The same thing is happening with businesses. People like to debate whether quantitative easing has helped small businesses. But it has clearly helped the "too big to fail" banks get even bigger. Last month, Forbes made a list of 29 banks that were "too big to fail." And topping the list... JPMorgan, the namesake bank of the man who helped drive the Federal Reserve's creation 100 years ago.

Along with Citigroup, Goldman Sachs, and other big banks, JPMorgan is one of the Fed's "primary dealers." These dealers act as the Fed's agent at Treasury auctions and in other markets. Under the current system, once the dealers buy the government bonds, they sell them to the Fed – for a slight profit, of course.

Not only do they profit from every Treasury bill the Fed purchases... but many people believe that their "seat at the table" offers the Fed's primary dealers insights into – and even influence over – our nation's monetary policies. The Fed has become a cartel with membership privileges.

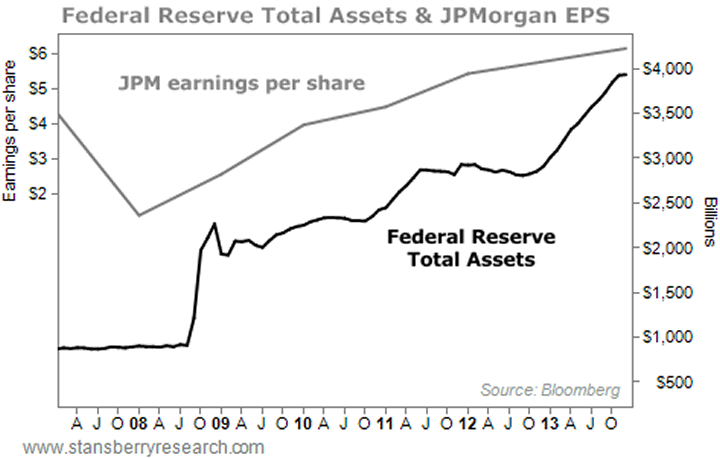

Quantitative easing has re-inflated the entire banking system. The chart below tracks the balance sheets of the Federal Reserve. Notice that assets (the black line) have ballooned from around $900 billion to nearly $4 trillion.

Meanwhile, JPMorgan has seen its assets grow from $1.6 trillion in 2007 to $2.5 trillion today. That is 58% in just a little more than five years. It has also seen earnings per share (the gray line) grow by 43% over the same period.

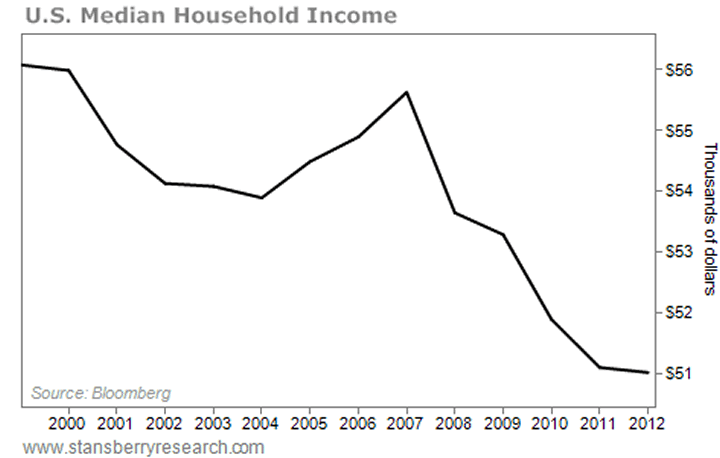

Meanwhile, Federal Reserve manipulation of the dollar has undermined the lives of millions of Americans. It has driven down the standard of living for the average American in two key ways. First, the average household is earning less money at a time when prices are increasing.

Second, it's nearly impossible for people to protect the value of any extra cash they can save. The cash that is left in bank accounts will buy less next year than it does today.

The Fed has set interest rates so low, it's impossible to earn a decent return. Remember, all interest rates are tied – either directly or indirectly – to rates set by the Fed. This is great for the banks that own the Fed. They get to borrow for 0% and lend to the rest of us at 4% or 5%. But it's terrible if you're trying to hang onto your savings for retirement 15 or 20 years down the road.

In short, the Federal Reserve has changed the markets. It has also changed how we invest. There are considerations today that we would never have imagined 20 years ago. It is no longer enough to study business cycles and company fundamentals. We have to consider the unintended consequences of quantitative easing...