Posted on 05/07/2013 6:41:42 AM PDT by blam

The US Economy Is The Envy Of The World Again, And Just Like That The Bears Have Been Annihilated

Joe Weisenthal

May 7, 2013, 4:44 AM

Just two and a half weeks ago, the bears were starting to feel good.

Markets around the world seemed to be rolling over. Commodities were falling. People were talking about deflation.

And then, the market turned, and then we got Friday's strong jobs report.

Now the market is back to making new highs again, and the market bears are crushed.

A new note from Olivier Korber at SocGen is titled "US payrolls annihilated 'sell in May.'" Basically, whatever temptation there was to dump risky assets starting in May (as the cliche goes) has been sapped.

Separately, Steven Englander of Citi wrote yesterday:

The implications of the payroll release for FX is that the US is back on track as an outperformer (admittedly modest, but still standing out) in a world of underperformance, From a Fed perspective labor market improvement since last year has been steady but clear, with household and payroll employment and aggregate hours converging to a 1.5% y/y gain (Figure 1, upper panel). This is probably at the low end of what the FOMC core would consider acceptable.

This idea of the US being the one country that you "must own" was a huge theme in markets during the first quarter. Everyone sensed that the US was going towards liftoff, and that regardless of whatever else, exposure to the US was a must.

The same takeaway was offered from trader Mark Dow, who tweeted yesterday.

For now, the US is back to being the envy of the world.

(Excerpt) Read more at businessinsider.com ...

Yeah our “poor” are pretty rich...

Right, if it somehow doesn't make sense to us then the historic records don't matter. There are a lot of economists who take that view, they'll say things like "well, that's all well and good for every day life, but how long do you think that idea would last in theory?"

James Pethokoukis from AEI always tweets on NFP day what the unemployment rate would be if the participation rate was the same as when Obama came into office. I think he said last week that it would be 10.3%. Of course the participation rate has been declining for 15+ years so it's not a new phenomenon.

However, it's not the "only reason" as the number of working people is up since the low (129.3 million in February 2010) by some 6.2 million (135.5 million in April 2013). We are still 2.6 million away from the peak of 138.1 million in January 2008.

tx!

Heh. :D

Buy American.

Of course, the population has grown in that same time period, so the number of “new” jobs has to be compared to the number of new jobs required just to employ the new workforce.

QE isn’t sustainable, so what is the end game?

My point was that you cannot take records from a period with a predominantly free market and assume that the indicators will remain the same under a predominantly state economy.

If the purpose of QE isn’t to inflate the market, then what is it? If you believe that job increases ALWAYS follow a rising market, then why not increase QE by a factor of 10?

Plants flower during the Spring, but carrying flowers outside during January will not summon Spring to arrive. i.e. the government can create money out of thin air and pump up the market, but it cannot create jobs. If the market rise isn’t brought about by natural market forces, then you aren’t going to get natural outcomes from it.

There are 5 million homes in distress, whether by delinquent payments or foreclosures that are not even on the market. The banks are trickling millions of others to put a floor on pricing. wiesenthal is whacked out.

More?

Half of those under 34 are unemployed or underemployed. That demographich happens to be the big spenders but they have nothing to spend.

The work week continues to shrink, this time to the tune of the equivalent of 700,000 workers laid off.

Income is declining proportionately while spending remains steady.

This is the formula for disaster.

And I’m not a bear. I think the market will continue to rise for a while. How long? Ask Ben.

How do you define irrational exuberance? When the economic data is good the market goes up based on the fundamentals of profits and sales. When the economic data is bad the market also goes up because of Big Ben and the printer.

Never said QE n+1 was sustainable... But liquidity injection is the absolute right answer for deflation from a supply side perspective. Just as liquidity removal is the answer for inflation. I have said countless times on here that timing will be critical. The Fed is obviously having internal debates as to when to pare back on the asset purchases as you can tell when you read their minutes of the FOMC meetings. They have now taken the unusual step of signaling when that will happen according to sir dual mandate: 6.5% unemployment and 2.5% inflation. We aren’t anywhere near those two levels yet.

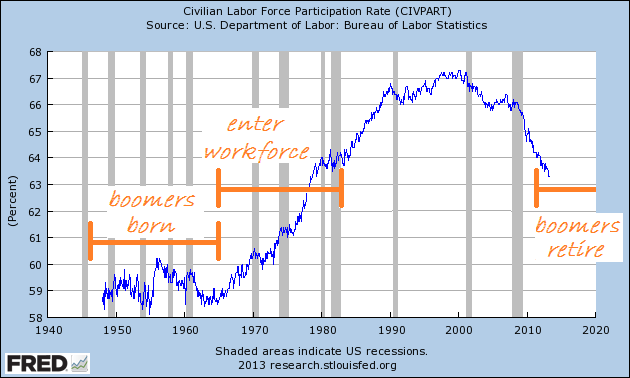

On the workforce it’s amazing how many people on here only show the participation chart over the last 5-10 years and completely ignore that participation rates have been far lower than they are now. The 40’s, 50’s, 60’s and most of the 70’s were far lower. They also completely ignor that the rate has been falling since the 1990’s. Selective presentation at best. Lying and manipulation at worst. As Moynihan said, you are entitled to your own opinion but not your own facts.

