Posted on 01/16/2016 10:19:48 AM PST by SkyPilot

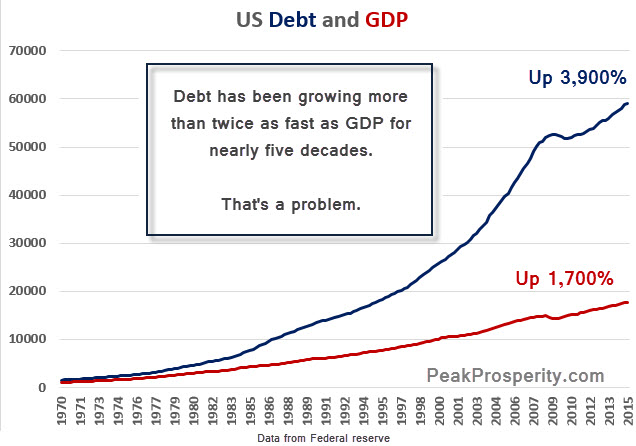

As we’ve been warning for quite a while (too long for my taste): the world’s grand experiment with debt has come to an end. And it’s now unraveling.

Just in the two weeks since the start of 2016, the US equity markets are down almost 10%. Their worst start to the year in history. Many other markets across the world are suffering worse.

If you watched stock prices today, you likely had flashbacks to the financial crisis of 2008. At one point the Dow was down over 500 points, the S&P cracked below key support at 1,900, and the price of oil dropped below $30/barrel. Scared investors are wondering: What the heck is happening? Many are also fearfully asking: Are we re-entering another crisis?

Sadly, we think so. While there may be a market rescue that provide some relief in the near term, looking at the next few years, we will experience this as a time of unprecedented financial market turmoil, political upheaval and social unrest. The losses will be staggering. Markets are going to crash, wealth will be transferred from the unwary to the well-connected, and life for most people will get harder as measured against the recent past.

It’s nothing personal; it’s just math. This is simply the way things go when a prolonged series of very bad decisions have been made. Not by you or me, mind you. Most of the bad decisions that will haunt our future were made by the Federal Reserve in its ridiculous attempts to sustain the unsustainable.

(Excerpt) Read more at zerohedge.com ...

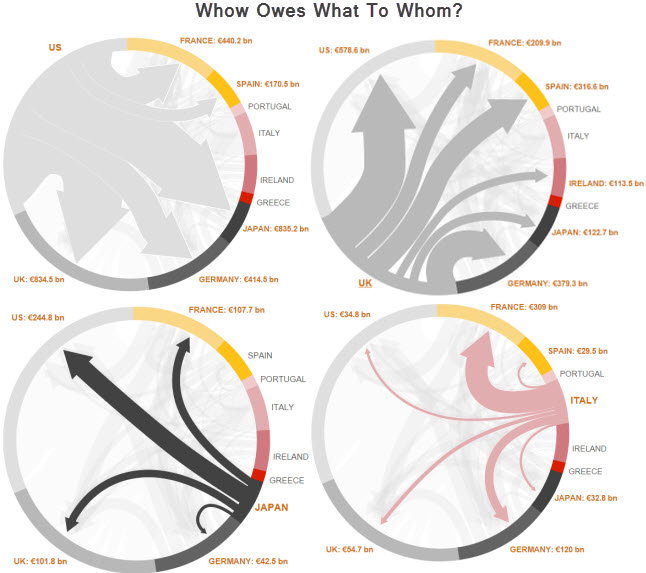

There’s a finite amount of wealth in the world. How can everyone collapse???

He's already here.

Oh this post is wrong.

What is about to happen, is that production will return to America from China and other countries. Because Donald Trump is going to win.

Nothing less, nothing more.

I’ve often wondered that. Economics is something I just don’t get.

I picture six people in a room, and one borrows money from another, who then borrows money from the third guy, and so and so on. And when the borrowing stops, there is no money in the room.

Makes no sense to me. The money doesn’t go anywhere. It just changes hands. And yet we seem to live in a world in which every country on the planet is broke and in debt.

How?

...is upon us.

Things will ever so slowly grind to a halt. And it won't matter who our next president is - they will only have a box of bandaids for a sucking chest wound.

For you procrastinators, start prepping NOW.

("Even so Lord Jesus, come quickly")

Earlier today in response to a similar post I wrote the following. Debt, manipulation of the economy in stupid ways and demographics are all coming together at once to create deflation. There is just too much stuff out there and not enough being done with it. We have a world of surplus / excess from machinery to houses. People want less, need less and can afford less from the looks of things. For example, my son will inherit three FULL houses of stuff he doesn’t need. He has a smaller house and no kids and won’t have any kids. A lot of it is really good stuff from great machine tools from two workshops to hand crafted solid hard wood furniture. He just does not need it so it is surplus. That means that something else will not be built.

