JPMorgan/Chase is a primary EBT dispenser for most of the Gum't dole now. They are contracted to 24 states currently, but they run through most of the wealth transfer, since those states are mostly BIG ones (translated BLUE)!

Posted on 11/24/2012 5:33:22 PM PST by upchuck

[Note: This editorial published on Nov 10, 2012]

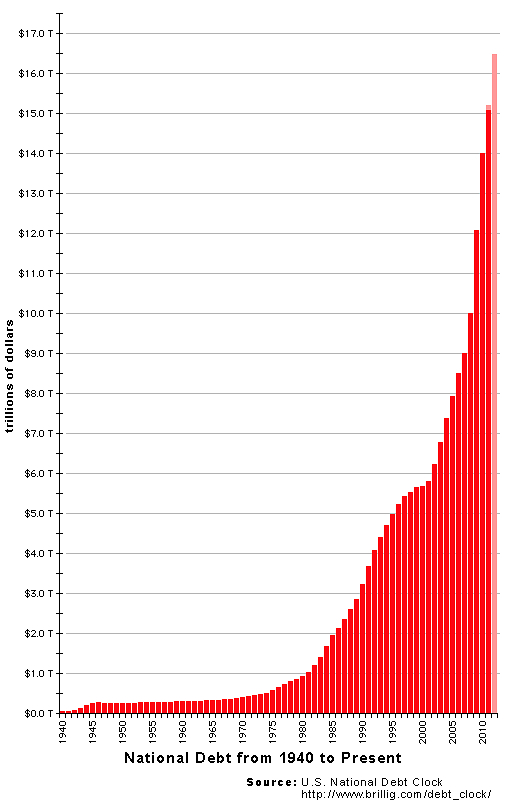

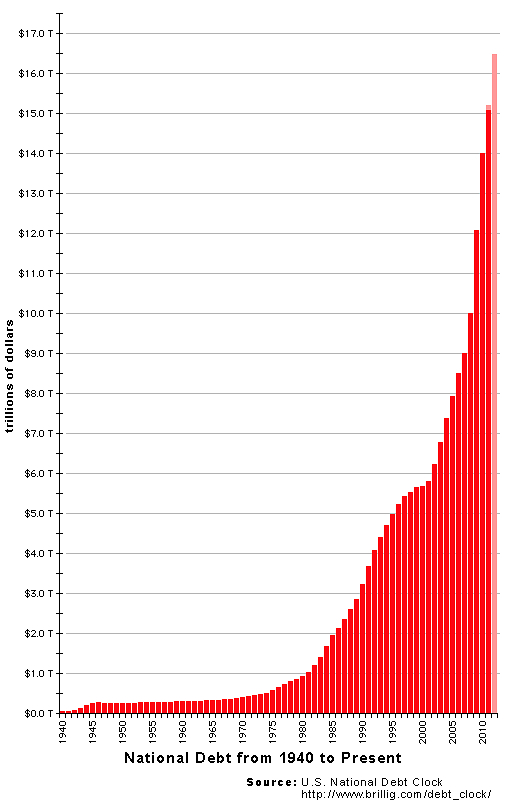

We are now rushing down a course that is going to create incredible economic hardships for millions of Americans. The increase in the amount of debt that has been added to our economy is astronomical. And there is no end in sight. We now have over $16 trillion of debt, and with Obama’s policies it will be almost impossible to reverse that course.

Debt is the problem. Big debt is a big problem. There are only four ways to tackle it: increase taxes to bring in more dollars, reduce spending to save dollars, reduce entitlements to save dollars, and/or increase job growth which will result in more overall tax dollars coming in to the government.

Increasing taxes in the immediate future is going to be highly counterproductive in that it is going to put a damper on job creation by removing money from the private sector, which in the long run is the only sure way out of this mess.

Reducing entitlements will most certainly have to take place, but is going to be very difficult due to all the lobbying pressures and the fact that Obama has no intention of doing so. Obamacare will make the situation much worse.

Reducing other spending offers some avenues to help fix the problem, but the impact of such reductions will be smaller and will, again, take time to become effective.

Increasing jobs so as to increase revenues is really the only way out. But this would take quite a number of years to accomplish even with someone who knew what he was doing at the helm. Obama is not that person. He doesn’t know how.

At the very least, after another four years the debt load this country will be carrying will be well over $20 trillion dollars. This is close to an impossible load to bear. Our tax base right now, in a good year, is only $2.5 trillion, and in a bad year is around $2 trillion. That means we have a debt to income ration of 8 to 1 or 10 to 1.

In addition, we are spending about $3.5 trillion per year, which means we are borrowing about 40% of everything we are spending. It’s pretty hard to pay off any debt when you are doing that. And how long can that be sustained?

The crux of this problem is that we are unable to deal with the huge debt without facing massive inflation. The big debt has led us right into the ugly face of inflation, the major problem we face.

Generally speaking the amount of money in an economy should be enough so that products and goods and services can be paid for with the existing supply. If the amount of product goes up, it stands to logic that there should be more dollars printed and put in circulation to go with the demand for those products. However, if a great deal more money is printed than would fill that demand, then inflation will follow. For example, if we say that $100 is equal to 1/10th of an ounce of gold, and you print more dollars and don’t add any more gold to the pile, then each dollar will buy less and less gold as the dollar becomes inflated.

In the past four years, we have done just that. Since 2008, our monetary supply has increased over 300%. This is a great more money than was needed to keep up with any increase in the supply of goods, which certainly did not increase by anywhere near 300%. Unfortunately, a great deal of this money was just wasted. What we got instead was just a lot of debt.

In addition, it needs to be noted that 36% of the debt owed by the U.S. has a maturity of less than one year. That makes it subject to frequent refinancing, which will have a severe impact as interest rates go up. The higher rates will make it necessary to print more money to pay just the interest, which in turn will add to the inflationary pressures.

We are all living just now in a ‘dollar bubble’ which is equal in specter to the ‘housing bubble’ and ‘stock market bubble’ we have recently experienced. We are living in a ‘bubble economy,’ no matter how it feels. It is always hard to see the ‘bubble’ when you are inside it. But it would be prudent to plan for it even if it is hard to see and difficult to believe.

It’s going to happen. Massive, high inflation is coming. There is no stopping it now. The “dollar bubble” is going to pop.

The problem is this. Those who have nothing to lose, you know, the parasites, takers, scumbags, are the ones out there making things happen, beCAUSE they have nothing to lose. Meanwhile, those of us that have everything to lose, don’t, because if we did, we risk losing it. We make phone calls, march a little, but until the whole thing comes down, which isnt good for us either, it will likely not change. We are at the point where we are farked. So prepare as best we can, move money around, what good it will do, and, lock and load!

is it hard to grow corn in the backyard?

**************************************************

Normally it is not. However the combo of heat and drought this past summer made it very hard.

Most of the deficit is owed to American Citizens ie: Social Security etc.

Where’s JP Morgan when you need him? He bailed out the Government when it went bankrupt before.

Instead of leaving the country I’m seriously considering moving to a small town I’ve recently become aware of in the Texas Hill country. Everyone owns guns and there are no democrats.

Well maybe you could make do with a couple of pet chickens to lay eggs?

This author understates the problem and fails to understand that the debt problem is built into our monetary system. From the day the federal reserve note and reserve banking were established, there was a designed in certainty that the total debt would always exceed the total money supply.

This is the system the entire civilized world runs on and there is no escaping the fact that at no point in time is there every nor has there ever been, enough of this thing called “money” to pay off all the debt on the books, it’s physically and mathematically impossible and always has been.

Much as I hate to admit it, this was not Obama’s doings and no matter who the President is, the choice is between more debt, exponentially more debt and total collapse of the system. There is no middle ground, there is no way to balance the federal budget. Any politician or economist saying we can actually balance the federal budget is either lying to your face or too stupid to be in charge of a lemonade stand.

JPMorgan/Chase is a primary EBT dispenser for most of the Gum't dole now. They are contracted to 24 states currently, but they run through most of the wealth transfer, since those states are mostly BIG ones (translated BLUE)!

Or, sell assets. For example, put the Grand Canyon on ebay for $16 trillion and see if China bites..

I recall reading just before the collapse of the Soviet Union that there was a loosening of the controls on small gardens. It became lawful for people to grow food for their own use. In a surprisingly short time, that 1% of the land being used to grow these personal gardens was creating 24% of the produce available.

should I cash in most of my IRA and take the penalty...what is the penalty for taking out too much......./ BEEN WONDERING ABOUY THAT and find a place to hide your girls even if its in your basement.....keep them safe....GG

What you are describing, and what I think a lot of people are missing, is that hyper-inflation can exist at a time when standards of living are rising or when standards of living are falling.

If standards of living are falling during an inflationary period, then the price of goods and services will be rising FASTER than people's ability to pay.

The farmer pays so much more for fuel, equipment, labor, and taxes that he ends up losing money even though he is able to sell his crop for ten times what he did prior to the inflation.

Some farmers go out of business, resulting in less food grown. People have to eat, but they find that their inflated salaries buy fewer groceries.

Inflation is a hidden tax on money. Such a tax makes bartering attractive and the holding of cash unattractive. Allowing hyper-inflation is like pouring sand into the machinery of our economy. The economy will slow, make awful noises, heat up, and eventually grind to a halt.

Somewhere very warm.

I agree with you. Have as much fixed interest debt as you can carry and hoard US gold & silver coins coins. Then when inflation goes wild trade the coins in for cash to pay off your debt with money to spare.

A better hedge would be resistant issues (whether debt or equity) denominated in currency of a law-abiding, property-respecting country that has a good economy underpinned by natural resources. Australia and Canada would qualify on those counts.

Mutual funds that concentrate in Aussie and Canadian natural-resource issues and consumer-goods (recession/reflation-resistant) equities and short-term debt issues would seem to be a good bet.

Virulent stagflation in the States would likely produce stagnation or even recession in other economies that do business with us and China (China is also courting an implosion, some China-watchers have warned), so running out and buying 30,000 shares of some Aussie iron-mining stock wouldn't be the best idea, but you follow my drift. Of course, that just the concept. Picking winners is the hard part.

How does THAT work?

I doubt that my bootstraps are quite that strong!

“Obama stole the election via massive fraud in Ohio, Pennsylvania, and Florida “?

Come on man, Just because over 100,000 more votes were cast in my district than were registered you can’t make the case for voter fraud now can you?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.