I agree with you. Most service jobs don’t cut it if you are thinking McDonalds type jobs.

But there are other types of service jobs that pay quite well. http://www.referenceforbusiness.com/management/Sc-Str/Service-Industry.html

Only if you start with the premise that we should have a state run economy.

The end result of QE is a European socialist economy with unemployment never dipping below 10% and real unemployment, especially among those below the age of 30, of over 40%. The new normal, as it were.

This QE will never stop, because it isn't working. In fact, it is ensuring that unemployment will never get better. Its not like we don't have dozens of such examples to look at.

Participation rates before the 70's reflect a different cultural norm of one earner households and low divorce rates. Going back 70 years reflects social change, not economic. That is broadly accepted by everyone that uses the charts. I also don't use industrial capacity charts from the 1700s.

As for things getting worse since the 90s, so? Is there someone on this thread indicating that we weren't already becoming a welfare state in the 90s?

You think that we are going to use the same game plan as Japan and Europe, but somehow achieve a different result. Now that is some first class selective thinking.

I reject your underlying premise that the state can manage the fundamentals of the micro economy by adjusting the macro indicators. Its a simple case of cause and effect. Artificially adjusting the indicators doesn't magically adjust the fundamentals, no more than turning a weather vane affects the direction of the wind.

Yep! Nothing can go wrong now cuz History tells us once the Financial News Mavens declare everything is alright well then everything is alright!

Stock market news moved from the financial pages to the front pages as the number of first-time investors grew in the 1920s. Throughout 1929 daily papers reported that the future looked bright for investors -- even after the devastating market crash in October.And the rest is History...Read newspaper excerpts from three New York papers: The World, The New York Herald Tribune, and The New York Times.

Wave of Buying Sweeps Over Market as Stocks Swing Upward

Radio Flashes High; General Motors and Steels Soar

By Laurence SternThe atmosphere of doubt and caution which Wall Street in recent weeks has come to regard almost as habitual on Thursdays was swept away yesterday in a rush of buying...

Perhaps the market's own strength weighed as heavily with speculative minds as the logic of the situation, since the tape is the one institution Wall Street does not argue with. At any rate, the market appeared entirely confident from the opening gong. It was a firm, almost buoyant, opening, many initial transactions involving large blocks at sizable price advances...

The advance was one of the most vigorous of the year, amounting to a net gain of 6.97 points in the Dow Jones "average" of thirty representative industrial issues...

-- The World, March 15, 1929

Stocks Soar As Bank Aid Ends Fear of Money Panic

By W. A. LyonThe stock market strode out from under the shadow of a panic in call money that so lately threatened, revived in all its old strength yesterday. Assured that the New York banks were ready with their boundless resources to prevent a money crisis, the public and the professional trader set out to repair the damage done to prices on Monday and the major part of Tuesday.

Stocks in the aggregate, though bucking a 15 per cent rate for loans, enjoyed the greatest advance they have known in a single day in the last two years. Not even the surging bull markets of the memorable year 1928 saw such a day of heavy buying.

-- New York Herald Tribune, March 28, 1929

Banker Says Boom Will Run Into 1930

That at least a part of the great amount of money in the securities market may represent temporary employment of funds eventually finding their way into business uses, and that the prosperity of the present business cycle will probably not end in 1929, is the belief expressed by the J. Henry Schroder Banking Corporation in the quarterly review of the London house of Schroder.

-- The World, March 30, 1929

As for the participation rate I've said it can be tied to women entering the workforce. Now the decline is because of women leaving the workforce. Male participation rates have been steadily dropping since the 40's. People can bitch about it being because of Obama. They are flat out wrong. It's structural.

And what structure is that? I would say 90% of it is tied to the welfare state. No one thinks that Obama invented the welfare state, but he's sure got his hand on the throttle and tiller right now, and that throttle has been shoved full forward.

Well, more like almost 13 years but who's counting.

Leftists like to blame the decline in 2009 on retiring boomers, but it doesn't wash. That boomer demographic anomaly was a birth boom from '46 to '64, a worker boom from '64 to '82, and we should have seen the retirement cause participation rate fall as a gradual decline starting in '93 and ending in 2011:

Whatever impact the boomers have had has been far overshadowed by the general economy.

The real issue is the decline of women as the male participation rate has declined steadily since the 40's.

One other thing, with the boomers being born from 1946-1964, if they retire at 65 wouldn’t the retirement boom be 2011-2029? 1993 would have been age 47 for the oldest boomer. That doesn’t seem reasonable to me.

Whoa, neat graph!

The wife & I were looking at it and what we’re seeing is that men & women are still different but not nearly as much as they were a half century ago.

That's right, spotted my math error & corrected the graph. We're still seeing the boomer retirement as not explaining the sudden drop in '09. Probably what we got is demographic and cultural forces controlling trends over decades and economic forces governing over months.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.