Posted on 10/02/2022 8:38:18 AM PDT by george76

One of the biggest advantages of Social Security is that its payments get annual cost-of-living adjustments (COLAs). When inflation is high -- as seniors have seen during the past couple of years -- these COLAs cause monthly checks to rise the following January to help retiree purchasing power keep pace. 2022's COLA boosted benefits by 5.9% this year, and early estimates make it likely that the COLA that will take effect in early 2023 will be between 8% and 9%.

What's even better news is that, unlike in 2022, many Social Security recipients are more likely to see the full amount of their cost-of-living adjustment actually hit their bank accounts. That's because the impact of another key program for older Americans, Medicare, is likely to reverse the painful blow it dealt participants this time last year.

...

The 5.9% COLA that took effect at the beginning of 2022 increased benefits for about 70 million Americans.

...

However, even those who were eligible for those benefits didn't see their actual checks rise that much. That's because the Social Security Administration automatically withholds Medicare premiums for those recipients who have enrolled in Medicare.

In 2022, the increases in Medicare costs for retirees were extremely high. Medicare Part B premiums jumped 12.7% in 2022, from $148.50 in 2021 to $170.10 this year. That took away $21.60 per month out of that $90 average benefit boost.

...

much of the increase came from a single factor: the Biogen Alzheimer's drug Aduhelm

...

Don't go spending that money just yet..

(Excerpt) Read more at nasdaq.com ...

“...Note the premiums are based on Modified Adjusted Gross Income..”

It’s “modified” by adding back in all your tax free interest, etc so as to inflate your income the better to hose you.

👍

NOT ONE TIME-—

CAN MOVE/SELL/MOVE AGAIN/SELL/MOVE AGAIN-—NO LIMIT

Must have property as your primary residence 2 years & ONE day minimum.

SOO—Move now out of your current residence—move into a rental property (IF you have one) and stay there 2 years & 1 day minimum-—Sell that & get a new EXEMPTION., ETC ETC..

Got a ‘Vacation house’ that is really nice—away from city, etc??

You sell your current residence—if there over 2 years & 1 day—and move to your vacation house with exemption..

NOT LIMITED TO ONLY ONE TIME.

Can repeat every 2 years & 1 day if you wish.

$500,000 exempt PROFIT if married-—$250,000 if single.

NOT SALE PRICE CALCULATIONS..2 different sets of numbers.

STRICT ABOUT 2 YEARS & 1 DAY, tho.

You must keep excellent records.

Nice to be able to vote FOR YOUR OWN RAISE——

It is odd. Probably intentional to tax even more SS benefits.

NANCY & OBAMA want to tax you on “PERCEIVED” gains on your assets.

It’s 85% taxable, I believe. Thank Slick Willie for that.

Employer matching is the biggest job killer and hindrance to wages. When you are hired, the employer has to match your SS withholding, pay state and federal unemployment tax and workman’s comp. Is it any wonder employers leave the country?

They’ll all probably blow it on a quart of gasoline.

Check with your Social Security office to see if they’ll raise the amount of your monthly check... worth a try.

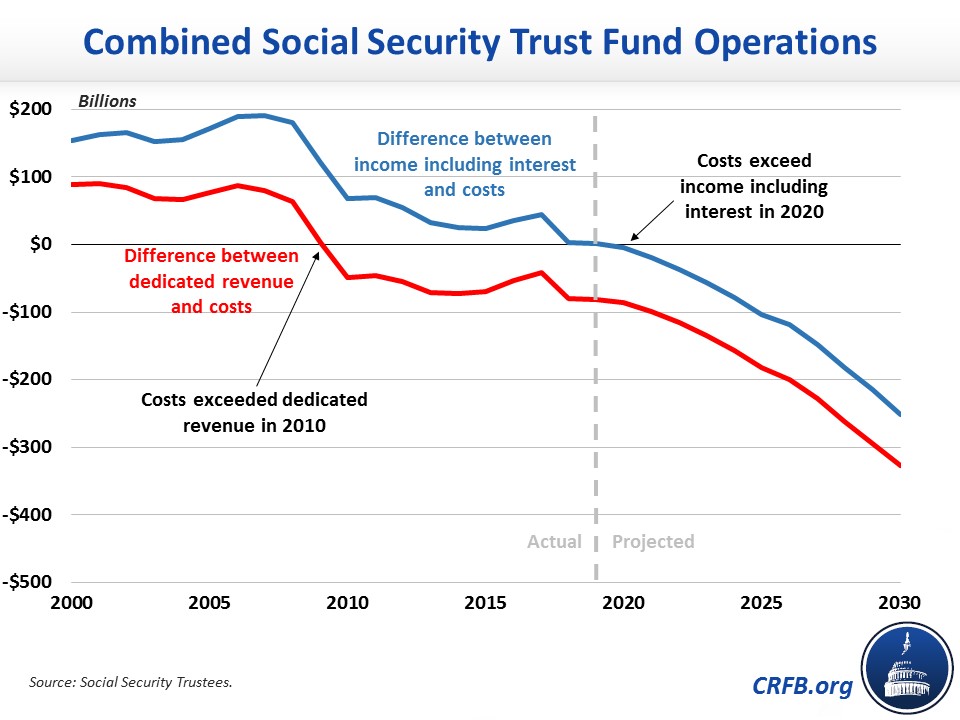

Keep in mind that 100% of the Social Security investments are in US Government Securities. THERE ARE NO RESERVES.

The Social Security Trust Fund will be depleted by 2034, based on current law projections. Payments to beneficiaries thereafter will be limited to program tax receipts. Source: 2015 OASDI Trustees Report.

Trust Fund obligations are considered “intra-governmental” debt, a component of the “public” or “national” debt. As of June 2015, the intragovernmental debt was $2.8 trillion of the $31 trillion national debt.

The Trustees project that the combined OASI and DI Trust Fund reserves will continue to decrease in 2022 because total cost ($1,243 billion) is expected to exceed total income ($1,196 billion) and that OASDI total cost will continue to exceed total income each year throughout the 75-year projection period.

The U.S. Federal Reserve currently holds $5.7 trillion of government debt (not including debt held under repurchase agreements). Prior to the COVID-19 public health and economic crisis, the Fed held only about $2.5 trillion in federal debt. The Federal Reserve printed money to loan it to the US Government. The Fed owns about 23% of the US Debt. (Thus the high inflation... the money spent was not borrowed per se, they just printed the $$$$$.)

If the feds were concerned about “seniors,” they would exclude SS payouts from federal income taxes.

I heard that it was the Corpus Christi Teacher’s Retirement system.

Makes me glad I never owned anything in my life.

I am always amused by mentions of the “Social Security Trust Fund”.

Here it is:

I am equally amused when some Freepers try to paint lipstick on that pig.

;-)

So how would this work in the following scenario.

2023 - Rebuilding house - taking out $200,000 from 401(k) - not taking S.S. still working - Job + 401(k) paying taxes

2025 - starting to take S.S. Over 68yr. - Would Part B costs be effected ?

I have gotten a kick out of the reports that seniors were

going to be getting ‘big’ raises, from time to time. As

others have posted here, those big raises are gobbled up

by Part B and whichever plan folks have bought to help

cover the amounts not covered by Medicare A & B. And

if you have Medicare Part D, good luck with that also.

If folks wind up with extra after it all shakes out each

year, it won’t be much.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.