Skip to comments.

Investment & Finance Thread 2014 New Year(Mar. 3 - nexttime edition)

Daily investment & finance thread ^

| Mar. 3, 2014

| Freeper Investors

Posted on 03/03/2014 2:15:00 AM PST by expat_panama

Investment & Finance Thread 2014 New Year(Mar. 3 - nexttime edition)

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here. Open invitation continues always for input on ideas for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket. |

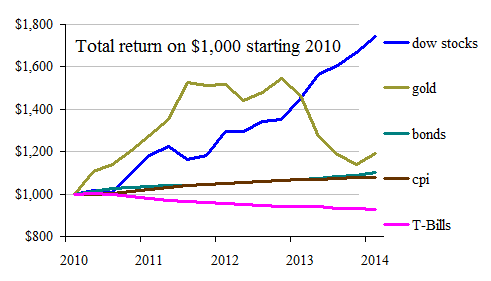

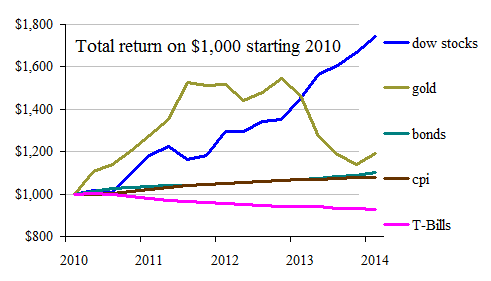

fwiw, these are the returns on $1,000 since 2010 for various investments: |

Incidentally, the plan is to include here a -- --so let me know if anyone wants on or off this ping. Be advised that it gets posted only when I'm not feeling lazy and remember that we now know from studies that sloth is completely genetic and lazy people are the way they are because they were born that way.

--so let me know if anyone wants on or off this ping. Be advised that it gets posted only when I'm not feeling lazy and remember that we now know from studies that sloth is completely genetic and lazy people are the way they are because they were born that way.

Bottom line is I can be as lazy as I want and society is required to grant me all the privileges that industrious people claim.

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; fedbubble; financial; investing; putin; russia; stockmarket; ukraine; wallstreet

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-80, 81-99 next last

To: abb; Abigail Adams; abigail2; Aliska; Aquamarine; B.O. Plenty; BenLurkin; bert; BipolarBob; ...

2

posted on

03/03/2014 2:24:56 AM PST

by

expat_panama

(Arguing with those who have renounced reason is like giving medicine to the dead. --Thomas Paine)

To: expat_panama

The Ukraine crisis is already over, IMO, and Putin played chess while the Obama/Kerry crowd was playing checkers. In the financial world, it will amount to very little, IMO.

3

posted on

03/03/2014 2:50:11 AM PST

by

abb

To: expat_panama

a 'buying opportunity I buying opportunity to purchase stocks that are artificially pumped up with fictitious Federal reserve decimal points moved on computer screens? The market is 53% overvalued based on 10 year averages, and even that does not describe how precarious it really is (factor in debt, a worldwide Depression that we are fooling ourselves about, weak manufacturing, the looming retirement of millions of Baby Boomers, soaring health care costs, and on and on).

4

posted on

03/03/2014 3:05:52 AM PST

by

SkyPilot

To: expat_panama; thackney

Related

http://online.wsj.com/news/articles/SB10001424052702303874504579376962979450296?mod=WSJ_Energy_2_4_Right&mg=reno64-wsj

Shale-Oil Boom Spurs Refining Binge

Higher U.S. Crude Production Has Valero, Marathon Increasing Capacity

By Ben Lefebvre

March 2, 2014 7:19 p.m. ET

U.S. refiners haven’t built a major new fuel-processing plant since 1976, in part because of environmental regulations. But a flood of oil from Texas, Oklahoma and North Dakota has companies rushing to expand existing plants and build small new processors around the country.

Valero Energy Corp. , Marathon Petroleum Corp. and other refiners are engineering ways to expand fuel-making capacity at their aging plants without the cost of building entirely new refineries to take advantage of the increase in light sweet crude flowing from U.S. wells.

The gasoline, diesel and other fuels they are producing can either be burned in the U.S. or sold around the world because they aren’t subject to the export ban Congress imposed on crude in the early 1970s.

American refiners are set to add at least 400,000 barrels of oil-refining capacity a day to existing plants between now and 2018, according to information compiled by The Wall Street Journal and the consulting firm IHS. That is the fuel-making equivalent of constructing a new, large-scale refinery.

snip

5

posted on

03/03/2014 3:09:59 AM PST

by

abb

To: expat_panama

You forgot to put the “Slavery” directional street sign on the post, man.

6

posted on

03/03/2014 3:42:26 AM PST

by

MeneMeneTekelUpharsin

(Freedom is the freedom to discipline yourself so others don't have to do it for you.)

To: expat_panama

Also, we need this link, “Why Investors should believe what they are told so they will trade in such a way as to make a profit for the poster of the link.”

7

posted on

03/03/2014 3:43:31 AM PST

by

MeneMeneTekelUpharsin

(Freedom is the freedom to discipline yourself so others don't have to do it for you.)

To: expat_panama

8

posted on

03/03/2014 3:48:40 AM PST

by

MeneMeneTekelUpharsin

(Freedom is the freedom to discipline yourself so others don't have to do it for you.)

To: expat_panama

I wish I could remember who it was that stated the economy was going to take a HUGE hit on March 4...

9

posted on

03/03/2014 3:52:14 AM PST

by

who knows what evil?

(G-d saved more animals than people on the ark...www.siameserescue.org.)

To: expat_panama

10

posted on

03/03/2014 3:52:38 AM PST

by

MeneMeneTekelUpharsin

(Freedom is the freedom to discipline yourself so others don't have to do it for you.)

To: who knows what evil?

I wish I could remember who it was that stated the economy was going to take a HUGE hit on March 4...Putin?

11

posted on

03/03/2014 3:54:14 AM PST

by

MeneMeneTekelUpharsin

(Freedom is the freedom to discipline yourself so others don't have to do it for you.)

To: abb

Ukraine crisis is already over, IMOmho too. As far as I can tell that chapter was closed with the Nov. '12 elections when American voted for a limp-wristed foreign policy. For us I'm thinking that we may be looking at mindless over-reacting on the part of traders.

12

posted on

03/03/2014 3:55:39 AM PST

by

expat_panama

(Arguing with those who have renounced reason is like giving medicine to the dead. --Thomas Paine)

To: expat_panama

13

posted on

03/03/2014 3:57:00 AM PST

by

MeneMeneTekelUpharsin

(Freedom is the freedom to discipline yourself so others don't have to do it for you.)

To: MeneMeneTekelUpharsin

To be honest; I really can't be sure...I saw/heard that date mentioned several months ago, and I filed it away in the 'conspiracy' portion of my brain. A poster mentioned March 4 earlier in this thread, so I'm not the only one aware of it.

When nothing happens (as usual), we'll all have a good laugh and 'move on'.

14

posted on

03/03/2014 3:58:19 AM PST

by

who knows what evil?

(G-d saved more animals than people on the ark...www.siameserescue.org.)

To: who knows what evil?

Oops...March 4 was mentioned on another thread.

15

posted on

03/03/2014 4:00:00 AM PST

by

who knows what evil?

(G-d saved more animals than people on the ark...www.siameserescue.org.)

To: expat_panama

Ok, finally a little relief. Dow futures -153. Whew. We’re going to survive. ROFL.

16

posted on

03/03/2014 4:00:08 AM PST

by

MeneMeneTekelUpharsin

(Freedom is the freedom to discipline yourself so others don't have to do it for you.)

To: expat_panama

Okay, now the Dow futures -147. I can get ready for work and actually go there instead of driving into a tree so my wife can collect my life insurance. :D

17

posted on

03/03/2014 4:01:41 AM PST

by

MeneMeneTekelUpharsin

(Freedom is the freedom to discipline yourself so others don't have to do it for you.)

To: SkyPilot

...The market is 53% overvalued based on 10 year averages...Wait, is that 53% and not 52% or 54%? Seriously, here's 120 of stock prices--

--and there're lots of folks that see good reason to believe we're over due for continued growth. My thinking is that for the long term I'm very confident that America will continue to prosper, and for the short term life holds many surprises...

18

posted on

03/03/2014 4:05:38 AM PST

by

expat_panama

(Arguing with those who have renounced reason is like giving medicine to the dead. --Thomas Paine)

To: who knows what evil?

...who it was that stated the economy was going to take a HUGE hit on March 4...lol --if you want a prediction that's guaranteed it's the fact that today we'll be hearing from tons of pundits saying that they they knew it all along and warned us way back when that today was crash day.

19

posted on

03/03/2014 4:14:22 AM PST

by

expat_panama

(Arguing with those who have renounced reason is like giving medicine to the dead. --Thomas Paine)

To: expat_panama

I don’t believe that. I’m retreating into my steel-reinforced concrete bunker and live like a hermit until the world as we know it comes to an end, or I die. Whichever comes first.

All you people who remain active and engaged and choose to participate in Life, and make the best of the situation...

YOU ARE ALL FOOLS!!

/sarc

20

posted on

03/03/2014 4:18:15 AM PST

by

abb

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-80, 81-99 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

--so let me know if anyone wants on or off this ping. Be advised that it gets posted only when I'm not feeling lazy and remember that we now know from studies that sloth is completely genetic and lazy people are the way they are because they were born that way.

--so let me know if anyone wants on or off this ping. Be advised that it gets posted only when I'm not feeling lazy and remember that we now know from studies that sloth is completely genetic and lazy people are the way they are because they were born that way.