Posted on 10/16/2025 9:51:50 PM PDT by SeekAndFind

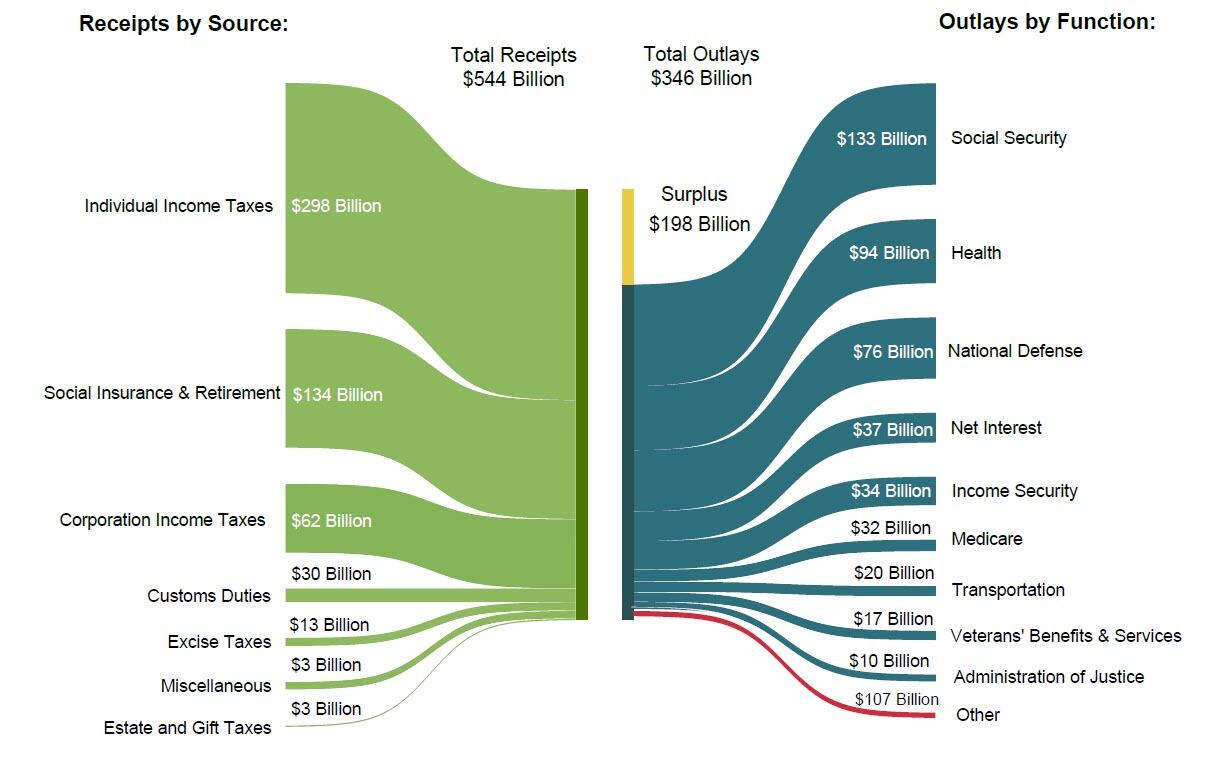

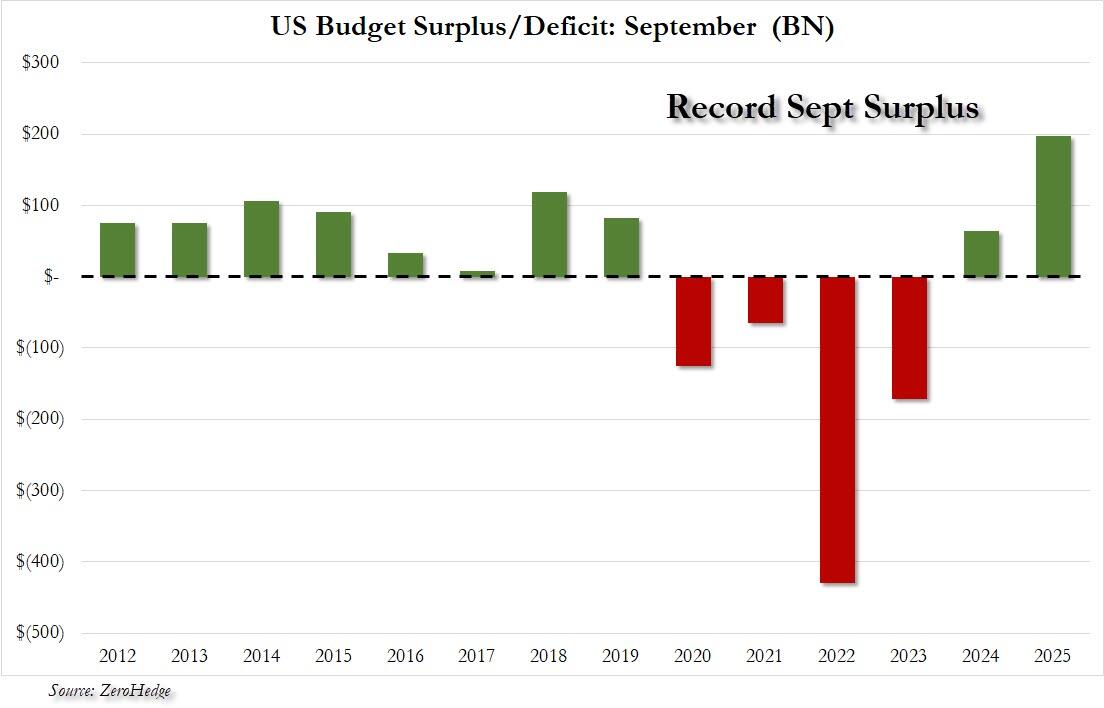

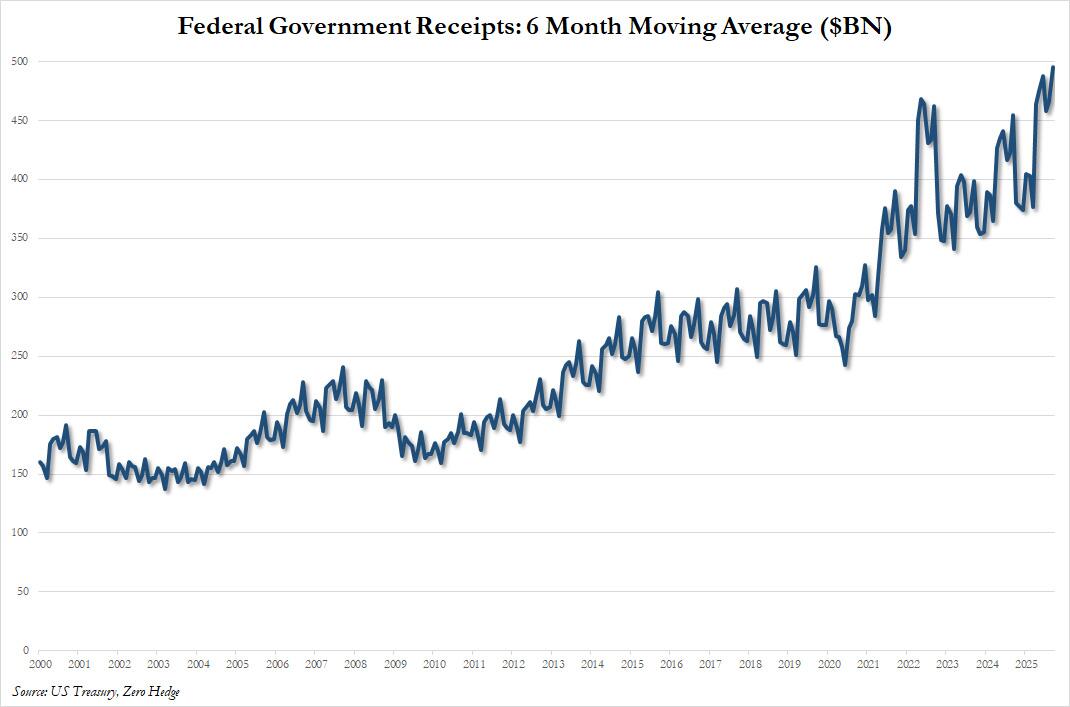

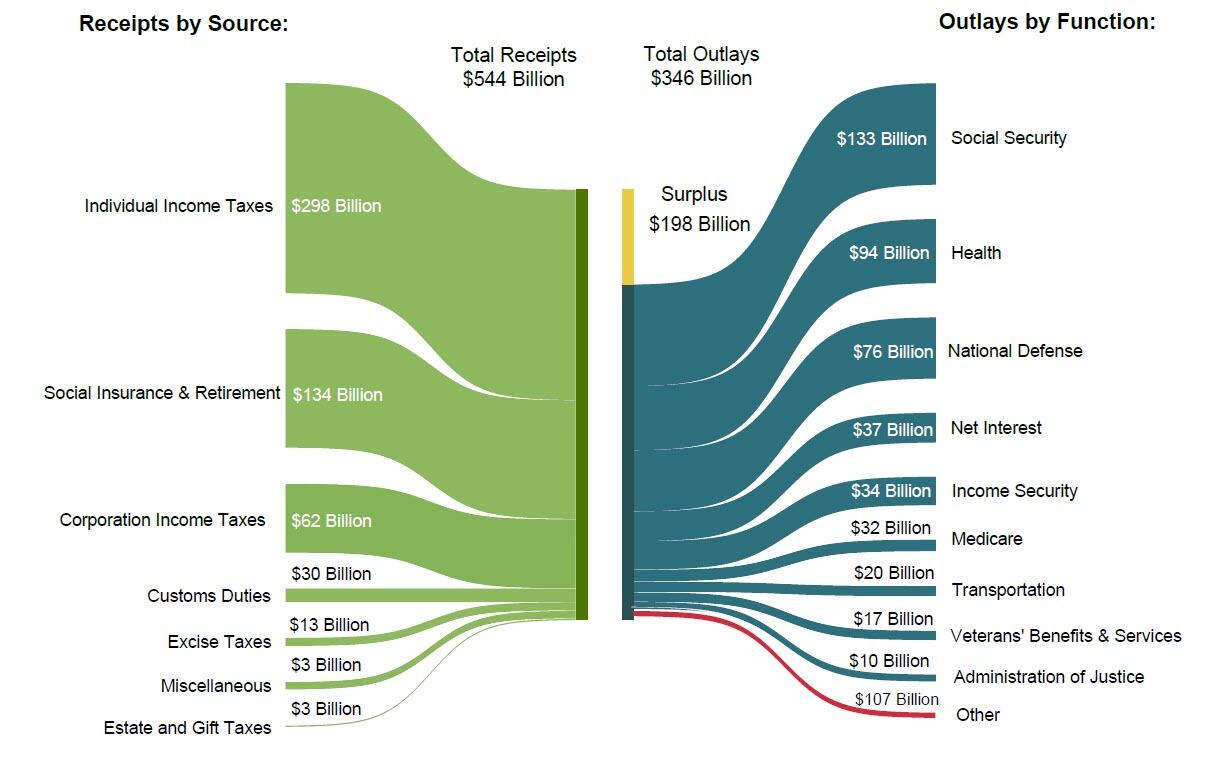

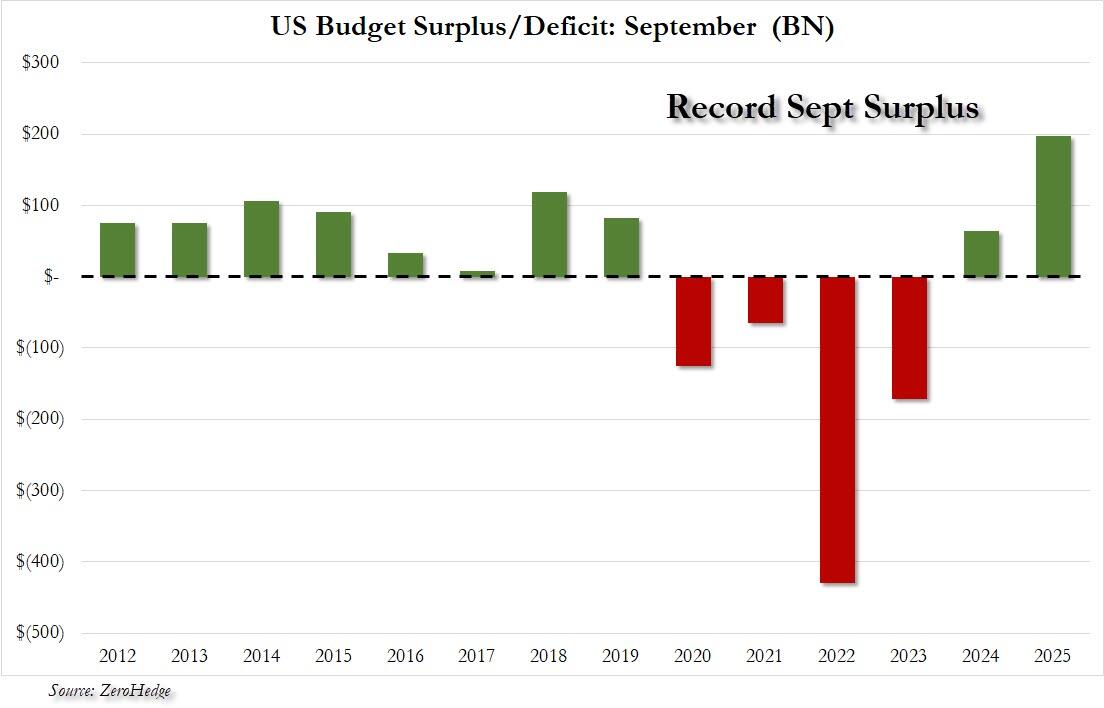

