Skip to comments.

“How NOT to be a victim of gold scams” Part Two.

FreeRepublic Original Research ^

| Feb 11, 2024

| Widget Jr

Posted on 02/11/2024 10:33:32 AM PST by Widget Jr

“How NOT to be a victim of gold scams”

Part TwoThe first part was to give some background in the realities of the industry, to help dispel what get rich forecasters say. The deeper I went... well... rabbit holes go deep. Armstrong, like many frauds of economics loves talking about gold. How to invest and make money in it. From the first post, there is no way a outsider investing in the stock market, will make more than those working in the industry. This part is to address specific gold predictions by Martin Armstrong... and how disconnected from reality they are.

I. The Price of Gold in Reality.

First, some background, the history of the price of gold for the 20 to 30 year. What the price of gold actually did, and what it meant for the predictions Armstrong, and his shills made. Gold prices over the years, in USD per ounce:

https://www.bullionvault.com/gold-price-chart.do

https://goldprice.org/

https://www.apmex.com/gold-price.

From 2004 to June 2011: gold rose from $400 to $1,840 USD.

From June 2011 to August 2012, gold dropped then rose back to $ 1,800 USD.

From August 2012 to November 2015: gold dropped to $1,060 USD.

From November 2015 July 2020: gold rose to $2,020 USD.

Since then the price of gold dropped in August 2020 to 1,600, then climbed back up to its current value of $2,020 to $2,040 USD.

The too long, didn’t read version: From 2004, the price of gold has been on a upward trend from $400 USD/ounce to over $2,000 USD/ounce, with a dip in price from 2012 to 2015 from which the price has recovered.

II. Armstrong’s $5,000 Gold Fantasy.

Now let’s look at Armstrong’s predictions (Are spoilers necessary? Probably not.)

November 7, 2009, Martin Armstrong’s Newsletter predicting $5,000 per ounce gold.

Eighteen pages explaining what absolutely must happen, that never happened.

August 24, 2013, Gold $5,000+ – Why

"We have only two possibilities. (1) We get the phase transition in the Dow now going into 2015.75 whereby the Dow nearly doubles in value creating the bubble top, or (2) the Phase Transition is postponed into 2025 for the next 8.6 year wave. This depends upon the debt crisis. If we see the sovereign debt unravel now, then capital will flee into tangibles. There will not be the flight to quality so sovereign debt will not be the alternative but tangible assets. Thus, gold will rally at that time in place of government bonds. Because there is little gold at the current price relative to the cash, its price must rise to the price level in the $5,000 area."

I am not going to unpack all the economic falsehoods. Further down, I will explain how Armstrong deceives people, not the specific deceptions. Although I think I am qualified to say none of these financial crises or their responses happened in the third or fourth quarter of 2015 anywhere close to what Martin claimed.

September 2, 2014, Will Gold Still Go to $5000?

“Yes – to answer a lot of questions. We still see the future rally in gold reaching the $5,000 level.”

Nope. Not even close.

April 15, 2015, Martin Armstrong – Gold Bullion To “Max Out At $5,000 Per Ounce”

"– Fall 2015 turning point – civil unrest and riots globally says forecaster Armstrong

– Fed have to raise rates – due to pressure from congress and media

– By 2020 the cost of servicing U.S. debt will outpace defence spending

– European banks will collapse and “blood in the streets”

– Higher rates will also devastate emerging markets who have issued dollar-based debt

– Gold to “max out at $5000 per ounce”

– Advocates diversification and holding bullion coins familiar to public such as $20 gold coins"

I will unpack this.

There is always civil unrest somewhere, and the catastrophic global unrest and riots Armstrong was predicting for 2015 did not happen. The increasing cost of servicing the debt to defense or any US Federal spending was already known, and had nothing to do with gold prices. The European Debt Crisis started in 2009 to the mid 2010s, was a ongoing problem. European banking did not collapse.

This was not a open ended forecast. If it was, it would be worthless to anyone's claims as a super forecaster. Armstrong's gold forecasts had definite timelines. From the Martin Armstrong Socrates Scam blog, Gold USD 5,000+ into 2016 we have Martin’s own words:

“THE SPIKE HIGH: ... This would signal an amazing rally may then develop with a high at least at the 5,000 level and perhaps even 12,000 by 1215.75 if we held the 1,500 level in June..”

“13: A 21 year bull market in stocks points to 2015 and a 17.2 year high in gold points to 2016. P14: However, if gold exceeds this level and it too forms the subsequent support, now we are looking at the $3,500 to $5,000 target zone. This is where we see the potential for Gold is a true economic meltdown of Confidence.”

Just to remind where we are, gold never reached $2,500 all the time Martin was saying $5,000 gold was inevitable, and would happen before 2016. That same page on the Socrates Scam blog shows lots of other failed predictions that were sure to happen.

Armstrong was busy predicting catastrophic global economic and political collapse, failure, turmoil (pick one or all) by the end of 2015 and in 2016. Events which did not happen.

Armstrong is using two tricks in these Gold forecasts. First, he keeps repeating the same lie, from 2009 to 2015, until it is worn out. The second is, he wraps what he says in all the biases and prejudices his target audience wants to hear. Armstrong panders to the libertarian, anti-EU, anti-Western dominance of everything conservative groups.

This is in no way a defense of the United States and European systems of power and control. What Armstrong is doing is taking advantage of people’s fears and prejudices to get them to buy his products, buy into his get rich schemes, while taking no responsibility when people lose money following his advice.

III. How Armstrong Deceives and Misleads for Fun and Profit.

His fun, his profit, and this is not a comprehensive list. Armstrong and his kind have a limited number of related tricks.

· Make wild predictions about current events that are already happening.

· Claim they predicted the exact events that are happening when they didn’t.

· Take credit for events they had not involvement.

· Make word salad claims that sound impressive to those who don’t know any better.

The trick that makes this a full time effort is to never shut up. It make it easier to:

· Ignore any previous predictions and claims that contradict the current narrative.

· Take advantage of search engines that are biased to what is trending, versus what is more reliably accurate information.

· Confuse anyone who wants to challenge all the nonsense because there is so much of it for the conmen to fall back on.

IV. Nick Nicolaas.

Now onto one of his promoters, Nick Nicolaas. He is the owner of Montan Mining, now Fidelity Minerals. He used to promote Armstrong. What he is really doing is promoting himself to those who don’t know better.

He went to Armstrong 2016 World Economic Conference, and used a old trick with a new twist. Selling the get rich scheme to get rich, by selling his notes for $1,000 to “cover the cost” of going to one of Armstrong’s conferences. Armstrong already sells his conference material. Why by the notes, when you can buy the real thing?

Then in January 18, 2021 on Facebook, he posted, Klondike Silver Update - Gold, the Dow, S&P 500 & the Nasdaq - Points to Ponder, he actually out did Armstrong:

"NY Gold Nearest Futures ...

The Silver Price will eventually become explosive. It will go back in the area of its historical Silver/Gold Ratio of Seventeen (17) Ounces of Silver to One (1) Ounce of Gold.

We still believe that there will be a Turning-point and Directional-Change in Gold. Gold will go below $981.50 after which will go above $981.50.

When that occurs, we will see Gold move to at least $2,500 and perhaps $5,000 per ounce. Eventually Gold will go as high as $20.000 per ounce."

He ends with this gem:

"At Mining Interactive resolved to move you the Investor into Super-fortune and Ultra-wealth status.

In the near future, of the first quarter 2021, the price of Gold was actually dropping. It took to the end of March, 2022 for gold to hit $2,000. At that time, the price of Silver would have to quadruple to meet a 17:1 ratio to gold. There was nothing except wild speculation to think the price would quadruple for some arcane reason.

The funny part is this, the difference in stock price between Nicolass’s company and Sibuyan Stillwater from Part One of How NOT to be a victim of gold scams. Nicolass owned Montan Mining, which in 2019 rebranded into Fidelity Minerals, FMN on the Toronto Venture exchange. At the time of this writing, FMN is trading at $0.05 USD / Share. Sibanye Stillwater Limited (SBSW), on the NYSE, is trading at $4.28 USD/ Share, 85.6 times higher. Sibanye Stillwater Ltd (SSW:SJ) stock price on the South African Johannesburg exchange is 1,973 ZAr (South African Rand), or $103.94 USD, a whopping 2,078.8 times higher!

If Nicolass followed his own advice based on Armstrong’s advice, he did not move into Super-Fortune or Ultra-Wealth status.

TOPICS: Business/Economy; Computers/Internet; Conspiracy; Society

KEYWORDS: armstrongeconomics; felonforcaster; gold; kmg; martinaarmstrong; martinarmstrong

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-58 next last

Part two of explain Martin Armstrong's gold scamming to sell his phony Socrates system. Link to

Part OneGold is a popular subject for get rich quick scheme sellers, economic doom and gloom fearmongers, and political hacks to use. Armstrong is all of these and then some.

Comments, questions, informed critiques, angry ranting and raving?

Tear Collection Kits available at poster's expense.

1

posted on

02/11/2024 10:33:32 AM PST

by

Widget Jr

To: Widget Jr; Widget; patriotfury; Jedi Master Pikachu; drzz; Vicomte13; Willie Green; coteblanche; ...

The

Martin Armstrong Ping List, dedicated to discussing and exposing the “Felon Forecaster” who spend a decade in prison for fraud.

More information at Martin Armstrong Socrates Scam.

2

posted on

02/11/2024 10:34:51 AM PST

by

Widget Jr

(🇺🇸 Trump 2024 🇺🇸)

To: Widget Jr

I generally don’t think of gold as an investment. It is more of a retainer of wealth. You start out with a pound of gold and years later it is still a pound. You can pretty much buy whatever you could buy with it before. Nothing beats that cool golden ring of a Kugarand however. Sounds as beautiful as it looks.

3

posted on

02/11/2024 10:42:55 AM PST

by

Nateman

(If the Pedo Profit Mad Moe (pig pee upon him!) was not the Antichrist then he comes in second.)

To: Widget Jr

If I could afford to buy gold, the best way for me would be to drive over to Pinehurst Coins and pay cash for gold Buffalos.

4

posted on

02/11/2024 10:49:05 AM PST

by

ComputerGuy

(Heavily-medicated for your protection)

To: Widget Jr

You can’t eat gold. Well, I guess you can drink some flakes.

5

posted on

02/11/2024 10:53:11 AM PST

by

Fester Chugabrew

(In a world of parrots and lemmings, be a watchdog.)

To: Nateman

Agreed, a means of barter. I’ve also read about people keeping vice products like liquor, tobacco etc. for trade.

6

posted on

02/11/2024 10:54:27 AM PST

by

Mean Daddy

(Every time Hillary lies, a demon gets its wings. - Windflier)

To: ComputerGuy

Yep, or hit the pawn shops and buy heavy pieces of gold jewelry. All the talk radios commercials talk about “owning physical gold” but do any buyers get to hold that gold in their hand?

7

posted on

02/11/2024 10:54:46 AM PST

by

Pollard

(Hi)

To: Pollard

Holding it in my hand immediately is part of the equation.

8

posted on

02/11/2024 10:57:29 AM PST

by

ComputerGuy

(Heavily-medicated for your protection)

To: Nateman

Gold is simply a hedge against inflation (retainer of wealth as you point out). I have it as 20% of my portfolio, with most of the rest in equities. This leaves me with enough to get by with in case the stock market crashes (in which case being poor will be among the least of our problems). Nobody is going to get rich speculating in gold.

9

posted on

02/11/2024 10:57:59 AM PST

by

SamAdams76

(6,575,474 Truth | 87,429,044 Twitter)

To: Widget Jr

When something is advertised on conservative talk radio shows it is generally a scam. Gold IFAs, IRS debt forgiveness, etc. Has ANYONE ever heard an ad saying, “NOW is a great time to sell gold.”

10

posted on

02/11/2024 11:04:32 AM PST

by

Organic Panic

(Democrats. Memories as short as Joe Biden's eye)

To: Widget Jr

If you do not get physical control of a precious metal all you have is a piece of paper worth less than a Zimbabwe trillion dollar bill.

11

posted on

02/11/2024 11:11:25 AM PST

by

fella

("As it was before Noah so shall it be again," )

To: Widget Jr

“How not to be a victim of gold scams.”

Be under 50…

12

posted on

02/11/2024 11:13:38 AM PST

by

EEGator

To: SamAdams76

There is a Noble medal element much more rare than Gold that draws my attention. It is Rhenium (#75) . It was the last stable element to be discovered. Even though it is very dense like Gold its ability to maintain high tensile strength at high temperatures means that jet engine blades can be up to 25% Rhenium. I figure nobody is ever going to go broke betting on war.

13

posted on

02/11/2024 11:17:14 AM PST

by

Nateman

(If the Pedo Profit Mad Moe (pig pee upon him!) was not the Antichrist then he comes in second.)

To: Pollard; ComputerGuy

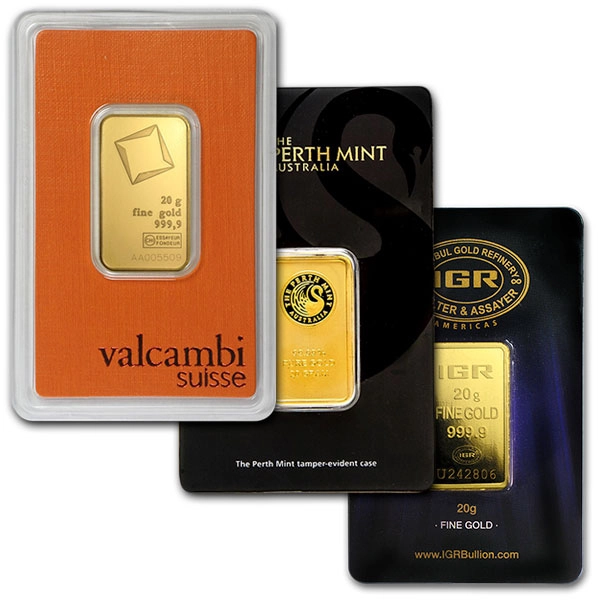

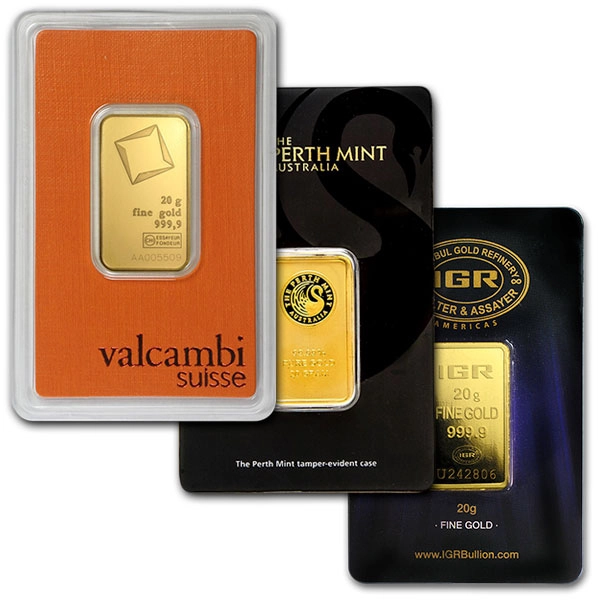

Assay packaged 1 gram and 20 gram ingots are the way to go in my opinion. -

There is a semblance of safety in paranoia.

The plastic assay packaging has anti-counterfieting features to it.

To: SamAdams76

Yep, and if you want the stuff, just buy the stuff - CEF if you don’t want to hold or pay to store

15

posted on

02/11/2024 11:20:29 AM PST

by

22for22

To: Widget Jr

GLD - Gold ETF - 20 Year ETF Price and Volume Chart...

16

posted on

02/11/2024 11:21:27 AM PST

by

zeestephen

(Trump "Lost" By 43,000 Votes - Spread Across Three States - GA, WI, AZ)

I look at my own investments, including gold and silver. My long term gold holdings have had a compound annual growth rate of 3.5% over a ten year run. Silver hasn’t kept up, with a .51% CAGR during the same period.

Gold is not going to make you rich. But it generally keeps up with inflation over time. Silver is crap.

17

posted on

02/11/2024 11:29:21 AM PST

by

Vermont Lt

(Don’t vote for anyone over 70 years old. Get rid of the geriatric politicians.)

To: zeestephen

Thanks for the chart. Going through pages, creating and editing images, and putting them online somewhere to post is something I don't have the time.

What the chart shows is what I linked about historic gold prices. Gold prices have been rising since 2004, there was a dip and recovery between 2012 to 2015, and the price and price variation have tapered off.

All of which shows Armstrong's forecasts about what would, was, and did happen were absurdly, obviously wrong.

Which is why he no longer refers to them while claiming he's predicted all major world events since the 1980s.

18

posted on

02/11/2024 11:33:47 AM PST

by

Widget Jr

(🇺🇸 Trump 2024 🇺🇸)

To: SamAdams76

You are correct sir. Again, people like the author, cherry pick dates, etc. to undergird their agenda. I bought a brand new, std. equipped Honda Civic in 1978 for $3800. Gold averaged roughly $200 an oz.that year. That car would have been equivalent to almost 19 oz. of gold. Today that would be equivalent to about $38,000. A basic Civic now is about $24,000. If I cherry picked that data, gold has far, far outpaced inflation. See how it works?

19

posted on

02/11/2024 11:34:11 AM PST

by

Right Brother

(Pray for God's intervention to stop UMCRevMom's invasion of Free Republic)

To: Widget Jr

Lookout when the Iraqi Dinar exchange flip hits!

(I know people who have held on to this hopium for way too long!)

20

posted on

02/11/2024 11:36:03 AM PST

by

Prov1322

(Enjoy my wife's incredible artwork at www.watercolorARTwork.com! (This space no longer for rent))

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-58 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson