Skip to comments.

Learning to Love Market Chaos --Investment & Finance Thread Jan. 18

Weekly investment & finance thread ^

| Jan. 18, 2015

| Freeper Investors

Posted on 01/18/2015 10:51:35 AM PST by expat_panama

|

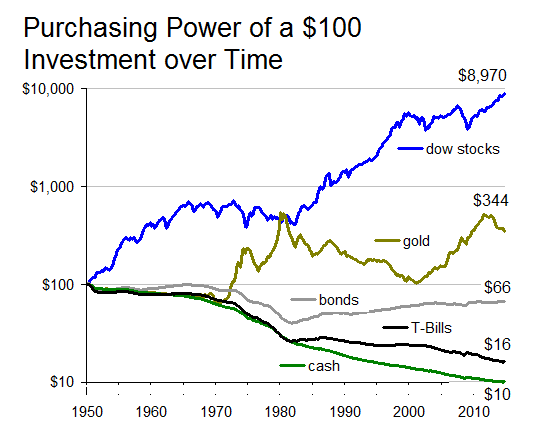

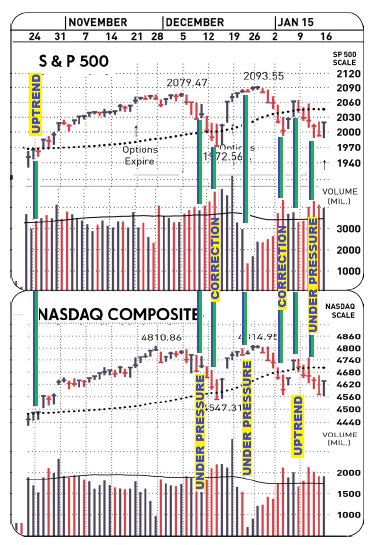

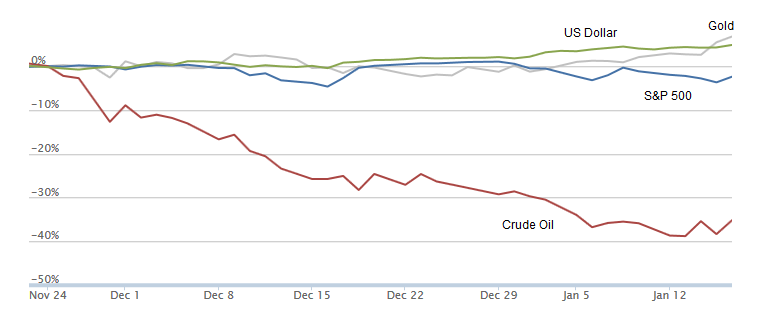

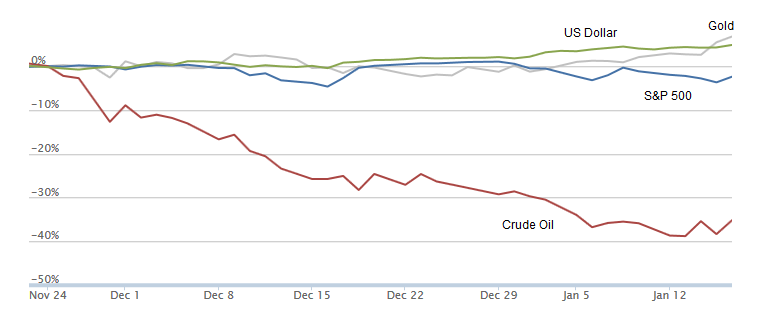

The main reason we try to predict markets is so afterward we can gloat saying we knew it all along. Easy-peasy -- all we do is predict doom'n'gloom and eventually asset prices will sag. Sure, most of the time prices go up, things grow and wealth is created, but the only time folks cry WHY!!?? is during the rough times. Then again, the other reason we figure out expected market trends is so we can make money. That's not that hard either because over time most investments do better than say, cramming bux in a mattress (first graph left). Then we get to the fact that not all types of investments are created equal, and various types of investments' eventual purchasing powers behave differently. My favorite's stocks, though there have been time periods when some of us have done even better w/ precious metals. Note that real estate, collectables, etc., are not being mentioned here because of the constraints of I don't want to. Long term over-the-decades is all well and good, but hey we also would like to see some good happening say, day by day or at least month by month. There's the rub; the past couple months have been crazy (graph right) what w/ tanking oil and sideways roller-coasters for everything else. I mean, usually when we spend a bit of time going over index charts we get patterns we can work with. Take IBD's market calls. what w/ tanking oil and sideways roller-coasters for everything else. I mean, usually when we spend a bit of time going over index charts we get patterns we can work with. Take IBD's market calls. Please. Years of research enabled them to correctly call the nifty run-up we all enjoyed last November (second graph left). That was then and for the past month all those formally dependable signals have suddenly gone into mid-life crisis. Rule Number One though is to accept things as they are, and if we got chaos then we got chaos. Everyone's got their own favorite way of muddling through times like these; my personal favorite calls back to the old oriental counsel going something like if you're going to be savagely attacked and beaten and there's nothing you can do about it you may as well just relax and enjoy it. iow, there's a lot to be said for the "don't just do something, stand there" approach --AKA wait and see and be good w/ it.

|

|

Top 10 reasons that us FR investors want to participate in the 2015 Q1 FReepathon:

10. Gold, silver, stock indexes, and bond values are all cr@pping out these days anyway...

9. The FReerepublic is a proven and solid force for (among other things) sound national fiscal policy; we need that force stronger now more than ever.

