Map: Wirepoints Source: IRS SOI migration data Get the data Created with Datawrapper

Posted on 04/28/2023 6:44:15 PM PDT by SeekAndFind

Illinois, New York and California continued their streak as the nation’s biggest losers of residents and their wealth to other states, according to a Wirepoints analysis of newly-released Internal Revenue Service migration data.

Texas and Florida continued to be the nation’s big winners.

The latest IRS state-by-state migration data is based on tax returns filed in 2020 and 2021, covering taxpayers (tax filers and their dependents) who moved from one state to another between 2019 and 2020 (see appendix for changes in our reporting methodology).

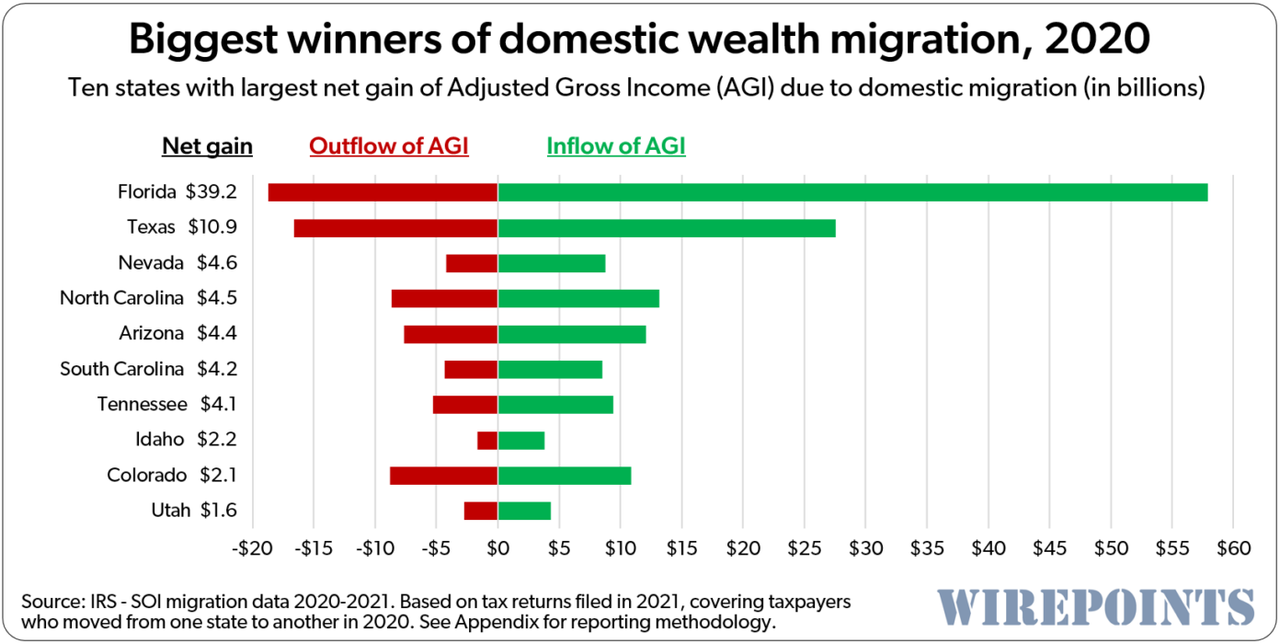

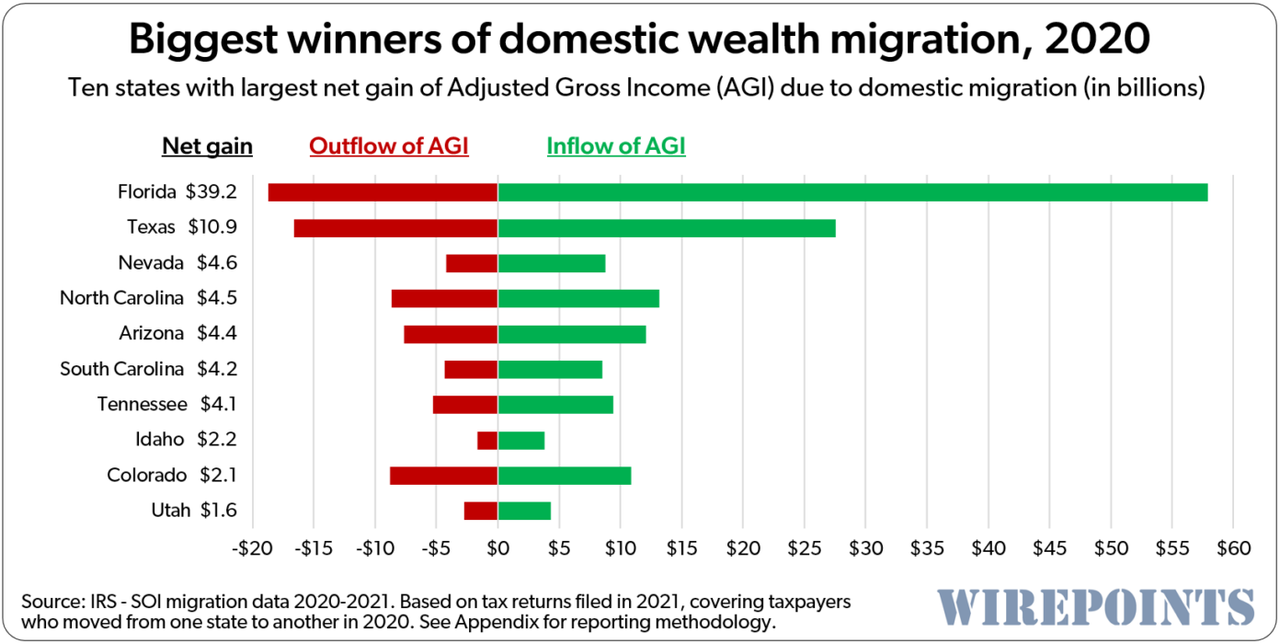

Florida, the nation’s perennial winner, gained in 2020 the most net people, 256,000, and the most net Adjusted Gross Income (AGI), $39 billion. Texas followed with a gain of 175,000 people and $10.9 billion in AGI.

In contrast, states like California, New York and Illinois once again experienced some of the nation’s biggest losses. California lost more people than any other state, with more than 332,000 net movers taking $29 billion to other states.

Wirepoints’ accompanying Illinois analysis includes a long-term look at out-migration from the state.

Map: Wirepoints Source: IRS SOI migration data Get the data Created with Datawrapper

The IRS migration report provides hard, indisputable data on the movement of Americans between states. The agency reviews tax returns annually to track when and where tax filers and their dependents move. It also aggregates the ages, income brackets and adjusted gross incomes of filers.

