Skip to comments.

Did You Know? Europe now has a natural gas oversupply (if you include ships waiting to unload)

Hotair ^

| 10/24/2022

| John Sexton

Posted on 10/24/2022 8:18:16 PM PDT by SeekAndFind

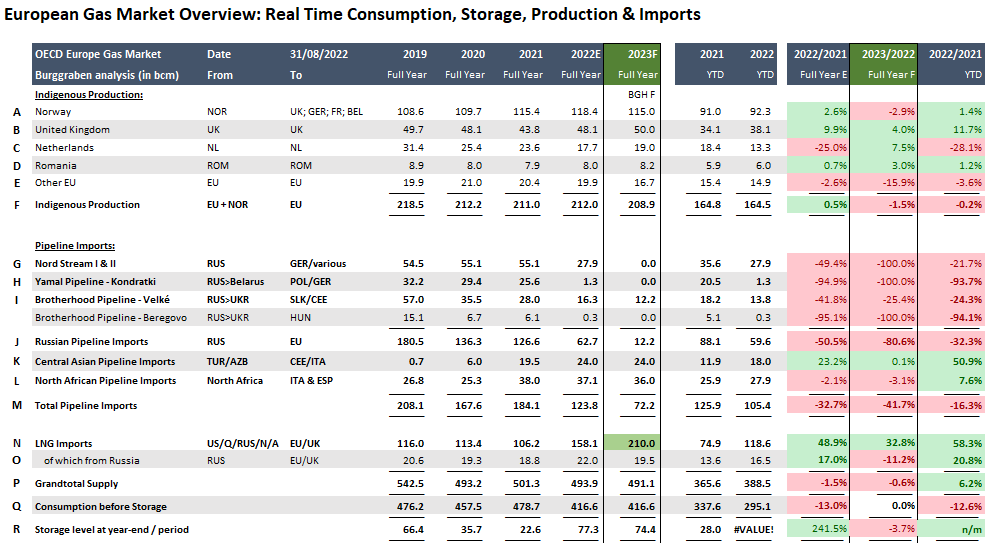

We all know how this has played out. This summer Russia started monkeying with the natural gas supply to Germany and the rest of Europe, claiming there was some technical problem that required maintenance. Then they cut the gas off completely and not long after that someone blew up the Nord Stream pipeline. The result of all this has been a huge spike in energy prices in Europe and concern that there might not be enough gas to heat homes this winter.

