Skip to comments.

Investment & Finance Thread 2014 New Year(Mar. 3 - nexttime edition)

Daily investment & finance thread ^

| Mar. 3, 2014

| Freeper Investors

Posted on 03/03/2014 2:15:00 AM PST by expat_panama

Investment & Finance Thread 2014 New Year(Mar. 3 - nexttime edition)

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here. Open invitation continues always for input on ideas for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket. |

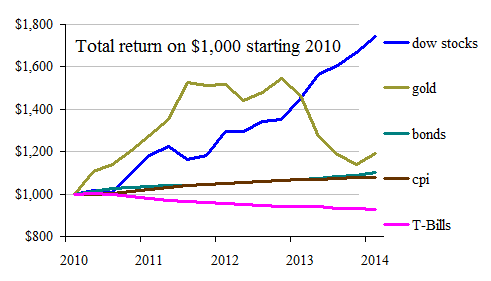

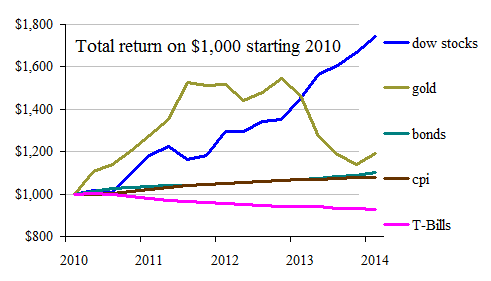

fwiw, these are the returns on $1,000 since 2010 for various investments: |

Incidentally, the plan is to include here a -- --so let me know if anyone wants on or off this ping. Be advised that it gets posted only when I'm not feeling lazy and remember that we now know from studies that sloth is completely genetic and lazy people are the way they are because they were born that way.

--so let me know if anyone wants on or off this ping. Be advised that it gets posted only when I'm not feeling lazy and remember that we now know from studies that sloth is completely genetic and lazy people are the way they are because they were born that way.

Bottom line is I can be as lazy as I want and society is required to grant me all the privileges that industrious people claim.

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; fedbubble; financial; investing; putin; russia; stockmarket; ukraine; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-99 next last

To: Wyatt's Torch

if I’m reading today’s numbers right it’s looking like we’re getting new long term highs this AM.

41

posted on

03/04/2014 6:46:45 AM PST

by

expat_panama

(Arguing with those who have renounced reason is like giving medicine to the dead. --Thomas Paine)

To: PGalt

Thanks for the 3rd link. Interesting data/timetable.Huh, I hadn't really read it seriously until you pointed it out. What got me was the part "...in the broad scheme of things, the invasion had little

influence on the market..." Reminds me of how the market tanked right before GHBush sent troops to Kuwait and soared right after. I made out super on that one.

42

posted on

03/04/2014 6:54:55 AM PST

by

expat_panama

(Arguing with those who have renounced reason is like giving medicine to the dead. --Thomas Paine)

To: expat_panama

To: expat_panama

44

posted on

03/04/2014 9:56:53 AM PST

by

Chgogal

(Obama "hung the SEALs out to dry, basically exposed them like a set of dog balls..." CMH)

To: All

V. Putin has said if sanctions are enacted then retaliation in the markets will be the result. I don’t know if Odumbo is likely to attempt any sanctions but with the market soaring this afternoon I sold half my holdings and bought some TZA as a hedge in case the Grand Caliph does something stupid.

To: abb; Abigail Adams; abigail2; Aliska; Aquamarine; B.O. Plenty; BenLurkin; bert; BipolarBob; ...

Great news, nothings going to happen today with stocks because this morning's futures are flat! For me that's a welcome improvement over yesterday's strong rebound from Monday's fierce sell-off, donno about you young people but I'm getting too old for that nonsense. Seriously, the thing is that less volatility is typically bullish. Headlines:

46

posted on

03/05/2014 4:36:14 AM PST

by

expat_panama

(Arguing with those who have renounced reason is like giving medicine to the dead. --Thomas Paine)

To: expat_panama; abb; blam; M. Espinola; TigerLikesRooster; Chunga85

47

posted on

03/05/2014 6:40:35 AM PST

by

ex-Texan

(The Time to "Wake Up" is Over !)

To: ex-Texan

Interesting. 100 years ago Russia was considered ‘the sick man of Europe’ and when they mobilized troops for westward armed expansion they got into a mess that replaced the entire Russian government.

—at huge cost to the rest of the world too...

48

posted on

03/05/2014 7:18:53 AM PST

by

expat_panama

(Arguing with those who have renounced reason is like giving medicine to the dead. --Thomas Paine)

To: expat_panama

49

posted on

03/06/2014 1:41:43 AM PST

by

expat_panama

(Arguing with those who have renounced reason is like giving medicine to the dead. --Thomas Paine)

To: expat_panama

One of my buddies in our morning coffee group has been catching hell from me for the past year. He’s been predicting a spectacular market crash for over a year, and of course has been wrong. I tell him, in front of all the rest, that his bogus advice has cost me untold thousands in losses.

I say that he’s a perfect “contrary indicator.”

It’s all in fun of course, as he is retired, financially secure, and a local county commissioner who’s personal fiscal habits also translate to his votes on the commission.

But he never had the nerve to invest in equities, because they’re “too risky.” What he accumulated, he earned from pure thrift, interest on CD’s, and purchases of land. The land has some gas production on it, and timber harvests, so there is an income stream from it.

I’ve really enjoyed gigging him the past year about it all.

One day, when the market does correct, he’ll finally trumpet “I told you so!!”

50

posted on

03/06/2014 1:50:46 AM PST

by

abb

To: abb

The best performing markets in the world the last few years have been Zimbabwe and Argentina. Your friend whom you give hell sees something (even if he can’t articulate it) that you don’t.

There are two reasons for equities to go up. One is a sugar high rush from cheap money looking for a place to go, and creating a bubble in bonds and equities. The other is a fiscally healthy economy which produces jobs, inventive entrepreneurs, healthy profitable companies whose stock pay dividends based on EARNINGS.

There are two things about a bubble that are always shocking: 1) how long they go on before they pop, and 2) how deep the trough of despair and gloom and pessimism the resultant pop creates.

Both of these are exacerbated when central banks attempt to overrule basic investment/economic laws by creating cheap money.

I am not attempting to “call” the time of the correction. If I could do that, I would quit my job and just play the swings in the S&P (I used to be a commodities floor trader years ago..... back when there really was a “floor” -lol). What I can do is try to hedge myself against the lunacy of our fake economy, built on debt and cheap money, and dependent on the idea that ponzi schemes are extendable forever.

I am telling you that the refusal to deal with the underlying problems (debt fueled spending and debasing the currency) have built into such a problem that when it resets (no one knows when, maybe as far out as 5-10 years) it is going to resemble a complete collapse more than a correction. Naive simpletons who look at charts only —and I have been reading charts for over 30 years now — are going to be caught so flat footed they are going to be astounded at the devastation.

51

posted on

03/06/2014 2:19:35 AM PST

by

AK_47_7.62x39

(There are many moderate Muslims, but there is no such thing as a moderate Islam. -- Geert Wilders)

To: AK_47_7.62x39

Yes, there will be a correction. Markets always correct to the downside, and to the upside. That’s why I’ve been taking profits off the table for over a year. I’m raising cash levels for two reasons, my age and the maturity of this bull run.

However, history has proved that equities have been the most consistent method of creating wealth in all of human history. Gold, property, bonds - none can touch equities.

I’m no Pollyanna when it comes to the woes that liberalism and The One have visited upon our economy. But anyone who bets against the long-term viability of the U. S. businessman and the creativity of Free Enterprise is taking a contrary position to historical patterns.

52

posted on

03/06/2014 2:32:48 AM PST

by

abb

To: abb; AK_47_7.62x39

"...purchases of land. The land has some gas production on it, and timber harvests, so there is an income stream..." Funny how when land prices tanked the losers blamed Bush for cutting prices below 'true' value, but when stock prices tanked they called it a burst bubble. OK so folks are goofy with money talk; but when my feelings hurt from hearing all the 'stocks are bad' nonsense I just cry on my way to the bank.

"...it is going to resemble a complete collapse more than a correction..."

Doom'n'gloom sells, people just eat it up and rave about how smart the crybabies are. Somehow it never seems to matter that America has grown steadily for hundreds of years. The fact is that we got a big problem with opening our eyes to the fact that human economic activity's been growing since the Garden of Eden --most folks simply hate losses more than they like gains. I mean, if someone makes $100 in a day he's happy, but if he starts out making $1,000 and loses $800 he's furious even though he's cleared twice the profit.

There's a popular investing strategy of secretly betting heavy on growth while publically proclaiming that the end is nigh. That way when prices drop 20% we can say "I-told-you-so" and nobody remembers the previous year's doubling.

53

posted on

03/06/2014 4:59:48 AM PST

by

expat_panama

(Arguing with those who have renounced reason is like giving medicine to the dead. --Thomas Paine)

To: expat_panama

That’s why I read Zerohedge with a grain of salt. I seen something the other day that I believe said the S&P is up 170% over the last five years. A real Guru would have been advising to be in the market all that time and then tell you just before it crashed now is the time.

54

posted on

03/06/2014 5:56:00 AM PST

by

Lurkina.n.Learnin

(This is not just stupid, we're talking Democrat stupid here.)

To: Lurkina.n.Learnin

I just looked and the S&P was up 140%. That 172 must have been an average of the Dow, S&P and the Nasdaq (which is up over 200% during that time).

55

posted on

03/06/2014 6:06:00 AM PST

by

Lurkina.n.Learnin

(This is not just stupid, we're talking Democrat stupid here.)

To: Lurkina.n.Learnin

"A real Guru would have been advising to be in the market ..."Publishers hire Gurus who sell magazines, being right doesn't end up being a factor. That said, we got to accept that things are what they are and like it or not doom'n'gloomers tend to win arguments even while optimists get rich. Now if only I could be better at saying one thing while doing another I'd be both rich and popular.

56

posted on

03/06/2014 6:10:50 AM PST

by

expat_panama

(Arguing with those who have renounced reason is like giving medicine to the dead. --Thomas Paine)

To: expat_panama

Somehow it never seems to matter that America has grown steadily for hundreds of years.

If you want to call conspicuous consumption based on credit "growth" then go ahead. If not, then the very premise is bogus and American has had very little growth since the 60s and net negative growth since around 1990.

Living high is not "growth" but who am I to sneer at the porsche in the garage of the McMansion. Enjoy it while you can.

57

posted on

03/06/2014 6:12:56 AM PST

by

AK_47_7.62x39

(There are many moderate Muslims, but there is no such thing as a moderate Islam. -- Geert Wilders)

To: AK_47_7.62x39

America has grown steadily for hundreds of yearsconspicuous consumption based on credit

Ah, that's what you think of the Louisiana Purchase, the Transcontinental Railroad, and America's world leadership in the twentieth century. We can agree to disagree.

58

posted on

03/06/2014 8:19:01 AM PST

by

expat_panama

(Arguing with those who have renounced reason is like giving medicine to the dead. --Thomas Paine)

To: expat_panama

If you cherry pick words from a person’s arguments to make it seem they are saying something other than what they actually said, then yes, it would be better to agree to disagree. I will leave it as “that is not what I said.”

Shifting gears, though, where do you live in Panama? I just sold my business. I am opening a corporation in Belize through which I will trade forex, ADRs, derivatives and some equities (though not based on US Exchanges). I am considering SEVERAL countries to live. I hitchiked thru Central America on the way to Colombia (and no, I did NOT hike the Darien Gap, lol... I flew), and then down to Lima. I fell deeply in love with all things Latino, and have vacationed in the area many times since. Panama is really nice, once you get up in the Mts. a little. Sea level is kind of oppressive to me.

59

posted on

03/06/2014 9:03:01 AM PST

by

AK_47_7.62x39

(There are many moderate Muslims, but there is no such thing as a moderate Islam. -- Geert Wilders)

To: AK_47_7.62x39

yeah but

Panama is really nice, once you get up in the Mts. a little.

That's what me & the wife decided so I got out a map w/ average temperature contour lines & figured out that at 2,500ft temps stay at 72ºF ± 5ºF year round. Working trades online's easy but to play it safe I've got 2 isp's to make sure I've always got a guaranteed connection.

60

posted on

03/06/2014 1:43:40 PM PST

by

expat_panama

(Arguing with those who have renounced reason is like giving medicine to the dead. --Thomas Paine)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-99 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

--so let me know if anyone wants on or off this ping. Be advised that it gets posted only when I'm not feeling lazy and remember that we now know from studies that sloth is completely genetic and lazy people are the way they are because they were born that way.

--so let me know if anyone wants on or off this ping. Be advised that it gets posted only when I'm not feeling lazy and remember that we now know from studies that sloth is completely genetic and lazy people are the way they are because they were born that way.