Posted on 01/16/2016 10:19:48 AM PST by SkyPilot

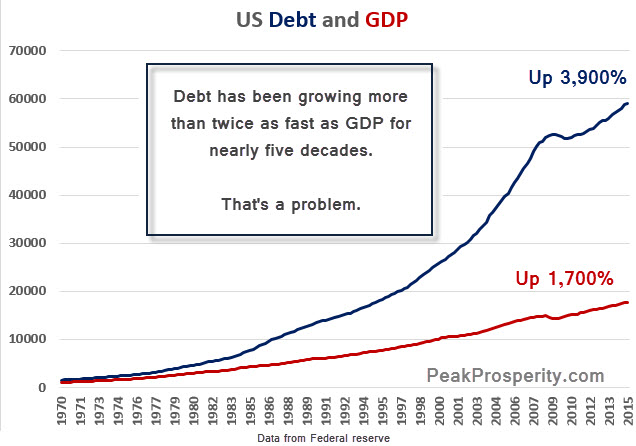

As we’ve been warning for quite a while (too long for my taste): the world’s grand experiment with debt has come to an end. And it’s now unraveling.

Just in the two weeks since the start of 2016, the US equity markets are down almost 10%. Their worst start to the year in history. Many other markets across the world are suffering worse.

If you watched stock prices today, you likely had flashbacks to the financial crisis of 2008. At one point the Dow was down over 500 points, the S&P cracked below key support at 1,900, and the price of oil dropped below $30/barrel. Scared investors are wondering: What the heck is happening? Many are also fearfully asking: Are we re-entering another crisis?

Sadly, we think so. While there may be a market rescue that provide some relief in the near term, looking at the next few years, we will experience this as a time of unprecedented financial market turmoil, political upheaval and social unrest. The losses will be staggering. Markets are going to crash, wealth will be transferred from the unwary to the well-connected, and life for most people will get harder as measured against the recent past.

It’s nothing personal; it’s just math. This is simply the way things go when a prolonged series of very bad decisions have been made. Not by you or me, mind you. Most of the bad decisions that will haunt our future were made by the Federal Reserve in its ridiculous attempts to sustain the unsustainable.

(Excerpt) Read more at zerohedge.com ...

I do get what you’re saying, but isn’t that really a transfer of fixed wealth, not the destruction thereof? If the wealth isn’t backed, it means somebody loses, but the fixed wealth remains only to be acquired by its creditors. No?

Yep. It has been one heck of a ride.

...Makes no sense to me. The money doesn’t go anywhere. It just changes hands. ...

What is happening is that governments expand the money supply by issuing bonds, or just plain printing more money. The result is you actually expand the amount of money in circulation, while at the same time devaluing its worth. The expected results are that the economy will expand with the added liquidity and you will be able to retire the additional debt (bonds) with the added taxes from the expanded economy.

The problem that emerges is if you expand the money supply faster than the economy grows, you run into the problems of inflation, or if the economy, does not react to the added stimulous, is deflation, which is the big concern now.

Jeremiah 17:5.

Any of you guys bought groceries lately?

Nearly everything I buy (food and over-the-counter medicine, etc.) regularly has gone up 10-100% in the last year.

Because the first guy to loan you money printed it and promised it was worth something. That is why the globullists are hell bent on a one world system, it will necessitate the destruction of old currencies and start the cycle of deception anew.

Stop eating. You are food addict.

We are in a stock market correction.

Stocks are being re-priced closer in general to their true value.

Stocks are supposed to be merely a means of buying future income. Stocks are not race horses, sports teams or beautiful paintings. In valuing stocks, unemotional reasoning should be applied.

Oil is in a temporary decline due to Saudi population pressures and the desire of US producers to meet agreed upon debt repayments.

Oil can not be produced in the US in the long term at the prices now being obtained , so it won’t be. Government need o nothing. However, it could buy domestic oil wells cheaply.

As for deflation, doctors and dentists aren’t lowering their prices and they won’t be. Plumbers and other repairmen won’t be charging less in my town.

Do you think health insurance will be getting cheaper? Only if your name is Barack.

If house prices fall by twenty percent in my town, houses will still be overpriced.

And if the $20,000 that I have in bank CDs buys more when the CDs mature, I won’t complain if I should be so lucky.

History shows markets always correct themselves. We knew it was coming, just when, how bad, and how long will it last is always unpredictable.

Considering corrections are enevitable, better now than in a year or two simply because it will happen on obamas watch.

I see recovery about the time Trump or Cruz is sworn in, and whatever they do can only make it better.

True.

If I would just stop eating, completely, all of my other problems would just fade away.

The way my professor explained it to my the true value of a stock is a moving target but it can be roughly calculated as the total assets of a corporation minus it's liabilities divided by the total number of outstanding shares. If you pay more than that price you speculating on future earnings which isn't bad , just realize what you are doing.

Fixed wealth has become a very difficult concept to define with the advent of electronic debt booked as assets.

To me, "fixed wealth" implies something you possess which cannot be simultaneously possessed by another (I have this double eagle, therefore you don't have it) AND which cannot be taken from you other than by force.

Not sure how much fixed wealth there is, but it's a lot less than most people seem to believe.

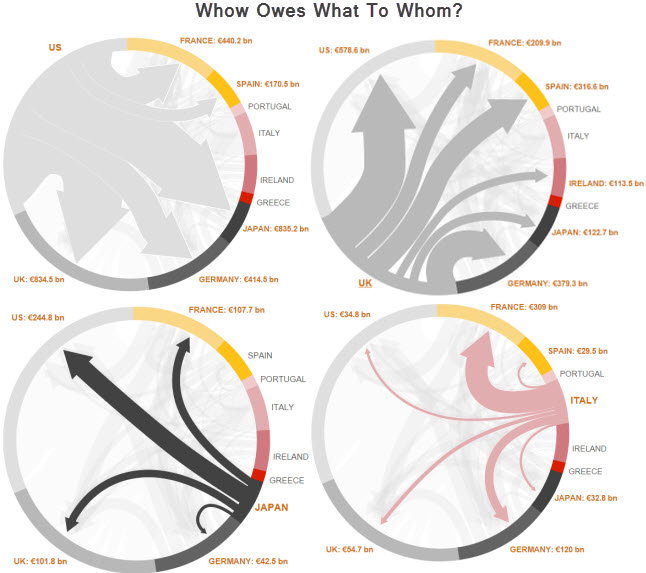

“Makes no sense to me. The money doesn’t go anywhere. It just changes hands. And yet we seem to live in a world in which every country on the planet is broke and in debt.”

Respectfully;

The people who took received the money are not broke and in debt. It’s the government entities that decided that spending money and printing it would be possible forever with no consequences who are obliged to repay it.

The money is in vehicles, homes, food markets, “investments” in solar collector companies, “saved” automotive companies, “infrastructure” projects that never took place, “free” phones, “free” food, “youth” programs, “free” school breakfasts, lunches and dinners, “free” tuitition, and every other excuse for government taxing, spending and borowing that results in debt that must be paid off.

The money has to be repaid but there’s noone left to repay such astronomical amounts of money that were thrown out with no hope of return, camouflaged as “investments”.

IMHO

....As for deflation, doctors and dentists aren’t lowering their prices ....

Deflation is just a surplus of any commodity vs demand. Doctors and dentists may not lower their prices, but if people just don’t go to a doctor or a dentist, there will be an economic impact on those practices. I may just decide to have a tooth pulled, at a cost of $200, vs the alternative of a dental implant $2-3000. Big difference. Deflation can cut a deep groove everywhere.

When the local governments collapse, the militia will rise to take care of business

The velocity with which transactions take place has as much to do with the “value” of the unit of exchange as the intrinsic factor of that medium of exchange.

Velocity of transactions has slowed TREMENDOUSLY as of recent times. The “go-go” factor is missing, drowned in red tape, bureaucracy and a growing fear factor.

If people have cash, they are sitting on it, and for those who do not have cash, their credit cards are about maxed out.

Can you say, “Bubble burst”?

Not with fractional reserves. The banks lend out much more money than what really exists. It is only appear wealth. True wealth is out right ownership of tangible assets.

My theory is that if the 50% who are concerned with CO2 production were to expire, many “problems” would be solved.

Economics is a "science" (I use the quotes because it is a human science, not a traditional science of the physical world), while finance involves mechanisms of trade that relate to economics.

Not to speak of promised future “benefits” that are currently unfunded.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.