8 We benefit from these threads personally. Equity as a legal doctrine thus requires our compensatory donations.

7. Economic realism: there's no free lunch.

6. Market realism: you get what you pay for.

5. Donations are necessary for continued maintenance/loss reduction of desired FR services.

4. Donations are a guaranteed adjunct to an individual investor's game plan. These threads will either pay for themselves through info leading to profits or reduced setbacks (in which case a monthly donation is reasonable overhead) or if by chance what you pick up here is dumb then having donated enables you to request a cheerful refund. [Note: "request" ≠ "receive"]

3. Hey, this place is fun!

2. This thread's been going on a year now. Those of us that found this thread useful for money making will be entitled to imagine saying that the donations were earnings expenses when they itemize next April.

--and here's my favorite: 1. On the internet, when you're getting something you're not paying for, then you're not a customer. You're a product.

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--  Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |

|

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; financial; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-71 next last

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

Enjoying as much of this stuff as we can stand ping.

To: expat_panama

What that first graph tells me is that going off the gold standard in 1970 created market chaos.

3

posted on

01/18/2015 11:14:10 AM PST

by

seowulf

(Cogito cogito, ergo cogito sum. Cogito.---Ambrose Bierce)

To: expat_panama

4

posted on

01/18/2015 11:20:15 AM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: expat_panama

The first trading of the new week.

http://gulfnews.com/business/markets/abu-dhabi-index-leads-rally-in-gulf-as-crude-recovers-1.1443090

Abu Dhabi index leads rally in Gulf as crude recovers

ADX general index ends up nearly 1.7% higher

By Siddesh Suresh Mayenkar, Staff Reporter

Published: 17:17 January 18, 2015

Dubai: The Abu Dhabi index led gains in the GCC on Sunday in a rally triggered by rebounding crude even as investors eyed December quarter results.

The Abu Dhabi Securities Exchange General Index ended 1.65 per cent higher at 4,555.27, after rising as much as 4,580.72.

“The rally was mainly triggered by strong performance in crude and a rebound in international markets,” said Marwan Shurrab, fund manager and head of trading at Vision Investments & Holdings.

Oil advanced, capping the first weekly gain since November, after the International Energy Agency lowered forecasts for supplies from outside the Organisation of Petroleum Exporting Countries (Opec) and an industry report showed US companies reduced drilling activity.

Brent for March settlement rose 3.9 per cent to end the session at $50.17 a barrel.

In stocks specific movements on the ADX, International Fish Farming Holding ended the trade 14.94 per cent higher at Dh5.54, while National Corp for Tourism and Hotels closed 14.55 per cent higher at Dh6.30. Out of a total of 31 companies traded on the exchange, shares of 19 companies rose, while shares of 7 companies fell.

Elsewhere, the Dubai Financial Market General Index also ended 1.48 per cent at 3,899.53. Arabtec, which was the most active stock in trade in terms of value, ended 2.56 higher at Dh3.20. Union Properties ended 4.72 per cent higher at Dh1.33.

Elsewhere in the region, other indices like the Tadawul index along with Qatar Exchange also advanced.

The Tadawul All Share TASI index ended up nearly 1 per cent, while Muscat Securities MSM 30 Index also advanced 1.11 per cent at 6,591.13. Qatar Exchange Index ended 0.45 per cent higher at 11,916.42.

Earnings in focus

“I see focus coming back to earnings as we saw Emirates NBD was one of the few to announce its results. The market would also focus on potential distribution of dividends that we have been seeing for the past couple of years,” said Shurrab.

Emirates NBD rose more than 2 per cent in trade after posting strong results.

Emirates NBD reported a net profit of Dh5.1 billion for the full year, up 58 per cent compared to 2013. Total Income for the year 2014 grew by 22 per cent to Dh14.4 billion.

“The growth that we saw year on year show strength in the banking system and recovery that we have seen over the past couple of years in the UAE’s economy.” said Shurrab.

Saudi Basic Industries Corp, one of the world’s largest petrochemicals groups and the country’s biggest listed company, reported a 29 per cent drop in fourth-quarter net income on Sunday. SABIC ended the trade more than 1.5 per cent higher.

5

posted on

01/18/2015 11:29:06 AM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: abb

Oil advanced, capping the first weekly gain since November,After said and done (and if trend holds), possibly the best economic news of the past 5 years.

6

posted on

01/18/2015 11:31:20 AM PST

by

catfish1957

(Everything I needed to know about Islam was written on 11 Sep 2001)

To: catfish1957

7

posted on

01/18/2015 11:38:23 AM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: expat_panama

I have a friend who is in the foreign Currency market. He LOVES Market Volatility. He makes his decisions to buy, sell, short-sell on a computer program he first developed in 1989, and has improved it since then. He tells me that a “stable” market is very bad for him.

To: MuttTheHoople

How did he do on the Swiss Franc the other day? I see some hedge funds are going under. Lot of people got caught with their pants down on it.

9

posted on

01/18/2015 12:08:00 PM PST

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: Lurkina.n.Learnin

http://blogs.wsj.com/moneybeat/2015/01/16/six-in-ten-retail-forex-traders-lose-money-each-quarter/

2:21 pm ET Jan 16, 2015

Six in Ten Mom-and-Pop Currency Traders Lose Money Each Quarter

By Erik Holm

FXCM Inc., a currency-trading platform for mom-and-pop investors, on Thursday revealed that its clients had taken a massive hit when the Swiss central bank surprised the world and abandoned its efforts to create a ceiling for its currency.

But that shouldn’t be a huge surprise. After all, about two-third of FXCM’s U.S. clients lose money each quarter. In last year’s third quarter, the most recent available, 68% of the firm’s active U.S. accounts were unprofitable.

That figure holds true across much of the industry. Among six of the biggest firms that allow U.S. retail traders to play in the currency market, a weighted average of 38.3% were profitable, according to Forex Magnates. In other words, more than six in ten were unprofitable.

snip

10

posted on

01/18/2015 12:56:43 PM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: seowulf

...going off the gold standard in 1970 created market chaos.We could say that since chaotic gold market prices didn't exist in the U.S. before the 70's because the gold market wasn't legal. Other countries had chaotic gold prices and after the 70's Americans were allowed to have 'em too. Kind of like saying Obama selling out to Castro 'created' Cuban cigars for Americans...

To: MuttTheHoople

He tells me that a “stable” market is very bad for him.--yet every time he buys low & sells high he's reducing volatility. Not to worry, markets will have wild swings as long we have life and change ---and more so as long as traders have emotions.

To: expat_panama

That’s true. A gold backed dollar should of course track gold.

I was more observing the increased noise/volatility in the graph following 1970.

Adding the variables of money supply manipulation and interest rate manipulation by the central banks increased the “chaos” in the stock market.

Prior to 1970 it seems that stocks increased steadily based on actual growth rather than fickle interest rates and monetary policy.

13

posted on

01/18/2015 1:35:18 PM PST

by

seowulf

(Cogito cogito, ergo cogito sum. Cogito.---Ambrose Bierce)

To: seowulf

14

posted on

01/18/2015 1:44:45 PM PST

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: abb

15

posted on

01/18/2015 2:11:23 PM PST

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: expat_panama; All

Anybody in here going to Davos this week? It’s where the elite meet. To bad they couldn’t harness all the hot air coming out of there this week.

16

posted on

01/18/2015 6:10:29 PM PST

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: seowulf

Prior to 1970 it seems that stocks increased steadily based on actual growth rather than fickle interest rates and monetary policy.Some people can say that especially when just comparing two decades before '70 to the four after, but looking at the seven decades before '70 stock index swings look much worse before:

To: abb

I’ve piddled around with currencies in a minor way and only have the nerve when the dollar is at a high which provides a margin of error and improves return, plus I stick to only 1st world currencies, very cautious. When the dollar calms down and declines I bring it back into dollars. Not going to make me rich because the opportunities aren’t frequent enough, but the return is OK. There have been several pronounced dollar spikes since 2008. I’ve usually gone into Euro, which is looking very poorly lately, $1.15 last I checked. Normally that would look like an opportunity since the dollar is still strong. Something feels wrong though, especially since the Swiss have done what they have done, so I’ll sit that one out.

To: Lurkina.n.Learnin

Every time I think Wikipedia has bottomed out I find they’ve gone and reached new lows.

To: expat_panama

When I first came across it I thought wikipedia was a childrens website. In that article they quote Frum as a "conservative".

20

posted on

01/19/2015 4:08:05 AM PST

by

palmer

(Free is when you don't have to pay for nothing. Or do nothing. We want Obamanet.)

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-71 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

what w/ tanking oil and sideways roller-coasters for everything else. I mean, usually when we spend a bit of time going over index charts we get patterns we can work with. Take IBD's market calls.

what w/ tanking oil and sideways roller-coasters for everything else. I mean, usually when we spend a bit of time going over index charts we get patterns we can work with. Take IBD's market calls.