The Federal Budget Balance, a key indicator of the health of the U.S. economy, has reported a significant swing into surplus territory. The actual figure for the month came in at $198.0 billion, a stark contrast to the previous month’s deficit of $345.0 billion.

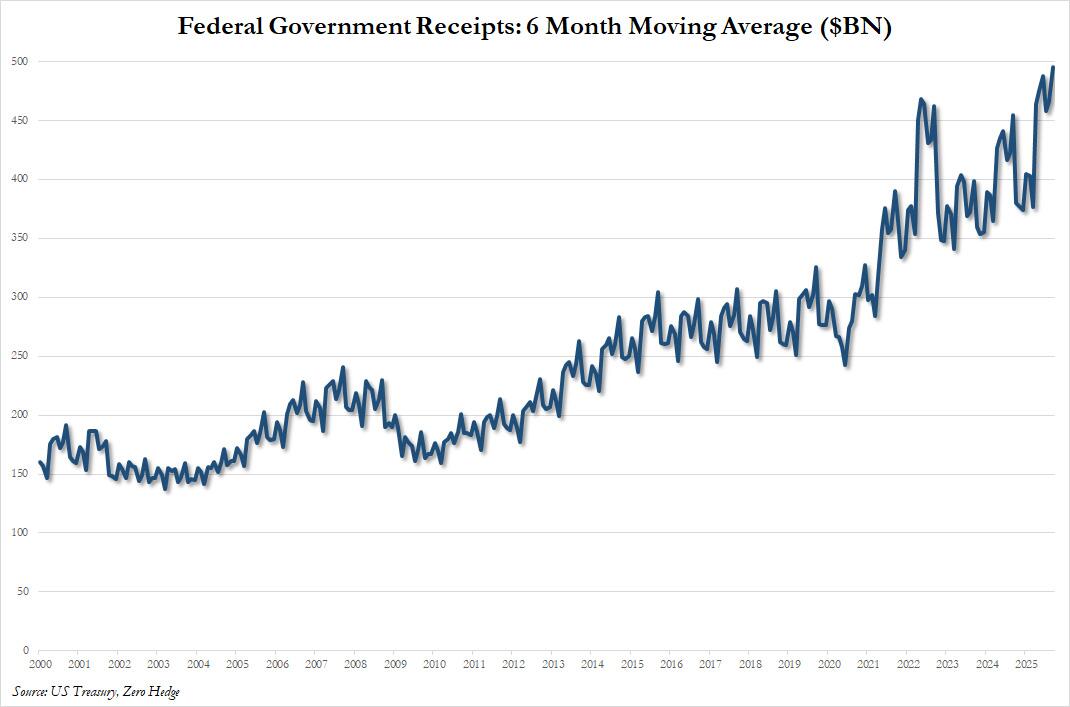

This substantial change in the budget balance has exceeded all expectations. Analysts had been forecasting a continued deficit, making this surplus a welcome surprise. The shift from a hefty deficit to a surplus indicates a robust increase in the federal government’s income relative to its expenditure for the reported month.

