Skip to comments.

Learning to Love Market Chaos --Investment & Finance Thread Jan. 18

Weekly investment & finance thread ^

| Jan. 18, 2015

| Freeper Investors

Posted on 01/18/2015 10:51:35 AM PST by expat_panama

|

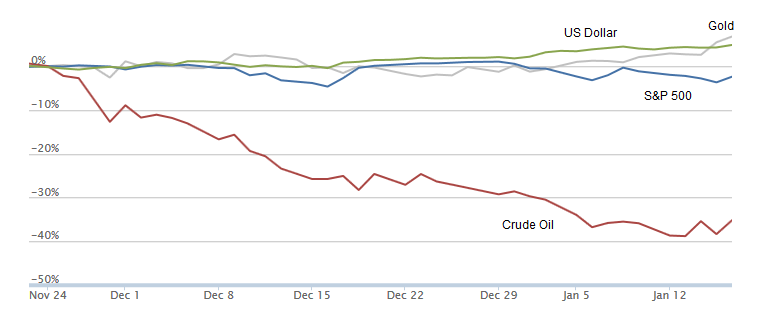

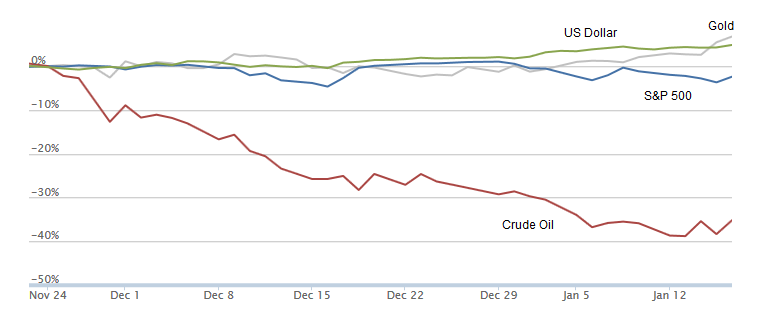

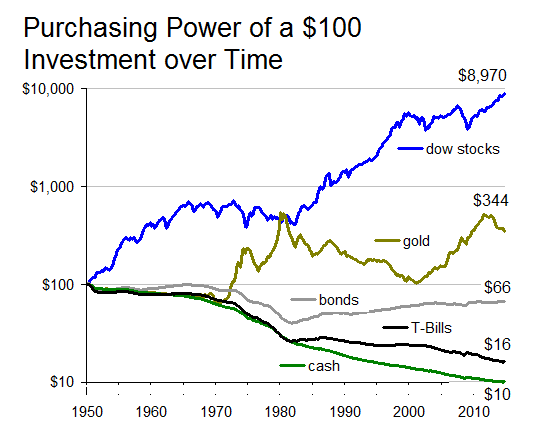

The main reason we try to predict markets is so afterward we can gloat saying we knew it all along. Easy-peasy -- all we do is predict doom'n'gloom and eventually asset prices will sag. Sure, most of the time prices go up, things grow and wealth is created, but the only time folks cry WHY!!?? is during the rough times. Then again, the other reason we figure out expected market trends is so we can make money. That's not that hard either because over time most investments do better than say, cramming bux in a mattress (first graph left). Then we get to the fact that not all types of investments are created equal, and various types of investments' eventual purchasing powers behave differently. My favorite's stocks, though there have been time periods when some of us have done even better w/ precious metals. Note that real estate, collectables, etc., are not being mentioned here because of the constraints of I don't want to. Long term over-the-decades is all well and good, but hey we also would like to see some good happening say, day by day or at least month by month. There's the rub; the past couple months have been crazy (graph right) what w/ tanking oil and sideways roller-coasters for everything else. I mean, usually when we spend a bit of time going over index charts we get patterns we can work with. Take IBD's market calls. what w/ tanking oil and sideways roller-coasters for everything else. I mean, usually when we spend a bit of time going over index charts we get patterns we can work with. Take IBD's market calls. Please. Years of research enabled them to correctly call the nifty run-up we all enjoyed last November (second graph left). That was then and for the past month all those formally dependable signals have suddenly gone into mid-life crisis. Rule Number One though is to accept things as they are, and if we got chaos then we got chaos. Everyone's got their own favorite way of muddling through times like these; my personal favorite calls back to the old oriental counsel going something like if you're going to be savagely attacked and beaten and there's nothing you can do about it you may as well just relax and enjoy it. iow, there's a lot to be said for the "don't just do something, stand there" approach --AKA wait and see and be good w/ it.

|

|

Top 10 reasons that us FR investors want to participate in the 2015 Q1 FReepathon:

10. Gold, silver, stock indexes, and bond values are all cr@pping out these days anyway...

9. The FReerepublic is a proven and solid force for (among other things) sound national fiscal policy; we need that force stronger now more than ever.

8 We benefit from these threads personally. Equity as a legal doctrine thus requires our compensatory donations.

7. Economic realism: there's no free lunch.

6. Market realism: you get what you pay for.

5. Donations are necessary for continued maintenance/loss reduction of desired FR services.

4. Donations are a guaranteed adjunct to an individual investor's game plan. These threads will either pay for themselves through info leading to profits or reduced setbacks (in which case a monthly donation is reasonable overhead) or if by chance what you pick up here is dumb then having donated enables you to request a cheerful refund. [Note: "request" ≠ "receive"]

3. Hey, this place is fun!

2. This thread's been going on a year now. Those of us that found this thread useful for money making will be entitled to imagine saying that the donations were earnings expenses when they itemize next April.

--and here's my favorite: 1. On the internet, when you're getting something you're not paying for, then you're not a customer. You're a product.

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--  Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |

|

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; financial; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-71 next last

To: expat_panama

LOL! Yeah. The ‘Big Money Guys’ sure saw that crude crash coming, didn’t they? ;)

41

posted on

01/21/2015 6:35:27 AM PST

by

Diana in Wisconsin

(I don't have 'Hobbies.' I'm developing a robust Post-Apocalyptic skill set...)

To: abb

A strong dollar is good for us. It makes imports cheaper and we can import, improve and export efficiently, therefore we’ll be just as competitive.

42

posted on

01/21/2015 10:29:05 AM PST

by

1010RD

(First, Do No Harm)

To: expat_panama

Different questions and a lot of these polls just generate noise because of it. Remember all the people worried about food with DNA in it or dihydrogen oxide or women’s suffrage?

43

posted on

01/21/2015 10:34:40 AM PST

by

1010RD

(First, Do No Harm)

To: Wyatt's Torch

What exactly is “somewhat” satisfied? Also, they missed the most important priority - keeping the Internet free of government regulation and taxation. That’s job number one for conservatives. It will go liberal once government gets a foothold.

44

posted on

01/21/2015 10:36:44 AM PST

by

1010RD

(First, Do No Harm)

To: expat_panama

GOP Congress caused the improvement. Starts ticking up in Oct when it was getting more and more obvious that the GOP would sweep. Somebody do something to stop Obama!

https://www.youtube.com/watch?v=9Sj89hMVYhI

Now, I’m not calling our POTUS a Reaver, but...

45

posted on

01/21/2015 10:42:43 AM PST

by

1010RD

(First, Do No Harm)

To: expat_panama

You are one sharp cookie.

46

posted on

01/21/2015 10:43:47 AM PST

by

1010RD

(First, Do No Harm)

To: abb; Hawthorn; expat_panama

Hawthorn, you magnificent FReeper. I read your post!

47

posted on

01/21/2015 10:47:32 AM PST

by

1010RD

(First, Do No Harm)

To: 1010RD

I would be in the “somewhat satisfied” camp. The economy certainly improved in FY14. It could also be a whole lot better. Particularly if the government would just get the hell out of the way.

To: expat_panama

The wave of the future

Job Site of the Future: Unmanned Bulldozers and Drones for Routine Construction

“The Wall Street Journal reports Drones’ Next Job: Construction Work.

Construction-equipment maker Komatsu Ltd. has plans to solve a potential shortage of construction workers in Japan: Let drones and driverless bulldozers do part of the work.

Tokyo-based Komatsu said Tuesday it plans to use unmanned aircraft, bulldozers and excavators to automate much of the early foundation work on construction sites.

Under Komatsu’s plans, U.S.-made drones would scan job sites from the air and send images to computers to build three-dimensional models of the terrain. Komatsu’s unmanned bulldozers and excavators would then use those models to carry out design plans, digging holes and moving earth.

The drones, made by San Francisco startup Skycatch Inc., and construction equipment would move along largely preprogrammed routes. The goal is to automate the construction site, leaving humans to program the machines and then push a button to send them to work. Human operators would also monitor progress and can jump in to take control of a machine if necessary.”

http://www.freerepublic.com/focus/f-chat/3249221/posts

49

posted on

01/21/2015 12:45:21 PM PST

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: Wyatt's Torch

I wish we had a party that consistently felt that government is the problem. It was rough going for a while, but we’re through and fine. I hate what it’s doing to America’s middle classes and how the welfare state continues to sap the poor’s economic prowess and mobility.

