Skip to comments.

Broader Market Rallies Right Up a "Wall of Worry"--Weekly Investor Thread March 22, 2015

Weekly investment & finance thread ^

| Mar 22, 2015

| Freeper Investors

Posted on 03/22/2015 7:24:29 AM PDT by expat_panama

Prices in both precious metals and stocks are booming again: metals are soaring as if they're looking for higher bases and stock indexes are within a couple percentage points of all time highs. The good news is that this time the experts show no sign of confusion as to what's going on and they've all decided what we need to do. It's all because of the Fed, international tensions, and the NCAA. The bad news is that each expert's saying something different.

Here are a few samples:

(excerpt from) ...Because March Madness begins next week, you might want to stay out of the stock market until it ends April 6. (excerpt from) ...Because March Madness begins next week, you might want to stay out of the stock market until it ends April 6. Come again? What does the NCAA men’s college basketball championship have to do with the stock market? More than you think: Believe it or not, stocks more often than not produce below-average returns during widely followed sports tournaments.  Last year’s March Madness was a case in point. Despite an overall positive year for equities, the S&P 500 fell 1.5% between the opening round of the 2014 NCAA championship and the final game. A rigorous study that appeared in the August 2007 issue of the prestigious Journal of Finance suggests that last year’s experience was not a fluke. The study, “Sports Sentiment and Stock Returns,” was conducted by finance professors... [snip] By the way, the non-sports fanatics among you shouldn’t become too holier than thou because of the lunacy of sports hysteria.The relationship between the stock market and investor mood extends well beyond sports. Just take the move to Daylight Saving Time, which took place this past weekend. Another academic study, which appeared in the September 2000 issue of the American Economic Review, found that the stock market’s returns are significantly below normal, on average, following shifts to Daylight Saving Time. To explain those results, the authors theorized: “We have all struggled through a day after a poor night’s sleep, weighed down by weariness, fighting lethargy and perhaps even facing despondency.” The bottom line: Take some (money) chips off the table for the next couple of weeks, and replace them with some (corn) chips while you watch the tournament.

|

|

(excerpt from)

As Central Banks Battle, Will Global Economy Suffer? Monetary Policy: A battle is taking shape between our Federal Reserve, which wants to raise rates, and Europe and Japan, which show no signs of ending their easy-money ways. The split threatens the world economy.

Since the financial crisis ended in 2009, the world's central banks have experimented with monetary policy like mad scientists in a bad horror movie.

Actually, Japan started it 14 years ago, in the middle of a seemingly endless economic slump and deflation, by doing what it called Quantitative Easing (QE) — buying bonds with money printed by the central bank to push down long-term interest rates and boost investment. By 2010, it was actually buying corporate stock on the open market — something unheard of at the time. Actually, Japan started it 14 years ago, in the middle of a seemingly endless economic slump and deflation, by doing what it called Quantitative Easing (QE) — buying bonds with money printed by the central bank to push down long-term interest rates and boost investment. By 2010, it was actually buying corporate stock on the open market — something unheard of at the time.

After the financial crisis, the U.S. Fed cut interest rates to zero — also unprecedented — and created its own Japan-style QE program that added $4 trillion to the balance sheet.

Then Europe's central bank slashed rates...

[snip]

.... Japan and Europe are still slumping. The U.S. recovery and expansion are the worst since the Great Depression. And while stock markets and corporate bond markets appear to have benefited from these moves, incomes have lagged and job growth has been slow.

Now the U.S. is poised to go its own way, raising interest rates and ending quantitative easing. The European Central Bank, however, is still printing money like crazy, driving the euro down and the dollar up, while Japan continues to pump up its stock market and weaken its yen to stave off deflation...

[snip]

...The soaring dollar and the crashing euro mean eurozone governments and companies that were used to borrowing cheap U.S. dollars at near-zero interest rates now could face major repayment difficulties, and even defaults, as U.S. rates rise and the dollar soars further.

|

|

Also:

|

|

|

TOPICS: Business/Economy; Culture/Society; News/Current Events

KEYWORDS: economy; financial; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-45 next last

To: citizen

Greece is the quarterly and annually pondered question - Euro Markets go viral when the politicians and bankers meet over Greece, and the markets do the obligatory drop and subsequent rise, as predictable as the waves on the beach.

If world markets, or for that matter, any markets could be affected by Greece that notion has long since been printed out of being anything more than an issue of currency - Quantitative Easing and the residual printing of an extra percent Euro Zone Wide makes up the difference. Money has ceased to be anything more than Oil, but better because Socialists can get more for their government initiatives than any other commodity.

21

posted on

03/23/2015 9:45:28 PM PDT

by

Jumper

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

A very good morning to all! Yesterday's drop was miniscule with infinitesimal volume and right now futures see stock indexes up +0.18% and metals +0.48%. The econ announcement floodgate opens this morning with--

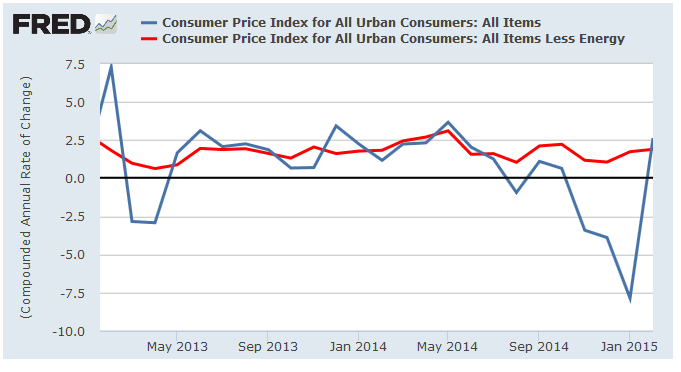

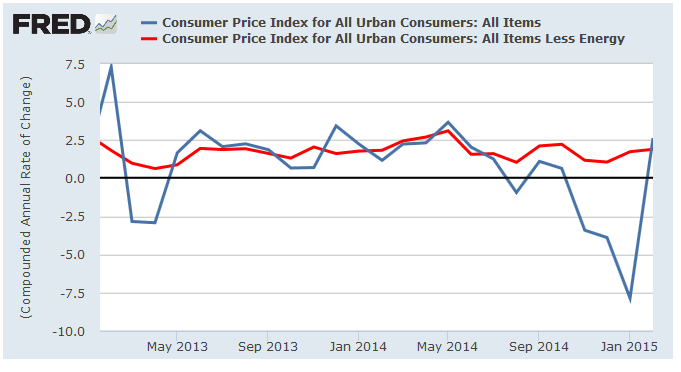

CPI

Core CPI

FHFA Housing Price Index

New Home Sales

--and for some reason (unlike yesterday) a lot of headlines seem interesting:

Oil drops as Saudi output nears record, China demand worries drag Reuters - 8 hours ago ... * China PMI falls below 50 points. * Saudi output near record highs. * Crude oversupply of 2 mln barrels per day seen in Q2 -FGE.

Asian shares wobble as China PMI weighs "For today the focus is likely to be on the preliminary flash manufacturing and services PMI data from Germany and France for March, particularly in light of the weak Chinese HSBC manufacturing PMI number," Michael Hewson, chief market analyst at CMC Markets, said in a note. MSCI's broadest index of Asia-Pacific shares outside Japan was up about 0.2 percent in choppy trade, pulling

Attacking Wall Street, Wounding Main - Iain Murray, Washington Examiner

Political Myths About Banking Make For Bad Policy - Douglas Elliott, RCM

Next Credit Crunch Could Make 2008 Seem Small - Ben Wright, Telegraph

A 'Patient' Uber Relieves the Yellen Fed Of Its Clothes - John Tamny, RCM

The Fed Must Be Free of Congress - Paul Johnson & Robert Rebelein, CNBC

4 Signs U.S. Shares May Be Losing Steam - Martin Pelletier, National Post

To: Wyatt's Torch; All

hmmm. maybe we're talking about rate hike sooner than Dec...

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

|

Markets |

|

Yesterday |

|

Today's Futures |

| metals |

|

Leveling off, upside resistance now at $1,200 gold & $17 silver |

|

-0.06% |

|

|

|

|

|

|

| stocks |

|

Indexes down a fraction in below avg. volume, NASDAQ distribution brings count to 6 w/ S&P at 5 |

|

0.04% |

Also this morning we get MBA Mortgage Index, Durables, and Crude Inventories. imho today's big story is: As Silence Falls On Chicago's Trading Pits. New econ threads:

To: expat_panama

As Silence Falls On Chicago’s Trading Pits joining buggy whips salesmen in a rousing rendition of “There’s a Tear in my Beer”. Interesting article.

25

posted on

03/25/2015 4:40:15 AM PDT

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: Lurkina.n.Learnin

Yeah, it really is an end of an era —the NYSE on Wall Street’s next.

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

Since we all know what happened yesterday what we got this morning is stock index futures -0.89% and metals +1.49% --and energies are up +1.95%! So now we know where the money is running to.

Ah. For those that may have tuned in late, yesterday's trade saw stocks taking a serious hit; the NASDAQ fell -2.4% and the S&P dropped -1.5%, all in rising volume. IBD even says the outlook is no longer "confirmed uptrend". Gold and silver have now climbed tp $1,213.65 and $17.32 respectively and today's claims day (Initial and Continuing Claims at opening bell). So what or who do we blame the shift on-- war in Yemen? yesterday's durables at -1.4%? More reasons:

GLOBAL MARKETS-Oil surges on Yemen air strikes, stocks tumble Reuters Africa - 19 minutes ago LONDON, March 26 (Reuters) - Crude prices rose as much as 6 percent on Thursday after Saudi Arabia and its allies launched air strikes on Yemen, pushing shares lower in Europe, the Middle East and Asia and lifting oil producers' currencies.

Oil stockpiled by Iran awaits sanctions' end to hit market Arkansas Online

To: expat_panama

Silly Explanations From Market’s Explainers

This guy is spot on. I enjoyed this. Thanks

28

posted on

03/26/2015 6:17:43 AM PDT

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: Rich21IE

higher interest rates will slow consumer spending...Do we really know that, and which consumer spending will it slow? If it's for imports that get charged by the financially stupid, how does the money they spend help the economy all that much?

In spite of the low interest on savings for over a decade now, a lot of seniors have a lot of money. The plan was to spend the interest. How many are spending less because of low interest rates? I suspect that a lot of retiree spending would be in local economies. How many conscientious savers would spend more if their savings were enhanced by earning interest?

The government is addicted to those 0% interest rates. Remember back when the interest rates were first lowered? The reasoning was so the gov could pay off its debts while the rates were low. That's worked out real well.

The definition of insanity is....well, we all no the definition. Doesn't it just make sense to bring those interest rates back to where they were when the US economy was functioning?

29

posted on

03/26/2015 7:26:11 AM PDT

by

grania

To: Lurkina.n.Learnin

Agreed; this idea of ‘predicting afterward’ has been making me chuckle for years in spite of all the times folks seemed to be eating it up.

To: expat_panama

We are setting up for a HUGE rally within the next 7 days.

31

posted on

03/26/2015 10:05:15 AM PDT

by

bankwalker

(In the land of the blind, the one-eyed man is king.)

To: bankwalker

a HUGE rally within the next 7 daysIn the past hour or so indexes reversed and we're now up for the day. Usually the 'trend is ur friend'; except it hasn't been happening the past couple days w/ all these hefty reversals. We'll have to see how long this 'reversal' thing lasts...

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

|

Markets |

|

Yesterday |

|

Today's Futures |

| metals |

|

Held to ceilings $1,200 gold & $17 silver |

|

-0.63% |

|

|

|

|

|

|

| stocks |

|

down/mixed volume to red line 50-day moving average and then upside reversal partial recovery |

|

-0.02% |

fwiw futures have been turning milder closer to opening; it's not only Friday but it's final GDP day. News:

Related threads:

To: expat_panama

A Perry/Walker ticket with either in the top spot would be hard to beat. Two successful governors versus any Dem. Perry brings a lot of money and political dynamism to the game. Walker’s brilliant and proven.

Reagan really came into his own as governor of California. It was there, in California’s huge and dynamic economy, that business leaders and money men tempered their opinion of him. Walker and Perry both have that, but Texas is a giant compared to tiny Wisconsin. It would give the ticket good balance.

Remember that we can’t win unless we get 270 EC votes.

34

posted on

03/27/2015 5:47:22 AM PDT

by

1010RD

(First, Do No Harm)

To: palmer

That politicization is typical of centrally planned economies like America (I never thought I’d type that).

35

posted on

03/27/2015 5:48:55 AM PDT

by

1010RD

(First, Do No Harm)

To: expat_panama

The Left’s war on commerce (business is too narrow a term) is consistent with a planned economy. That’s what the Fed does. They’re always late or early.

Milton Friedman proposed a flat 3% growth rate for the money supply. That would take all the guessing and misallocation of capital out of the equation.

Sometimes 3% would be too little and sometimes too much, but you’d have certainty. Commerce faces enough uncertainty without adding political risk. Keep in mind that it is political risk - private property rights, tax codes, regs, monetary policy, etc. - that make 3rd World countries 3rd World.

Truth, honest and consistency are what make America such an economic powerhouse. The more we turn our economy over to politicians/central planners (and don’t doubt that Fed governors are not political and central planners) the less truth, honesty and consistency our economy will have.

Look at the manhours/dollar spent on reading the Fed tea leaves after every FMOC minutes release.

36

posted on

03/27/2015 5:54:02 AM PDT

by

1010RD

(First, Do No Harm)

To: expat_panama

Correct. I don’t foresee a rate hike this year. The economy is sputtering again.

37

posted on

03/27/2015 5:55:20 AM PDT

by

1010RD

(First, Do No Harm)

To: Wyatt's Torch

If you can see that, then so can the rest of the Fed and the financial press. It’s useless to raise rates that minimally. Low interest rates are a cause of the current economic environment.

38

posted on

03/27/2015 5:57:24 AM PDT

by

1010RD

(First, Do No Harm)

To: Rich21IE

Interesting surmise about raising rates and it is a part of human nature as regards power. If you have it you want to use it. That’s political and emotional thinking. Given that the Fed is made up of human beings no more able to predict the future than we are.

Lastly, there is no such thing as a market deflationary spiral. Where it exists it is always caused by government action. See the Long Depression and dispel this myth.

39

posted on

03/27/2015 5:59:57 AM PDT

by

1010RD

(First, Do No Harm)

To: Lurkina.n.Learnin; expat_panama

Ritholtz has some good analysis for a Lefty.

40

posted on

03/27/2015 6:02:13 AM PDT

by

1010RD

(First, Do No Harm)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-45 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

(excerpt from)

(excerpt from)

Actually, Japan started it 14 years ago, in the middle of a seemingly endless economic slump and deflation, by doing what it called Quantitative Easing (QE) — buying bonds with money printed by the central bank to push down long-term interest rates and boost investment. By 2010, it was actually buying corporate stock on the open market — something unheard of at the time.

Actually, Japan started it 14 years ago, in the middle of a seemingly endless economic slump and deflation, by doing what it called Quantitative Easing (QE) — buying bonds with money printed by the central bank to push down long-term interest rates and boost investment. By 2010, it was actually buying corporate stock on the open market — something unheard of at the time.