Posted on 04/15/2024 9:26:51 AM PDT by george76

A series of weak auctions for U.S. Treasurys are stoking investors’ concerns that markets will struggle to absorb an incoming rush of government debt.

...

inflation not tamed ... Federal Reserve will leave interest rates at multidecade highs for .. years to come. The 10-year yield—the benchmark for borrowing rates on everything from mortgages to corporate loans—finished the week around 4.5%...

At the same time, the government is poised to sell another $386 billion or so of bonds in May—an onslaught that Wall Street expects to continue no matter who wins November’s presidential election. While few fear a failed auction—an unlikely scenario that analysts said could potentially trigger prolonged turmoil—some worry that a glut of Treasurys will rattle other parts of the markets, raise the cost of government borrowing and hurt the economy.

“There’s been a big shift in the market narrative. The CPI [consumer-price index] report changed everybody’s view of where Fed policy is headed,”

...

In the first three months of 2024, the U.S. sold $7.2 trillion of debt, the largest quarterly total on record. That surpasses the second quarter of 2020, when the government was financing a wave of Covid-19 stimulus. It also builds on a record $23 trillion of Treasurys issued last year, which raised $2.4 trillion of cash, after accounting for maturing bonds.

...

the deficit will increase from 5.6% of U.S. gross domestic product to 6.1% ... Debt held by the public is set to expand from $28 trillion to $48 trillion in that time, up from $13 trillion 10 years ago.

...

A record $8.9 trillion of Treasurys, roughly a third of outstanding U.S. debt, is set to mature just in 2024,

...

If we continue to see hot inflation prints, it’s going to keep a lot of people on the sidelines

(Excerpt) Read more at wsj.com ...

no one in their right mind wants to lend money to a criminally corrupt, bankrupt government ....

Some time ago, the Vice President of the CCP’s Central Bank said (several times, actually) how it was a losing proposition for Communist China to lend the USA government money (buy our bonds) when the USA government depreciates the real purchasing value of our currency far faster than compensated for by the interest on the bonds.

Lend 1 billion, get back 1.05 billion YES... But that 1.05 billion will, when finally received, only actually purchase 0.6 or 0.7 Billion of merchandise, material, products, services.

So Bejing suffers two losses. First, it is losing today...not getting, buying things it wants or needs today. Deferred investment in their own country.

Second, when China finally gets their bond money back it will only buy them LESS goods and services than when they lent the funds in the first place.

If there’s anything the Communist Chinese bankers understand, and understand well, it is how capitalist free markets function.

$2-$3 Trillion per year in Fed.gov deficits is finally giving the world pause.

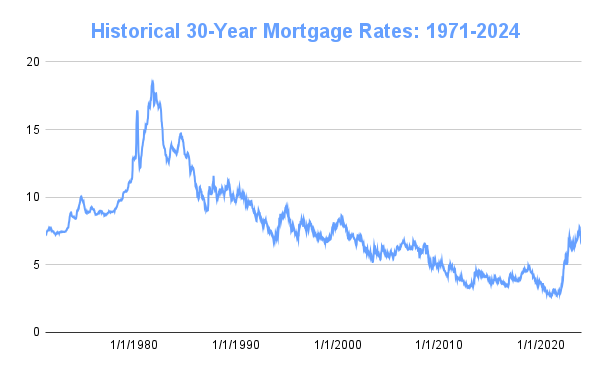

Making the obvious point that interest rates are way too low, and that what Biden and his sycophant Powell have done is created the situation where we need early ‘80s interest rate levels.

If the Zoomers and Millennials thought 7% was rough, wait till they see 14% mortgages.

We are just one failed Bond Auction away from disaster....................

Not just that, but we're talking about supply and demand. Supply for US Treasuries are off the charts high with the U.S. gov printing more and more money. Meanwhile demand is down with the Federal Reserve lowering their balance sheet (not buying new treasuries to replace the old ones after they mature).

we saw mortgage interest rates peak at 21.5% for awhile back in the Jimmy Carter era.

This is why alI borrowed a large sum of money for my business in 2021 when I was anticipating a steep rise in interest rates. I front-loaded a bunch of capital expenditures and kept some funds in reserve for future expenses.

Yeah, I remember

Was short period though in ‘82

Stayed north of 12% - 16% for a long time though, basically until the Reagan tax cuts kicked in and got the late ‘80s economy going again...which then collapsed due to the S&L crisis!

Back to the Future

Still frightening. I remember it all!

So other than buy gold, silver and short term TBills what do we do?

FYI, I just watched Peter Schiff on the PBD podcast this weekend. He is about half gold, gold mining stocks and energy stocks.

A government run by criminals, for criminals.

We’re broke.

Sure, we got good cash flow, but we’re broke.

We can right the balance sheet if we sell California.

5.56mm

Smart

Newsflash!!!!!

They’re always getting either harder or easier to sell.

The fed does not control the long end of the yield curve.

We’re $200,000,000,000 trillion in debt/unfunded obligations-

and folks-moistly American citizens are still willing to lend their hard earned money to the govt for 30yrs at 4.74% at the moment.

If Putin could borrow at 4% instead of 16%, Russia borrowing at rates less than us would be posted here constantly. He is paying more than junk bonds. China has an A+ rating which is numerous levels below our AA+-never posted here in a headline one time.

Yet Putin is a genius and China will be over taking the world.

America’s Bonds Are Getting Harder to Sell

_____________________________________________________

Not to the Fed they aren’t.

Uncle Pamela

Auntie Pam

Uncle Pam

Uncle Susan B.

Gold mining stocks haven't done crap in years. Go figure the disconnect..

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.