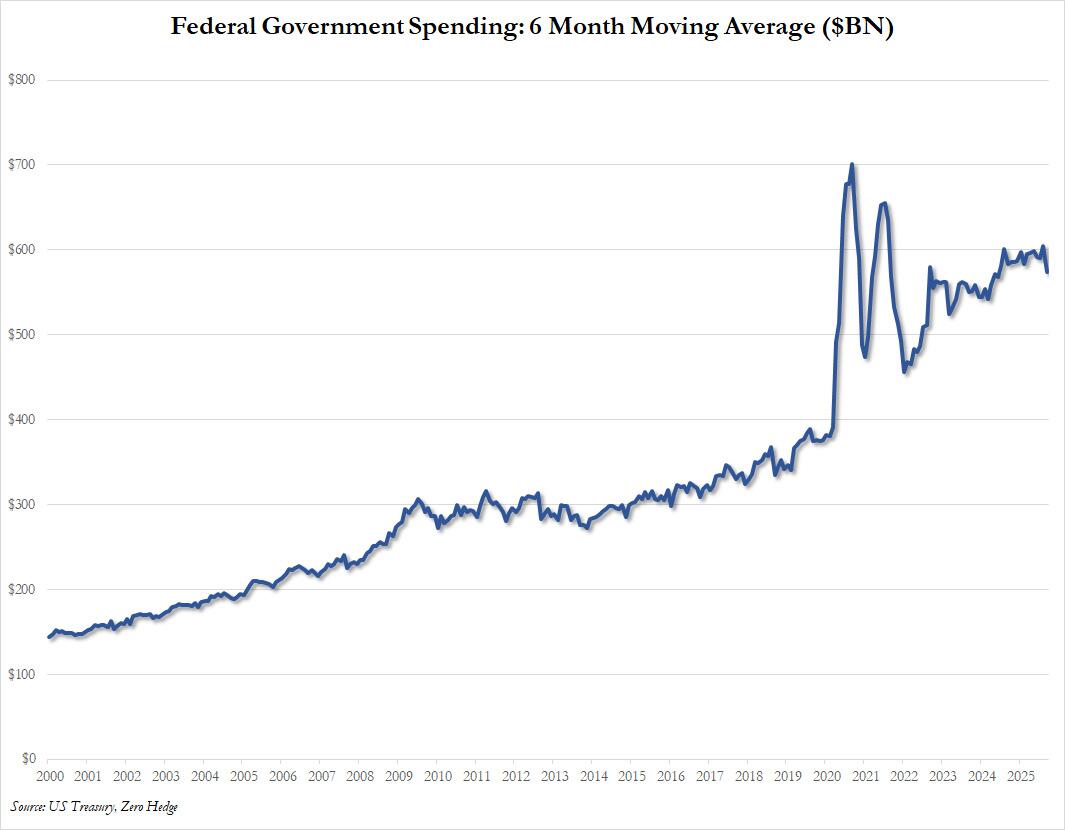

The surplus of $198.0 billion not only outperformed the forecasted figure but also marked a significant turnaround from the previous month’s deficit. This shift represents a swing of over half a trillion dollars, a change that is rarely seen in such a short period. The dramatic change in the Federal Budget Balance can be attributed to a combination of increased government income and controlled expenditure.

The implications of this budget surplus are expected to be bullish for the U.S. dollar. A higher than expected budget balance is generally considered positive for the USD, as it indicates a stronger fiscal position for the U.S. government. This surplus could potentially influence investors to increase their holdings in U.S. assets, which would further strengthen the dollar.

However, it’s important to note that while a single month’s surplus is a positive sign, it doesn’t necessarily indicate a long-term trend. The Federal Budget Balance is a volatile figure that can be influenced by a variety of factors, including changes in tax revenues, government spending, and economic conditions.

Nevertheless, this unexpected surplus provides a much-needed boost to the U.S. economy, indicating a stronger fiscal position and potentially laying the groundwork for a stronger U.S. dollar.

As they say in football games that have two minutes left...it is better to be up by 7 rather than down by 7.

This may not be a long term trend and it won’t be until we start stringing them together. But it is better to have any surplus rather than a deficit.

We used to have consecutive years of budget surpluses in the late 1990’s when Newt Gingrich was the Speaker and Slick Willy was President. Oh, for those days to return...

Democrats deeply saddened.

Crazy that we have to look that far back to see fiscal sanity!

But I will take it, even one month. You cannot climb a mountain until you take the first step...

Seems to be an article that heralds the stats, then tells us

to wring our hands for what’s just around the corner.

Unless I missed it, not ten cents worth of credit is given

to Trump for masterminding this situation.

