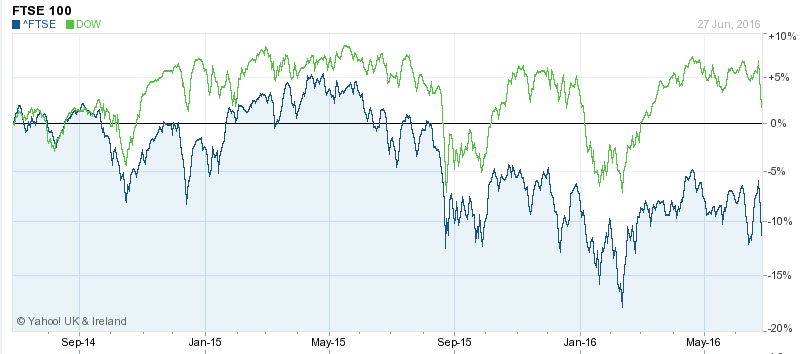

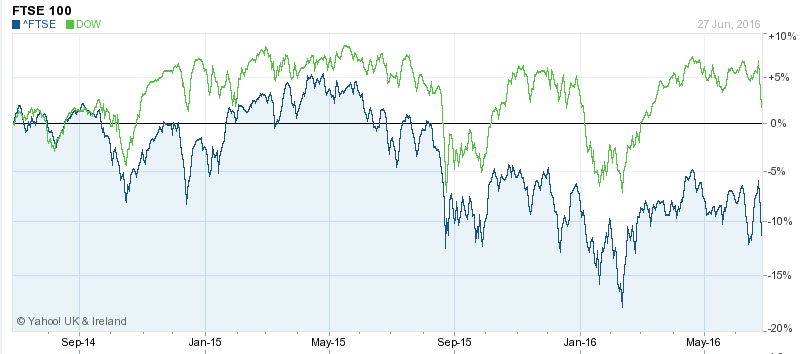

Not sure how good that is--

--but the latest from ukyahoo has it right back down again.

Posted on 06/28/2016 4:27:45 AM PDT by expat_panama

How long will the Brexit meltdown continue? How far will the market fall?

It's impossible to say for sure, of course. But if history is any guide, then you should expect about a month of market weakness and nearly an 11% decline before the next upturn.

WPERS_01_062716This could help guide any post-Brexit investment moves you're weighing.

Friday's 3.6% tumble in the market -- measured by the S&P 500 -- jibed closely with the 3.5% average first-day market decline sparked by all sorts of shocking stock market news since World War II. That includes bombings and assassinations, according to a Monday morning report by Sam Stovall, U.S. equity strategist for S&P Global Market Intelligence.

How much worse will things get? The S&P 500 lost 1.8% Monday. Historically, the market fell a total of 10.3% on average during the first 32 days after a notably jarring event. Capture short term gains with SwingTrader! Try us free for 14 days.

On average, it took the market 113 days after the 32-day downturn to rally back to its initial pre-shock level. Many experts caution mutual fund investors against going to cash precisely because it is impossible to know for sure when the next rally will begin.

Meanwhile, how badly was Wall Street walloped on Friday's compared to other first-day market meltdowns since World War II? Of the 20 postwar events analyzed by Stovall, Friday's 3.6% Brexit breakdown ranked number seven.

Its first-day market impact was smaller than the next deepest dive, which was a 4.4% decline after the Japanese attack on Pearl Harbor that drew the U.S. into World War II.

The worst single-day decline was the 20.5% plunge that marked the Crash of 1987 on Oct. 19 of that year.

(Excerpt) Read more at investors.com ...

Reminds me of that JPMorgan quote during a crash when some kid asked "what will stock prices do next Mr. Morgan???". He said "They will fluctuate, they will fluctuate..."

The FTSE is already back to the “norm” it held throughout most of MAY

Idiot bankers got hit the hardest as many of them bet the farm Brexit would “Remain”

https://www.google.com/search?q=ftse+chart&ie=utf-8&oe=utf-8

maybe the S & P was more poised for a correction?

https://www.google.com/search?q=s%26p+chart

I’m sure somewhere there are folks buying and making money, but I’m not one of them; I don’t seem to work well w/ unstable markets. Just the same the tickers you mentioned yesterday all looked good, some (iirc) were even on my IBD ‘buying range’ list.

Meh. Diversity is your friend...but only where money is concerned. ;)

Not sure how good that is--

--but the latest from ukyahoo has it right back down again.

Opening bell, stocks are soaring up from yesterday’s excruciating depths and are now reaching up to just awful.

LOL!

I’m not worried. This will be a BLIP compared with 2008 - unless Government decides to ‘fix’ things for us.

*ROLLEYES*

P.S. I got an offer on my little farm! Another asset nearly liquidated. Go, ME! :)

GREAT! Let's celebrate with SAMMICHES that you make me!

Now the elites will have a place to lay blame. If the market crashes in the next 6 months they will blame it on Brexit and still be talking about it in a century. “All right you unwashed, remember what happened because of Brexit, now get in line”.

The media meme-building about Brexit is just spin, talking points, whatever. The coverage is all about the narrative -- and the narrative is, unfettered immigration without naturalization is good, reasserting sovereignty is racist/nativist/bad. The '87 crash is, quite appropriately, the worst on that list, and yet the senile Alan Greenspan just equated that with Brexit.

Looks like after 2 days the market is stabilizing after a Correction that was coming irregardless of BREXIT!

even so, word is the nutrition and safety are still good. What’s taste if your hungry?

Wall Street moves higher after Brexit-induced selloff

BY YASHASWINI SWAMYNATHAN, REUTERS - 13 MINUTES AGO

TOP NEWS

Email Facebook. Twitter. LinkedIn. Google Plus

(Reuters) - Wall Street was higher on Tuesday as investors rushed to pick up stocks after Britain’s decision to leave the European Union sparked a massive two-day selloff in global markets.

Banks, which were the worst hit since the referendum on Thursday, were among the most attractive stocks for bargain hunters. The S&P financial index rose 1.37 percent.

Morgan Stanley , Bank of America , Citigroup and JPMorgan were all up more than 2.5 percent while Goldman Sachs rose 1 percent.

I bought more of our favorite mutual funds in our IRAS, Monday at the close of the markets.

The market has become an extension of totalitarian globalist propaganda. Only real people get hurt when they are taken for these rides.

Everything is up today.

DJIA 17,272.65 +132.41 +0.77%

NASDAQ 4,657.34 +62.89 +1.37%

S&P 500 2,019.89 +19.35 +0.97%

Oil 47.35 +1.02 +2.20%

Yep - they used scare tactics then capitalized on the “crisis”. Howls of gloom and doom when what happened may have been “brisker” than some previous “slumps” after passing 18,000, but falls right into the parameters we’ve been watching as it moves up to 18K or a little over then drops back to around 17K before turning around again.<p.They have found their “safe” borders to milk value out until the Fed mans up and does what needs to be done to actually get us on a sane track again.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.