers,” and that’s it’s not elderly people who are dying, but “primarily working-age people 18 to 64” who are the employees of companies that have group life insurance plans through OneAmerica.

“And what we saw just in third quarter, we’re seeing it continue into fourth quarter, is that death rates are up 40% over what they were pre-pandemic,” he said.

“Just to give you an idea of how bad that is, a three-sigma or a one-in-200-year catastrophe would be 10% increase over pre-pandemic,” he said. “So 40% is just unheard of.”

(Excerpt) Read more at justthenews.com ...

I don’t even know how to answer your post adequately, since you include a lot of things in it that have nothing to do with what I’ve posted on this thread.

The reason this whole story about higher claims in group insurance plans is making headlines now is simple. These companies fix their group premiums for the calendar year, so they were immersed in all these figures through November and December to set their group insurance premiums for 2022.

The actuarial tables are screwed for at least one generation. Actuaries are really going to earn their pay over the next 20 years coming up with estimates based on fraudulent data.

That’s simply not the case for group life insurance. If you work for Walmart and the company offers a $25,000 life insurance policy as a benefit, the insurance carrier will generally pay that claim without waiting to see a death certificate.

It’s obviously a whole different story if the CEO with a $25 million individual policy dies.

Well, there are the police death squads prowling the streets and gunning down unarmed black men strolling on the sidewalk. The media and the ratparty tell us that this is now epidemic.

Now they’re being faced with claims figures that are undermining that narrative. And the offices of these companies are now the scenes of heated battles between nitwits who watch CNN regularly and actuaries who know how to analyze data.

One of your most interesting posts,certainly the best I have seen.

BECAUSE nothing in big corporations, especially those who stock is publicly traded, takes precedence over the bottom line.

In short, they will lose their ass if they don’t adjust their rates and in this state, they will need to spell out the specific reason for a need to raise rates.

OH!! I know! Its global warming! The heat is killing them!

How much is fentanyl and opioids?

Two contradictory statements.

This article is about escalating claims in group life insurance plans, not death rates in general.

How many of those deaths end up on a group claim? I ask because group policies tend to cover working individuals who avoid illicit drugs.

“See Post #99. This is coming directly from the insurance industry.”

From one company-OAN , not all.

Also most group life insurance co’s specialize in certain business. Some concentrate on blue collar, some white collar, some just hi tech people, some just doctor and lawyer groups etc.

Maybe OAN has a lot of poorer blue collar types of business insured-with more drug overdoses and suicides.

Again I work in the business not all insurance co’s are seeing 40% increases in deaths among young people.

No, they are two separate issues, both drug related.

LOL, math is racis'

The found out Biden won it can’t be any worse.

How many “meth heads” are (1) employed, and (2) employed by a company that offers group life insurance to their employees?

In poor areas of West Virginia and SE Ohio you would be surprised.There are no other employees so the employers have to hire at the bottom of the barrel.

A plastics factory in Wheeling has a bus that goes to a local homeless shelter and brings them in to work than takes them back home to the shelter at the end of day.

And by meth heads does not mean the typical ones you see on the news.Many use drugs in my area and still work.

One astute actuary recently told me that his best employees are the ones who say “I don’t know” more often than anyone else when discussing things that seem to throw actuarial tables out of kilter.

“I ask because group policies tend to cover working individuals who avoid illicit drugs.”

See my post #114. Go to poor areas of the country with high drug use and I do not mean the inner city ghetto’s but poor white areas.

I live in a poor white rural area and drug use is rampant and most are employed.

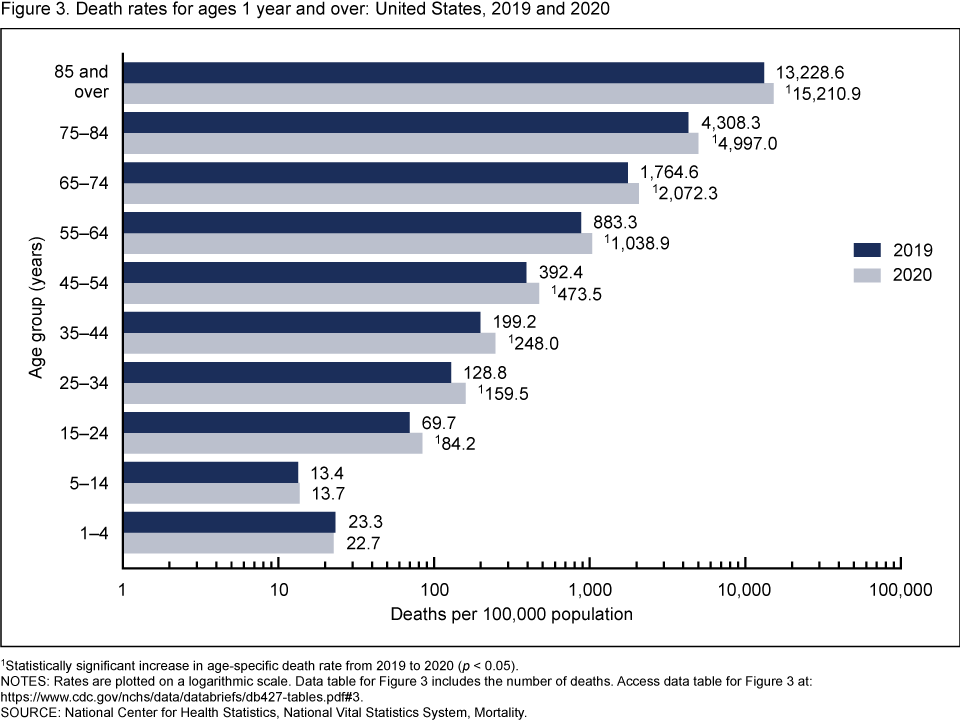

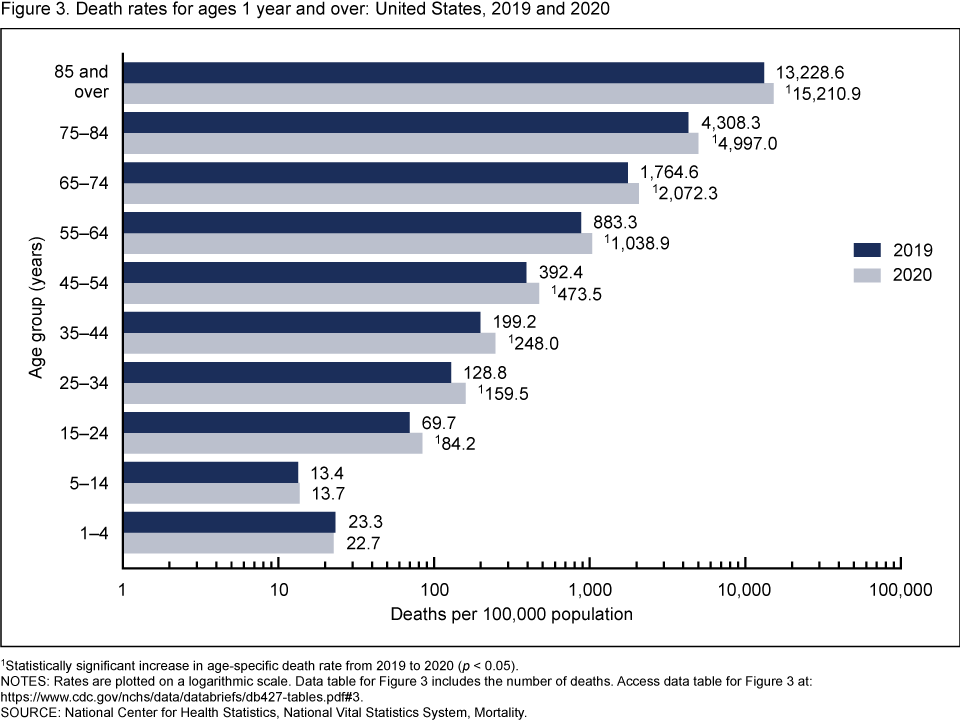

I seem to recall that in recent years, the death rate in America is somewhat under 1% of the population - between 2.6 and 2.8 million people a year (out of 330 million). A 40% increase over an entire year would be more than a million extra deaths. That couldn’t be explained by more auto accidents or murders, or even fentanyl deaths, which have been rising for years. Something else is afoot.

Yep.

Quick to take your money, almost have to sue them to get payment.

On March 4, 2020 I married a 2nd time (wife of 47 years died of heart failure in 2018). That day during the Covid Insanity, we went to the farm after the ceremony at the church and took some photo’s. Found the back door open and ajar. Called Sheriff’s office and it took 2 hours to document that.

I had a theft claim at my house at the farm. Someone broke in and took $2500-3000 of property. It was in construction phase.

In the process the thieves ran over the septic tank on the West side of the house and broke the top of the tank on one corner. They never included it in the claim.

It took 2 days for me to document what they took and estimate the replacement cost. How do you estimate the cost of a mirror stolen from a 1947 vintage dresser in my grandparents bedroom?

That one was still pending when I parted ways with them.

They later wrote me a check for $879.81.

OH, I forgot. They cancelled my auto insurance policy for “underwriters reasons”. (no claims, auto billed, no accidents)

If you were here I would explain the “details”.

But “TEXAS FARM BUREAU” really sucks.

Nothing will every change that, they are run by idiots with computers.

Sorry for the confusion. The item I posted in #99 comes from one of the largest insurers in the U.S., not OAN. And their group plans cover employees for many Fortune 500 companies, not smaller regional employees. The claims trend noted in this article is a national one across many insurance carriers.

They don’t say why death rates are up. Can’t be covid, there is a vaccine to protect everyone from that. Right? I wonder why so many are dying?

I wonder how many of the claims have been denied?

I’m afraid the long term consequences of the wonderful vaccination will not be death but lingering disability. Even better than wounding soldiers where for every one wounded it takes two to carry him to the aid station.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.