Winners and losers

The Sunshine State attracted over $57.9 billion in Adjusted Gross Income (AGI) from 699,000 new residents (tax filers and their dependents) that moved into Florida in 2020. On the flip side, Florida lost $18.7 billion in AGI from 443,000 people who left. On a net basis, Florida came out ahead with 256,000 net new people and $39.2 billion in net new taxable income.

That was a total gain of 3.1 percent of the state’s total AGI ($711 billion).

Texas was the runner up with an AGI income gain of $10.9 billion, followed by Nevada with $4.6 billion. North Carolina and Arizona rounded out the top five with net gains of $4.5 billion and $4.4 billion, respectively. (See Appendix for top 10 winners of people.)

On the losing side, California suffered the worst outflow of money of any state in 2020. The Golden state lost a net $29.1 billion in income, or 2.0 percent of its AGI, while a net of 332,000 residents moved out.

New York was next, losing a net $24.5 billion and 262,000 people. Illinois was 3rd with a net loss of $10.9 billion and 105,000 people. Massachusetts and New Jersey were in 4th and 5th place, with $4.3 and $3.8 billion in income losses, respectively. (See Appendix for top 10 losers of people.)

Tables with each state’s ranking in migration gains/losses are provided below.

The cumulative impact of income losses and gains

The problem with chronic outflows, like in the case of New York, is that one year’s losses don’t only affect the tax base the year they leave, but they also hurt all subsequent years. The losses pile up on top of each other, year after year. And when a state loses income to other states for 21 straight years, the numbers add up.

