Posted on 12/17/2024 8:44:36 PM PST by SeekAndFind

Wow. No wonder all the traders on the floor of the New York Stock Exchange broke out in a USA, USA, USA” chant when Trump visited last week.

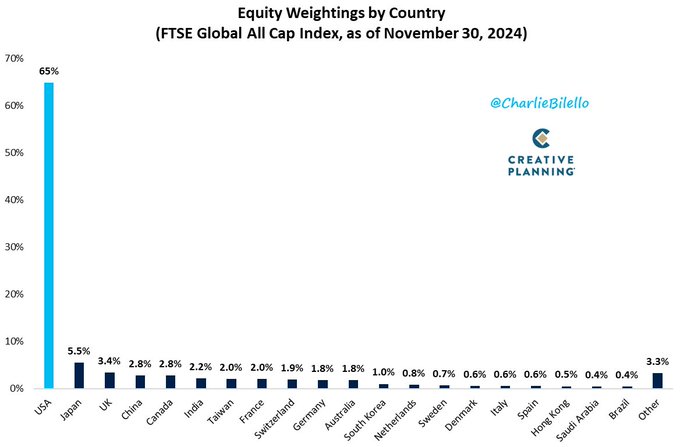

The HOTLINE has frequently reported on the rising global dominance of American stocks. The end of November marked a new milestone: US equities now represent over 65% of global market capitalization. Japan is number two at just 5.5%. China’s companies are about one-twentieth as valuable as U.S. firms.

If the Magnificent Seven tech companies were a separate stock market, they would be nearly as valuable as all the rest of the companies publicly traded around the world. How moronic that our OWN regulators want to break up these American wealth creators for the unforgivable crime of being TOO successful.

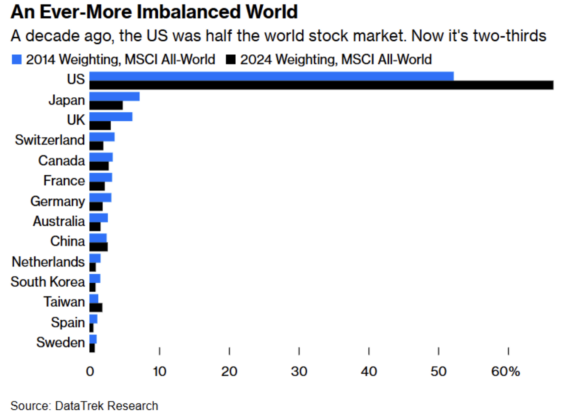

Bloomberg notes how badly foreign markets have lagged:

Over the last decade, in price terms, the MSCI Europe has lagged the S&P 500 by an average compounded rate of 7.7% per year, while the MSCI Emerging Markets has lagged by 9.6%. That’s terrible underperformance.

Can it continue? The bull case is that the political party that wants America to follow Europe on energy, tax, and regulatory policy lost this year. Badly.

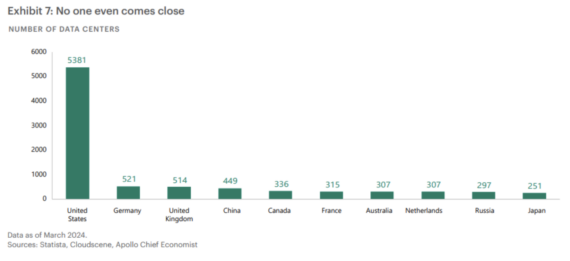

The United States is also completely dominating the global race to build data centers, with more than the rest of the world combined. The biggest concentration of data centers in the world is in Loudoun County, Virginia – known as “Data Center Alley.”

That is a result not just of US dominance of Big Tech, but also the availability of reliable energy that – despite the best efforts of the left – remains relatively affordable and abundant in the US. Especially compared to Europe, which is much further down the green rabbit hole.

To ensure U.S. economic dominance, let’s not go down that hole.

P/E of US equities is near historical crash levels.

Meaning way overpriced.

This is not healthy and always ends in tears. Ask the Athenians, and the Spanish, and the Brits.

And every other pinnacle of civilization.

Captain Edward Smith said “Not even God can sink this ship”.

Meanwhile, the muzzies are breeding like rabbits while European Christendom abstains, prevents and aborts.

Gonna be a reckoning.

Maybe we have four extra years.

The Democrats will regroup and will go with a better candidate. Gavin Newsom. Gretchen Whitmer. Etc.

I guess Prince William will become the King of Australia?

If there is no big systemic shock like wars or disease or large terror events—the USA is going to on an economic tear —the scale of which the world has not seen in a long time.

Because we're the only major economy that's relatively "open".

The EU is stagnant. Their economy was bigger than the U.S. 20 years ago. Failed to keep pace.

China is communist.

India will continue to do better but they're still a third world country (with problems due to their caste system).

Indeed.

From Grok:

Here are the top 10 biggest U.S. companies by market capitalization, based on the latest available data:

Apple Inc. ($AAPL) - $3.794 trillion

Microsoft Corporation ($MSFT) - $3.357 trillion

NVIDIA Corporation ($NVDA) - $3.232 trillion

Amazon.com Inc. ($AMZN) - $2.449 trillion

Alphabet Inc. ($GOOG) - $2.415 trillion

Meta Platforms Inc. ($META) - $1.57 trillion

Tesla Inc. ($TSLA) - $1.40 trillion

Broadcom Inc. ($AVGO) - Market cap not specified, but ranked in top 10

Berkshire Hathaway Inc. ($BRK-B) - Market cap not specified, but ranked in top 10

Walmart Inc. ($WMT) - Market cap not specified, but ranked in top 10

Please note that exact market caps for some companies were not listed in the sources, but their positions among the top 10 are confirmed. Market caps can fluctuate daily, so these figures are based on the most recent information available.

So you’re saying invest in Brazil?

And India.

Re: data centers in Louden County

I’m pretty sure that is a result of the legacy of MAE-East, the original East Coast Internet peering point back in the 1990s. If you read up on its history, it started out in Vienna, vA and was ultimately replaced by a location in Louden County.

Those DCs have to talk to the world, so proximity to serious Internet connections is vital.

I was formerly more pessimistic about the US economy in general and the dollar in particular. Then I realized the other world currencies are even more screwed up. Not to say we can’t still screw up more, and might still do so catastrophically. But we’re still the best place on the globe. Who knows, Milei may turn Argentina then South America into a powerhouse to topple us. Stranger things have happened.

But is that just because its more inflated, because its currency is more inflated???

I laugh when I read that tiny Taiwan is in the same league on “Global Equity” as France and Germany. It says alot about why the EU is doing so poorly.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.