It has looked to me for several years that the old long term market is not what it used to be. Higher frequency and higher amplitude disruptions in a system usually mean a major change from a previous pattern is coming. The boomer era of consumption is about over. Add to that smaller fewer houses, cars and devices result in less materials consumed.

It took from 3/2/09 until 1/1/13 for the DOW to return to the pre-recession level of 10/1/07 at about 13900. That was an agonizing 3 years and nine months. One of the longest recoveries in history.

From 1/1/07 until now the Dow has grown a “whopping†2.75% and had two big “corrections†since the recovery began.

Let’s look at some other periods:

-40.4% The GREAT “recession†10/1/07 to 3/2/09

-14.3% I think the chickens have come home to roost 3/2/15 to 1/15/16

-.8% Carter years 1/1/77 to 1/1/81

10.81% Reagan and Bush I years 1/1/81 to 1/1/93

15.75% Clinton years 1/1/93 to 1/1/01 after the “peace dividend†and the dot com boom. Even clintoon had enough sense not to screw up the economy

-2.19% Bush II years after 9/11 that took at least four years to recover from 1/1/01 to 1/1/09 9/11 was a much bigger event that many remember. The war that followed was a huge expense and the defense industrial complex made out like bandits.

9.82% Obongo years 1/1/09 to 1/1/16 when more than 4 trillion dollars have been printed and pumped into the markets with interest rates less than 2%. The economy has been pilloried in every way possible to create a massive atmosphere of FEAR, UNCERTAINTY, DOUBT and CONFUSION. Just like the obongo plan called for to fundamentally change America.

In the years since 1979 until 12/31/15 the DOW increased at a more traditional 8.5%

In periods starting 1/1/79 and ending 10, 20, 30 and 37 years later the rates of return were:

RoR For period from 1/1/79 and ending on date:

10.28% 1/1/89

12.93% 1/1/99

8.39% 1/1/09

8.37% 1/1/16

It looks to me like the nation has been running out of steam and is like an old car that can’t be fixed and obongo has run it without oil to finish it off.

20 years of war since the Bush years has not helped one bit either.

You can check your own periods of interest if you want to:

https://www.measuringworth.com/DJIA_SP_NASDAQ/#

I got out of college in the mid-70s and have invested for retirement ever since. I was probably one of only a few 22 year olds that asked for the retirement trust financial reports at Exxon when I started. In the last 40 years I have never seen such a long and miserable time in this country as the last 10 to 15 and surely the last 7 has been the worst of that time for outright general depression of the people.

In the last 40 years the oil industry has had busts and some massive layoffs in 1979 that few remember, 1982, 1986 through at least 1994 and it may not have ended because another came in 1998, 2001 and 2008 and again now in 2015. It has not been a steady life at all.

It could simply be demographics and the aging of the nation but I don’t think that is the real cause our economy and the mood of the nation is now so bad.

One guy is the Fed and has a stash of cash over in the bedroom.

A lot of wealth exists on paper only,not in tangible goods.

That’s a great question. I see how the legality of loans and treaties could make balancing transfers difficult between countries, but that’s usually a temporary thing. Explains depressions and why they eventually end.

Because a lot of that "wealth" consists of money that somebody or something owes to somebody else.I don't know what the ratio of real money to debt masquerading as money is, but it's surely less than one.

That being true (not enough real money to pay the debts, perhaps not enough real money to even service the debts), the collapse is a certainty.

You loan to me,

We'll live in prosperity...

Sounds like a Barney Song.

'little people' can't kite paper...

But that’s not wealth per se. It’s merely a promissory, one that needs reconciled when the music stops.

What are the real market costs of goods and the value of money? Remember deflation is the opposite of inflation.

The Country will only become healthy again when raw materials/unfinished parts are transformed into useable products by labor in this country.

Yes but all they have to do is print more money and buy more stocks with it and they will force the prices back up again. Limited supply of stock shares versus infinite potential supply of dineros

Then there is all of that derivative smoke and mirrors...

There are only three kinds of true wealth and they are mined, grown and manufactured. Infrastructure is wealth also, buildings bridges etc. Everything else is service of that wealth and does not create wealth but are wealth enhancers. So if an economy slows or even stops completely the eventually then food gets eaten, manufactured goods get consumed and thrown away and oil/gas/ore is used up. Leaving a crumbling infrastructure as the only wealth left. So wealth can disappear.

u get it.

"You're a great old car but you can't climb hills worth a damn."

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.