In 2020 alone, New York would have had nearly $144 billion more in AGI to tax had it not been for the state’s string of yearly migration losses. And when the state’s AGI losses are accumulated from 2000 to 2020, it totals $1.1 trillion in cumulative lost income that could have been taxed over the entire period.

The opposite is true for migration winners like Florida. Gains in people and income pile on top of each other each year, building an ever-growing tax base. In 2020 alone, the state’s tax base was some $230 billion higher due to the 21-year string of positive income gains from net in-migration.

Even though Florida doesn’t tax incomes, Wirepoints also added up Florida’s cumulative AGI to make an apples-to-apples comparison with New York. When the Sunshine State’s AGI gains are accumulated from 2000 to 2020, it totals $1.75 trillion in income that could have been taxed over the entire period.

The competition for people matters

Illinois, one of the nation's other big losers, shows just how damaging being an “exit” state can be – especially when a state starts to lose its wealthier residents and they are only partially replaced by people who make less. The Illinoisans who fled in 2020 earned, on average, $44,000 more than the residents Illinois gained from other states. That’s the biggest gap since at least 2000, based on Wirepoints’ analysis of the IRS data.

Based on a percentage of total income, Illinois ranked 2nd-worst nationally for income losses in 2020. Illinois lost 2.5 percent of its AGI. Only New York was worse, with a loss of 3.1 percent.

In contrast, Florida was the nation’s big winner on a percentage basis in 2020, gaining 5.5 percent of its AGI base. The nation’s top five were rounded out by Nevada, Idaho, Montana and South Carolina.

******************

The IRS data shows for yet another year Americans chose better managed, less expensive areas over larger, government-centric, high-cost cities and states. And it provides a glimpse of a demographic future in which states that prioritize an affordable, less intrusive government will dominate those that over-tax and over-regulate the lives and businesses of their residents.

Gosh, look at that.

People hate the communist progs and are voting with their feet.

How DARE they...

.

Be quiet, you heretic! Trump says Florida is a failed sh—hole, and his disciples are all over the place!

Texas is getting a lot of business and a lot of immigrants.

Virginia is a pretty high tax state, at least the parts near DC, and I can’t figure out what they spend it on.

Clearly the solution is to require internal passports and Federal Relocation permits. /s

The issue is FREE States and FEAR States!

COVID unleashed the inner Libertarianism of the formerThey move & then they vote Democrat in their new home.

Hyena never chages it’s stripes.

So things will be getting cheaper in CA and NY state?

And more expensive in FL and in TX?

Regards,

I’d say things will be getting bluer in FL/TX because yankee conservatives are not the same as Southern conservatives.

The truth is we have a bunch of whiny-butt Californians here now, affecting our culture, home values and property taxes.

This is not a "win" for Texas. They can take their $$ somewhere else.

Albany is cool with replacing makers with takers.

Makers don’t employ as many bureaucrats.

And Deep State will be happy to cover the shortfall with guess whose money.

Note to the other 49’s taxpayers: You’re not helping.

You’re FReeping with a Yankee conservative.

And all the people we know who’ve bugged, some to FL, are as MAGA red as we are.

If we were as blue you seem to think, Deep State wouldn’t need to steal our elections, would it.

I’m grew up in what is now commie MA, spent 25 years in Ctrl FL and live in rural MO now. I’m not afraid to admit that there’s a different way of thinking among natives of different places. Hell, FL was within 30k votes of electing a commie governor. If Trump hadn’t endorsed DeSantis...

I can’t afford FL anymore.

Totalitarians never think their wonderful policies are to blame, it’s only the unenlightened, fleeing masses that are to blame. Tax base disappearing? Remember the Berlin Wall? Something akin to this legislatively will be attempted in those blue hellholes.

Who knew that if you tax something more, you get less of it? Well, let’s hope the criminals, welfare mommas, and illegals will pick up the slack and pay their fair share. I see a lot more Detroits in our future.

The blue states’ politicians are doing this for several reasons, one of which is to drive small businesses, the middle class, and conservatives out. On the face of it the act of driving out taxpayers seems insane and destructive so why would they do it? They wouldn’t... unless they were getting reimbursed for their losses by DC.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.