Skip to comments.

Investment & Finance Thread 2014 New Year(Mar. 3 - nexttime edition)

Daily investment & finance thread ^

| Mar. 3, 2014

| Freeper Investors

Posted on 03/03/2014 2:15:00 AM PST by expat_panama

Investment & Finance Thread 2014 New Year(Mar. 3 - nexttime edition)

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here. Open invitation continues always for input on ideas for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket. |

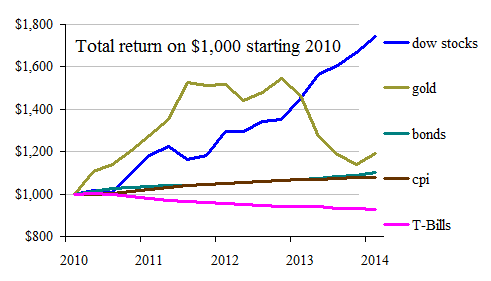

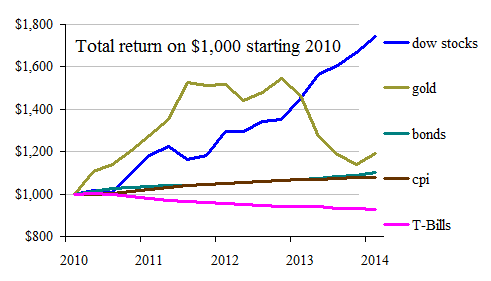

fwiw, these are the returns on $1,000 since 2010 for various investments: |

Incidentally, the plan is to include here a -- --so let me know if anyone wants on or off this ping. Be advised that it gets posted only when I'm not feeling lazy and remember that we now know from studies that sloth is completely genetic and lazy people are the way they are because they were born that way.

--so let me know if anyone wants on or off this ping. Be advised that it gets posted only when I'm not feeling lazy and remember that we now know from studies that sloth is completely genetic and lazy people are the way they are because they were born that way.

Bottom line is I can be as lazy as I want and society is required to grant me all the privileges that industrious people claim.

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; fedbubble; financial; investing; putin; russia; stockmarket; ukraine; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-99 next last

To: abb

lol!

What I like to do on a day like today is check out the pre-opening bid/ask prices on my holdings to guesstimate the current values. That way I got time to think out strategies when I’m not in a hurry.

21

posted on

03/03/2014 4:37:48 AM PST

by

expat_panama

(Arguing with those who have renounced reason is like giving medicine to the dead. --Thomas Paine)

To: MeneMeneTekelUpharsin

Dow futures at -145 now.Dow futures -150.

Dang, and here I spent all that time this weekend on such a terrific 'buy-list'.

22

posted on

03/03/2014 4:39:39 AM PST

by

expat_panama

(Arguing with those who have renounced reason is like giving medicine to the dead. --Thomas Paine)

To: who knows what evil?

Probably Zero Hedge along with Jan, Apr11, Mar16, etc, etc, etc. Pick a date, they pretty much got them all covered.

23

posted on

03/03/2014 4:39:41 AM PST

by

Lurkina.n.Learnin

(This is not just stupid, we're talking Democrat stupid here.)

To: abb

American refiners are set to add at least 400,000 barrels of oil-refining capacity a day to existing plants between now and 2018 100k bpd per year sounds at or below the average expansion for the last decade or so.

24

posted on

03/03/2014 4:53:41 AM PST

by

thackney

(life is fragile, handle with prayer)

To: expat_panama

That’s exactly my thinking too, expat. The long-term trend is so obviously steadily upward, one would be a fool not to be riding it up. Backup plans for short-term reversals are necessary, of course.

TC

To: Pentagon Leatherneck

The immediate shock reaction to this geo-political crisis is panic. Be prepared for a flight capital tsunami into the US “safe harbor” markets. Bear-Market madness is collective. Consequential recoveries are cummulative.

26

posted on

03/03/2014 5:49:15 AM PST

by

Tugo

(Bozo of the Day)

To: expat_panama

You’re probably right, at least I hope so. But, we have to survive 980 more days of Obama, and I have my doubts. I really do.

27

posted on

03/03/2014 6:17:29 AM PST

by

SkyPilot

To: expat_panama

Good to see you. Been churning and burning since you’ve been gone. Now maybe I can make some money...

28

posted on

03/03/2014 7:29:16 AM PST

by

MichaelCorleone

(Jesus Christ is not a religion. He's the Truth.)

To: expat_panama

Still sitting on the sidelines. We all have our "big fishes" that got away. I thought that correction wasn't enough and haven't learned how/when to short.

Here's what I come away with today. I've been looking at Vanguard on Scottrade but want to steer clear of S&P 500 index because of Soros. Emerging markets wouldn't be good now. Last night Bob Brinker practically yelled at a caller, Vanguard whole stock market. That made sense so I look it up. Well Scottrade doesn't have it any ore (I don't think) nor the Wellington fund. So forget that.

I watched Walgreens go from about 45 to where it was today, 68 something, down a little.

jc Penney's and Blackberry in play again. I don't want to risk JCP but BBRY I will keep my eye on it, made some on it then got burned.

Just about everything else looks overvalued. I don't want to spend all my time on stocks but will look into energy stocks. Also, I got more in divideds last year than I got in interest on more than 3X the money on my credit union account.

Dividends require you to be owner of record on a certain day. Then you can sell. Regardless, I see the overall advantage of dividends, hopefully with a good performer along with it.

I've been out for awhile and think I've kind of lost the feel of it.

29

posted on

03/03/2014 2:07:54 PM PST

by

Aliska

To: All

30

posted on

03/03/2014 2:10:13 PM PST

by

musicman

(Until I see the REAL Long Form Vault BC, he's just "PRES__ENT" Obama = Without "ID")

To: Aliska

Check out Kinder Morgan or AMLP. Kinder Morgan is a pipeline so they have tax implications and AMLP may because of that be a better fit.

31

posted on

03/03/2014 4:44:23 PM PST

by

Chgogal

(Obama "hung the SEALs out to dry, basically exposed them like a set of dog balls..." CMH)

To: Chgogal

Thank you. I'll put them in energy watchlist tomorrow and look at some charts for them. Someone here who is no longer around recommended Holly Energy if it went down to 45. It did but I don't like to blindly follow advice. It's had its ups and downs but could have made me some money if I'd played it right.

I can't remember the stock code for Holly and don't want to log in to look it up.

One company I was in paid terrific dividends. It is a fertilizer company, RNF (not sure that's the right code) Renfro Nitrogen Fertilizer, probably is. When I was in, it was at 30 something. Then it started tanking. The dividend still paid but not 11%. Anyway, I got out of that at a loss. Told myself I'd buy back in if it got to 17. Probably did, I don't watch all the time. Today it was 18 something.

I'm always looking for promising IPO's, too. Made pretty good on 2, SCTY, XONE, and a reit I got out of fast at a small profit. Too many jumped on the first two and I don't play them any more for various reasons.

32

posted on

03/03/2014 5:18:02 PM PST

by

Aliska

To: expat_panama

Please put me on the ping list!

33

posted on

03/03/2014 5:45:11 PM PST

by

Bookwoman

("...and I am unanimous in this...")

To: abb; Abigail Adams; abigail2; Aliska; Aquamarine; B.O. Plenty; BenLurkin; bert; BipolarBob; ...

34

posted on

03/04/2014 2:27:32 AM PST

by

expat_panama

(Arguing with those who have renounced reason is like giving medicine to the dead. --Thomas Paine)

To: expat_panama

35

posted on

03/04/2014 2:29:28 AM PST

by

dennisw

(The first principle is to find out who you are then you can achieve anything -- Buddhist monk)

To: MichaelCorleone

churning and burning since you’ve been gone. Now maybe I can make some money...It's the group (imho), for me the chatter from others doing similar work seems to make thinking easier. There are a lot of investing chat/groups but this one also has a lot of other common interest advantages.

36

posted on

03/04/2014 4:00:50 AM PST

by

expat_panama

(Arguing with those who have renounced reason is like giving medicine to the dead. --Thomas Paine)

To: expat_panama

Looks like it will be roaring back this morning.

37

posted on

03/04/2014 5:02:57 AM PST

by

Lurkina.n.Learnin

(This is not just stupid, we're talking Democrat stupid here.)

To: Lurkina.n.Learnin

yeah; futures still not quite as upbeat today as they were down yesterday but my personal approach atm is checking out possible new buy candidates...

38

posted on

03/04/2014 5:06:53 AM PST

by

expat_panama

(Arguing with those who have renounced reason is like giving medicine to the dead. --Thomas Paine)

To: expat_panama

Thanks for the 3rd link. Interesting data/timetable.

39

posted on

03/04/2014 5:37:05 AM PST

by

PGalt

To: expat_panama

ES this morning:

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-99 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

--so let me know if anyone wants on or off this ping. Be advised that it gets posted only when I'm not feeling lazy and remember that we now know from studies that sloth is completely genetic and lazy people are the way they are because they were born that way.

--so let me know if anyone wants on or off this ping. Be advised that it gets posted only when I'm not feeling lazy and remember that we now know from studies that sloth is completely genetic and lazy people are the way they are because they were born that way.