Posted on 09/28/2014 10:13:30 AM PDT by expat_panama

Investment & Finance End of 2014 Q3 into Q4 Thread Edition

| Comodities | Stock Indexes | ||||||

| now | 3 Mo. Chg. | Annualized return | now | 3 Mo. Chg. | Annualized return | ||

| gold | $1,220.26 | -7.2% | -25.9% | S&P500 | 1,982.85 | 1.2% | 4.7% |

| silver | $17.71 | -16.2% | -50.7% | DJIA | 17,113.15 | 1.7% | 7.0% |

| oil | $512.66 | -6.2% | -22.6% | NASDAQ | 4,512.19 | 2.4% | 9.8% |

| U.S. $ | $85.62 | 6.7% | 29.8% | Rus2k | 1,119.33 | -6.2% | -22.5% |

Looks like the dollar soared (so much for Fed printer devaluations), metals tanked (so much for safe havens), and while big cap. stocks have done best this past quarter the current status is "market under pressure" (read: under a cloud)

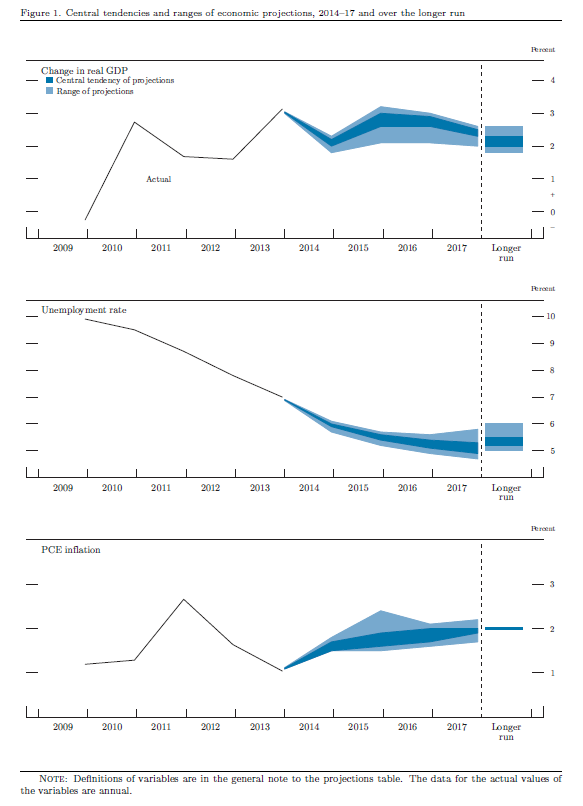

OK so while the future is anyone's guess we do know that these plotted guesstimates are what the Fed (FOMC) is planning on

---[click/enlarge]>>

The new-quarter homework reading assignment. Note: this material will be on the Final Exam:

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |

More later (already on my Twitter feed) but Panetta at the DB conference was fantastic. Really impressed. Surprised how open he was. Great stuff.

Wednesday, October 01, 2014 |

|||||

| Markets | yesterday | today | |||

| metals | gold, silver new lows | Futures -0.54%, now trading mixed. | |||

| stocks | Stocks Fall Again As Indexes Gain Distribution Day in a 1/3% drop w/ soaring volume. Still not quite a correction (yet). | Futures @ 2.5 hrs. before opening down -0.15% | |||

Big report day today:

MBA Mortgage Index

ADP Employment Change

ISM Index

Construction Spending

Crude Inventories

Auto Sales

Truck Sales

--and even without The Onion we still go loads of news:

any transcript/summary/video/audio would be SUPER welcome!

“lol! You know it and I know it but we may need to keep this just between a select few of us..”

I thought PM was a way to maintain some sort of purdchasing power as a medium of exchange should the paper money be printed into oblivion. A store of value as such. No?

Are you referring to the physical metal or futures/ETF’s only?

What precautions should one take given the nonstop money printing? SOS!

PMs are way down but yet I hesitate to buy. If I had extra cash I’d be buying Silver Eagles but I don’t. My quandary is that if inflation is so low why is everything so expensive and why am I broke?

Humans have been printing money based on PM's for thousands of years. When folks saw how bad problems of wild swings in purchasing power were getting with gold money they tried silver, they tried a mix, and finally now the world uses money based on the value of a list of stuff that most things people are buying. That's policy, and my vote is what controls that.

My investing choices is what protects me from financial risk and imho the risk to my safety from money printed into oblivion is pretty low on my risklist. In fact, over the past few years all that American Fed printing is what's been preventing the disappearing dollar. The money supply grew more before the Fed printing beginning w/ the '08 collapse, and since then it's barely kept the money supply from falling altogether. Our problem for six years now is that what little money supply growth we've had has just been Fed money, and now that's stopping.

That's what I keep asking too, and my thinking is the problem's not inflation, it's the anti-business econ policy.

I posted some stuff on my Twitter feed: https://mobile.twitter.com/bpjauburn/tweets

Coal stocks are tanking (even more) along with PMs. I guess the world hates cheaper electricity. SLW, SAND, BTU, CNX and a host of others are being took to the woodshed. I look for some takeovers at these prices. SODA should be bought out at less than $28 by a major soft drink co. for sure.

Haven't heard that one, what I was following was Airlines Stocks Are Getting Crushed And Traders Are Blaming Ebola and As Ebola spreads, drug stocks surge. mho the airline story was only half true, and I'll check out the drug story now.

Checked; CNN lied. Drug stocks are tanking w/ the market in general.

There are only three stocks tied to ebola and the rest are tanking. Tekmira, sereptra and one more I think. I’m just going off the top of my head. Tekmira spiked over 20% Monday i think. Again off the top of my head. as far as airline stocks DAL and JBLU look good. this ebola scare is a one-off. In a few weeks it will be forgotten and airlines/cruise lines should resume.

Only three drug stocks are connected to ebola.

Whoa, welcome to Crash-Thursday! -at least according yesterday's returns and today's futures! Metals got nowhere yesterday and today they're pegged for a sharp drop while stock indexes saw more than a % drop in heavy trade --"market in correction". Report sched (ET):

7:30 AM Challenger Job Cuts

8:30 AM Initial Claims

8:30 AM Continuing Claims

10:00 AM Factory Orders

10:30 AM Natural Gas Inventories

News is all over the place:

Global stocks down on recovery, Ebola worries Washington Post - 6 hours ago SEOUL, South Korea - Global stock markets were lower on Thursday amid worries about the strength of U.S. and European recoveries and the first American case of Ebola.

Heretical As It Sounds, Be an 'Un-American' Investor - Ken Fisher, Forbes

The Six Things Investors Need to Know About October - Matt Krantz, USA

You Should Ignore October Correction Talk - Amit Chopra, MarketWatch

Small Cap Stocks: Look Out Below - GaveKal Team, GaveKal Capital

Inflation Panic Will Kill the Economic Recovery - Clive Crook, Bloomberg

Jobless Rate Understates the Economy's Problems - Jared Bernstein, NYT

Obamacare Health Insurers May Be Next Big Bailout - Steve Moore, IBD

Supreme Court Poised For A Do-Over On Obamacare The majority of Americans who continue to oppose Obamacare should be greatly pleased to learn that the Supreme Court is likely to get a do-over on this misguided and too-often-lawlessly-implemented law. As eloquently detailed by fellow Forbes blogger Michael Cannon on September 30, “The U.S.… Forbes from RSS

Discuss...

Well This Is Just Embarrassing For The Fed Haters

Markets More: Federal Reserve

Well This Is Just Embarrassing For The Fed Haters

Joe Weisenthal

One of the most infuriating things about the Fed haters — i.e. the people who predicted massive inflation and dollar debasement as a result of quantitative easing — is that they’ve never really admitted they got it all wrong.

Maybe a few have, but for the most part, the people predicting doom and gloom and Weimar, Germany-like outcomes continue to say the same thing, without regard for actual evidence.

This is what makes folks like Krugman so infuriated, and why he’s so harsh towards his critics, because he regards them as intellectually dishonest.

There’s more evidence of that today, courtesy of a great Bloomberg piece by Caleb Melby, Laura Marcinek and Danielle Burger in which they called up various signatories to a 2010 letter that warned Bernanke about impending inflation.

The upshot: For the most part, they don’t accept they were wrong.

Here for example is Jim Grant, editor of Grant’s Interest Rate Observer, and intense critic of Fed easing:

Jim Grant, publisher of Grant’s Interest Rate Observer, in a phone interview:

“People say, you guys are all wrong because you predicted inflation and it hasn’t happened. I think there’s plenty of inflation — not at the checkout counter, necessarily, but on Wall Street.”

“The S&P 500 might be covering its fixed charges better, it might be earning more Ebitda, but that’s at the expense of other things, including the people who saved all their lives and are now earning nothing on their savings.”

“That to me is the principal distortion, is the distortion of the credit markets. The central bankers have in deeds, if not exactly in words — although I think there have been some words as well — have prodded people into riskier assets than they would have had to purchase in the absence of these great gusts of credit creation from the central banks. It’s the question of suitability.”

Grant is not 100% wrong in his concerns about the recovery. It has been disappointing. But a rising stock market is not how people measure inflation, and the labor market has recovered significantly, bringing real relief to millions of people. It is true that it hasn’t been a great time to be a saver who’s been 100% in cash, but if you’ve been in stocks (or even bonds!) you’ve done quite well.

And here’s Niall Ferguson also trying to claim credit: “Though generally regarded by a cause for celebration (even by those commentators who otherwise lament increasing inequality), this bull market has been accompanied by significant financial market distortions, just as we foresaw.”

Sorry, but no. “Distortions, just as we foresaw” is at worst wrong, and at best tautological, in the sense that you can define distortions in any way you want, relative to any baseline that you have imagined in your head.

Has the recovery been disappointing? Yes. Are there things the government and the Fed could have done differently to make the recovery better? Certainly. Have the Fed haters gotten things right? Not even close.

Although I agree with the general premise here I found this laughable. “This is what makes folks like Krugman so infuriated, and why he’s so harsh towards his critics, because he regards them as intellectually dishonest.”

Paul Krugman? Intellectually dishonesty is certainly something he knows about.

Ha! Very true...

If food and energy are discounted, yes inflation has been “moderate.” What has camouflaged the increase has been a relatively mild increase in housing/property prices. But food prices have increased the most I’ve ever seen in my lifetime.

And what has driven this recovery is what drives ALL economic recoveries - productivity. In other words, the producers work harder, smarter, and longer to tote the load of the ever growing rent-seeking class.

"The president has taken the right step in confronting ISIS but this is going to be a long long fight."

"When the U.S. stands back, nobody else will do the job. The U.S. has to provide the leadership."

"Iran, through the Quds force, has sponsored terrorism on five continents. They are a bad player."

"Iran's 19,000 centrifuges could produce weapons grade fuel in 12-15 months."

"In the anxiety to cut a deal with Iran, we are going to cut a bad deal."

"one option going after Bin Laden was sending in a B2 bomber and blowing the shit out of it. Something attractive about that."

on Bin Laden raid "Important for the U.S. To send the message that you cannot attack the United States and get away with it."

on Putin "He sensed weakness in the way we dealt with the Syria red line."

"I looked into his eyes and all I saw was KGB, KGB, KGB."

on Putin/Russia "I would reinstate missile defense. The Russians hate missile defense."

on Hong Kong protests "You cannot allow people to enjoy the benefits of a free society without allowing people to be free."

on cyberattacks "The capability exists to take down our power and water systems right now."

on cyber security "This is like dealing with nuclear weapons."

"History will look at this time as the time in which we are at war with Islamic terrorism."

"Every operation I conducted as CIA director I briefed Congress so that they were aware."

on Obama "He believes that if you explain and issue people will embrace it. Shit it doesn't work that way."

"I want this president to succeed just like I want every president to succeed. But in order to do that he has to engage."

"One of the greatest threats to the U.S. Is the dysfunction in Washington today."

"If men and women are willing to fight and die for this country it's not too much to ask for leadership to take a little risk."

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.