Skip to comments.

Investment & Finance Thread (week July 6 - July 12 edition) [my title: The Economy Looks Great!]

Weekly investment & finance thread ^

| July 6, 2014

| Freeper Investors

Posted on 07/06/2014 10:24:34 AM PDT by expat_panama

|

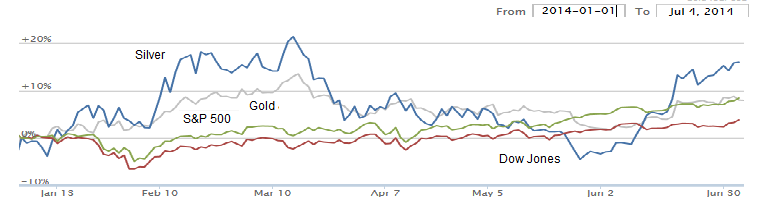

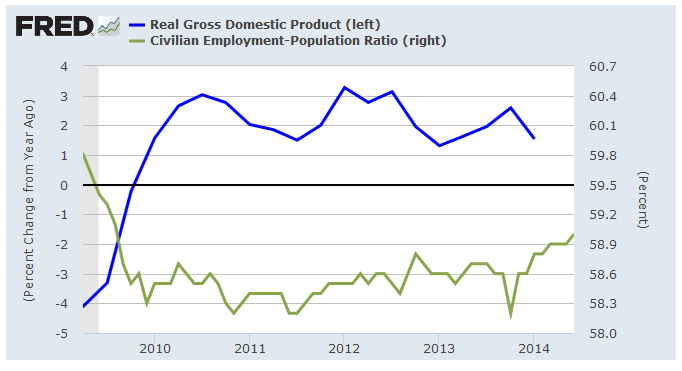

Huh. Huh. While coming into the second half of 2014 we just had the GDP and employment rpts, and what happened is we got what seemed to be contradictory -2.7% and +6.3 bombshells. On the other hand (Truman hated economists saying that) a look at the year over year GDP return along with the employment/population ratio puts the two together. [click to enlarge] The reason GDP growth looks solid is because that -2.7% was just one Qtr to the next, so last week's rpt tells us more about how good Q4 was than it does about how bad Q1 turned out. Something else is the fact that over this past 1/2 year employment/population is finally making a move --a move we've not seen since the "recovery" began in '09. |

|

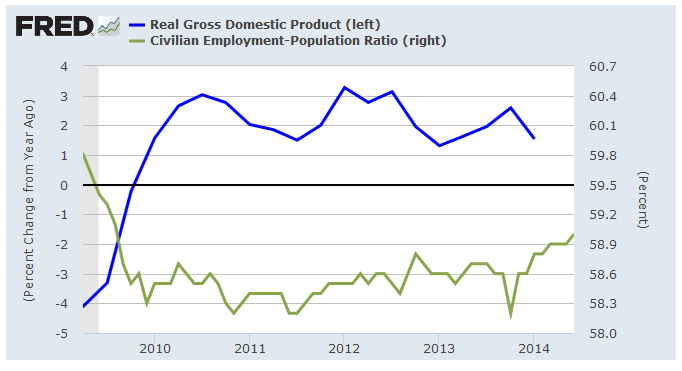

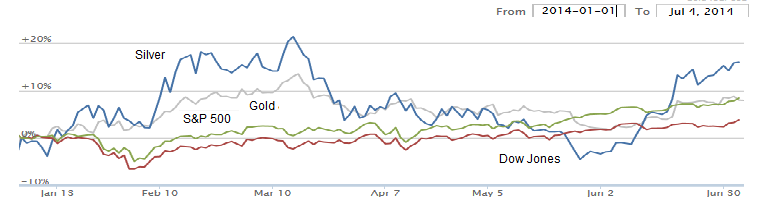

OK, so last week I said "IMHO we're in an economy where we can still make money but it's just going to take more effort", but judging how stocks'n'metals are now rising up from this year's base there's reason to think that it may not take as much effort after all... |

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; financial; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-73 next last

To: Wyatt's Torch; MichaelCorleone

When they propose confiscating wealth from 401k’s is when the shooting starts...--which is why it will most likely be simply put into affect without any overtly announced proposal before hand. Another bet is that it'll happen in stages beginning with raising the existing taxes (aka SEC fees) on stock trades--(Democrats revive financial transaction tax idea | Reuters) and then stepping up the war on the wealthy with say, a national property tax.

To: citizen

abandoning stocks for safer havens fwiw, yesterday I closed all my individual stock positions and am now down to ETF's and mutual funds. This is part for market timing but mostly just going with what's been working best.

To: expat_panama

On a separate note...

To: Wyatt's Torch

tx!

There are a lot of sides to the current econ climate, and it takes a bit of effort to hold back the negativism. Was thinking of how often on these threads that more bank loans is a good things, but more people going into debt is a bad thing.

Go figure.

To: expat_panama

Like it or not credit is the lifeblood of economic activity. This is a very positive sign for economic activity and for monetary policy.

To: Wyatt's Torch

...credit is the lifeblood of economic activity...True, and that means over the past few years the private sector has been anemic while the federal governments shows signs of hemorrhaging. All things considered though my personal view is of a guarded recovery in both areas.

To: expat_panama

47

posted on

07/09/2014 11:41:42 AM PDT

by

Chgogal

(Obama "hung the SEALs out to dry, basically exposed them like a set of dog balls..." CMH)

To: All

Stock tip of the day - sell

Costco.

To: expat_panama; Wyatt's Torch

Thanks for your input. I’ve come to lean on your insights on the weekly thread to check on what I’m doing and/or thinking. And I’ll bet I’m not the only one either.

It’s scary to think of the possibility that some or all of the money you’ve worked and sacrificed for can so easily be taken away from you for no other reason than they ‘just need it’.

Thanks again.

49

posted on

07/09/2014 7:53:12 PM PDT

by

MichaelCorleone

(Jesus Christ is not a religion. He's the Truth.)

To: abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; Aquamarine; Archie Bunker on steroids; ...

Whoa, we're really looking at a fight from stocks to metals now! Yesterday's metals gains now have futures traders charging in while yesterday's modest stock come back in light volume (AKA "dead cat bounce") now sees futures traders fleeing. Also for today's festivities are scheduled Initial + Continuing Claims along with Wholesale + Gas Inventories.

China says it's up to US to drive global economy BEIJING (AP) — China's finance minister said Wednesday that the country is not planning any new stimulus measures and it is up to the United States to drive the global economy. Associated Press

'Gridlock' Is What's Reviving the U.S. Economy - Merrill Matthews, Forbes

To: MichaelCorleone

insights on the weekly thread to check Seems contradictory but the fact that nobody knows what's going on is a very good reason to keep in touch with others' thinking, reality being somewhere in between us all. I know I'm constantly helped out here; my take is the same as yours that we're watching to fronts, how to make more money and how to keep what we got.

To: MichaelCorleone

all of the money you’ve worked and sacrificed for can so easily be taken away from you for no other reason than they ‘just need it’. History proves large tyrannical governments do just that. Do you really think Harry Reid, Nancy Pelosi or Barrack Hussein Obama care that you worked and sacrificed to get that money?

52

posted on

07/10/2014 5:41:20 AM PDT

by

BipolarBob

(Obama - The Scandal a Week President.)

To: expat_panama

China says it’s up to US to drive global economy BEIJING (AP) — China’s finance minister said Wednesday that the country is not planning any new stimulus measures and it is up to the United States to drive the global economy. Associated Press

Interesting. Accurate though. China is highly dependent on US consumerism which remains sluggish. What concerns me is China having a hard landing from real estate. Nit sure their governmental model can manage a soft landing.

To: expat_panama

This Portuguese Bank Stock Is Crashing And Its Leading Markets Into The Red

The parent company of Banco Espirito Santo, Portugal’s second-largest bank, missed debt payments to “a few clients,” according to a Bloomberg report, and markets are freaking out.

Shares of Banco Espirito Santo trading in Lisbon were down more than 17% on Thursday.

Google Finance

The Portuguese stock market was also down about 4% after the news. Stocks across Europe were also broadly lower. In the U.S., stock futures are also lower.

Citing a statement from Espirito Santo, Bloomberg reported that Espirito is “currently assessing the financial impact of its exposure.

Yesterday, Moody’s downgraded the debt ratings of Espirito Santo Financial Group, which is the largest shareholder of Espirito Santo International, according to Bloomberg, with Moody’s saying its, “concerns regarding ESFG’s creditworthiness are heightened by the lack of transparency around both the Espirito Santo Group’s financial position and the extent of intra-group linkages including ESFG’s direct and indirect exposure to ESI.”

Uncertainty also seems to have reached the Spanish banking sector as well. According to reports from both Bloomberg and The Wall Street Journal, Banco Popular Espanol postponed a planned debt sale, citing adverse market conditions.

Shares of Banco Popular trading in Madrid were down more than 4%.

The news has also spooked investors who are concerned about how uncertainty in the Spanish and Portuguese financial sectors could impact assets across the Eurozone.

Bloomberg cited comments from Adrian Miller, director of fixed-income strategy at GMP Securities, who said in a note to clients, “Should the Portuguese situation continue to deteriorate, risk aversion contagion could quickly spread to other euro zone member states’ bonds and other asset classes.”

The news of missed debt payments by Espirito Santo International also comes on the heels of discouraging economic data out of the Eurozone.

Earlier today, inflation data out of France showed that its economy is teetering. Industrial production fell 3.7% in May and with consumer prices rising just 0.5% in June, concerns about deflation risks in France are increasing.

Industrial production data out of Italy also disappointed, with production falling 1.2% in May.

The Eurozone’s recovery from the sovereign debt crisis has been about improving situations in the economic bloc’s peripheral economies like Italy and Portugal, and this new batch of uncertainty in Portugal’s financial sector is not sitting well with investors.

To: expat_panama

Espirito Santo -17,4%

UBI Banca -5,3%

Unicredit -4,3%

BBVA -4%

Commerzbank -3,9%

Soc Gen -3,7%

Credit Agricole -3,7%

Barclays -3,4%

To: Wyatt's Torch

That’s far more than the general market, looking more like a contraction in the “financials” up in post #27.

To: expat_panama

All euro banks related to Espirito Santo’s drop as well as French economic numbers.

To: expat_panama

To: abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; Aquamarine; Archie Bunker on steroids; ...

It's Friday and the adventure continues! Yesterday's expected rocket metals and torpedo stocks ended up w/ mixed metals and "off a bit" stocks. Now futures are expecting the reverse of those two and we wrap up reports this week at 2PM w/ the Treasury Budget. The latest from the Nobody-Knows-Nuttin' News Service:

- European Stocks Rise, Rebounding From Five-Day Decline Businessweek

- Markets bounce after Portugal banks trigger sell-off: live Telegraph.co.uk

- Oil slips towards $108, heading for 3rd weekly loss Reuters - 4 hours ago ... * IEA says markets well supplied but risks "extraordinarily high". * "Little room for complacency" in oil markets, IEA says.

- Obama, corporate giants announce plan to boost suppliers Reuters - an hour ago WASHINGTON, July 11 (Reuters) - President Barack Obama is enlisting several major U.S. and multinational companies to draw attention to an initiative aimed at helping small businesses expand and hire workers.

- Rising bond yields point to rate rises Financial Times - 3:08am Investors' radar screens have long been clear of the one blip guaranteed to sound the alarm in financial markets: interest rate rises by central banks.

- In Jobs, GDP Data, a Baffling Contradiction - Floyd Norris, New York Times

- Dow 17,000 Is Just a Number, Not a Milestone - Chuck Jaffe, MarketWatch

- What Good Is a Crash to Prevent a Crash? - Noah Smith, Bloomberg

To: Lurkina.n.Learnin

Amazing, zero earnings and the guy raises $6B in stock sales --all perfectly legal! One more reason why I like to steer clear of Over-the-Counter (OTC) stocks, they got reporting rules that are a LOT more lax.

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-73 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson