The Federal Reserve Board on Thursday announced preliminary unaudited results indicating that the Reserve Banks provided for

payments of approximately $88.9 billion of their estimated 2012 net income to the U.S. Treasury. Under the Board's policy, the residual earnings of each Federal Reserve Bank are distributed to the U.S. Treasury, after providing for the costs of operations, payment of dividends, and the amount necessary to equate surplus with capital paid-in.

The Federal Reserve Banks' 2012 estimated net income of $91.0 billion was derived primarily from $80.5 billion in interest income on securities acquired through open market operations (U.S. Treasury securities, federal agency and government-sponsored enterprise (GSE) mortgage-backed securities (MBS), and GSE debt securities). Additional earnings were derived primarily from net realized gains on the sale of U.S. Treasury securities of $13.3 billion, net income of $6.1 billion attributable to the consolidated limited liability companies that were created in response to the financial crisis, and income from services of $450 million, offset by losses of $1.1 billion that result from the daily revaluation of foreign currency denominated asset holdings at current exchange rates. The Reserve Banks had interest expense of $3.9 billion on depository institutions' reserve balances.

Operating expenses of the Reserve Banks, net of amounts reimbursed by the U.S. Treasury and other entities for services the Reserve Banks provided as fiscal agents, totaled $3.7 billion in 2012. In addition, the Reserve Banks were assessed $1.2 billion for the cost of new currency and Board expenditures, and $387 million to fund the operations of the Bureau of Consumer Financial Protection and Office of Financial Research. In 2012, statutory dividends totaled $1.6 billion and $461 million of net income was used to equate surplus to capital paid-in.

The preliminary unaudited results include valuation adjustments as of September 30 for Term Asset–Backed Securities Loan Facility (TALF) loans and the consolidated limited liability companies. The final results, which will be presented in the Reserve Banks' annual audited financial statements and the Board of Governors' Annual Report, will reflect valuation adjustments as of December 31.

The attached chart illustrates the amount of Federal Reserve Banks' residual earnings distributed to the U.S. Treasury from 2003 through 2012 (estimated).

For media inquiries, call 202-452-2955

http://www.federalreserve.gov/newsevents/press/other/20130110a.htm

That said, access to all of that “free money” is were most of the banks’ profit is derived.

Banks have no access to free money from the Fed.

In fact, today, banks are borrowing a whopping $6 million from the Fed Discount Window.

Newly printed Fed money tends to find its way into the pockets of those who need it least...

The same thing is happening with businesses. People like to debate whether quantitative easing has helped small businesses. But it has clearly helped the "too big to fail" banks get even bigger. Last month, Forbes made a list of 29 banks that were "too big to fail." And topping the list... JPMorgan, the namesake bank of the man who helped drive the Federal Reserve's creation 100 years ago.

Along with Citigroup, Goldman Sachs, and other big banks, JPMorgan is one of the Fed's "primary dealers." These dealers act as the Fed's agent at Treasury auctions and in other markets. Under the current system, once the dealers buy the government bonds, they sell them to the Fed – for a slight profit, of course.

Not only do they profit from every Treasury bill the Fed purchases... but many people believe that their "seat at the table" offers the Fed's primary dealers insights into – and even influence over – our nation's monetary policies. The Fed has become a cartel with membership privileges.

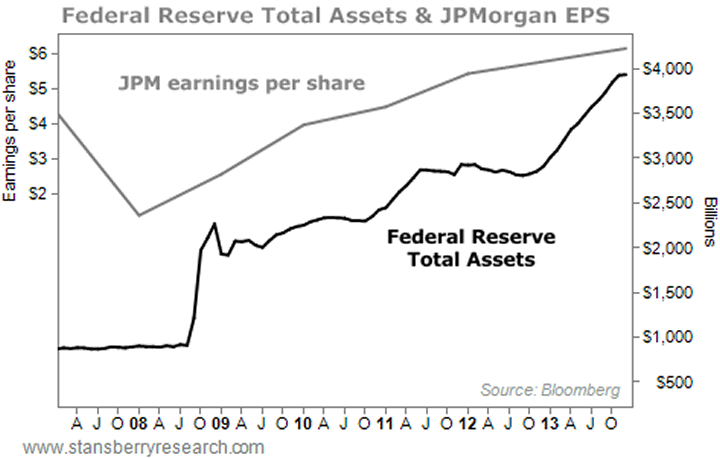

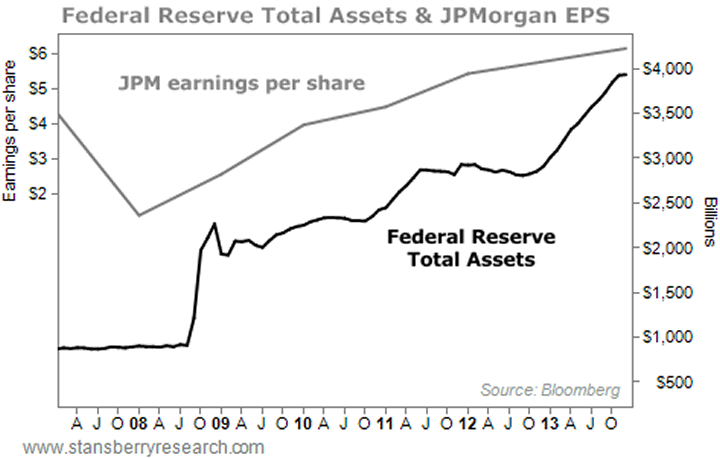

Quantitative easing has re-inflated the entire banking system. The chart below tracks the balance sheets of the Federal Reserve. Notice that assets (the black line) have ballooned from around $900 billion to nearly $4 trillion.

Meanwhile, JPMorgan has seen its assets grow from $1.6 trillion in 2007 to $2.5 trillion today. That is 58% in just a little more than five years. It has also seen earnings per share (the gray line) grow by 43% over the same period.

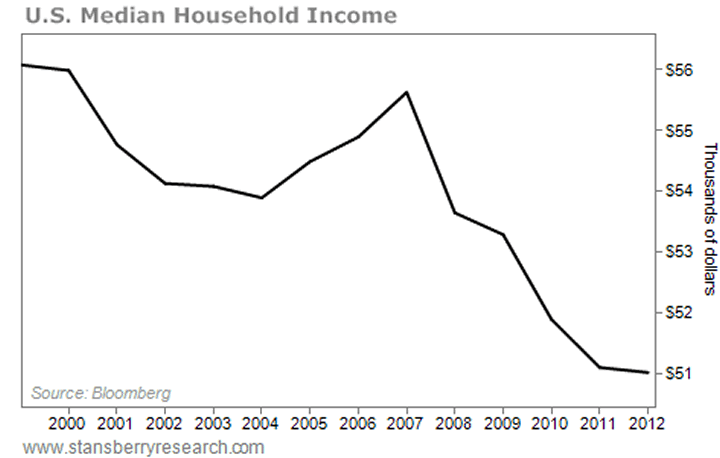

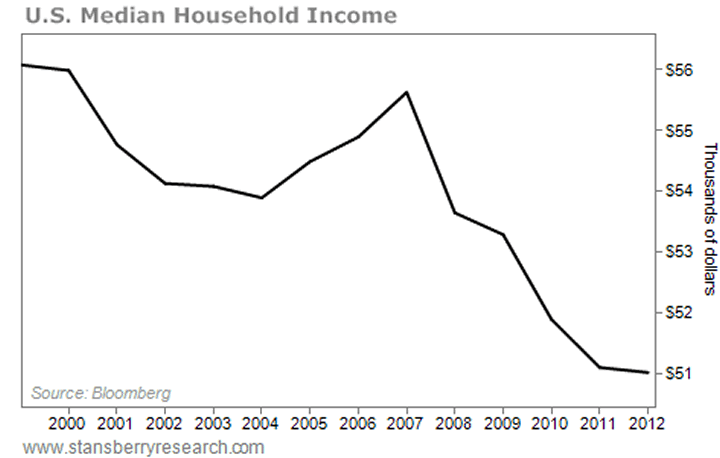

Meanwhile, Federal Reserve manipulation of the dollar has undermined the lives of millions of Americans. It has driven down the standard of living for the average American in two key ways. First, the average household is earning less money at a time when prices are increasing.

Second, it's nearly impossible for people to protect the value of any extra cash they can save. The cash that is left in bank accounts will buy less next year than it does today.

The Fed has set interest rates so low, it's impossible to earn a decent return. Remember, all interest rates are tied – either directly or indirectly – to rates set by the Fed. This is great for the banks that own the Fed. They get to borrow for 0% and lend to the rest of us at 4% or 5%. But it's terrible if you're trying to hang onto your savings for retirement 15 or 20 years down the road.

In short, the Federal Reserve has changed the markets. It has also changed how we invest. There are considerations today that we would never have imagined 20 years ago. It is no longer enough to study business cycles and company fundamentals. We have to consider the unintended consequences of quantitative easing...

How the Fed Steals from You... and Gives to the Very Rich