Posted on 12/17/2019 10:41:54 AM PST by SeekAndFind

In my days before I worked for the Mises Institute, I had a colleague who knew I associated with Austrian-School economists. In the wake of the bailouts and quantitative easing that followed the 2008 financial crisis, he'd sometimes crack "where's all that inflation you Austrians keep talking about?"

But then, in the very same conversation, he'd remark with dismay on how much housing-price increases had outpaced household income in the region.

He didn't need an answer from me. He'd found some of "that inflation" all on his own.

These exchanges illustrated some of the blind spots we repeatedly find among economists and pundits who insist there is no inflation, or that there's even deflation. (In this article, I'm talking only about price inflation, and not money-supply inflation.) But whether or not one is experiencing an inflationary economy can vary widely on socio-economic status, location, life stage, and age. For those who need higher education services, housing, health care, and savings for retirement, the current inflationary economy could be problematic indeed.

This isn't to say that price inflation is increasing everywhere. Oil prices are down by nearly half since 2014, for instance, which means lower transportation costs for most of us. Apparel prices have been declining for decades.

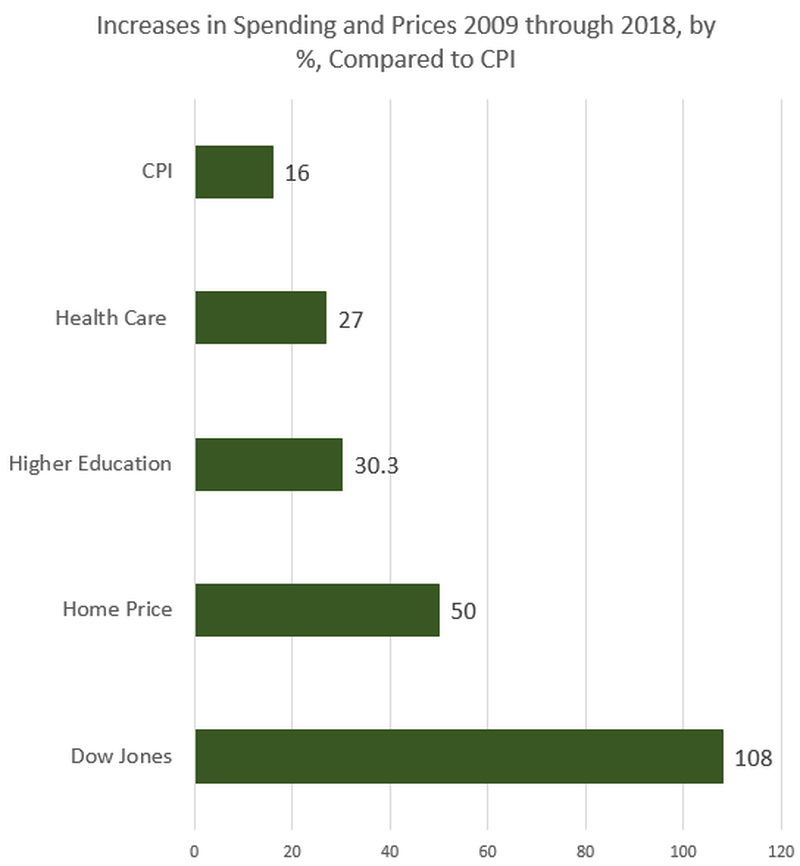

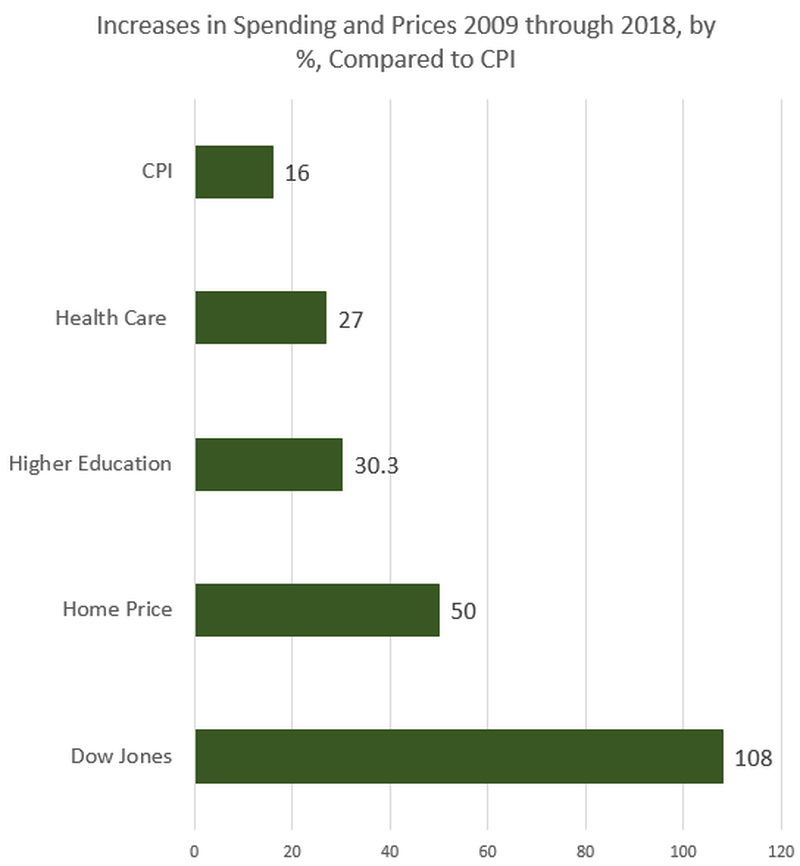

Nevertheless, the official measure of inflation — the CPI — does show an increase over the past decade. Over the ten years from 2009 to 2018, the CPI value rose 15 percent. It has risen fifty percent in the twenty years since 1999.

Yet, the CPI increase has been significantly outpaced by prices in a number of sectors.

For example, the price of higher education increased 30 percent over the past decade.1 At the same time, health care spending per capita increased 27 percent.

Even bigger increases are found in asset prices. According to Case-Shiller, for example, the 20-city housing index rose 50 percent from 2009 to 2018. During the same period, the Dow Jones rose 108 percent.

Just because price inflation is showing up more in some assets and services than in others doesn't mean it's not there.

Supporters of the status quo tend to defend housing-price increases on the grounds that rising housing prices are good for people who own those assets.This is true. Unfortunately, not everyone is a homeowner.

Those who wish to dismiss the possibility to significant price inflation might also claim the CPI is reflective of the real-world situation because not everyone buys a college education, and not everyone needs sizable medical services. That's true, and averages could be used in these cases to portray increases in spending in these areas are more muted than the experience of many individuals suggests.

But this ultimately just shows the problem with using broad aggregate numbers and averages to represent the cost of living.

In practice, increases in asset prices hurt first-time homebuyers, and low income households who have so far been unable to afford a downpayment and the elevated asset prices we're now seeing. Nor is everyone in the market to buy real estate soon. Or ever. Real estate price increases drive up rents as well, and this is a problem for both young consumers and low-income ones. Over the past decade in the metro Denver area the average rent increased 60 percent in contrast to the CPI increase of 16 percent. In Phoenix, the average rent increased seven percent from 2018 to 2019.

The CPI might tell us that inflation is "subdued," or "muted," there are plenty of people whose budgets are taking big hits anyway. Moreover, home prices are a big part of most households' monthly expenses. Combined with healthcare spending and higher education, the increases in the cost of living — reflected in price increases — we've seen over the past decade are hardly something we could describe as "deflationary."

Defenders of the there's-no-inflation position might claim "but these price increases are moderated by price declines in other places!" That may be true, but housing, healthcare, and education make up a pretty sizable portion of a family's expenses. We can't simply assume the CPI's basket of goods necessarily reflect the day-to-day economic realities that ordinary people face. For many people who don't fit the profile of the "average", generic, or aggregated American, the official numbers may not reflect reality at all. Indeed, it appears lower-income, younger, and more elderly consumers are the ones who suffer the most. For example, elderly retirees on fixed incomes can't just increase their incomes by working more to keep up with price increases. And young people with no assets will have a much harder time acquiring assets if prices are relentlessly speeding upward. Mid-career people with flexible incomes and with assets are one thing. Everyone else is more likely to encounter trouble.

Finally, it's important to keep in mind that what's routinely touted as "low inflation" isn't all that low.

For example, even though we're told we live in an age of exceptionally low inflation, the CPI measure shows the that a dollar's worth of goods and services twenty years ago requires about $1.50 today. Even over just the past decade, what one dollar once bought then requires $1.17 today.

