Posted on 05/07/2013 6:41:42 AM PDT by blam

The US Economy Is The Envy Of The World Again, And Just Like That The Bears Have Been Annihilated

Joe Weisenthal

May 7, 2013, 4:44 AM

Just two and a half weeks ago, the bears were starting to feel good.

Markets around the world seemed to be rolling over. Commodities were falling. People were talking about deflation.

And then, the market turned, and then we got Friday's strong jobs report.

Now the market is back to making new highs again, and the market bears are crushed.

A new note from Olivier Korber at SocGen is titled "US payrolls annihilated 'sell in May.'" Basically, whatever temptation there was to dump risky assets starting in May (as the cliche goes) has been sapped.

Separately, Steven Englander of Citi wrote yesterday:

The implications of the payroll release for FX is that the US is back on track as an outperformer (admittedly modest, but still standing out) in a world of underperformance, From a Fed perspective labor market improvement since last year has been steady but clear, with household and payroll employment and aggregate hours converging to a 1.5% y/y gain (Figure 1, upper panel). This is probably at the low end of what the FOMC core would consider acceptable.

This idea of the US being the one country that you "must own" was a huge theme in markets during the first quarter. Everyone sensed that the US was going towards liftoff, and that regardless of whatever else, exposure to the US was a must.

The same takeaway was offered from trader Mark Dow, who tweeted yesterday.

For now, the US is back to being the envy of the world.

(Excerpt) Read more at businessinsider.com ...

How about bringing back US jobs?

The market is more visible, but the jobs are more important.

Bring back US jobs to America.

Cue “Happy days, are here again!”

That says more about the rest of the world than about our own sorry a*s economy.

With food lines in the video.

Gov’t vs Gov’t. The rich get richer and the poor get poorer.

Markets are nothing but a pool of liquidity. If the Federal Reserve Board and Treasury create money at a faster clip than it is being called upon by Government, Industry and Consumers, Stock and bond prices move higher. This is the primary reason stock prices move 4 to 6 months ahead of the economy.

Pour me another one, but I am afraid the future holds a heavy hangover.

The jobs numbers are fake, completely relying on ‘adjustments’ to make them positive.

The stock market relies - absolutely relies - on index futures buying by Fed agents to keep it moving from plummeting.

This is all MOPE (Management Of Perception Economics).

WHY?

The fundamentals that led to 2008 have not changed. When you look at the design margin, you could argue current environment is even worse than that time.

I’m guessing the article is sarcasm in light of this:

http://freerepublic.com/focus/f-news/3016591/posts

Then again, maybe this is one of those “in a world of blind men, the one eyed man is king” things.

Just because the the US economy is falling a bit slower than the rest of the world doesn’t mean it’s flying.

You can't argue with irrational. First, it wasn't a "strong" jobs report, but it doesn't really matter.

Good reports = good economy = BUY!

Bad reports = more QE = BUY!

“Friday’s strong jobs report”?

Until hiring hits >350,000, we’re in a holding pattern. The percent of adults working remains at historic lows. Just because everyone’s given up and is on the dole in one form or fashion doesn’t mean jobs are back.

Whose gun are you going to use to force a company to “bring back US jobs?”

The one thing the current unemployment numbers do not account for is people retiring. These numbers are large and will continue to be.

Now back to our regularly scheduled arm flailing.

Good grief.

Wall Street is not the economy.

It is being floated to the tune of $85 billion a month from the FED. Why shouldn’t they be doing well.

That doesn’t mean that the economy is healthy. In fact, it shows that we are more bankrupt than ever.

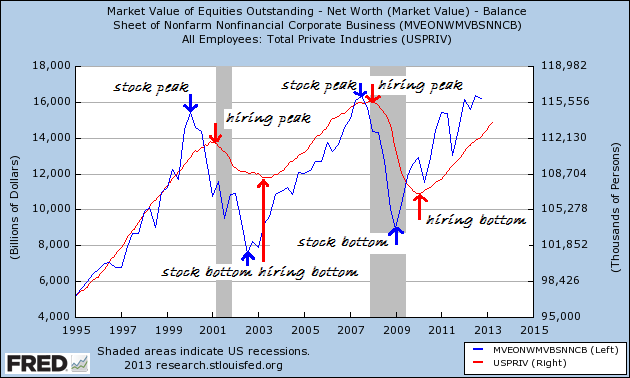

Weird how so many people are oblivious to the fact that most hiring is done by corporations, and that the more stocks corps sell the more people they hire. Sure, ideology may make it hard to accept, but sometimes things simply are what they are:

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.