Skip to comments.

Investment & Finance Thread (week June 29 - July 3 edition)

Weekly investment & finance thread ^

| June 29, 2014

| Freeper Investors

Posted on 06/29/2014 2:17:00 PM PDT by expat_panama

Yesterday was the 100th anniversary of the assassination of Archduke Franz Ferdinand in Sarajevo which sparked the war and the NYSE decided to close for the duration (more here). This week we begin the new quarter --and the second half of 2014. We'll see if the GDP for Q2 shows any improvement (1st report coming out in three weeks). Imho we're in an economy where we can still make money but it's just going to take more effort.

Review of last week here, reports/consensus coming out this week here.

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; financial; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-88 next last

To: Grampa Dave

...orders up to date with the maximum % of loss you can stand...That's what I was just thinking too with this run-up, time to 're-notch' the loss limits...

To: expat_panama

I took some profits today. I get nervous up here skating on the ceiling.

To: Lurkina.n.Learnin

There’s probably going to be a lot of profit-taking sessions in the near future, but what I’m seeing is one of those times we say “hold your nose and buy”.

To: expat_panama

“That’s what I was just thinking too with this run-up, time to ‘re-notch’ the loss limits...”

It is nice how much some of our returns has jumped since the first of the year.

We have a few ETFs, zero actual stock, which have been on fire since late January.

Re-notching the loss limits is usually a 3-5 month job for me.

That is not fast enough for a few of them.

I set a 10% loss for my stop loss orders, and this year I have been checking on that calculation on a shorter time table and “re notching” as you call it.

44

posted on

07/01/2014 11:19:35 AM PDT

by

Grampa Dave

( Herr Obozo, the Sunni Won-Doer, will not divert $'s from his war on Americans to help our Veterans!)

To: Lurkina.n.Learnin

I took profits yesterday and bought a defensive stock and a short stock today. The 4th of July holidays make me nervous (actually any holiday anymore). GLTA

45

posted on

07/01/2014 12:02:20 PM PDT

by

BipolarBob

(Obama - The Scandal a Week President.)

To: BipolarBob; expat_panama

I didn’t get rid of every thing, I just pared back and got rid of some that weren’t performing that well. They will probably take off tomorrow.

To: Lurkina.n.Learnin

That’s mostly what I did. Re position.

47

posted on

07/01/2014 3:54:08 PM PDT

by

BipolarBob

(Obama - The Scandal a Week President.)

To: Grampa Dave

A little advice if you aren’t doing it, keep your Stop Loss orders up to date with the maximum % of loss you can stand. Don’t get greedy. Thanks... I will definitely do that. Today, I sold all holding other than the ones I listed above... and a couple of mutual funds.

If 2nd qtr GDP sucks again... the jig will be up.

48

posted on

07/01/2014 8:09:57 PM PDT

by

SomeCallMeTim

( The best minds are not in government. If any were, business would hire them!)

To: abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; Aquamarine; Archie Bunker on steroids; ...

Neat --right after seeing gains in metals and stocks yesterday this morning futures traders are predicting more of the same! I mean, profit taking isn't as much fun by oneself while everyone else is still out having all the fun, but then again the saying is still true that "nobody ever went broke taking a profit".

Reports today: MBA Mortgage Index, Challenger Job Cuts, ADP Employment Change, Factory Orders, Crude Inventories; this morning's stories:

To: expat_panama

Reading the headlines, a quote from a '60's Sci-fi comes to mind.....

"Danger Will Robinson!!!!!..... Danger!!!!!

The market exuberance has no basis. This is the freakin' Twilight Zone I tell ya.

50

posted on

07/02/2014 5:38:45 AM PDT

by

catfish1957

(Face it!!!! The government in DC is full of treasonous bastards)

To: SomeCallMeTim

I have been an investor for 35 years, and never have I seen what feels like a runaway train like the fin markets now. Can’t jump on, can’t jump off. Hope the end result is not the same.

51

posted on

07/02/2014 5:41:40 AM PDT

by

catfish1957

(Face it!!!! The government in DC is full of treasonous bastards)

To: expat_panama

Bull Market in Borrowing: Corporate Debt Skyrockets to $9.6 TrillionHey...works for the federal government, what the heck could go wrong. /s

52

posted on

07/02/2014 5:43:27 AM PDT

by

catfish1957

(Face it!!!! The government in DC is full of treasonous bastards)

To: catfish1957

It reminds me of the late 1990’s. EVERYTHING was up... especially, if it had “Dot Com” in the name. I rode the train for awhile... started peeling back in 1999....

Then got the break of my life when Bob Brinker from “Money Matters” came on the air on his radio show in Feb 2000 to state : “Folks? GET OUT! This is as HIGH as it can go”.

I listened to him.. and missed virtually all of the 2000 crash. Brinker also correctly called the time to get back IN the market... exactly... in March 2003.

Sadly, he didn’t help me much in 2008. :-(

I stayed on the sidelines far too long in 2009... but, finally made the decision that: As long as the Fed was printing money, I was going to be fully invested (more or less).

That idiom has been working pretty well. The Fed IS STILL printing... but, they are pulling back. They’re going to force me to find a new reason for courage.

I work in the Petrochemical arena. The financial advantages favoring investment in the US are stronger now than at anytime since the 1960’s. Investment is flowing in as fast as possible. The next two years (the length of time it takes to actually BUILD new plants) is simply crazy. Everyone is making money.

I just try to avoid companies with Investments in Europe or Asia. And, I’m going to try to be OUT of US plants sometime in the next 2 years... before all this new capacity comes on-line.

53

posted on

07/02/2014 6:01:07 AM PDT

by

SomeCallMeTim

( The best minds are not in government. If any were, business would hire them!)

To: catfish1957

It’s the path to prosperity. My grampa used to say “credit is the ruination of a nation”. They apparently think he was wrong. I think he was a lot wiser than I realized at the time.

To: catfish1957

Corporate Debt Skyrockets to $9.6 Trillion Hey...works for the federal government

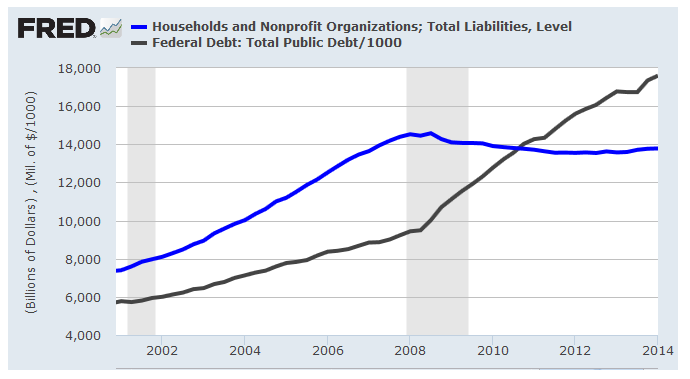

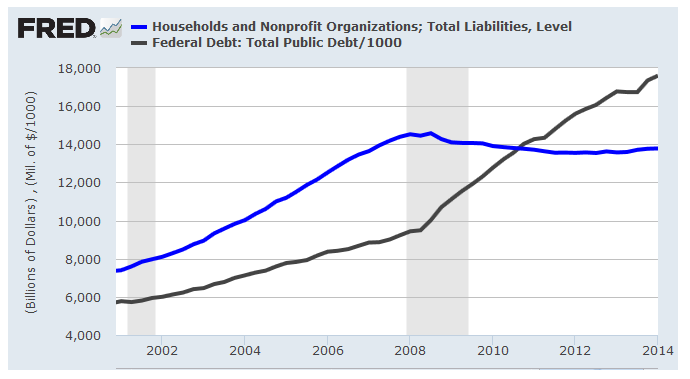

Corporations can't be compared to the federal government. Corporations borrow because they're worth it --they can create wealth that free people are willing to pay good money for. The federal government can borrow because it can pay off the debts by simply taking money from others by force. What's worse is that this federal debt has soared while private debt is at a standstill:

To: All

To: expat_panama

Uh.... Did you miss the little “/s” in my msg? :)

57

posted on

07/02/2014 12:07:06 PM PDT

by

catfish1957

(Face it!!!! The government in DC is full of treasonous bastards)

To: expat_panama

T minus 1 hour until the jobs report! Prepare the “it’s all BS!”, “Obama made it up!”, “This is crap we’re in a DEPRESSION!” posts!

Consensus estimate +215K, UE3 estimate 6.3% (Source: FactSet)

SocGen’s Brian Jones raised his estimate to +290K: “A variety of factors support our call for the largest payroll gain since the 360,000 leap recorded at the beginning of 2012. The average number of persons filing initial claims for unemployment insurance benefits contracted by 12,100 to 312,000 over the four weeks heading into the June establishment survey period. The total number of persons collecting unemployment insurance benefits under regular state programs likely contracted by 54,000 to 2.57 million between canvassing periods – the fewest since October 2007 – implying that a substantial number of those previously unemployed are finding work. The impressive breadth of hiring across private industries over the March-May span also points to a pick-up in headline payroll growth.”

To: abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; Aquamarine; Archie Bunker on steroids; ...

Good morning all, futures have metals off and stocks up slightly which is exactly how they both closed yesterday. Lot's of reports coming--

Challenger Job Cuts

Nonfarm Payrolls

Nonfarm Private Payrolls

Unemployment Rate

Hourly Earnings

Average Workweek

Initial Claims

Continuing Claims

Trade Balance

ISM Services

Natural Gas Inventories

--although volume may be in lighter "off-for-the-weekend" trade today, I know my brain's about out the door already.

Asian stocks tread water ahead of U.S. jobs data Asian stocks lingered near three-year highs on Thursday as investors waited for the U.S. nonfarm payrolls report to see if the economy is gaining momentum. Three-month copper on the London Metal Exchange CMCU3 rose to as high as $7,145 a tonne, its highest level since late February. "People were saying, 'What is cheap in the world?' They figured out the metals were cheap and if things accelerated a little bit, why not take a position?" said analyst…

Dow, S&P 500 edge to records iAfrica.com - 5 hours ago The Dow and S&P 500 edged to new records on Wednesday ahead the official US jobs data for June, with the outlook buoyed by a strong ADP private sector report.

Is This The Time To "Sell High"? - Lance Roberts, StreetTalk Live

The IRS Has Unleashed a Massive New Regulation - Wayne Brough, RCM

To: Wyatt's Torch

“it’s all BS!”, “Obama made it up!”, “This is crap we’re in a DEPRESSION!”Ah, thanks. Now I'm ahead for my reading today...

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-88 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson