Skip to comments.

1,000 Banks to Fail In Next Two Years: Bank CEO

CNBC ^

| August 27, 2009

| Natalie Erlich

Posted on 08/27/2009 3:25:44 PM PDT by RobinMasters

The US banking system will lose some 1,000 institutions over the next two years, said John Kanas, whose private equity firm bought BankUnited of Florida in May.

“We’ve already lost 81 this year,” he told CNBC. “The numbers are climbing every day. Many of these institutions nobody’s ever heard of. They're smaller companies.”

Failed banks tend to be smaller and private, which exacerbates the problem for small business borrowers, said Kanas, who became CEO of BankUnited when his firm bought the bank and is the former chairman and CEO of North Fork bank.

“Government money has propped up the very large institutions as a result of the stimulus package,” he said. “There’s really very little lifeline available for the small institutions that are suffering.”

This comes at a time when the FDIC has established new rules on bank sales. Private equity, for instance, would have to hold double the capital of their competitors in order to buy such an institution, said Kanas.

(Excerpt) Read more at cnbc.com ...

TOPICS: Breaking News; Business/Economy; Culture/Society; Front Page News; Government; News/Current Events

KEYWORDS: 401k; american; bailout; bank; banking; bankingfailures; banks; bhoeconomy; business; congress; democrats; economy; election; evil; fdic; fed; federalreserve; finance; firearms; florida; investments; kennedycare; money; obama; obamacare; patriots; politics; sharia; stimulas; stockmarket; stocks; tarp; teaparty; townhall; united; us; wallstreet; whitehouse

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-68 next last

To: BP2

Excellent and informative post. Thanks!

41

posted on

08/28/2009 8:29:37 AM PDT

by

LomanBill

(Animals! The DemocRats blew up the windmill with an Acorn!)

To: thefrankbaum; LomanBill; Pilsner; NoObamaFightForConservatives; foxfield; ...

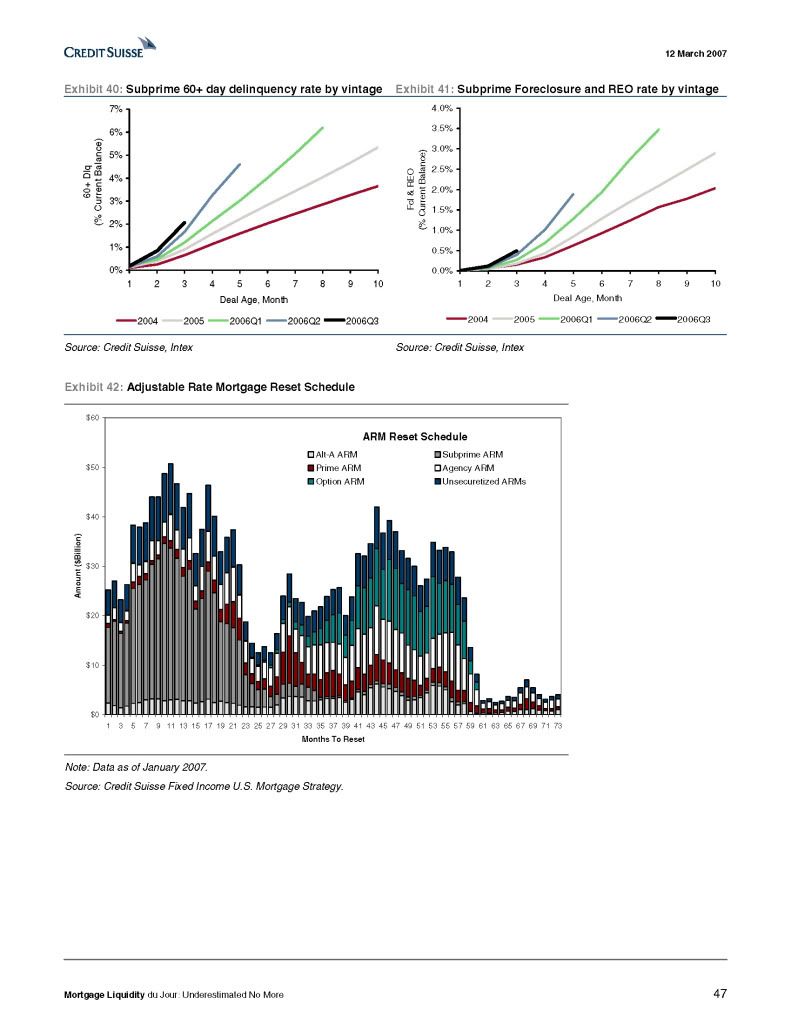

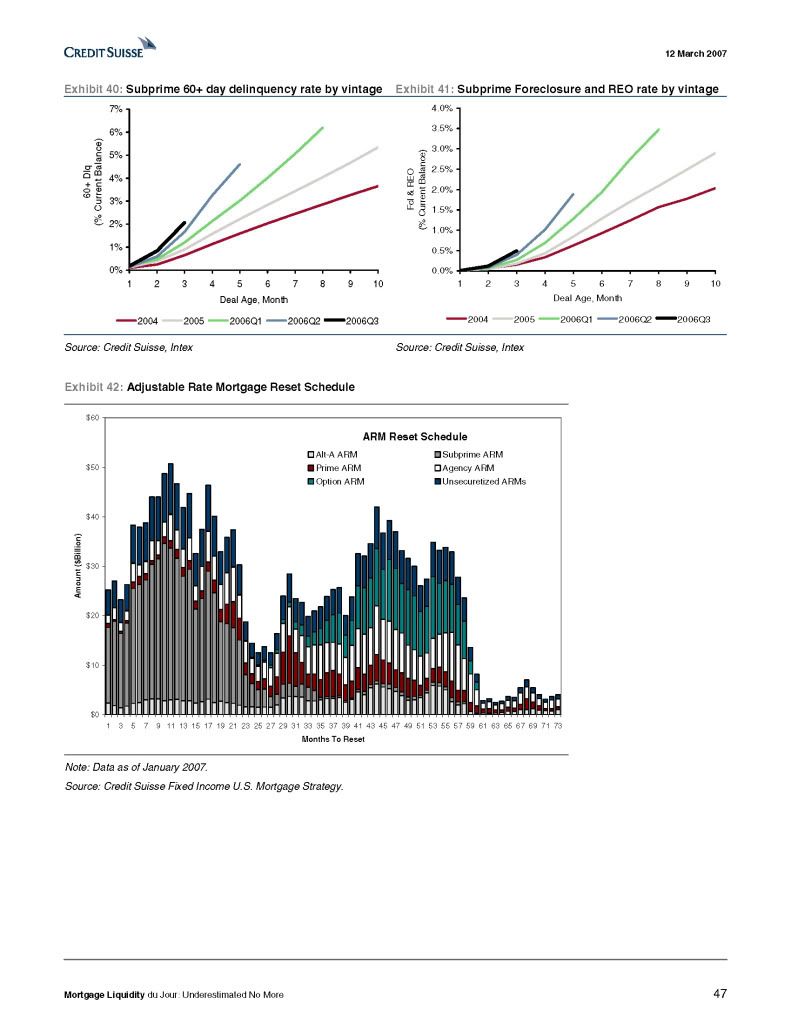

What most people don't know is that the chart (featured on Glenn Beck's show, CNBC, and other places) on Post 17 ABOVE was originally featured as this in 2007, nearly 18 months before things really unraveled in September 2008:

This is page 47 of a report by Credit Suisse published in March 2007. The FULL March 2007 report is parked here: "Mortgage Liquidity du Jour: Underestimated No More"

This chart has since been updated, as shown in Post #17, bumping the expected foreclosures -UP- on moderate risk loans. Many of those borrowers in those categories bought houses in the 2004-2006 period before underwriters started tightening the terms to lend to high (subprime) and moderate risk (Option ARMS and Alt-A) borrowers under Community Reinvestment Act provisions. So when you hear people like Barney Frank saying they didn't know about the looming foreclosure crisis, and how & when it was going to hit, you can see they LIE through their teeth! They (both Democrats and Republicans) were too busy enjoying contributions and profiting themselves from the inside knowledge. THEY KNEW and let it happen back in early 2007, coming to a head in September 2008, right before the election!!! It's sickening to think of the TRILLIONS of dollars of personal wealth for retirement, mostly from unsuspecting Baby Boomer with IRAs, that is GONE forever. And at the risk of sounding like a broken record -- the WORST is still ahead!

The only bright spot might be that for those who are about to have their house foreclosed on, if they ask for the bank to "Produce the Note", they have a hard time doing so. This is because banks sold, and re-sold and re-sold the mortgages leading up to the big bust in September 2008, and have those mortgages tied up in mortgage-backed securities to such a degree that it stalls the actual Statutory Foreclosure process SIGNIFICANTLY. The homeowner then has more time to get another job or find some way to improve the situation. Also, in many states, paying just ONE month's mortgage, even though the owner is 90 days behind, restarts the entire foreclosure process.

|

42

posted on

08/28/2009 8:51:31 AM PDT

by

BP2

(I think, therefore I'm a conservative)

To: Ghost of Philip Marlowe

>>Because, ultimately, this will result in food

>>shortages, the best way to control people.

Kurtz: Are you an assassin?

Willard: I’m a soldier.

Kurtz: You are neither; You’re an errand boy, sent by grocery clerks to collect a bill.

"The Appetite of Tyranny is never far removed from the Tyranny of the Appetite."

The Horror...

43

posted on

08/28/2009 9:06:36 AM PDT

by

LomanBill

(Animals! The DemocRats blew up the windmill with an Acorn!)

To: socialismislost

Obama may be in over his head, but he’s got financial gurus behind him running this thing. Soros, for one; I’m sure there’s others. They’re planning to own assets now in other hands.

44

posted on

08/28/2009 9:08:26 AM PDT

by

twigs

To: foxfield

Yeah, I’ll elaborate.

Welfare cases get to live in formerly $1,000,000 + McMansions for free while I continue to have to pay for my monthly mortgage payment; while still paying federal taxes for the aquisition, refurbishing and upkeep of said McMansions...

...and how much longer am I going to continue to do so...?

45

posted on

08/28/2009 9:09:52 AM PDT

by

Reagan80

(If Ann Dunham had access to abortion on demand in 1961, we wouldn't be punished with her baby")

To: dannyboy72a

You should look up Steve Cordasco on the internet. He’s got a financial show on local radio here in the Philadelphia region. I used to listen to him while driving to work early on Saturday mornings. He addresses a lot of the things you’re trying to remember and he doesn’t understand why financial reporters are not digging into this story. It’s huge. He also knows a lot about T. Geithner and how he fits into this story.

46

posted on

08/28/2009 9:13:37 AM PDT

by

twigs

To: foxfield

We tried to buy such a property for over a year last year. We think that the real estate agent was part of the problem. He wanted the property himself and made an offer to the owner while he sat on our offer; he was later arrested for theft, but is still an active agent. We think that he had some kind of arrangement with the bank holding the second mortgage. Then, about the time we found another house to buy, the house quietly sold for 80K less than we had in our offer still on the table. Someone had connections...

47

posted on

08/28/2009 9:19:29 AM PDT

by

twigs

To: RobinMasters

48

posted on

08/28/2009 9:52:16 AM PDT

by

RushIsMyTeddyBear

(“During times of universal deceit, telling the truth becomes a revolutionary act.” -George Orwell)

To: BP2

Have noticed several for sale signs in our neighborhood over the past 2 yrs. ,collecting the info-flyer i watch the asking price

drop several Ks’$ in 3mo increments... then some still don’t sell, But... the For Sale sign will just disappear and the

house just sits there. So is this the result you are talking about ?

49

posted on

08/28/2009 10:12:18 AM PDT

by

urtax$@work

(The best kind of memorial is a Burning Memorial.........)

To: RobinMasters

Add to this the report in the WSJ within the last two days that the FDIC is bankrupt as of August 19th this year. Our "safety net" is gone.

50

posted on

08/28/2009 11:17:19 AM PDT

by

ExSoldier

(Democracy is 2 wolves and a lamb voting on dinner. Liberty is a well armed lamb contesting the vote.)

To: twigs

Obama has got financial criminals behind him. Soros is one of them. You are right, they are planning to own assets now in other’s hands

To: RobinMasters

52

posted on

08/28/2009 1:02:11 PM PDT

by

wolfcreek

(http://www.youtube.com/watch?v=Lsd7DGqVSIc)

To: dalebert

The question: Where is the oversight of banking system?

Chris Dodd: Senate banking committee

Barney Frank: House banking committee

Same two guys who started this financial forest fire to win an election. Problem is that the fire is out of control and they have no clue how to stop it.

Plus add in the huge amount of commercial real estate that is empty/abandoned. Those notes are typically longer term than residential but when that ballon pops, the banks are going to be left holding the bag. And since there is precedent for the ozero regime bailing them out, that will happen again. All done with our tax money.

53

posted on

08/28/2009 1:15:36 PM PDT

by

Texas resident

( Boys and Girls, it's us against them.)

To: AdmSmith; Berosus; bigheadfred; Convert from ECUSA; dervish; Ernest_at_the_Beach; Fred Nerks; ...

54

posted on

08/28/2009 4:52:20 PM PDT

by

SunkenCiv

(https://secure.freerepublic.com/donate/__Since Jan 3, 2004__Profile updated Monday, January 12, 2009)

To: BP2

I’m finding your posts both informative and very interesting.

So what would you recommend as defensive steps for those of us who are financially responsible with reasonable savings and liquidity? I’ll admit: I’m truly frightened in many ways right now and really don’t know how to best position our assets for the storm ahead.

55

posted on

08/28/2009 5:26:13 PM PDT

by

Jedidah

("Those who cannot remember the past are condemned to repeat it." George Santayana)

To: Texas resident

well people need to make noise about it....these rats think they are pulling the wool over stupid american eyes

56

posted on

08/28/2009 5:41:08 PM PDT

by

dalebert

To: Jedidah

I cant figure it out. as i see it liquid assetts will be worthless soon.....and so will everything else....buy food and hide it i guess so we dont starve to death....

57

posted on

08/28/2009 5:43:08 PM PDT

by

dalebert

To: lapsus calami

“May the debts of a thousand bank failures nestle in Obama’s private parts...”

..and may a pox and curse fall upon him and his czars.....

58

posted on

08/28/2009 5:52:58 PM PDT

by

lgjhn23

To: Kartographer

Uh oh, I don’t see any money on those trees.

To: BP2

Additionally, that chart does not include commercial real estate, a huge bubble that is already popping.

Pick a mall, any mall, and drive around it and see how many resale shops are vacant.

When that bubble pops, not only will it be enough to create a mini-recession even if the economy is fine, but it is going to add another spike to unemployment.

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-68 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson