Posted on 06/11/2022 4:00:14 PM PDT by blam

Inflation is not a new problem in the US; there has been a steady expansion of price inflation and a devaluation of the dollar ever since the Federal Reserve was officially made operational in 1916. This inflation is easily observed by comparing the prices of commodities and necessities from a few decades ago to today.

The median cost of a home in 1960 was around $11,900, which is the equivalent of $98,000 today. In the year 2000, the median home price rose to $170,000. Today, the average sale price for a home is over $400,000 dollars. Inflation apologists will argue that wages are keeping up with prices; this is simply not true and has not been true for a long time.

In today’s terms, a certain measure of home price increases involve artificial demand created by massive conglomerates like Blackstone buying up distressed properties. We can also place some blame on the huge migration of Americans out of blue states like New York and California during the pandemic lockdowns. However, prices were rising exponentially in many markets well before covid.

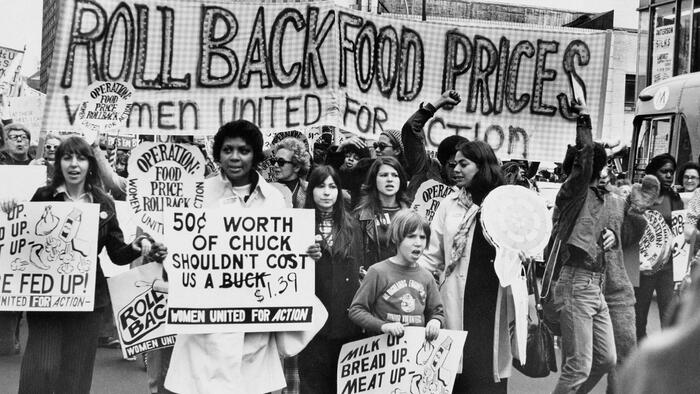

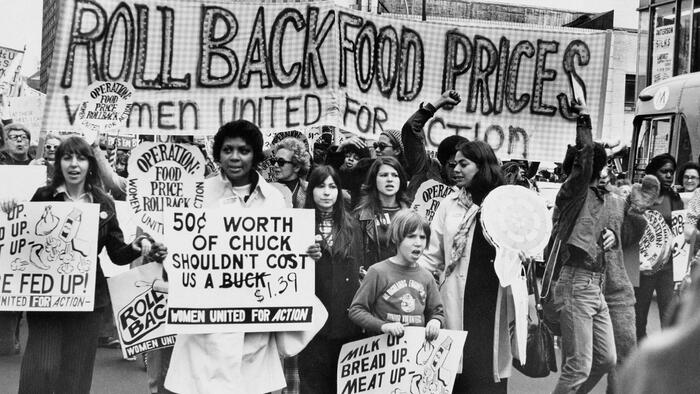

Americans have been dealing with higher prices and stagnant wages for some time now. This is often hidden or obscured by creative government accounting and the way inflation is communicated to the public through CPI numbers. This is especially true after the inflationary crisis of the late 1970s and early 1980s under the Carter Administration and Fed Chairman Paul Volcker.

It’s important to understand that CPI today is NOT an accurate reflection of true inflation overall, and this is because the methods used by the Fed and other institutions to calculate inflation changed after the 1970s event. Not surprisingly, CPI was adjusted to show a diminished inflation threat. If you can’t hide the price increases, you can at least lie about the gravity of those increases.

Today, the official CPI print from the Fed came in much hotter than expected at 8.6%. For market investors hoping for a lower print and more Fed stimulus, the dream is dead, or it should be treated as such. There is very little chance that the central bankers will reverse course in the midst of the largest inflationary crisis since the 1970s. What they aren’t telling you, though, is that REAL inflation is much worse that what the CPI shows us.

By the 1990s the Fed and the government had effectively upended the traditional calculation methods for inflation and, ever since, the CPI has been subdued. If we look at numbers from Shadowstats, which uses the same calculation methods that were used in the 1980s, we can see that CPI is actually closer to 17%. This makes much more sense given the dramatic increases in food and energy prices, as well as home and rent costs just in the past two years. The 1970’s crisis peaked at around 14.5%.

It’s also important to note that the crisis of the 1970s was the product of a decade long decline in the US economy. The real trigger event happened in 1971 when Richard Nixon fully removed the US dollar from the gold standard. It was not long after in 1973 that CPI rose to around 8%. By 1980 inflation was officially at 14%. Volcker and the Fed responded by dramatically increasing interest rates to a record high of 15.8% by 1981.

Recession hit hard and unemployment grew to 10%. High inflation followed by high interest rates also made manufacturing in the US difficult and likely helped to precipitate the exodus of factories from America to Asia.

The difference between the 1970’s crisis and today’s crisis is that we are facing far worse conditions. Our crisis started around 2008 after the credit bubble collapse, which facilitated an endless stream of bailouts and stimulus packages. The Federal Reserve has printed or created tens of trillions of dollars over the course of the past 14 years.

The official US national debt has tripled in that time. In 2020 alone, the Fed created over $6 trillion from thin air and injected it directly into the economy through covid relief checks and PPP loans. Unemployment is low, for now, but this is a fleeting condition created by covid stimulus. Joblessness will likely skyrocket over the next year now that covid checks are spent and the average consumer has maxed out their credit cards.

If the Fed takes the same actions as they did in the 1970s, then it is likely that interest rates will be aggressively hiked within the next couple of years to levels even beyond those seen in 1981. The current planned pace of rate increases by the Fed will do nothing to stall rising inflation, and they know this is a fact though they will not admit it to the public until it’s too late. Inflation will continue to climb well beyond current CPI. They will have to hike to the point of extreme economic pain, and this may still not stop rising prices.

Obviously, interest rates anywhere beyond 2%-3% will lead to a stock market crash, because stocks are highly dependent on corporate buybacks fueled by cheap loans. The central bank has yet to even begin true rate hikes and already we are seeing stocks decline in response to the mere prospect that the easy money train is over.

Recession is a commonly used word in the media for what we are facing, but this is a softball term that misrepresents reality. It’s more accurate to say that the party is over – The deflationary crisis we should have dealt with in 2008 will return with a vengeance, but this time we have the added inflationary pressures caused by years of fiat money printing. In other words, it’s a stagflationary disaster that needs to be taken far more seriously in the mainstream than it currently is.

Two things. Yes they need to raise rates NOW!

But more importantly the federal govt need to stop spending.

17% sounds about right, maybe even higher. I know Eggs are up 32% in one year.

I’m no economist, but I do believe the government spending orgy is a key cause.

What I DO know, is I can’t make 8%+ less this year than I did last year, let alone 12%.

Both options crush the economy. Not sure if one is worse. We are boxed into a corner. The only thing they seems to want to do is let inflation run until they kill demand which will lower prices. It’s going to take a long time and in the meantime, get ready for mass layoffs.

I remember $1.07/dozen eggs at Aldi when Trump was in the White House.

Ah, the good ole days....

As you can attest, I replied to one of your posts many weeks ago and estimated that the actual inflation rate was really about 16% not the phony 7% or 8% they were claiming at the time.

"Missed it by that much."

Yes. Unlike in 1979, when debt/GDP was around 30%, its now around 130%. Long term interest rates at 10% on Fed.gov $30 Trillion in debt (and that's assuming they balanced the budget immediately) would cost Fed.gov $3 TRILLION A YEAR.

Fed.gov currently collects about $3.7 trillion in taxes a year. So obviously, interest rates that high will simply not be allowed

Get used to high inflation. Its how America's socialists will whittle down that massive pile of debt, just like how they do it in Argentina, Bolivia, Brazil, etc....

XD XD

” kill demand”

What does that mean? Do I not eat out (actually don’t do that much), no vacation, no new car or just what?

Yes. I work in purchasing for a small manufacturing and distribution company. I have records on everything we have ever bought for the last 20 years. Before 2020 - I already estimated the rate of inflation was around 6% a year. Things over the last 18 months have been so spikey, I wouldn't even want to guess where inflation rate is now.

Drive through Pimmet Hills west of DC and look for original ~1960 type houses.

Not much of a price originally, and not much of a house either.

If north of the Potomac, Wheaton, Maryland awaits your viewing.

Interest rates need to be higher than Inflation.

Just ask Milton Friedman.

In 1980 I bought a newly built house with a mortgage of 13%. My neighbors had higher at 17%, all new houses.

yeah, the goal is to get everyone else to stop spending so prices will fall.

Any bets on when the Great Depression 2.0 starts?

Answer:

We cannot currently produce taxes at these levels.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.