Posted on 01/12/2022 11:50:14 AM PST by blam

Today, I heard two local, small town radio DJs going on about rate hikes coming down the pike, and I thought wow here we are again with rate-hike-hysteria.

Eight years ago I posted an article, Interest Rates Cannot Rise, Here’s Why In that article I depicted my model, forecasting that interest rates would not and could not rise.

Now remember 2014 was the peak messaging period by the Fed and Wall Street gearing up for “rate normalization”. So to go on record stating that rate normalization was impossible, was a risky move. In fact, a friend, who is a friend of Tom Campbell, who at the time was the Dean of Berkeley’s Haas Business School, described a conversation the two of them had about my theory. In that conversation Tom had me pegged as a “half-baked-monkey”. And fair enough, because at the time “rate normalization” had become a household phrase. It was simply, a given.

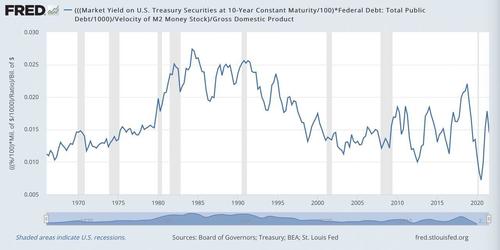

But the model I built was simple and took debt service as a percent of GDP over history and found a fairly tight range, (2%, 5%). Debt service is a drag on economic output and is a function of interest rates and debt. Given the deteriorating independent parameters of debt and GDP, the 10 year rate (proxy for average rate on public debt) was rigidly constrained, at least if history was a guide. Here’s the model.

The blue line above represents the predictive model and it predicted that the 10 year could not possibly break 4%. It is now 8 years on and we know that the 10 year peaked in 2018, at around 3.25%. History proved smarter than the experts.

Fast forward to today and here we go again. I figured it was time to dust off the model and give it another look. The one issue I always had with the model in its original form was that it wasn’t dynamic enough. That is, it didn’t adjust for the deteriorating economic productivity, which reduces capacity for economic drag (i.e. interest rates). It means the model lacked a key gauge for drag or interest rate capacity.

Think of it in terms of towing a trailer. Imagine two trucks both hauling 6,000 lbs (i.e. drag) at 60 mph (i.e. output). From the outside they look the same. However, from inside the cockpits we see that one truck is running at 2,000 RPMs and the other is running at 7,000 RPMs. That is, one has additional drag capacity, whereas the other is at full capacity and burning much more fuel. The drag on both trucks is the same (6,000 lbs) and the output is the same (60 mph) but the truck at 2,000 RPMs has additional drag capacity meaning it could take on more weight while maintaining 60 mph output (it would simply increase RPMs). The truck at 7,000 RPMs is at max RPMs and could not take on additional drag without reducing output i.e. speed. Its drivetrain simply does not have the productivity for additional drag without giving up output.

In our economy interest rates are drag and GDP is output and those were covered in my original model. But I needed to improve the model to adjust for drag capacity i.e. drivetrain productivity. Here’s where I landed.

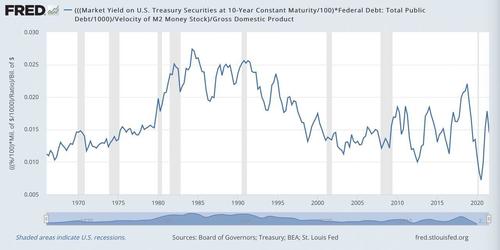

Money velocity is, in effect, the productivity of the economic drivetrain. It is a gauge of how efficiently or productively each dollar is used to generate output. It’s similar to RPMs in the above metaphor albeit in the inverse. The higher the velocity, the more capacity for additional drag given a fixed level of output. And so I updated my model by inserting M2 Velocity. Here’s what we get.

I take the the 10 year rate as a proxy for average rate on public debt multiplied by total public debt to give us our debt service. That’s our drag. But this needs to be adjusted by a factor of productivity to give us an “adjusted debt service”, and to do that I use M2 Velocity. Now we have our adjusted debt service over GDP.

What we find is an even tighter historic range than we had in the original model. The updated model range is (.9%, 2.74%) of GDP. That is an extremely tight range over a 60 year period with underlying parameters that have significant variance over time. Now we can solve algebraically for a max 10-year rate given various inputs of debt, GDP, and velocity.

Ok so what does all this mean?

In a nutshell, the 10-year rate cannot break 2.5%.

At 2.5% our adjusted debt service to GDP moves to 2.74%, matching the all time high in 1985. At that time, the economy had a very high capacity for drag and managed 13% rates due to a very productive drivetrain (low public debt and high velocity). Today we have the drivetrain of an ’83 Yugo with no drag capacity at all. In fact, today, in real terms, our economy is being pushed by negative drag. Even small adjustments to that negative drag will have enormous impacts on output.

In short, the Fed has no tools to add drag without a catastrophic reduction in output. And so inflation is a freight train hurling down an endless abyss with no brakes. Sir Hayek, was right.

Just to add: Consumer revolving debt is again at a huge spike. And people are quitting their jobs AND running out of stimulus money. When you throw that into the mix with the points in this article, it just may be that their “kicking the can down the road” really HAS hit the end of the road.

As I’ve said for well over a decade, every year is more “interesting” than the one before. This one is, as I predicted this time last year, going to be a doozey. And Next year even moreso. Honestly, it’s looking like the entire middle class is being forced into a life of indentured slavery. There is still a lot of talk about deflation followed by hyperinflation. I think that is probably what we’re gonna see. IMO, the most important thing a person should work toward is being debt free. Either that or charge your sox off, take all your money and put it into PM’s, and then bury it somewhere and file for bankruptcy, to get that clock started.

Low interest rates allow investors to borrow cheap money and invest in the market. The current place to hedge against inflation.

I'm not following. If it is already in their savings, it is available to be loaned out by the bank where it sits at low interest.

Bkmk.

Gold Under The Mattress vs Gold Investment

“If you can’t hold it in your hand, you don’t own it.”

That’s one of the most common refrains we hear from gold and silver investors. And while there is a kernel of truth in this saying, investing by these words alone could prove a costly mistake.

(I still agree with you)

When I was in college I was bored with economics.

Now that interest rates are higher than when I graduated from college (1982) I find it fascinating.

I am glad I am not just starting out in this world—back in ‘82 the national debt was much, much less of a drag on everything.

This stuff usually ends in a war or worse.

Here's a secret. The Dollar Index is going to strengthen as we go through this.

We're seeing deflationary price inflation - not inflationary price inflation.

The Fed cannot, and will not, increase the FFR.

A mortgage or corporate bond might have two interest rates.

A first interest rate would provide steady income - such as a 30-year fixed 2.88% payout rate.

A second interest rate would provide protection of the principal against inflation - such as an adjustable principal increase rate, which might be tied to property tax assessments or government spending or retail prices, or a calculated mixture.

A $300,000 2.88% payout purchase mortgage might pay $8,640 in interest its first year and have a principal balance of $312,000 at the start of month 13.

Monthly mortgage payments would remain affordable, but the mortgage would protect mortgage investors quite well against inflation.

Writer starts out with “10yr rate can’t rise”.

Then states later: “10yr rate can’t go above 2.5%”.

10yr rate today: 1.735%. 2.5 - 1.735% = .765%

Looks like according to his own claim the 10yr rate can go up .765%, which is a rise of 44% (1.735 to 2.5)

“A lot of folks are holding off retiring, or otherwise dealing with low income, fearing out-living their money”

A friend retired 2 years ago at age 57 with a fixed benefit defined pension plan. .$4800 month. He has a lot of money invested also-all in the stock market.

Told me a few days ago he may go back to work. Worried about the impact of inflation. In just 2 years he has seen how much less that 4800 pays.

Prime rates ranged from 17 to 11.5 in 82 per a table I found.

http://www.fedprimerate.com/wall_street_journal_prime_rate_history.htm

It is rather stupid to loan money to a house buyer at 3% and have the house buyer see a house price rise of 12% that is not shared with the lender.

Watch them.

This country is going communist.

It is best to spend down one’s assets.

We are headed down the same road. Interest rates will go to 21% if inflation and debt spending is not checked. The millinials of today are not the same mindset of my generation of the late 70s during Carter.

The biggest impediment to rising interest rates is the long-term DEFLATIONARY trend that is driven by demographics and the accompanying decline in output.

“I am glad I am not just starting out in this world—back in ‘82 the national debt was much, much less of a drag on everything”

I graduated in 1984. The gravy train years compared to today.My first job was a field rep for an insurance co and I got a brand new taurus every 6 months and they paid 100% of the car expenses including gas. My job was th schmooze agents in 2 states I was not a golfer and was not a good schmoozer so I always had expense count money left in my account each month.

My boss would tell me to use up the money each month by taking my gf out to dinner on the company charge card.

We truly lived the golden years.

It is rather stupid to loan money to a house buyer at 3% and have the house buyer see a house price rise of 12% that is not shared with the lender.

No it’s not, it’s good for the lender.

“This country is going communist. It is best to spend down one’s assets”

I have heard for 40 years the country is going into another depression and the stock market will collapse. Has not happened yet.

You can spend your golden years broke and living in section 8 govt housing..not me.

Yet there are many "all cash" buyers out there. They look for price.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.