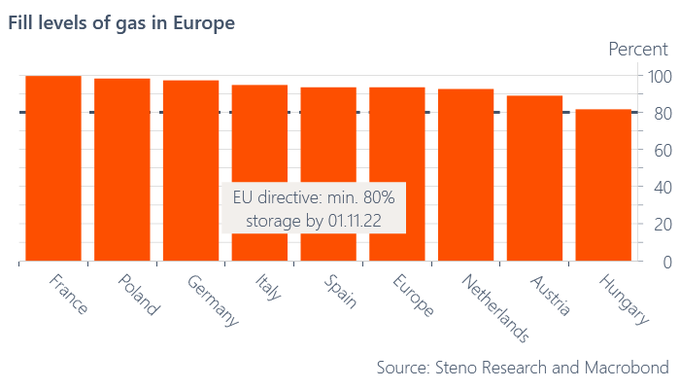

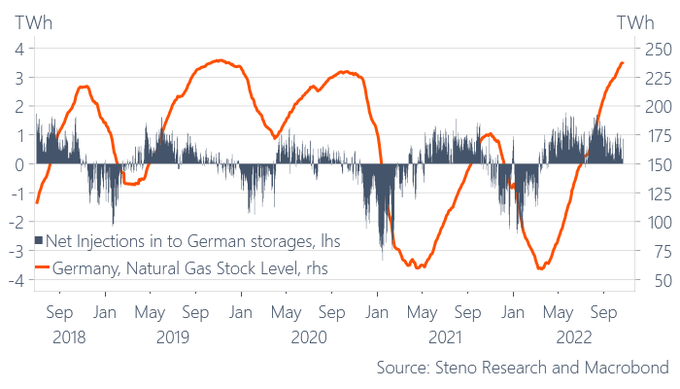

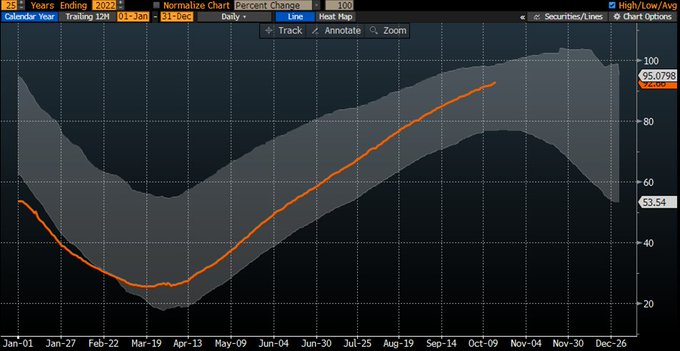

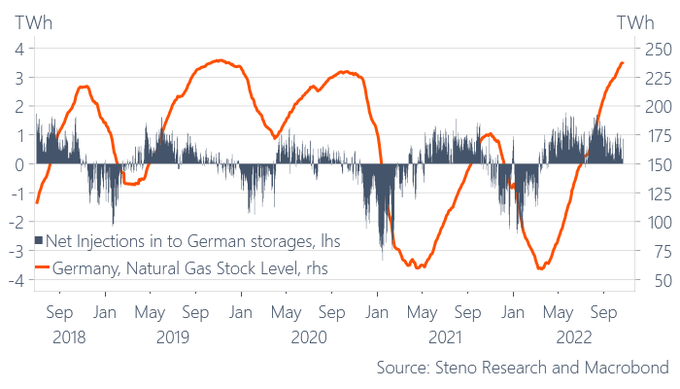

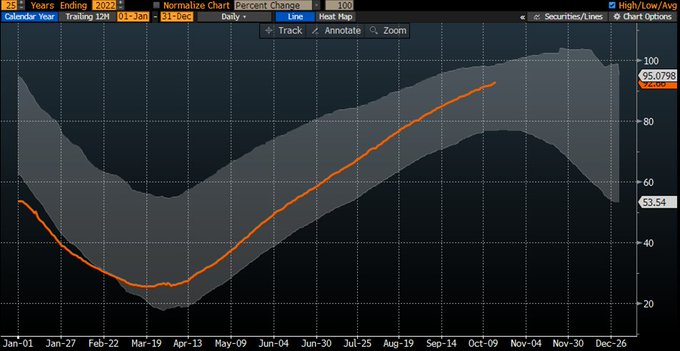

But here we are in late October and the situation is looking very different. For one thing, Europe has mostly filled the underground gas storage tanks for the winter. Collectively, the plan was to fill storage to 80% by November 1 but with a week left to go, European storage is 93.4% filled.

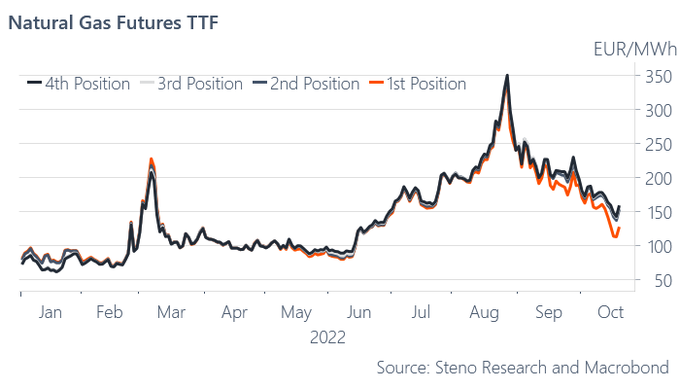

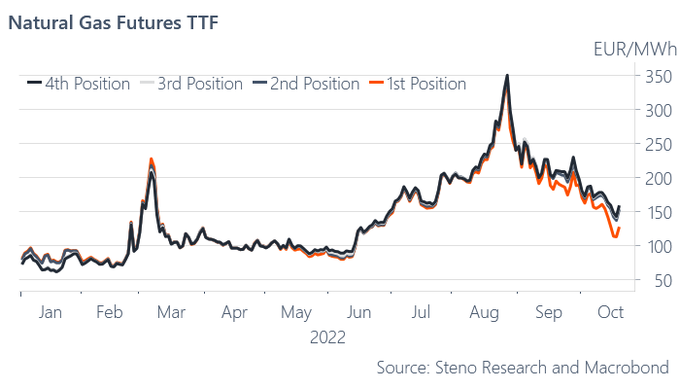

When Russia started playing with the gas supply, prices went way up but now the opposite is happening. Prices have dropped below $100 for the first time in months and there are lots of liquified natural gas tankers floating off the coasts of Europe waiting to unload.

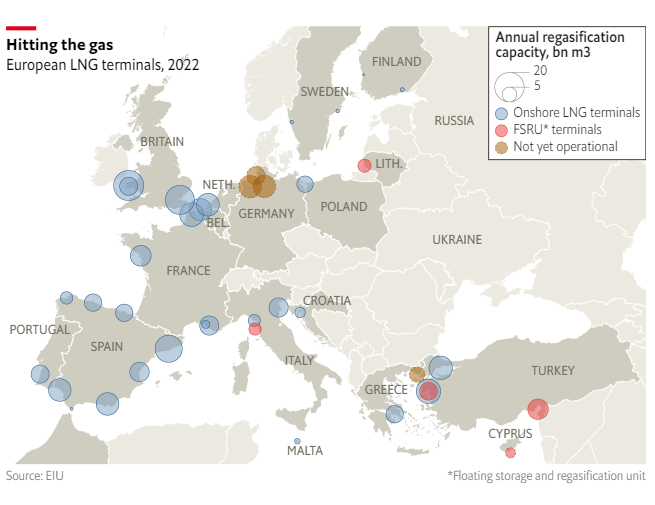

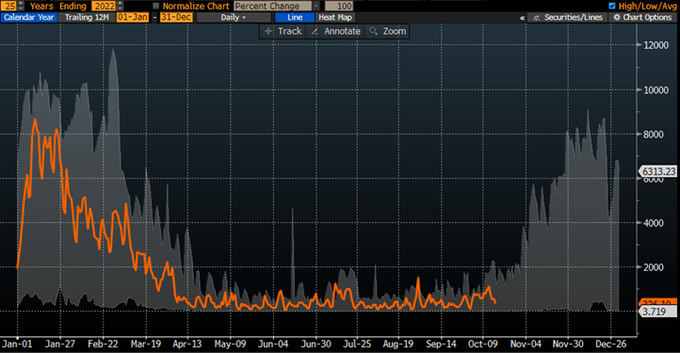

Sixty LNG tankers have been idling or slowly sailing around northwest Europe, the Mediterranean, and the Iberian Peninsula, according to MarineTraffic. One is anchored at the Suez Canal. Eight LNG vessels that came from the U.S. are underway to Spain’s Huelva port.

“The wave of LNG tankers has overwhelmed the ability of the European regasification facilities to unload the cargoes in a timely manner,” said Andrew Lipow, president of Lipow Oil Associates…

European gas prices had soared above 340 euros ($332.6) per megawatt hour in late August, but this week dipped below $100 for the first time since Russia cut supplies. Before the war, the price had been as low as 30 euros.

An investment analyst did a Twitter thread on this yesterday.

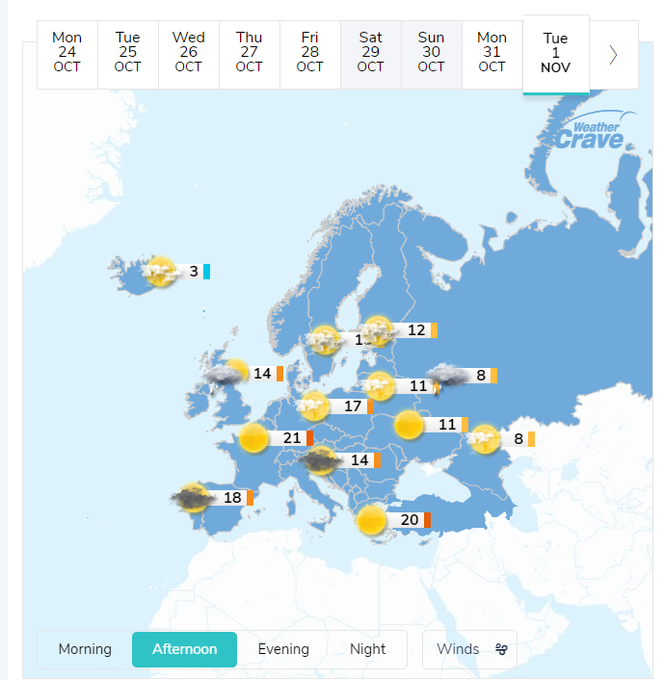

And there’s one more factor that is creating a short term over-supply. The temperature in Europe has been well-above average so far, meaning less gas is leaving those underground storage tanks than anticipated.

It has been an unseasonably warm October.

And the result of all of this is that prices should keep dropping.

But as good as this looks, the situation could turn very quickly. That’s because Europe’s gas storage needs continual resupply. So if the weather suddenly turns cold, the surplus could disappear in a matter of days or weeks. Unfortunately, there’s no telling what things will look like a month from now. Here’s the cautious view from a commodities analyst. Because natgas can only be consumed or stored. If storage is (95%) full & not consumed (mild weather), prices have to do the work to keep system balanced as comdties trade in present (d-s), unlike equities/bonds which discount future.

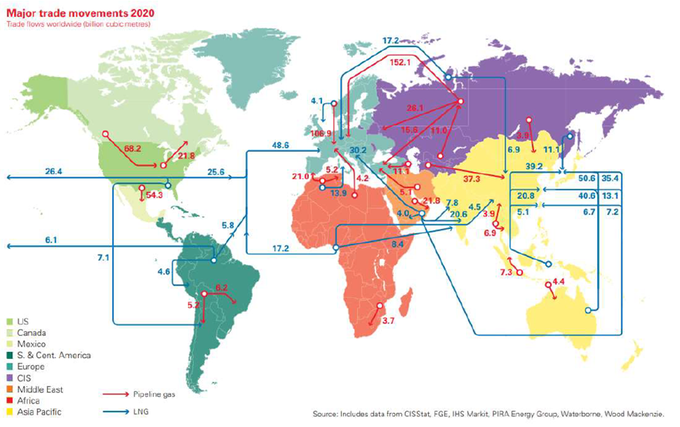

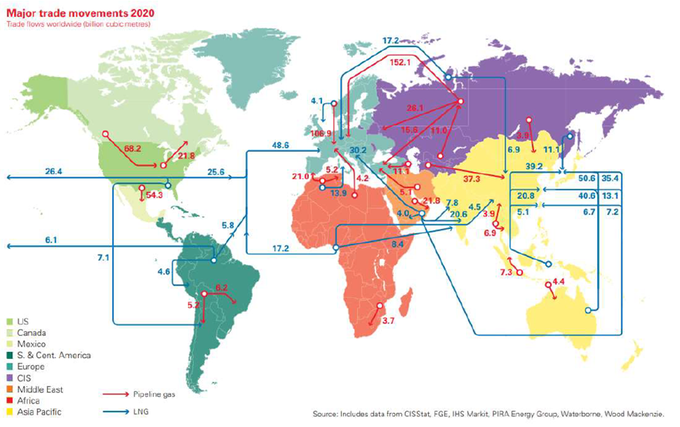

Here is a visual how to think about the global LNG market. In general: US, Qatar & Australia are the big 3 exporters while EU, China, Japan & South Korea are the big importers of the global LNG market.

Of course, Middle East (UAE; Oman) & Nigeria or Angola matter too.

In short, even if they get through this winter in good shape, they are still going to need even more gas next year and that won’t be easy or cheap to do.

TOPICS: Business/Economy; Foreign Affairs; Germany; News/Current Events; Russia; War on Terror

KEYWORDS: 0iqputintrolls; 0iqrussiantrolls; energyschadenfreude; europe; gaseousexcretions; germany; haha; hateamericafirst; hotgas; itisolaugh; itistolaugh; itsitolaugh; johnsexton; lng; naturalgas; nyuknyuknyuk; putinlovertrollsonfr; putinsbuttboys; putinsfrmistresses; putinswar; putinswarofchoice; putinworshippers; russia; russianstupidity; russiansuicide; sextonisaclown; supply; tdaw; ttdaw; vladtheimploder; waronterror; wemissallahpundit; zottherussiantrolls

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-62 next last

To: null and void; aragorn; EnigmaticAnomaly; kalee; Kale; AZ .44 MAG; Baynative; bgill; bitt; ...

Meanwhile the Northeast is gonna freeze....

2

posted on

10/24/2022 8:21:48 PM PDT

by

bitt

(<IMG SRC=' 'width=50%>)

To: bitt

Meanwhile the Northeast is gonna freeze....Probably not.

3

posted on

10/24/2022 8:23:31 PM PDT

by

Alter Kaker

(Gravitation is a theory, not a fact. It should be approached with an open mind...)

To: bitt

All I needed to see was “Alexander Stahel 🇺🇦” to know this is full of crap.

4

posted on

10/24/2022 8:23:56 PM PDT

by

MNDude

(Once you remove "they would never" from your vocabulary, it all begins to make sense)

To: bitt

Meanwhile the Northeast is gonna freeze.... Nope...NE relies on home heating oil, heat pumps, and wood stoves.

Midwest and Great Plains are in deep...

5

posted on

10/24/2022 8:25:55 PM PDT

by

lightman

(I am a binary Trinitarian. Deal with it!)

To: SeekAndFind

In the meantime natural gas prices here in the Midwest have soared through the roof and why? Because we’re supplying Europe and oh yeah 10% for the big guy. Once again American consumers get f***** in the ass.

6

posted on

10/24/2022 8:27:57 PM PDT

by

usconservative

(When The Ballot Box No Longer Counts, The Ammunition Box Does. (What's In Your Ammo Box?))

To: SeekAndFind

No problem then, right?

Calling BullShiite

7

posted on

10/24/2022 8:28:26 PM PDT

by

A strike

(LGBFJRoberts)

To: SeekAndFind

btw, those temperature are all in Celsius

20 deg C = 68 F

11 deg C = 52 F

so, mild winter & lots’o’gas = Europe will be fine

but the Russian shills here will be ticked off

To: Alter Kaker

9

posted on

10/24/2022 8:28:57 PM PDT

by

hardspunned

(former GOP globalist stooge)

To: SeekAndFind

Well then, that is all so super duper, maybe now the protest across Europe over energy prices, etc can now cease taking place, yes? /s

10

posted on

10/24/2022 8:29:16 PM PDT

by

cranked

To: SeekAndFind

In European countries we are going to have to wear a sweater at home and turn down the heating. Also no city wide Christmas lighting.

And build more nuclear power stations and retire the coal ones.

11

posted on

10/24/2022 8:29:38 PM PDT

by

Cronos

To: bitt

12

posted on

10/24/2022 8:29:40 PM PDT

by

lightman

(I am a binary Trinitarian. Deal with it!)

To: SeekAndFind

The demand in Asia of LNG for petrochemical feed stocks will keep the prices up.

13

posted on

10/24/2022 8:30:30 PM PDT

by

Deaf Smith

(When a Texan takes his chances, chances will be taken that's for sure.)

To: SeekAndFind

Canada, then Germany grabbed their compressor. Germany stopped all technical assistance with the lines. The EU, Brits and USA stole 650 billion in gold and cash on deposit in the west and killed the method used to pay for Russian gas. In Dec 2021 Germany refused to allow gas to ship in the brand new Nordstream 2. Then we and the Poles blew the lines.

The entire time Russia kept making deliveries through the Ukrainian line.

Russia is offering to repair the line and to immediately turn on Nordstream 2.

Somehow all the above is Russia “monkeying with the gas supply”. LoL

14

posted on

10/24/2022 8:34:35 PM PDT

by

DesertRhino

(Dogs are called man's best friend. Moslems hate dogs. Add it up..)

To: cranked

It's not even November, and already the FR Pollyannas are claiming "mild winter"...

15

posted on

10/24/2022 8:35:34 PM PDT

by

kiryandil

(China Joe and Paycheck Hunter - the Chink in America's defenses)

To: SeekAndFind

Wow! I’m convinced.

All the graphs, ya know. And stuff. Lots of stuff. I can’t be blamed for thinking it was the “Return of The COVID Killer Vaccine People”.😱

Run!!

16

posted on

10/24/2022 8:37:42 PM PDT

by

MotorCityBuck

( Keep the change, you filthy animal! )

To: kiryandil

Leave it to the FR propaganda peddlers, sheesh.

17

posted on

10/24/2022 8:37:55 PM PDT

by

cranked

To: canuck_conservative

18

posted on

10/24/2022 8:39:10 PM PDT

by

DesertRhino

(Dogs are called man's best friend. Moslems hate dogs. Add it up..)

To: DesertRhino

Russia unilaterally shut off all the gas on Aug. 31st, claiming flows won’t resume “until all the sanctions are lifted”

Russia is losing about $5-10 billion every week from lost gas sales to Europe

it’s been almost 8 weeks already ...

To: kiryandil

The Farmers Almanac predicts the opposite.

20

posted on

10/24/2022 8:41:38 PM PDT

by

DesertRhino

(Dogs are called man's best friend. Moslems hate dogs. Add it up..)

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-62 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson