Skip to comments.

Why Bankers Created the Fed 100 Years Ago

The Market Oracle, UK ^

| 23 December, 2013

| Christopher_Westley

Posted on 12/24/2013 1:45:23 PM PST by Errant

The Democratic Party gained prominence in the first half of the nineteenth century as being the party that opposed the Second Bank of the United States. In the process, it tapped into an anti-state sentiment that proved so strong that we wouldn't see another like it until the next century.

Its adversaries were Whig politicians who defended the bank and its ability to grow the government and their own personal fortunes at the same time. They were, in fact, quite open about these arrangements. It was considered standard-operating procedure for Whig representatives to receive monetary compensation for their support of the Bank when leaving Congress. The Whig Daniel Webster even expected annual payments while in Congress. Once he complained to the Bank of the United States President Nicholas Biddle, “I believe my retainer has not been renewed or refreshed as usual. If it be wished that my relation to the Bank should be continued, it may be well to send me my usual retainer.”

(Excerpt) Read more at marketoracle.co.uk ...

TOPICS: Constitution/Conservatism; Crime/Corruption; Culture/Society; Government

KEYWORDS: banking; collapse; fed; inflation

Navigation: use the links below to view more comments.

first previous 1-20 ... 41-60, 61-80, 81-100 ... 401-402 next last

To: Toddsterpatriot

61

posted on

12/25/2013 2:55:16 PM PST

by

Errant

To: Errant

It was "created" by the government (finish reading Griffin's book). It just isn't "owned" by the government, as you keep insisting. The government doesn't own it, but gets 98% of the profits? Sounds like your kind of ownership. LOL!

62

posted on

12/25/2013 2:57:44 PM PST

by

Toddsterpatriot

(Science is hard. Harder if you're stupid.)

To: Errant

I guess you'll just have to read to find out. I read it, didn't see any details. If you found any, please cut and paste.

63

posted on

12/25/2013 2:58:53 PM PST

by

Toddsterpatriot

(Science is hard. Harder if you're stupid.)

To: Toddsterpatriot

The government doesn't own it, but gets 98% of the profits? Sounds like your kind of ownership. LOL! Might be, what's 2% of 17T? Btw, by law it's 6%, IIRC.

64

posted on

12/25/2013 3:01:49 PM PST

by

Errant

To: Toddsterpatriot

If you found any, please cut and paste. What's a matter, you worried about your bankster friends?

"An ALMC spokesman said that the premises are indeed being searched and that the bank’s staff members are doing their best to help.

In other news, four people have so far been arrested today in connection with the special prosecutor’s investigation into Landsbanki.

One of the arrested parties is Jon Thorsteinn Oddleifsson, former Landsbanki treasury boss; and it is not yet known who the other three are.

According to Visir.is sources, the arrests concern a brand new section of the wider case against the bank and are not directly connected to searches and arrests made last week"

http://www.icenews.is/2011/01/20/more-icelandic-bankers-arrested/

65

posted on

12/25/2013 3:07:51 PM PST

by

Errant

To: Errant

The stock may not be sold, traded, or pledged as security for a loan;And you can't buy extra. Pretty weak ownership.

That's a pretty darn good return on investment if you're one of the lucky ones.

The "private owners" got $1.6 billion in dividends last year. The government "non-owners" got $89 billion. Guess who was luckier?

Especially given the huge sums we're talking about an

$1.6 billion, not so huge.

66

posted on

12/25/2013 3:08:24 PM PST

by

Toddsterpatriot

(Science is hard. Harder if you're stupid.)

To: Errant

Might be, what's 2% of 17T?You're confusing "ownership" of Fed "shares" and ownership of Treasury Bonds. Your confusion is sad, but not surprising.

Btw, by law it's 6%, IIRC.

Yes, 6% of their "shares", not 6% of Fed profits. Not 6% of the debt either.

67

posted on

12/25/2013 3:12:10 PM PST

by

Toddsterpatriot

(Science is hard. Harder if you're stupid.)

To: Toddsterpatriot

Your figures are questionable, more so since we don’t get to see some of them. That said, access to all of that “free money” is were most of the banks’ profit is derived. The guaranteed profit is just “gravy” from the taxpayers.

68

posted on

12/25/2013 3:13:49 PM PST

by

Errant

To: Errant

What's a matter, you worried about your bankster friends?I'm not worried about anything.

When people who don't understand banking make claims, I like to see proof. Usually there's no there there.

According to Visir.is sources, the arrests concern a brand new section of the wider case against the bank and are not directly connected to searches and arrests made last week"

Hmmmmmmm....a nearly 3 year old link. No updates with actual crimes charged? Interesting.

69

posted on

12/25/2013 3:17:03 PM PST

by

Toddsterpatriot

(Science is hard. Harder if you're stupid.)