The much-vaunted two-percent-inflation standard shows similar results. If central banks are able to nail the "low" two-percent-inflation level, we'd still end up with a dollar that loses nearly half its value in 20 years. In this scenario, a dollar would lose nearly one-fifth of its value in just a decade.

For regular people who can't count on a a four-percent return on their investments, and who rely on banks which pay around one percent, this means a lot of lost wealth in spite of these households' best efforts at saving.

Although central bankers insist a two-percent inflation rate offers "price stability" the reality is one of significant depreciation in wealth for those who are struggling to acquire assets and who may be facing medical problems, high rent, and and college bills.

This may account for some of the growing divide between higher-income investors and middle- to low-income Americans. They often can't take advantage of the higher-yield options enjoyed by those who already have high incomes and portfolios packed with assets.

As shown by Karen Petrou in recent research, many regular people have placed more of their wealth in real estate, but often real estate in less inflationary markets in middle America. The result has been a class of wealthier investors in expensive coastal cities who own a lot of stocks and own real estate in stylish markets. But there are also many Americans who have smaller portfolios and own real estate in markets that have seen far less appreciation. Inflation is by no means uniform nationwide and its more benign in some places — and in some socio-economic groups — than in others.

None of this shows up in the official aggregate data, but that results are real. Some benefit greatly from the asset price inflation. Others aren't benefittng nearly as much.

If my retirement portfolio is through the roof — I don’t complain about inflation.

“Just because price inflation is showing up more in some assets and services than in others doesn’t mean it’s not there.”

But that’s always the case, even in a recession prices of some things increase, for example gold or bonds or cash itself.

The lesson here is that if you want to MAINTAIN the value of your nest egg over long periods of time the best strategy is a diversified portfolio.

If you want to GROW it then you better be real good at predicting which assets will go up in value and which don’t.

If you want to SHRINK it keep it in a saving account or under the mattress.

The point is that the Fed is un-elected by anyone, and they are making de facto social policy.

Those who are hurt by such a policy have a right to be angry with the Fed and those who permit it to have such power.

And don't gamble it away...

I think one of the biggest areas of inflation the last 20 years has been taxes and fees. It’s one reason I got out of Seattle. My license fees for four cars is around $260 a year. It’s cheaper in some states but a LOT more in others.

A friend of mine used to always brag about his stock portfolio and how high it was going. This was in late 1999. Just before the dot-com bust...

Yeah, that’s pretty much always true. :)

Here’s a funny one, though: I was forced to liquidate (divorce related) my five figure 401k, taking the penalty hit - a month BEFORE the bust. :)

Supporters of the status quo tend to defend housing-price increases on the grounds that rising housing prices are good for people who own those assets.This is true.

But with those housing prices, most of us see our property taxes going up with them for no reason. I don’t demand anymore services than I did before. My community isn’t demanding anymore services that it did before. The cops and the firemen aren’t getting raises. The value of my home, according to the county assessor and appraiser went up $65,000 in one year. That is not possible, especially where I live. About 40 miles east of Atlanta. Taxes went up $900 with it. They needed my tax money and know they couldn’t raise the millage rate, so they just said everyone’s homes were worth that much more.

And I’m starting to see a bit of a slow down. The For Sale signs are staying in the ground a little longer than they were last year or the year before.

RE: don’t demand anymore services than I did before. My community isn’t demanding anymore services that it did before.

Doesn’t rising prices imply that DEMAND exceeds SUPPLY?

If there is more demand, doesn’t that also imply more people wanting to move in, increasing the population, thereby requiring more services?

California is making the rest of the country pay their taxes.

“You Democrat voters just go ahead and steal. The Democrat Party will make sure you never get punished.”

So the national chains have to raise everyone’s prices to cover their losses so that the Democrats can control California.

Great way to raise taxes and handout free shirt.

If you want it to SHRINK, vote Democrat.

Definitely, that would be the fastest way to shrink it.

Isn’t Central Banking using fractional reserve lending of a pure fiat currency great?? it only takes the banksters 20 years to Steal Half of the VALUE of your Dollars

There is no more demand. There isn’t an increase in population or in services.

One thing the county has done, actually two things, give away the ranch for two projects/developments, one of which the developer has dipped out on, after declaring bankruptcy. One in which the community and surrounding area does not need or have the people to support. But, as we all know, certain people are walking away with some pockets stuffed with cash.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.