Posted on 04/29/2024 6:00:10 AM PDT by Red Badger

The U.S. economy is showing signs of stagflation as growth slumps down and prices continue to surge for average Americans, experts told the Daily Caller News Foundation. U.S. annual economic growth measured just 1.6% in the first quarter of 2024, following a report of persistently high inflation in March of 3.5% year-over-year. The combination of both low growth and high inflation, in conjunction with continuously high amounts of government spending and debt, has led to signs of stagflation in the U.S. economy, which wreaked havoc on U.S. consumers throughout the 1970’s, according to experts who spoke to the DCNF.

“It’s not so much that we risk stagflation as we’re already there,” E.J. Antoni, a research fellow at the Heritage Foundation’s Grover M. Hermann Center for the Federal Budget, told the DCNF. “We have basically pulled forward trillions of dollars of economic growth by borrowing from the future, but that must be repaid at some point. And it is highly inefficient as well.”

Stagflation is a unique economic phenomenon that involves slow growth, high unemployment, and elevated inflation and is particularly difficult to address as solutions for one issue can exacerbate the others, according to Investopedia. The most notable example of stagflation occurred in the 1970’s, after an oil crisis.

The U.S. national debt climbed above $34 trillion for the first time at the start of 2024 and currently sits at nearly $34.6 trillion, according to the Treasury Department. The national debt has increased by around $6.8 billion since President Joe Biden first took office in January 2021.

“Stagflation is the inevitable result of Bidenomics,” Michael Faulkender, chief economist at the America First Policy Institute, told the DCNF. “When you massively increase spending, whether green subsidies or student loan forgiveness, while simultaneously reducing the ability of the economy to produce because of all the regulatory restrictions being imposed, you get reductions in growth with higher prices. If Bidenomics continues, then we should expect stagflation to continue.”

Biden has made high-spending policies part of his broader agenda, signing the $1.9 trillion American Rescue Plan in March 2021 and the $1.2 trillion Bipartisan Infrastructure Law in November 2021. The president also signed the Inflation Reduction Act in August 2022, which authorized $750 billion in new spending, with $370 billion of that dedicated to green initiatives to combat climate change.

The Biden administration’s latest plan to forgive student loans would cost an estimated $559 billion over the next ten years through various loan cancellations and interest suspensions. The president had one of his previous, more costly plans to forgive student loans struck down by the Supreme Court in June 2023.

Jai Kedia, a research fellow in the Center for Monetary and Financial Alternatives at the Cato Institute, cautioned the DCNF about assuming the U.S. was suffering from stagflation, noting that the phenomenon is usually accompanied by major supply shocks.

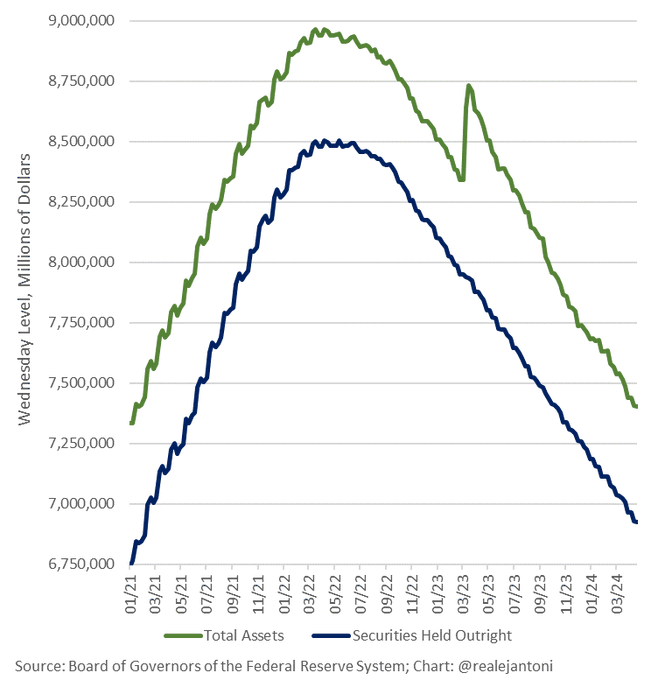

E.J. Antoni, Ph.D. @RealEJAntoni · Follow QT continues but there's a long way to go before we return to normalcy, and that likely won't happen w/ Powell & Co. chomping at the bit to cut rates and taper the balance sheet runoff - securities are only down 18.6% from their peak and total assets down just 17.4%:

“The news on both fronts — inflation and output — is far from ideal, but there is no reason to think that we will get stagflation from just this one report,” Kedia told the DCNF. “When stagflation last occurred in the 1970s and early 1980s, the U.S. economy had significantly different characteristics. That era was marked by severe wage inflation and strong wage contracting at unsustainably high levels, driven primarily by labor union bargaining. Businesses passed those labor costs on to consumers, and since those wage increases weren’t the result of any productivity gains, the result was inflation with little economic growth. That unique situation is (hopefully) unlikely to occur again.”

Despite recent low growth figures, gross domestic product surged in the third and fourth quarters of 2023 to 3.4% and 4.9%, respectively. Economic growth projections in those quarters included huge gains from government spending.

“Today’s report shows the American economy remains strong, with continued steady and stable growth,” the White House said in a statement following Thursday’s GDP report. “The economy has grown more since I took office than at this point in any presidential term in the last 25 years — including 3% growth over the last year — while unemployment has stayed below 4% for more than two years. But we have more work to do. Costs are too high for working families, and I am fighting to lower them.”

Top-line job growth has remained high as well, with the U.S. most recently adding a total of 303,000 nonfarm payroll positions in March with an unemployment rate of 3.9% after adding 275,000 in February. Despite persistent growth, gains have been dominated by part-time jobs and employment from the government.

“In general, high inflation and low output occur as a result of severe supply shocks,” Kedia told the DCNF. “The Fed does not have much control over such shocks, and it’s usually best to avoid making drastic monetary policy decisions on the basis of such shocks. It’s too early to tell if such a shock has occurred over the past month, so it is unclear whether output has gone down due to supply constraints, or whether the increased borrowing costs have finally cut down on people’s consumption, or whether this was a noisy data observation.”

In an effort to reduce the rate of inflation, the Federal Reserve has already raised its federal funds rate to a range of 5.25% and 5.50%, the highest in 23 years, with the last hike being in July 2023. At the Federal Open Market Committee’s (FOMC) most recent meeting in March, the majority of Fed governors kept their estimate from December that there would be three rate cuts by the end of 2024.

“There is absolutely no reason for the Fed to cut rates this year besides the obvious political motivation,” Antoni told the DCNF. “Recall that during the first three years of the Trump presidency, the Fed was raising rates and selling off the balance sheet, also called ‘quantitative tightening.’ The reasoning for tighter monetary policy was fast labor market growth and inflation fears. Today, those indicators look even worse according to the Fed’s own thinking: job growth has been much faster according to official government metrics, and inflation remains far in excess of the 2.0% target, with inflation expectations completely unanchored. They should be talking about raising rates, not cutting them.”

A majority of investors now predict that there won’t be a rate cut until the FOMC’s September meeting as inflation remains persistent, according to CME Group’s FedWatch Tool.

Business leaders are cautious about the current state of the economy, with JPMorgan Chase CEO Jamie Dimon saying on Friday that he is hopeful that the U.S. can bring down inflation and maintain growth, but he is worried about the possibility of stagflation, according to The Associated Press.

“Sadly, the indicators point to stagflation for quite some time because the excessive government spending that caused this problem isn’t letting up,” Antoni told the DCNF.

The White House deferred the DCNF to previous statements.

Jimmy Carters “Misery Index” is going to look not so bad.

ping

A couple of differences between now and the ‘70s. No oil embargo this time. We’re tying to sanction Russian oil but that’s not really working. And we’re having a lot of immigration. If it wasn’t for that, then yes, maybe stagflation.

Places like Detroit, Camden, Baltimore (the list is endless and growing) have been nightmare scenarios for decades.

“following a report of persistently high inflation in March of 3.5% year-over-year.”

The real rate is at least twice that.

L

Agreed. Connected the dots on the thread yesterday, regarding Trump’s senior advisor, Susie Wiles - a uniparty globalist plant.

Dear Lord, please share Your strength.

Tatt

When Trump becomes POTUS 47, he will fix the economy!

President Trump is no Herbert Hoover!

He is WAY smarter and WAY more clever than Hoover/!

Unlike Hoover Trump will never say “Prosperity is just around the corner” and he would not try Socialist pump priming like FDR did in 1933—things that really prolonged the Depression!

But, he did end prohibition! NRA sounded good, got people to work but was cast out by the courts as unconstitutional.

BFLR

We KNOW and they KNOW that with President Trump as POTUS 47, prosperity will be “. . . just around the corner.”

Hoover was in a “no-win” situation, just as Biden SHOULD be.

In a just world, Democrats would have already jettisoned Biden and Harris!

FDR provoked the Japanese and WW II ended the man-caused depression.

Is that 10 year?

From the article

5% on the 10 year treasury would be the breaking point for markets and the economy.

From the article

5% on the 10 year treasury would be the breaking point for markets and the economy.

Guilty. Sorry.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.