Posted on 01/12/2022 11:50:14 AM PST by blam

Today, I heard two local, small town radio DJs going on about rate hikes coming down the pike, and I thought wow here we are again with rate-hike-hysteria.

Eight years ago I posted an article, Interest Rates Cannot Rise, Here’s Why In that article I depicted my model, forecasting that interest rates would not and could not rise.

Now remember 2014 was the peak messaging period by the Fed and Wall Street gearing up for “rate normalization”. So to go on record stating that rate normalization was impossible, was a risky move. In fact, a friend, who is a friend of Tom Campbell, who at the time was the Dean of Berkeley’s Haas Business School, described a conversation the two of them had about my theory. In that conversation Tom had me pegged as a “half-baked-monkey”. And fair enough, because at the time “rate normalization” had become a household phrase. It was simply, a given.

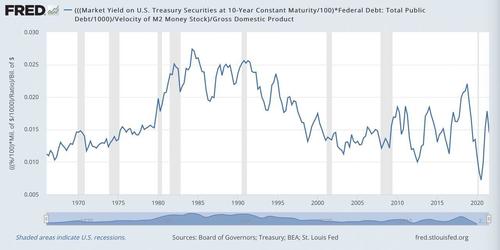

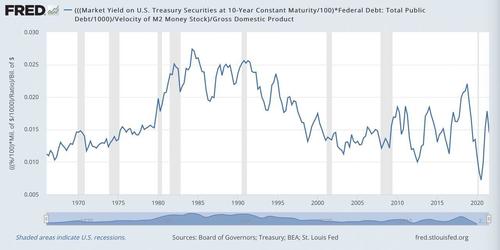

But the model I built was simple and took debt service as a percent of GDP over history and found a fairly tight range, (2%, 5%). Debt service is a drag on economic output and is a function of interest rates and debt. Given the deteriorating independent parameters of debt and GDP, the 10 year rate (proxy for average rate on public debt) was rigidly constrained, at least if history was a guide. Here’s the model.

The blue line above represents the predictive model and it predicted that the 10 year could not possibly break 4%. It is now 8 years on and we know that the 10 year peaked in 2018, at around 3.25%. History proved smarter than the experts.

Fast forward to today and here we go again. I figured it was time to dust off the model and give it another look. The one issue I always had with the model in its original form was that it wasn’t dynamic enough. That is, it didn’t adjust for the deteriorating economic productivity, which reduces capacity for economic drag (i.e. interest rates). It means the model lacked a key gauge for drag or interest rate capacity.

Think of it in terms of towing a trailer. Imagine two trucks both hauling 6,000 lbs (i.e. drag) at 60 mph (i.e. output). From the outside they look the same. However, from inside the cockpits we see that one truck is running at 2,000 RPMs and the other is running at 7,000 RPMs. That is, one has additional drag capacity, whereas the other is at full capacity and burning much more fuel. The drag on both trucks is the same (6,000 lbs) and the output is the same (60 mph) but the truck at 2,000 RPMs has additional drag capacity meaning it could take on more weight while maintaining 60 mph output (it would simply increase RPMs). The truck at 7,000 RPMs is at max RPMs and could not take on additional drag without reducing output i.e. speed. Its drivetrain simply does not have the productivity for additional drag without giving up output.

In our economy interest rates are drag and GDP is output and those were covered in my original model. But I needed to improve the model to adjust for drag capacity i.e. drivetrain productivity. Here’s where I landed.

Money velocity is, in effect, the productivity of the economic drivetrain. It is a gauge of how efficiently or productively each dollar is used to generate output. It’s similar to RPMs in the above metaphor albeit in the inverse. The higher the velocity, the more capacity for additional drag given a fixed level of output. And so I updated my model by inserting M2 Velocity. Here’s what we get.

I take the the 10 year rate as a proxy for average rate on public debt multiplied by total public debt to give us our debt service. That’s our drag. But this needs to be adjusted by a factor of productivity to give us an “adjusted debt service”, and to do that I use M2 Velocity. Now we have our adjusted debt service over GDP.

What we find is an even tighter historic range than we had in the original model. The updated model range is (.9%, 2.74%) of GDP. That is an extremely tight range over a 60 year period with underlying parameters that have significant variance over time. Now we can solve algebraically for a max 10-year rate given various inputs of debt, GDP, and velocity.

Ok so what does all this mean?

In a nutshell, the 10-year rate cannot break 2.5%.

At 2.5% our adjusted debt service to GDP moves to 2.74%, matching the all time high in 1985. At that time, the economy had a very high capacity for drag and managed 13% rates due to a very productive drivetrain (low public debt and high velocity). Today we have the drivetrain of an ’83 Yugo with no drag capacity at all. In fact, today, in real terms, our economy is being pushed by negative drag. Even small adjustments to that negative drag will have enormous impacts on output.

In short, the Fed has no tools to add drag without a catastrophic reduction in output. And so inflation is a freight train hurling down an endless abyss with no brakes. Sir Hayek, was right.

I'll take the 5th., lol. Honestly, I think the inflation is going on even in items flowing freely through the market.

I don't claim to have a real grip, but then neither do most of the so-called experts ...

Still, given what Joe’s doing (or should I say the puppeteer, Obama) I worry about persistent INFLATION right now.

That doesn’t make any sense. A mortgage lender lends money. It doesn’t buy an equity stake in an asset. When I borrowed money to start a business, was I supposed to share the profits with the bank?

Mortgage lenders could switch to the five-year adjustable rate mortgages which I believe are common in Britain.

In an adjustable rate mortgage environment, people won’t overpay say 50% for house simply to lock in a low interest rate.

A house worth $300,000 would sell for $300,000 instead of for $450,000 ($300,000 for the house + $150,000 for the Federal Reserve-backed, below market rate of the mortgage).

The FED could easily sell off 5-year ARMs for near the principal amounts. Its 3% 30-year fixed rate mortgages might only be merchantable at say a 25% discount.

“I have heard for 40 years the country is going into another depression and the stock market will collapse. Has not happened yet.”

I first heard the total-currency-collapse-only-gold-will-save-you story in 1965, 57 years ago. Adjusted for inflation, Gold made its last high in January, 1980.

That would explain why the mortgage on my recently purchased home was sold by my bank to Freddie Mac before I made a single payment on it.

The bank makes maybe 3% on its money overall and pays less than 1% for the use of my money.

Over time, most of the money lent by the bank will eventually be of its own capital.

“That doesn’t make any sense. A mortgage lender lends money. It doesn’t buy an equity stake in an asset. When I borrowed money to start a business, was I supposed to share the profits with the bank?”

You are correct. I’m a private mortgage lender. I am very happy when the properties I lend on go up in value, they are my only security for the mortgage! The last thing I want is flat or down values while I hold mortgages.

If I want equity, I buy real estate. If I want income secured by property, I loan on it.

I meant inflation. Typing on a phone can be hit or miss when you can’t read the damned screen.

“The bank makes maybe 3% on its money overall and pays less than 1% for the use of my money.

Over time, most of the money lent by the bank will eventually be of its own capital.”

I’ve been part owner of 2 banks and I have no idea what you are trying to say. Banks don’t have any money of their “own”, they have your money and they can lend many times the amount you keep on deposit. The first bank I bought into was started by 45 investors putting up a total of $3.5mm to get it off the ground. We got stock in the bank at $10 a share for whatever amount we put up. Minimum investment was $25k.

Those shares we bought for $10 sold when the bank got gobbled up by a larger band 7 years later. The shares sold for 55 dollars a share.

The latest Official RPI [Retail Prices Index] figure i.e. annual retail prices inflation, here in the UK is 7.1%

But no one in officialdom is shouting about it.

This strikes me as “Bill James” or “Moneyball” stuff. There’s definitely something to it, but there are plenty of dumb people who would ignore what the numbers are saying.

Mortgage rates have already risen.

“The latest Official RPI [Retail Prices Index] figure i.e. annual retail prices inflation, here in the UK is 7.1%”

Thanks, that’s interesting. Can you remember what it was when Covid first hit?

The difference is that Fedgov has pumped ungodly, record-breaking amounts of money into the economy. And much of it is in the hands of investors, from large companies to wealthy individuals. That money has to go somewhere. That may prevent real estate prices from declining much, if at all, in high-demand markets.

I just bought a house in Sarasota. We made offers on 6 houses before we nabbed one. Cash offers took the first 5. Interest rates aren’t as important to folks like that.

The house has likely appreciated 10% since late November when our offer was accepted.

The Fed is saying 3 hikes in 2022. Likely a quarter point each. 0.75% will barely dent this market in places like Sarasota. Prices won’t rise as fast, but they will continue to rise.

If the Fed can increase by 2% or so, and that flows down to fixed rate investments, then some of the money currently finding its way to real estate will be diverted elsewhere, a lot of non-cash buyers will be priced out, and real estate will cool.

But by the time the Fed gets there, in some markets, prices could rise another 20% or more.

“That doesn’t make any sense. A mortgage lender lends money. It doesn’t buy an equity stake in an asset. When I borrowed money to start a business, was I supposed to share the profits with the bank?”

There are reasons why financier J.P. Morgan was able to afford to buy a lot of art.

Mortgage rates change every morning and are good for the day. Mortgage rates are set by adding a markup to the current yield of the 10yr Treasury Bond.

The 10yr today is at 1.735%

Some years ago when I was more involved daily, the spread was about 1-4 to 1.5% + the 10yr yield. That would equate to about 3.2% for a 30yr mortgage. That spread may have changed but that’s probably still fairly close.

Read later.

“Banks don’t have any money of their ‘own’.”

It’s called ‘capital’ and long ago banks would make it a point tell you how much they had.

They now will make the information known quietly.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.