I just think some of these questions on questionnaires are questionable. ;-]

50

posted on

01/21/2015 2:24:51 PM PST

by

1010RD

(First, Do No Harm)

To: Lurkina.n.Learnin

Skycatch/Skynet what’s in a name?

Who will make the babies of Japans future who want all this construction done? Japanese Mormons can’t do it all alone.

51

posted on

01/21/2015 2:37:21 PM PST

by

1010RD

(First, Do No Harm)

To: 1010RD; abb

>> A strong dollar is good for us.<<

Roger that!

>>It makes imports cheaper and we can import, improve and export efficiently<<

Megadittoes!

>> therefore we’ll be just as MORE competitive <<

There! Fixed it!

52

posted on

01/22/2015 4:30:56 AM PST

by

Hawthorn

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

|

Markets |

|

Yesterday |

|

Futures |

| metals |

|

Mostly flat ending w/ gold'n'silver @ $1,292.80 and $18.11 |

|

Trading down -0.75% |

|

|

|

|

|

|

| stocks |

|

Were down then reversed up in lower volume. |

|

0.20% |

You probably should know that the reason I'm slow starting out is because earlier my day began with Senate Votes 98-1 That Climate Change 'Is Not A Hoax' and it made me think of all the carbon taxes and EPA regs coming up. Ah well, things look ok for this morning's trading although it's 'claims' day:

Initial Claims

Continuing Claims

FHFA Housing Price Index

Natural Gas Inventories

Crude Inventories

To: Lurkina.n.Learnin

Tx! [passing link to my robot engineering student daughter...]

To: 1010RD; Wyatt's Torch

Different questions and a lot of these polls just generate noise...What was confusing me about Wyatt's post was he was talking about econ optimism and I'd been looking at O's approvals. If I understand this correctly what's happening is that the America's happy about earning a living in spite of O. The WSJ/NBC econ poll of 800 people came about not that far from Gallup's 4000.

To: expat_panama

ECB QE = €1,000,000,000

:-O

To: Lurkina.n.Learnin

57

posted on

01/22/2015 6:24:41 AM PST

by

Diana in Wisconsin

(I don't have 'Hobbies.' I'm developing a robust Post-Apocalyptic skill set...)

To: expat_panama; Wyatt's Torch; Lurkina.n.Learnin; All

Ok, folks. The market is almost back up to full price!

“Well , here’s another nice mess you’ve gotten me into!”

(With apologies to Stan Laurel and Oliver Hardy)

58

posted on

01/22/2015 11:22:56 AM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: abb

....apologies to Stan Laurel and Oliver Hardy....jpg)

Huh. I thot I was the only one here who remembered that one....

To: expat_panama; thackney; All

http://www.wsj.com/articles/oil-prices-tad-lower-as-markets-brace-for-ecb-decision-1421904042

Oil Prices Slide as Supplies Grow

U.S. Energy Information Administration Report Shows Domestic Supplies Rose Sharply

By Nicole Friedman

Updated Jan. 22, 2015 3:16 p.m. ET

Oil prices slid Thursday, nearing recent lows, as U.S. crude-oil supplies hit their highest January level in more than 80 years.

U.S. crude inventories rose by 10.1 million barrels in the week ended Jan. 16, the U.S. Energy Information Administration said Thursday, more than the 2.7-million-barrel build that analysts surveyed by The Wall Street Journal had expected.

“The build was huge,” said Carl Larry, analyst at Oil

Crude supplies now total 397.9 million barrels, the highest January level on record in weekly EIA data going back to August 1982. In monthly data, stockpiles haven’t exceeded that level in any January since 1931, according to the EIA.

U.S. crude oil for March delivery fell $1.47, or 3.1%, to $46.31 a barrel on the New York Mercantile Exchange. Brent, the global benchmark, fell 51 cents, or 1%, to $48.52 a barrel on ICE Futures Europe. Both contracts settled above the near-six-year settlement lows they reached last week.

60

posted on

01/22/2015 12:54:50 PM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-71 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

what w/ tanking oil and sideways roller-coasters for everything else. I mean, usually when we spend a bit of time going over index charts we get patterns we can work with. Take IBD's market calls.

what w/ tanking oil and sideways roller-coasters for everything else. I mean, usually when we spend a bit of time going over index charts we get patterns we can work with. Take IBD's market calls.

.jpg)