Even people who are supposed to be on our side, have no

idea what the hell is going on.

The Left is out on the streets with their message as biased

but clear as it can be. We couldn’t sing a verse out of

a hymnal in unison.

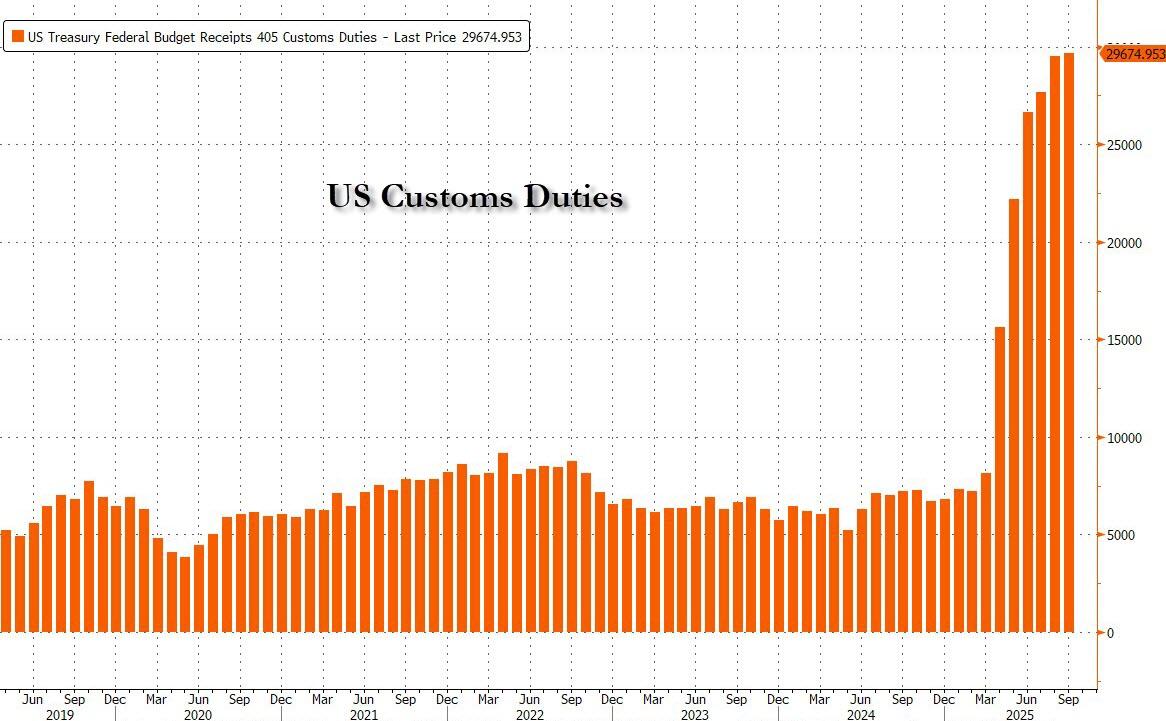

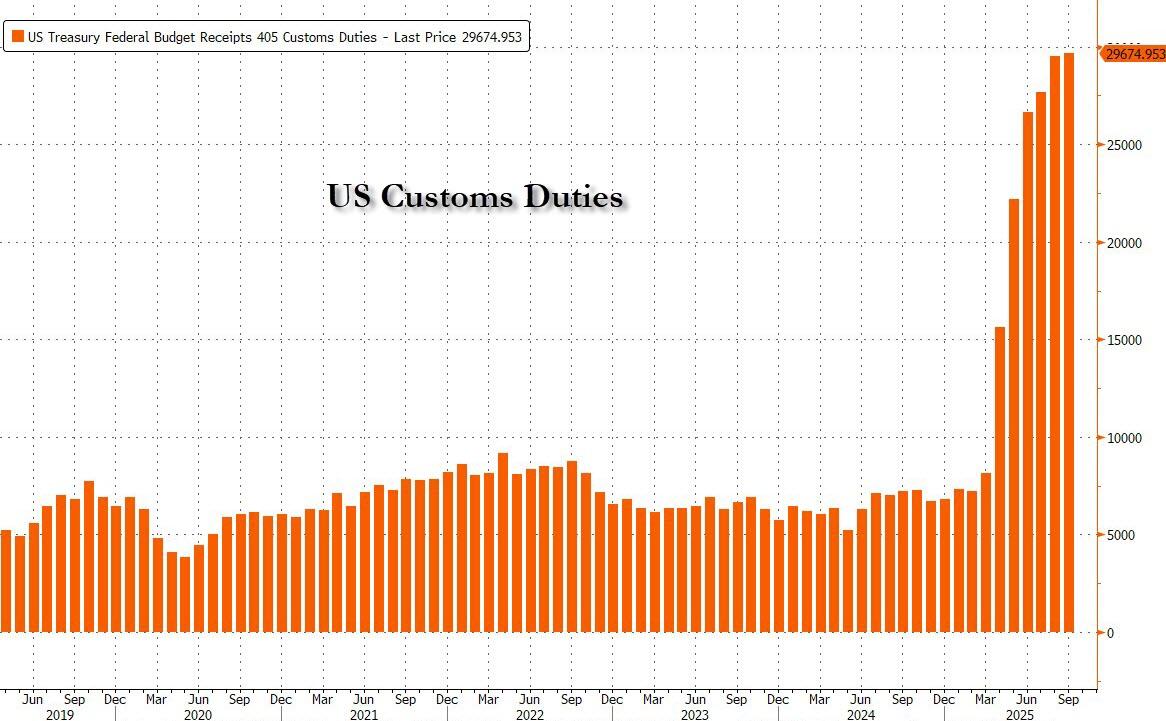

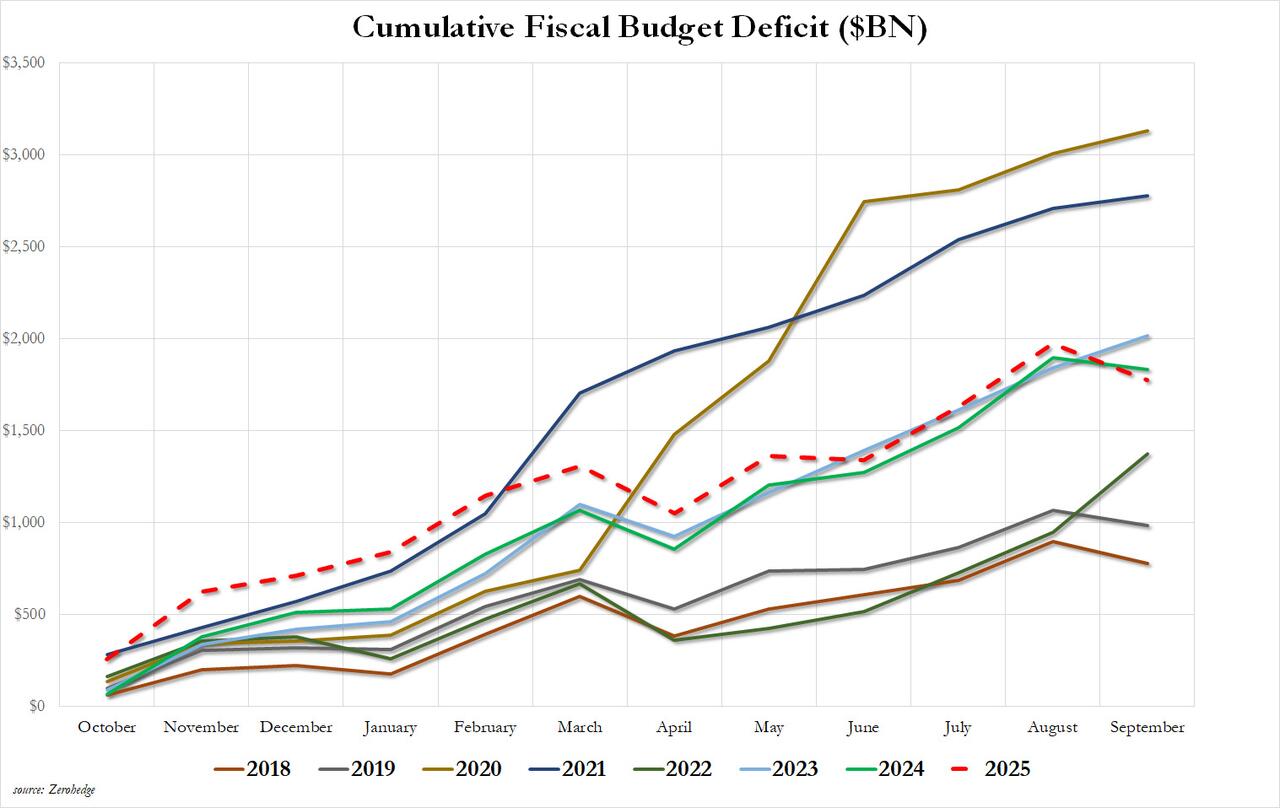

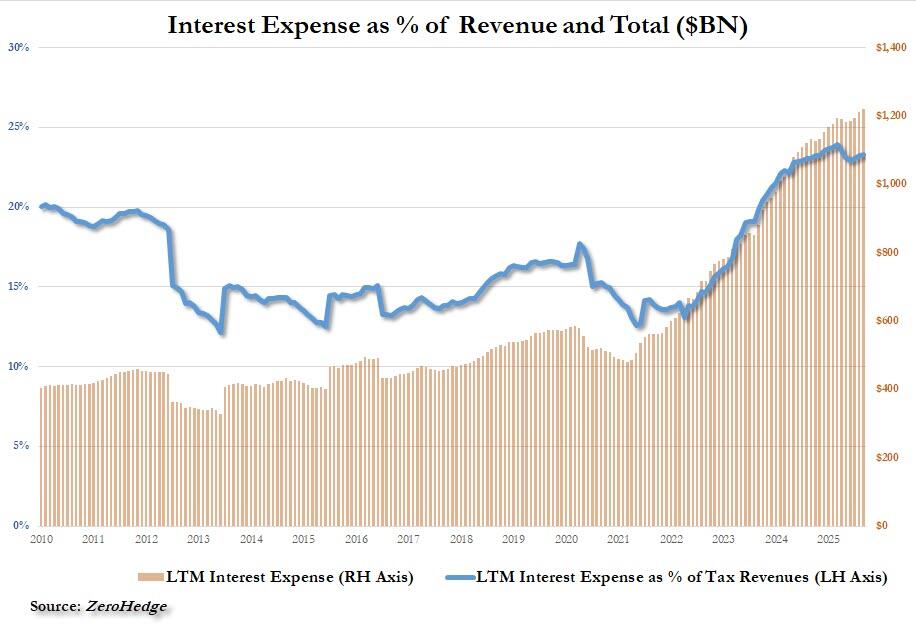

Fiscal year 2025 logged in with a deficit of 1.78 trillion dollars. That included about 6 months of tariff income and that number as I recall was about 200 billion. I probably should revisit that but if 200 billion is the number then that deficit becomes 1.98 trillion without the tariff income.

I shouldn’t phrase it that way. It’s not without the tariff income. It’s without the extra tariff income since there were some tariff receipts in fiscal year 2024.

And of course since the purpose of the tariffs is to drive manufacturing back to the United States, should that take place the tariff income disappears.

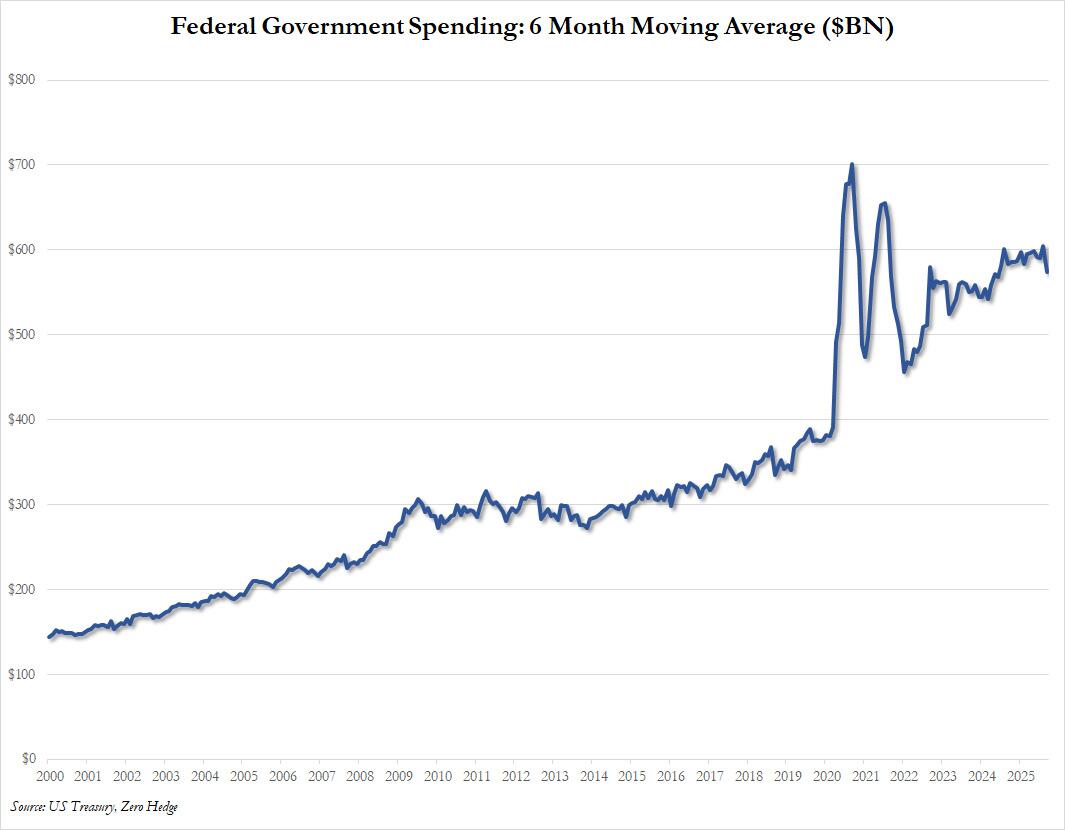

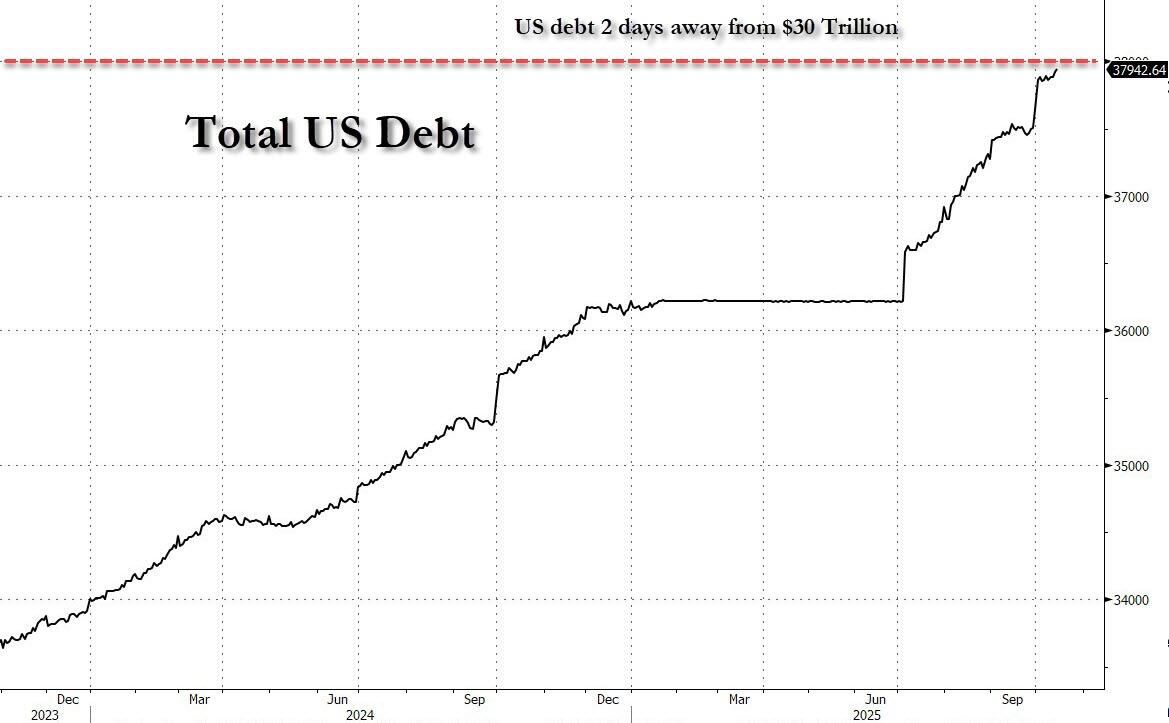

This celebrating a single month’s number after an entire year at almost 2 trillion dollars of deficit is pretty much absurd. And no a long trip is not started with a single step. A long trip up a downward moving escalator doesn’t care about your single step because if your steps are slow enough the escalator will take you down to where you started and further.

Chuck-you Schumer will be salivating to spend it - and more.

.

> Unless I missed it, not ten cents worth of credit is given

to Trump for masterminding this situation.<

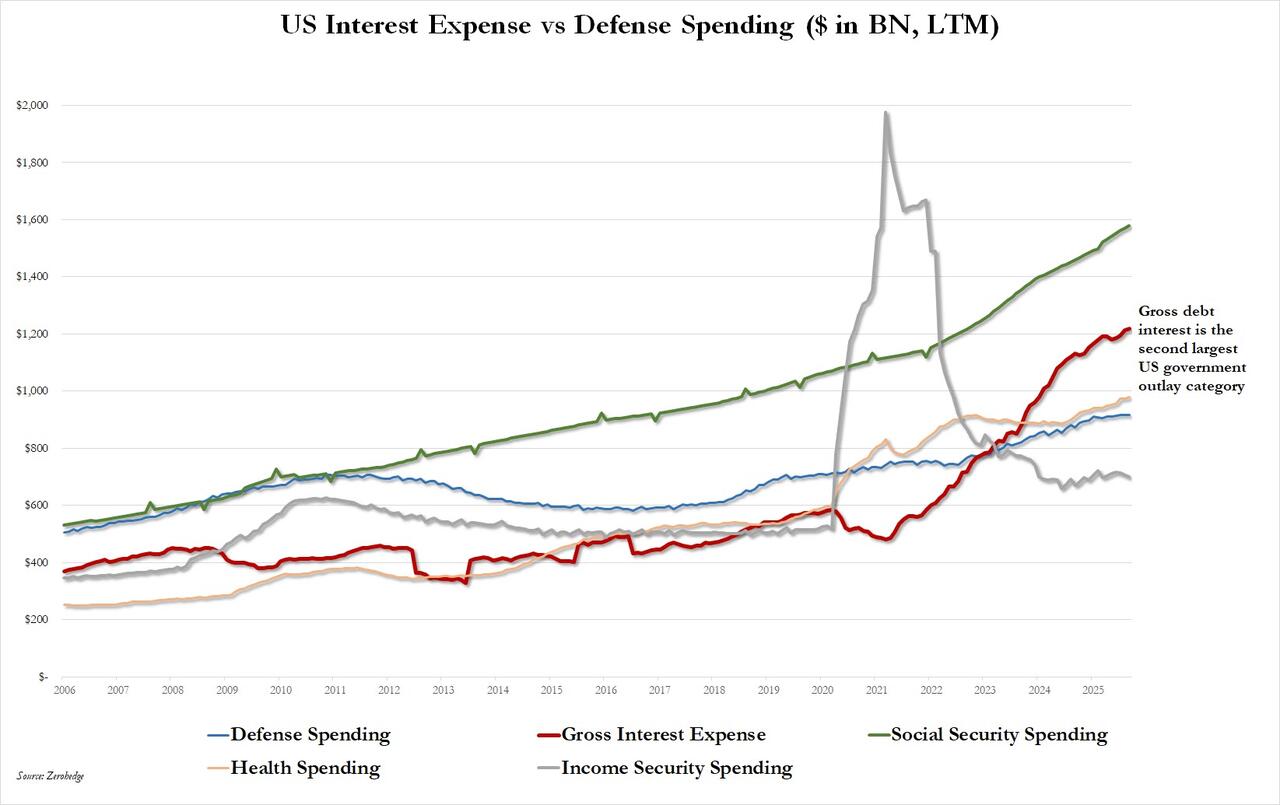

The graphs are telling. Not ten cents worth of blame is shined on Biden Inc for the ugly looking period of 2020-2024.

EC

So, the shut down of fed gubmint is working.

We are a really long way from there.

Look for Judge Boasberg to immediately demand at least $400 billion in retroactive spending.

Exactly. Any improvement in the monthly numbers is welcome ... but we are still running a huge deficit, so an improvement in the monthly figures just means that we are going bankrupt slightly less slowly.

By all means, let’s acknowledge the progress. But we still haven’t touched the core problem, which continues to be entitlement spending. We still have to deal with Medicare, Medicaid and Social Security.

True that. But the tariff tax revenues would be repealed by business tax revenue and taxes on personal income. All the more so with low tax rates (Laffer Curve) and less illegal immigrant labor (often untaxed labor).

Sorry. I meant replaced, not repealed.

.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.