To: Toddsterpatriot

You're confusing "ownership" of Fed "shares" and ownership of Treasury Bonds. No, you're just trying to circumvent the truth. The treasury MUST eventually get the money to pay off the bonds from the Fed, by issuing even more bonds/debt. It's a self-perpetuating scheme. The debt can NEVER be paid off.

70

posted on

12/25/2013 3:20:53 PM PST

by

Errant

To: Errant

The Federal Reserve Board on Thursday announced preliminary unaudited results indicating that the Reserve Banks provided for

payments of approximately $88.9 billion of their estimated 2012 net income to the U.S. Treasury. Under the Board's policy, the residual earnings of each Federal Reserve Bank are distributed to the U.S. Treasury, after providing for the costs of operations, payment of dividends, and the amount necessary to equate surplus with capital paid-in.

The Federal Reserve Banks' 2012 estimated net income of $91.0 billion was derived primarily from $80.5 billion in interest income on securities acquired through open market operations (U.S. Treasury securities, federal agency and government-sponsored enterprise (GSE) mortgage-backed securities (MBS), and GSE debt securities). Additional earnings were derived primarily from net realized gains on the sale of U.S. Treasury securities of $13.3 billion, net income of $6.1 billion attributable to the consolidated limited liability companies that were created in response to the financial crisis, and income from services of $450 million, offset by losses of $1.1 billion that result from the daily revaluation of foreign currency denominated asset holdings at current exchange rates. The Reserve Banks had interest expense of $3.9 billion on depository institutions' reserve balances.

Operating expenses of the Reserve Banks, net of amounts reimbursed by the U.S. Treasury and other entities for services the Reserve Banks provided as fiscal agents, totaled $3.7 billion in 2012. In addition, the Reserve Banks were assessed $1.2 billion for the cost of new currency and Board expenditures, and $387 million to fund the operations of the Bureau of Consumer Financial Protection and Office of Financial Research. In 2012, statutory dividends totaled $1.6 billion and $461 million of net income was used to equate surplus to capital paid-in.

The preliminary unaudited results include valuation adjustments as of September 30 for Term Asset–Backed Securities Loan Facility (TALF) loans and the consolidated limited liability companies. The final results, which will be presented in the Reserve Banks' annual audited financial statements and the Board of Governors' Annual Report, will reflect valuation adjustments as of December 31.

The attached chart illustrates the amount of Federal Reserve Banks' residual earnings distributed to the U.S. Treasury from 2003 through 2012 (estimated).

For media inquiries, call 202-452-2955

http://www.federalreserve.gov/newsevents/press/other/20130110a.htm

That said, access to all of that “free money” is were most of the banks’ profit is derived.

Banks have no access to free money from the Fed.

In fact, today, banks are borrowing a whopping $6 million from the Fed Discount Window.

71

posted on

12/25/2013 3:24:45 PM PST

by

Toddsterpatriot

(Science is hard. Harder if you're stupid.)

To: Toddsterpatriot

72

posted on

12/25/2013 3:27:42 PM PST

by

Errant

To: Errant

No, you're just trying to circumvent the truth LOL! Do you know the difference between debt and equity?

The treasury MUST eventually get the money to pay off the bonds from the Fed

Nope. The Treasury gets money to pay off debt from taxpayers like you and me.

The debt can NEVER be paid off.

Another silly claim. Like saying you can never pay off your mortgage without issuing more debt.

73

posted on

12/25/2013 3:28:30 PM PST

by

Toddsterpatriot

(Science is hard. Harder if you're stupid.)

To: Toddsterpatriot

Newly printed Fed money tends to find its way into the pockets of those who need it least...

The same thing is happening with businesses. People like to debate whether quantitative easing has helped small businesses. But it has clearly helped the "too big to fail" banks get even bigger. Last month, Forbes made a list of 29 banks that were "too big to fail." And topping the list... JPMorgan, the namesake bank of the man who helped drive the Federal Reserve's creation 100 years ago.

Along with Citigroup, Goldman Sachs, and other big banks, JPMorgan is one of the Fed's "primary dealers." These dealers act as the Fed's agent at Treasury auctions and in other markets. Under the current system, once the dealers buy the government bonds, they sell them to the Fed – for a slight profit, of course.

Not only do they profit from every Treasury bill the Fed purchases... but many people believe that their "seat at the table" offers the Fed's primary dealers insights into – and even influence over – our nation's monetary policies. The Fed has become a cartel with membership privileges.

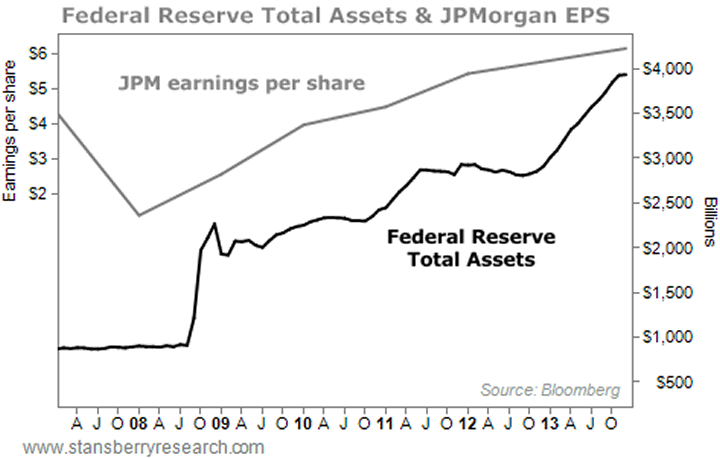

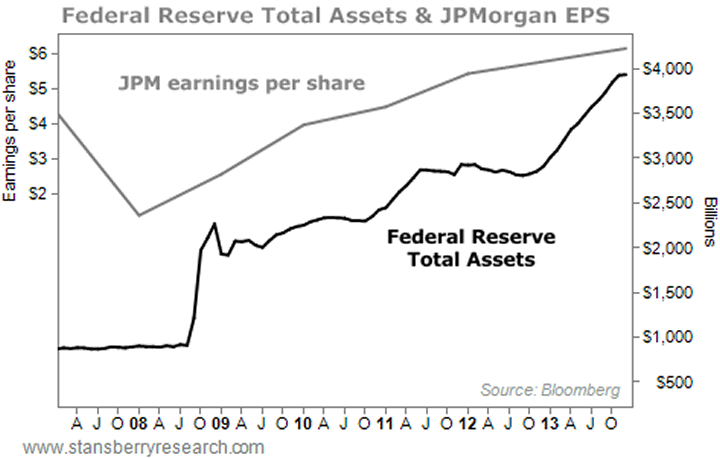

Quantitative easing has re-inflated the entire banking system. The chart below tracks the balance sheets of the Federal Reserve. Notice that assets (the black line) have ballooned from around $900 billion to nearly $4 trillion.

Meanwhile, JPMorgan has seen its assets grow from $1.6 trillion in 2007 to $2.5 trillion today. That is 58% in just a little more than five years. It has also seen earnings per share (the gray line) grow by 43% over the same period.

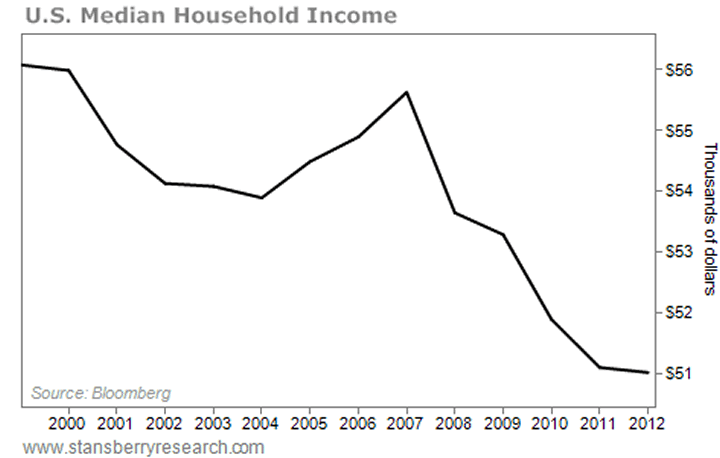

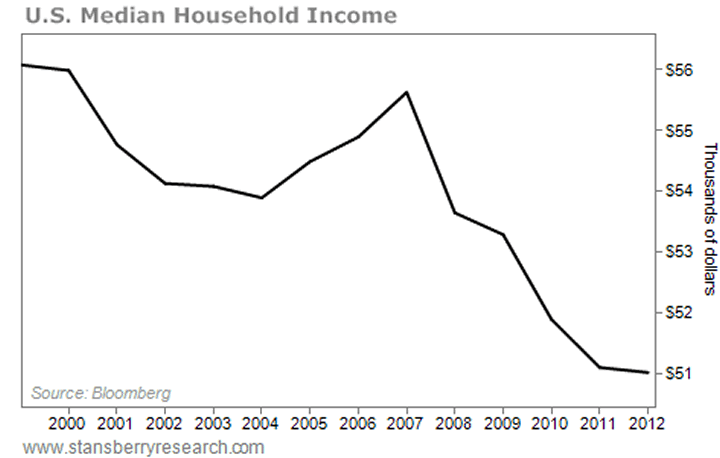

Meanwhile, Federal Reserve manipulation of the dollar has undermined the lives of millions of Americans. It has driven down the standard of living for the average American in two key ways. First, the average household is earning less money at a time when prices are increasing.

Second, it's nearly impossible for people to protect the value of any extra cash they can save. The cash that is left in bank accounts will buy less next year than it does today.

The Fed has set interest rates so low, it's impossible to earn a decent return. Remember, all interest rates are tied – either directly or indirectly – to rates set by the Fed. This is great for the banks that own the Fed. They get to borrow for 0% and lend to the rest of us at 4% or 5%. But it's terrible if you're trying to hang onto your savings for retirement 15 or 20 years down the road.

In short, the Federal Reserve has changed the markets. It has also changed how we invest. There are considerations today that we would never have imagined 20 years ago. It is no longer enough to study business cycles and company fundamentals. We have to consider the unintended consequences of quantitative easing...

How the Fed Steals from You... and Gives to the Very Rich

74

posted on

12/25/2013 3:38:26 PM PST

by

Errant

To: Errant

In Iceland four former bank chiefs have been jailed for fraud - the sentences go as far as five years behind bars. They're accused of concealing that a Qatari investor bought a stake in their firm, using cash lent from the bank itself - illegally. The deal took place just ahead of the collapse of the bank due to huge debts. That's good, fraudulent bankers should go to jail.

All the silly claims you've linked said bankers were arrested for causing the crisis. How did these crooks cause the crisis?

75

posted on

12/25/2013 3:44:35 PM PST

by

Toddsterpatriot

(Science is hard. Harder if you're stupid.)

To: Toddsterpatriot

Nope. The Treasury gets money to pay off debt from taxpayers like you and me. Good luck with that! LOLOL It'll NEVER EVER be paid off. It's a mathematical imposibility. It's a flawed system that prevents paying off from ever happening. The ONLY way for the system to grow is through the generation of more DEBT!

Another silly claim. Like saying you can never pay off your mortgage without issuing more debt.

What you fail to understand, is than in a system where fiat currency is borrowed into existence, it can never be paid off since it's borrowed into existence in the first place.

We're seeing a huge decline in M2 velocity even with all the QE going on. Paying off the debt would lower M2 even further and throw the economy into a depression even sooner.

76

posted on

12/25/2013 3:46:50 PM PST

by

Errant

To: Errant

Second, it's nearly impossible for people to protect the value of any extra cash they can save. The cash that is left in bank accounts will buy less next year than it does today.It's true, risk-free cash earns very low returns today.

This is great for the banks that own the Fed. They get to borrow for 0% and lend to the rest of us at 4% or 5%

They don't own the Fed and they can't borrow at 0%. In fact, at the current 0.75% discount rate, they're only borrowing $6 million. That's million with an M.

77

posted on

12/25/2013 3:50:32 PM PST

by

Toddsterpatriot

(Science is hard. Harder if you're stupid.)

To: Toddsterpatriot

It's true, risk-free cash earns very low returns today. You're concept of "risk-free" is laughable. The value of the federal reserve dollar will one day be calculated against its initial value at issue in decimals. Its value isn't even close to maintaining pace with inflation.

And by artificially manipulating interest rates, the banksters are stealing billions and billions from the savings of millions of hard working Americans.

78

posted on

12/25/2013 3:58:54 PM PST

by

Errant

To: Errant

Good luck with that! LOLOL It'll NEVER EVER be paid off. It's a mathematical imposibilityIt's a political impossibility. No one has the guts to cut spending or reform entitlements.

What you fail to understand, is than in a system where fiat currency is borrowed into existence, it can never be paid off since it's borrowed into existence in the first place.

Loans are paid off all the time. So what?

What you fail to understand, is than in a system where fiat currency is borrowed into existence, it can never be paid off since it's borrowed into existence in the first place.

The money supply increased when I took out my mortgage. It will shrink as I pay it off. So what?

We're seeing a huge decline in M2 velocity even with all the QE going on.

We're seeing a huge decline in M2 velocity because of all the QE going on. Fixed it for you.

79

posted on

12/25/2013 4:02:44 PM PST

by

Toddsterpatriot

(Science is hard. Harder if you're stupid.)

To: Errant

You're concept of "risk-free" is laughable Money in an FDIC insured bank account is risk free. And you'll earn very little on those risk free deposits.

And by artificially manipulating interest rates, the banksters are stealing billions and billions from the savings of millions of hard working Americans.

No one is forcing you to earn these low rates for deposits. If rates are too low, borrow instead of lending.

Markets are two sided, don't act helpless.

80

posted on

12/25/2013 4:06:15 PM PST

by

Toddsterpatriot

(Science is hard. Harder if you're stupid.)

Navigation: use the links below to view more comments.

first previous 1-20 ... 41-60, 61-80, 81-100 ... 401-402 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson